Civil Infrastructure Construction Index

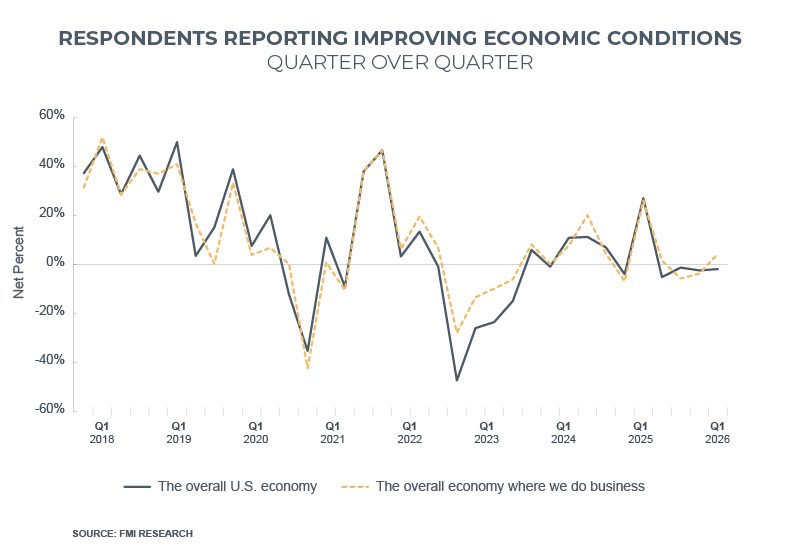

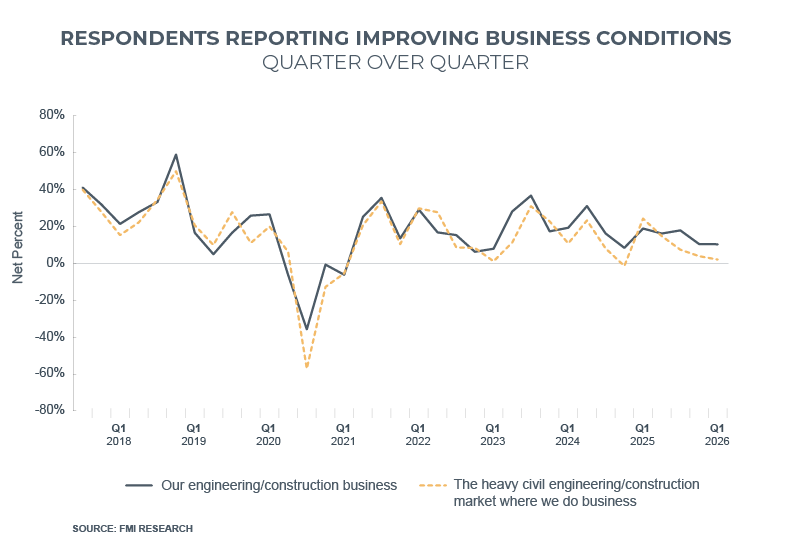

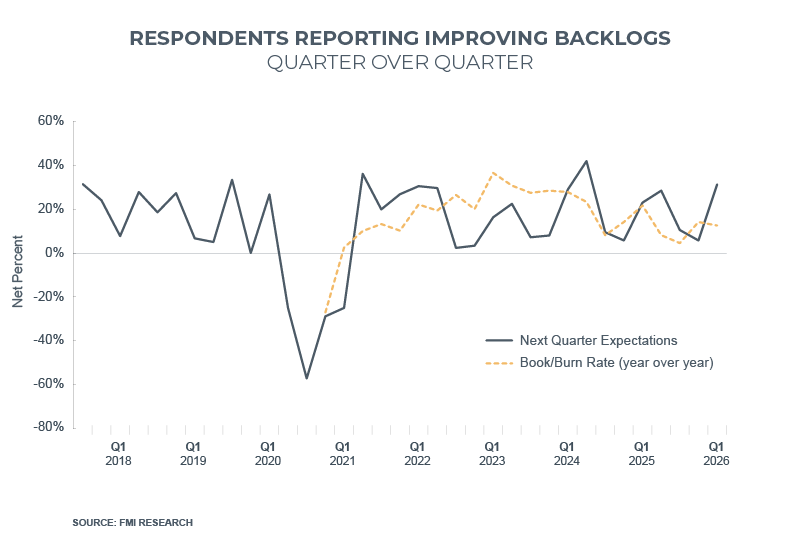

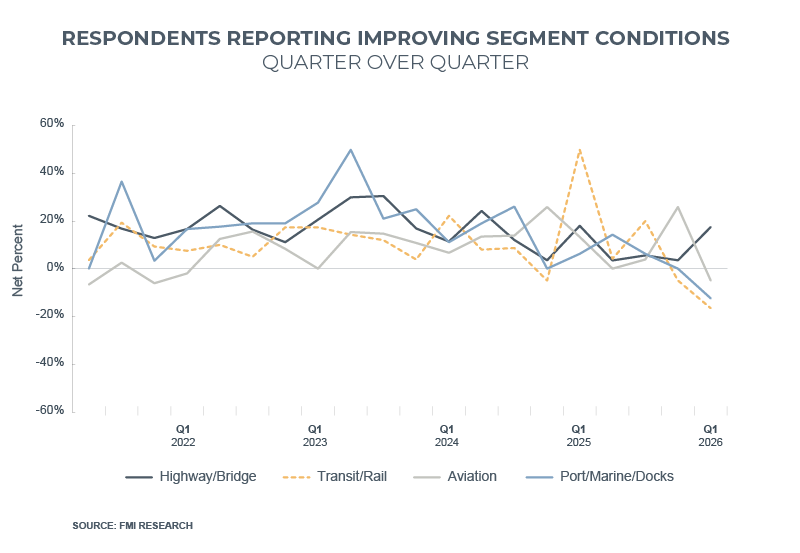

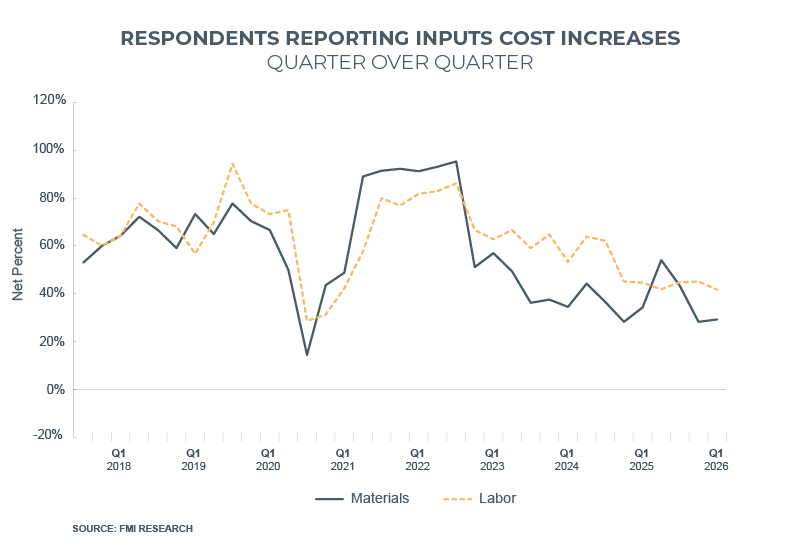

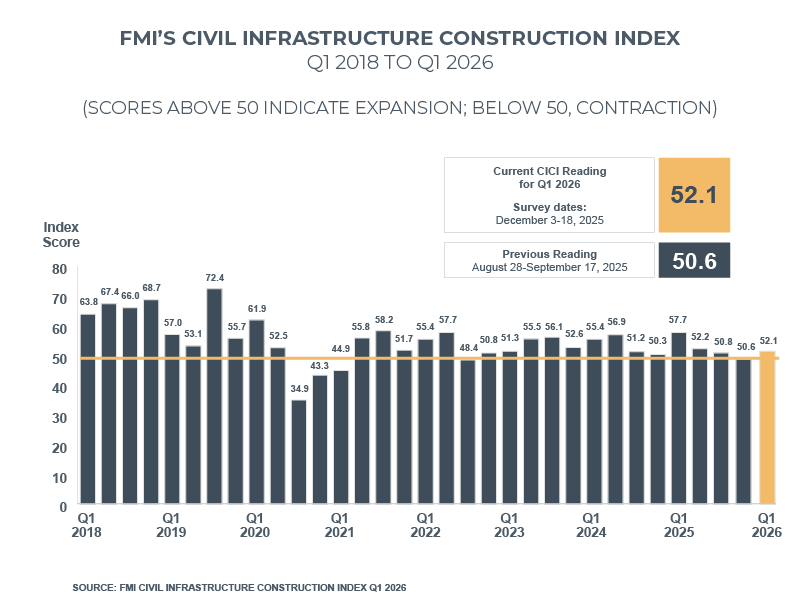

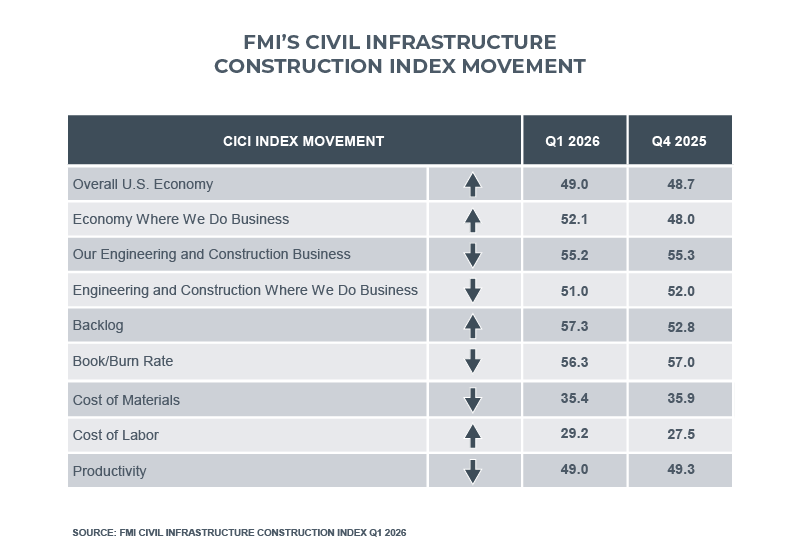

The CICI edged up to 52.1 in the first quarter 2026 from 50.6 in the fourth quarter, reflecting stable and improving sentiment across civil markets. Respondents reported slightly improved sentiment toward the overall U.S. economy and the local economies where they operate. Expectations for their own construction businesses and construction