Nonresidential Construction Index

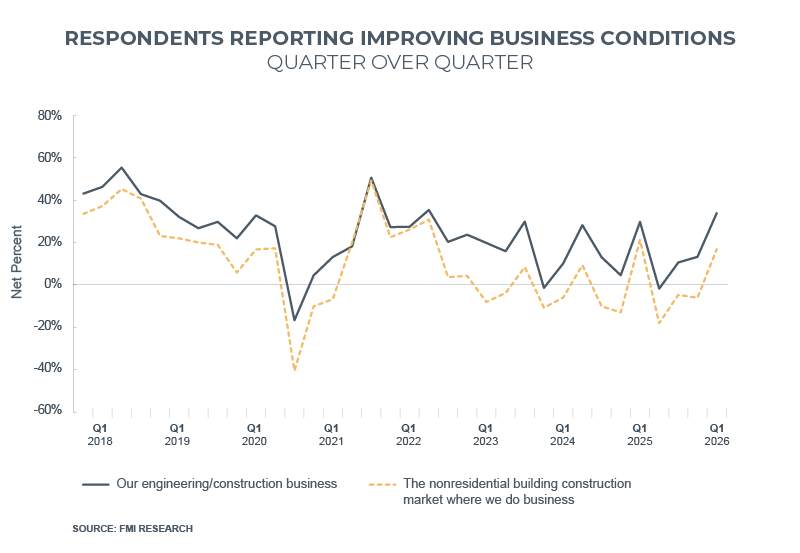

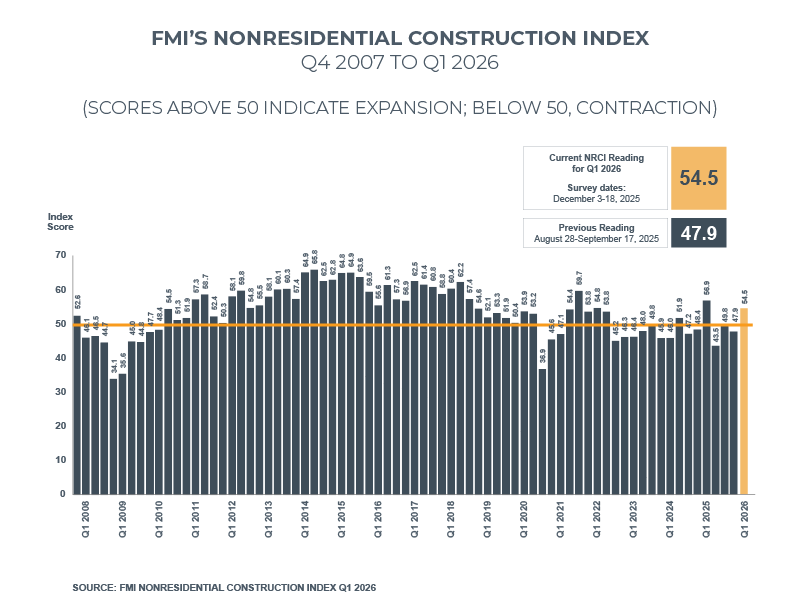

The NRCI climbed sharply to 54.5 in the first quarter 2026, up from 47.9 in the fourth quarter, as sentiment improved across every major component. Views on the overall U.S. economy and local economies where respondents operate moved into expansion territory this quarter.

