2020 CIRT Sentiment Index: Second Quarter Report

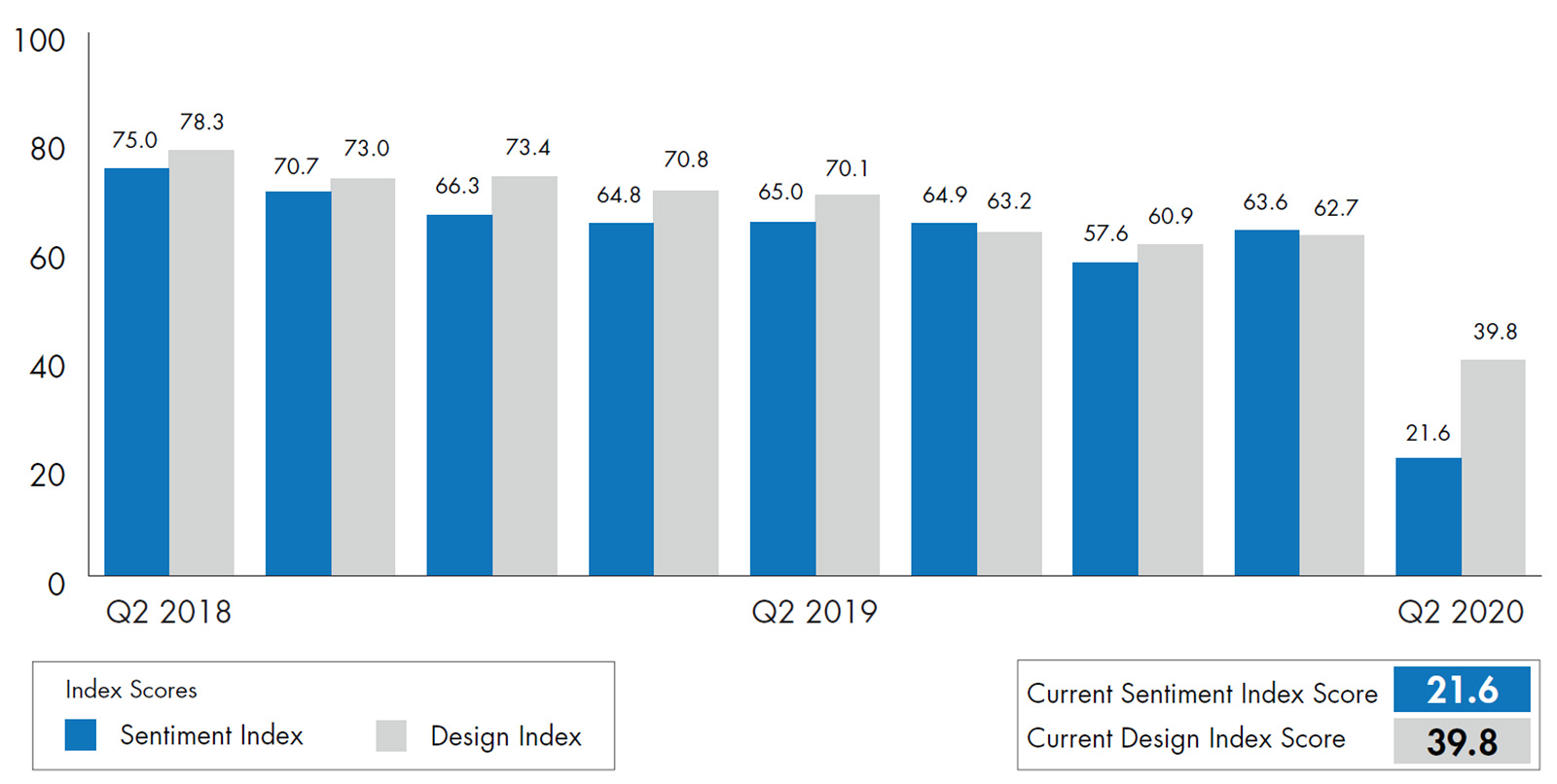

The second quarter of 2020 survey results suffered a significant tumble in both the CIRT Sentiment Index and the Design Index. The CIRT Sentiment Index experienced an unprecedented plunge from 63.6 to 21.6, with the Design Index seeing a similar drop from 62.7 to 39.8, indicating fewer opportunities are likely in the coming quarter(s). This historic decline appears to manifest the duel concerns of fear and uncertainty driven by the global pandemic, COVID-19, alongside corresponding market disruptions and volatility. Though many hope a government stimulus can help alleviate some of the losses, an economic recession appears to be very possible, if not an imminent threat.