conditions in their local markets wavered slightly but held in healthy expansion territory. Backlog measures in aggregate continue to strengthen, rising to 57.3 from 52.8 in Q4, pointing to rising expectations for new starts. Input costs also remained in line with last quarter, signaling persistent cost pressures on materials and slightly fewer escalation pressures for labor. Last, productivity was essentially flat at 49.0, suggesting most crews are keeping momentum despite continued and ongoing labor challenges.

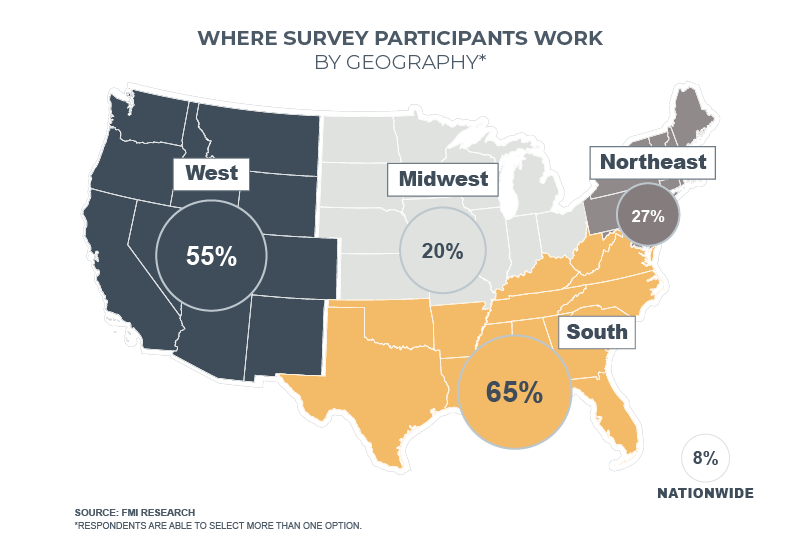

These index numbers, typically found in the Civil Infrastructure Construction report, are being released as soon as they're available. The full report will be available in the coming weeks. Our survey participants enable us to provide vital insights into current trends and market conditions. If you’re interested in contributing, we encourage you to fill out the CICI sign up form.

The above table and accompanying arrows illustrate how individual components contribute to the overall index score compared to the prior quarter. For most components, scores above 50 signal healthy or expansionary market conditions quarter over quarter. Cost of materials and cost of labor are exceptions whereas lower values in these components indicate expectations for rising prices and serve as a counterbalance.