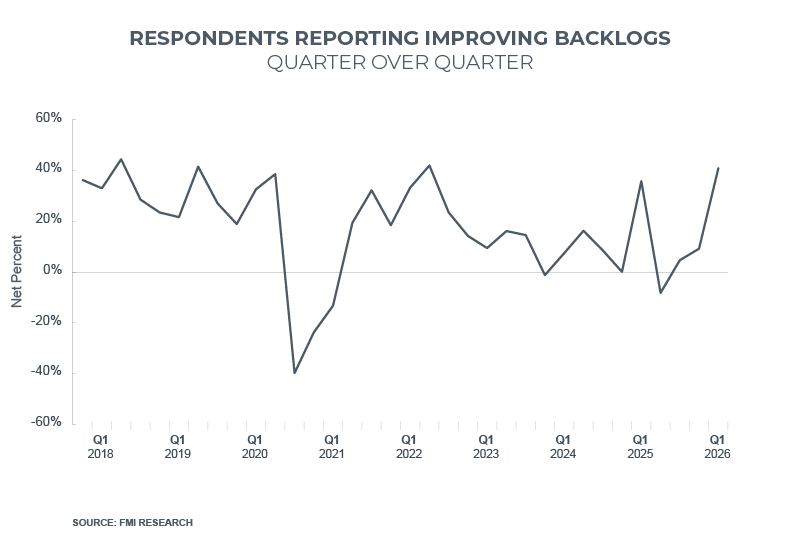

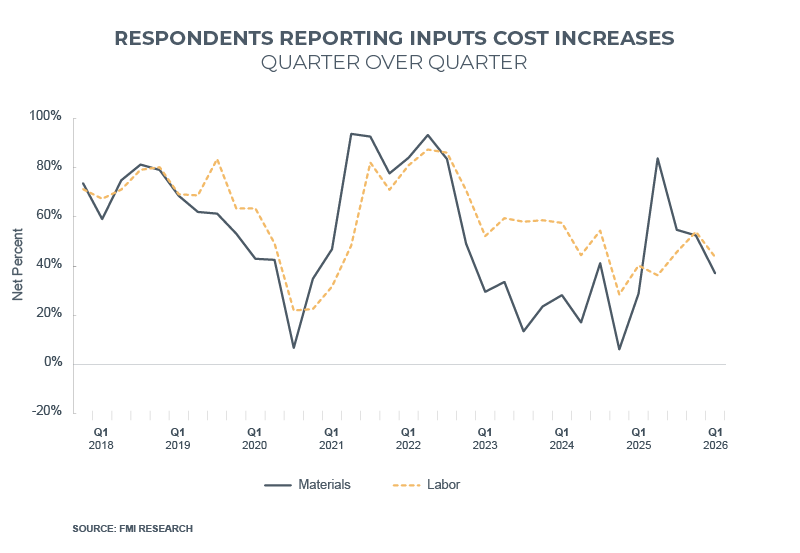

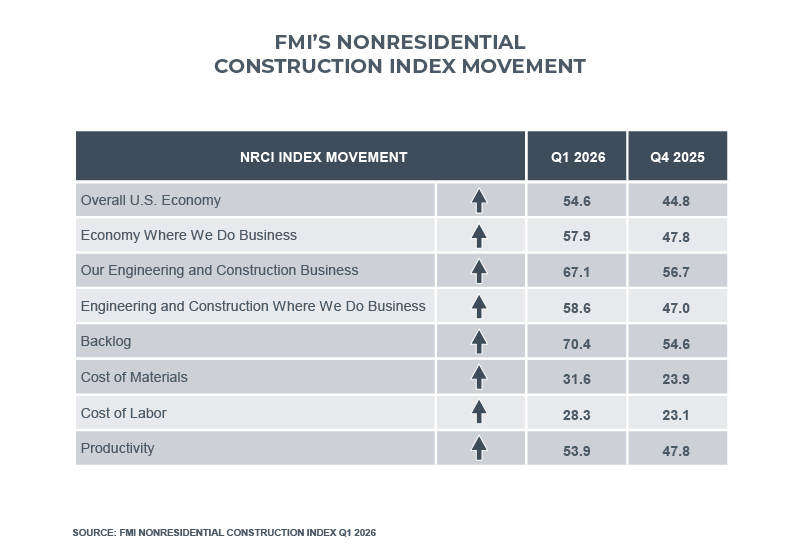

Expectations for their own construction businesses saw the largest improvement, jumping to 67.1 from 56.7 in Q4, while sentiment toward construction activity in their local markets also strengthened. Backlog expectations also rose to 70.4 from 54.6, signaling stronger workload visibility heading into 2026. Cost input indicators remained a drag, with materials and labor cost expectations still well below 50 at 31.6 and 28.3, respectively. Both measures suggest slower escalation than earlier in the year. Last, productivity improved to 53.8 from 47.8, offering relief as contractors push for efficiency gains in a tight margin environment.

This index, typically found in the North American Engineering and Construction Outlook report, is being published as soon as it’s available. The full report will be released in the coming weeks. Our survey participants enable us to provide vital insights into current trends and market conditions. If you’re interested in contributing, we encourage you to fill out the NRCI sign up form.

The above table and accompanying arrows illustrate how individual components contribute to the overall index score compared to the prior quarter. For most components, scores above 50 signal healthy or expansionary market conditions quarter over quarter. Cost of materials and cost of labor are exceptions whereas lower values in these components indicate expectations for rising prices and serve as a counterbalance.