Private Equity Consulting for the Built Environment

Private equity deal activity in engineering and construction has exceeded $27 billion annually in recent years, driven by sector fragmentation, federal infrastructure investment, and long-term demand tailwinds including a 4–7-million-unit housing shortage and sustained growth in data center construction. FMI helps private equity firms capitalize on these opportunities with deep sector expertise built over more than 65 years serving the built environment.

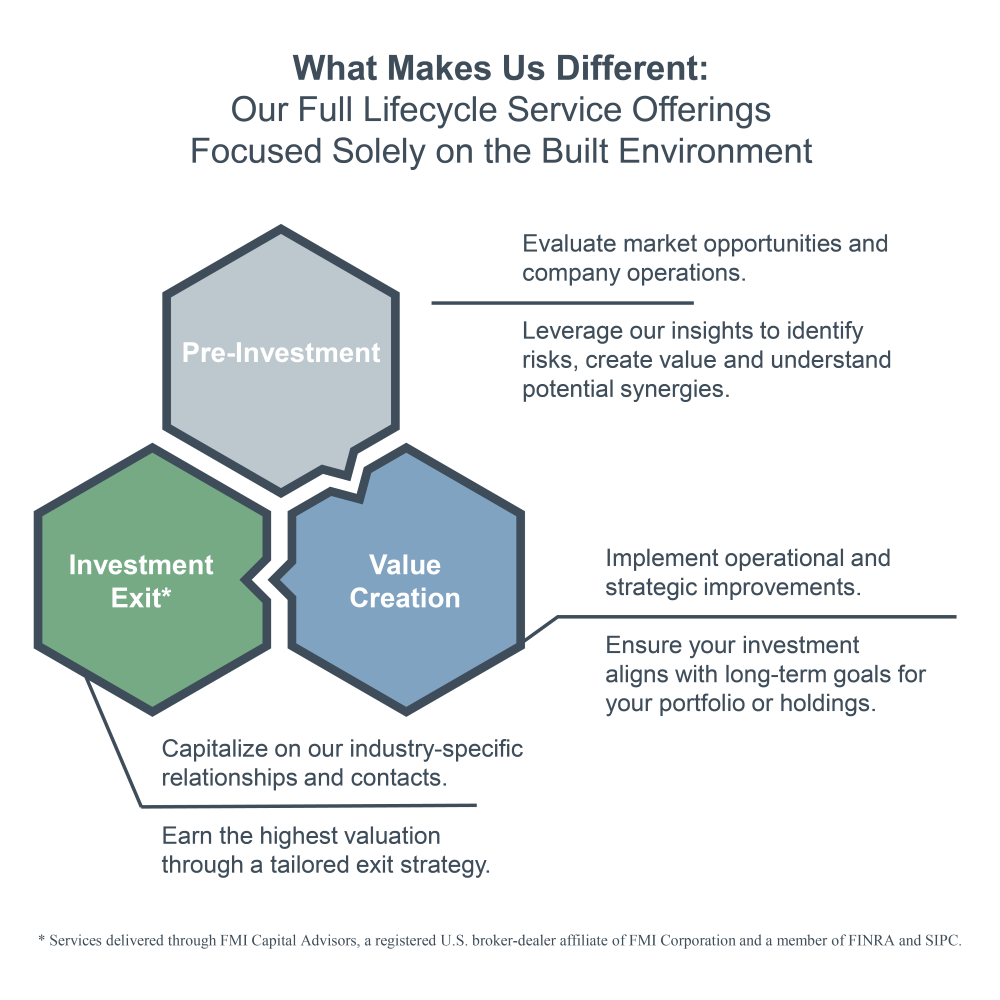

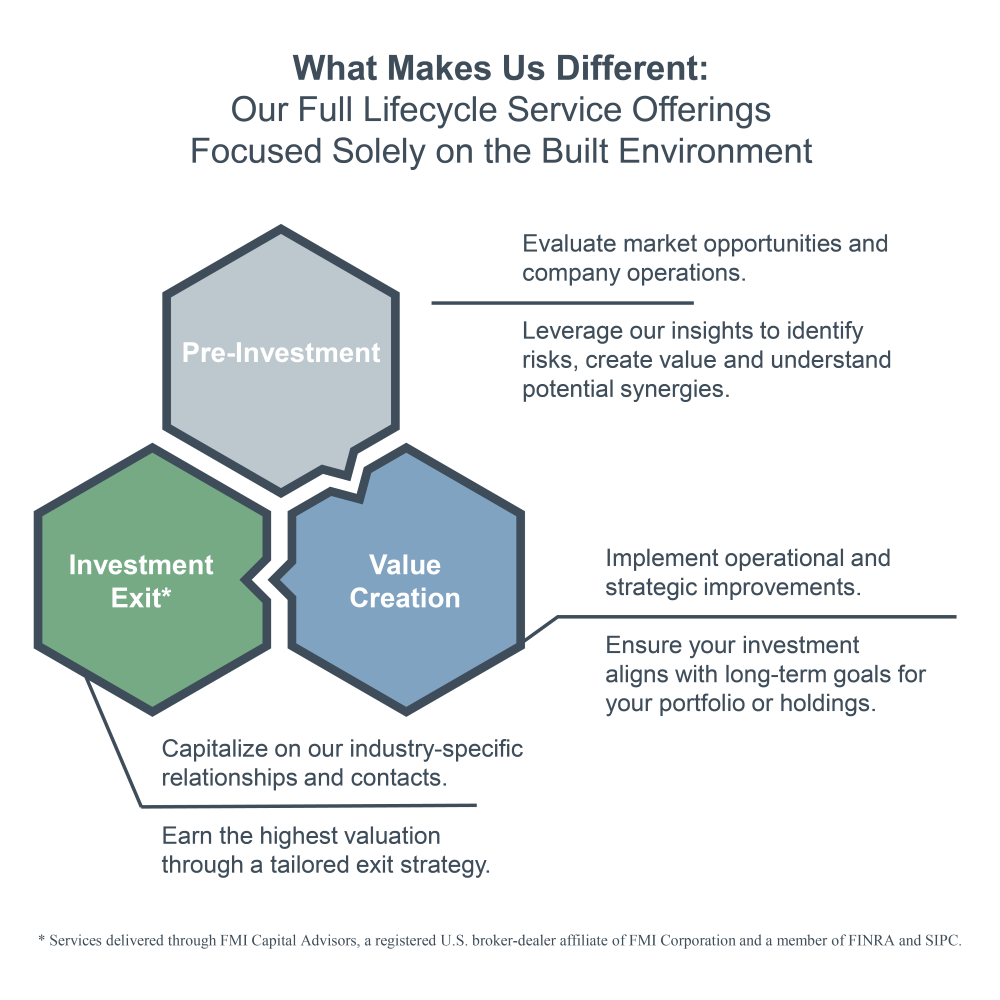

Our private equity consulting team specializes in thesis development, commercial and operational due diligence, post-acquisition value creation planning, and performance improvement implementation. With 75% of PE returns now driven by operational improvement rather than financial engineering, our sector-specific knowledge helps sponsors identify and execute the operational levers that create real value in portfolio companies.

Whether you're evaluating an opportunity in engineering, field services, infrastructure, building products, or another niche area of the built environment, our dedicated team provides the industry knowledge and custom analysis to guide your decisions. Financial sponsors seeking to unlock value from their investments look to FMI for decades of sector expertise, proprietary industry relationships, and knowledge of operational best practices that general consultants cannot match.

Clients turn to us for highly customized commercial due diligence, operational assessments, value-creation plans, and sell-side market studies. We help private equity firms uncover areas of value and risk across the asset life cycle, from platform formation through add-on acquisition strategy to exit positioning.