This quarter our current issues questions address impacts on the various economic disruptions seen over the past few weeks (including COVID-19, depressed oil prices and market volatility). Open-ended comments pointed to a common theme related to the significant uncertainty COVID-19 was causing throughout the industry. Many found ongoing difficulty in keeping up with a range of local- and state- restrictions. Geographic impact points to hardship across the Northeast and West. Sector performance suggests short- and long-term resiliency in institutional and infrastructure segments.

In order to address current economic disruptions, a large majority (over 90%) of CIRT members reported limiting business travel as well as staff exposure on-site and/or in the office. Further, approximately 84% of members were postponing business meetings, and 79% were deferring spending decisions. When asked about schedule impact, well over half of all respondents (58%) reported some extension. Of those who realized changed schedules, two-thirds of respondents noted extensions between one and three months, 16% saw schedules extended between three and six months, and, combined, nearly one out of five (19%) had seen schedules extended by six months or more, or indefinitely. When inquired on material cost and availability, approximately half (51%) of all respondents reported that prices were unchanged. The second largest group, 38% of respondents, indicated a greater concern for material availability than price.

Among the industries represented by CIRT’s member base, lodging, commercial and international work are projected to realize the largest short- and long-term declines within both the design and construction industries. Similarly, both groups anticipate health care will expand unceasingly over the next year. The design industry’s long-term view of project growth remains positive, with every sector tracking above 3.0. The construction respondent’s long-term view is comparably lower, with only five of the tracked 10 sectors projected above 3.0 (health care, industrial, manufacturing, public works and transportation). Construction respondents anticipate commercial, education, international, lodging and office will all remain depressed well into 2021.

CIRT SENTIMENT INDEX AND DESIGN INDEX SCORES FROM Q2 2018 TO Q2 2020

To access the full report including all charts and graphs, please download the PDF.

ABOUT THE CONSTRUCTION INDUSTRY ROUND TABLE (CIRT)

The Construction Industry Round Table (CIRT) is composed exclusively of approximately 120-125 CEOs from the leading architectural, engineering and construction firms doing business in the United States.

CIRT is the only organization that is uniquely situated as a single voice representing the richly diverse and dynamic design/construction community. First organized in 1987 as the Construction Industry Presidents’ Forum, the Forum has since been incorporated as a not-for-profit association with the mission “to be a leading force for positive change in the design/construction industry while helping members improve the overall performance of their individual companies.”

The Round Table strives to create one voice to meet the interests and needs of the design/construction community. CIRT supports its members by actively representing the industry on public policy issues, by improving the image and presence of its leading members, and by providing a forum for enhancing and developing strong management approaches through networking and peer interaction.

The Round Table’s member CEOs serve as prime sources of information, news and background on the design/construction industry and its activities. If you are interested in obtaining more information about the Construction Industry Round Table, please call 202-466-6777 or contact us by email at [email protected].

CIRT SENTIMENT INDEX

The CIRT Sentiment Index is a survey of members of the Construction Industry Round Table conducted quarterly by FMI Research, Raleigh, North Carolina. For press contact or questions about the CIRT Sentiment Index, contact Mark Casso at [email protected] or Brian Strawberry at [email protected].

All individual responses to this survey will be confidential and shared outside of FMI only in the aggregate.

All names of individuals responding to this survey will remain confidential to FMI.

Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. The combination of Brian’s analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected].

Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. The combination of Brian’s analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected]. Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at [email protected].

Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at [email protected].