Carbon Mitigation: How Innovative Business Models Are Profitably Driving Greenhouse Gas Reductions

Businesses are bridging the gap between today’s carbon footprint and tomorrow’s climate goals through innovative business models. These approaches are driving greater value in emission reductions while accelerating real-world impact to meet the growing need for climate action amid infrastructure upgrades and expansions.

The 2020s have been dubbed the decade of climate action by the United Nations, underscoring the nearterm progress that is necessary to achieve internationally agreed-upon climate goals. Since the Paris Agreement was signed in 2016, countries, companies and organizations have committed to reducing carbon emissions. So far, progress has been at best mixed toward achieving these goals. However, necessity breeds innovation, and the gap between climate commitments and progress has created a rapidly increasing market opportunity for solutions that address carbon mitigation and management.

Today we’re seeing a wave of entrepreneurship shaping the carbon mitigation and management landscape, with strategies and technologies focused on reducing greenhouse gas (GHG) emissions across the built environment value chains. Business models are helping create quantifiable emissions reductions, from decarbonizing industrial processes and making forest preservation economically viable, to verifying emissions reductions through learning models. This strong momentum in carbon mitigation and management is buoying companies to continue innovating and growing their efforts to reduce emissions.

EMISSIONS 101

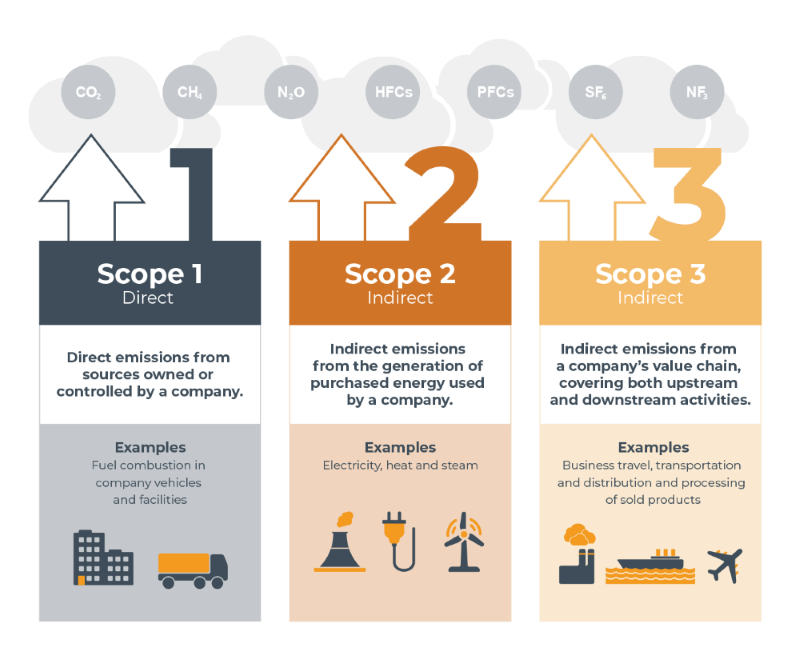

At the heart of the climate landscape is the need to reduce GHG emissions. These emissions are commonly categorized into scopes 1, 2 and 3, based on their origin within a company’s value chain.

- Scope 1: Direct emissions of GHGs from sources owned or controlled by the reporting company. Examples include:

- Combustion of fuels in company-owned or controlled equipment, such as boilers, furnaces and vehicles

- Chemical production in company-owned or controlled process equipment

- Fugitive emissions, such as leaks from refrigeration systems or methane releases from pipelines

- Scope 2: Indirect emissions from the generation of purchased energy consumed by the reporting company. These emissions occur at the facility where electricity is generated but are accounted for in the company’s GHG inventory since the company uses the energy.

- Scope 3: Indirect emissions that occur not in sources owned or controlled by the reporting company, but in its value chain. Included are both upstream and downstream activities.

- Upstream: Emissions from the production of purchased goods and services, capital goods, fuel- and energy-related activities not included in Scope 1 or 2, waste from operations, business travel, employee commuting and transportation and distribution.

- Downstream: Emissions from the transportation and distribution of sold products, processing of sold products, use of sold products, end-of-life treatment of sold products and operation of franchises and investments.

THE PROBLEM

Companies spanning every sector of the economy, including Aecom, CBRE, Kroger, Microsoft, Target and Valero, have made climate commitments to reduce their emissions. According to the Net Zero Tracker, a tool that catalogs the stated commitments of companies and countries worldwide, 500 large North American companies have made commitments to lower emissions, become carbon neutral or reach net zero emissions. While this widespread goal setting is an achievement in itself, only 2% of these companies have confirmed that they’ve met their goals.

But pressure is mounting to accelerate progress toward emission goals. More than 50% of companies set interim targets for 2030 or sooner, and pressure from investors and consumers continues to support climate action. Additionally, based on the current performance of global companies with climate goals, MSCI estimates there is a gap between progress made to reduce emissions thus far and stated scope 1 and 2 targets of 400 MtCO2e. To put this into perspective, 400 MtCO2e is approximately equal to the emissions produced by about 100 coal-fired power plants in a year, or the amount of carbon captured annually by a forest over two times the size of Texas.

To close the gap, large firms need to change their emissions trajectories imminently, which can be difficult to do, especially for companies that don’t have relevant in-house resources or expertise. And because no company wants to fail to meet commitments or related mandates, there are substantial opportunities for firms that specialize in managing and mitigating emissions.

ENTER: THE SOLUTION PROVIDERS

Many companies are rising to meet this challenge, offering scalable, meaningful solutions that profitably reduce emissions. These solutions range from making internal operational improvements to leveraging the voluntary carbon markets and taking novel approaches using advanced technology.

- Operational improvements are a logical first step with vast opportunity. Helping companies tackle their emissions goals in-house naturally starts with optimizing energy usage, especially for scope 2 emissions. Not only can operational improvements decrease energy usage, but they can also improve return on investment, modernize the workplace, reduce operating costs and increase safety. Companies like Ally Energy Solutions have helped their clients make progress toward their climate goals by designing and implementing energy-saving projects and programs nationwide. Their solutions have resulted in an estimated cumulative reduction of more than 500,000 tons of carbon dioxide and cost savings of $240 million from lower electricity demand. Energy efficient solutions, especially when coupled with other aforementioned benefits, provide both economic sense and real-world impact.

- Carbon credit creators enable action and extended impact. When in-house operational improvements are not commercially viable or able to facilitate necessary reductions, some companies may consider carbon credits. Also called offsets, carbon credits allow entities that have made carbon reductions to quantify and trade those credits to entities that want to reduce their emissions. These credits can be part of either the compliance market or voluntary carbon market (VCM), based on the type of project and industry.

Understanding Compliance and Voluntary Carbon Markets

Compliance (Mandatory) Credit Market

Markets established by governments to enable certain companies to meet regulated emissions reductions by trading credits, with each credit representing the right to emit one ton of CO2e.The largest compliance markets include:

- EU Emissions Trading System

- California’s Greenhouse Gas Cap-and-Trade Program

- Regional Greenhouse Gas Initiative (in the Eastern U.S.)

- Korea Emissions Trading Scheme

Voluntary Carbon Market

Highly fragmented but active set of marketplaces for nonregulated entities to trade carbon offsets, typically motivated by corporate sustainability goals. In its entirety, the VCM includes a variety of suppliers (credit creators), registries, verifiers, marketplaces and buyers (credit consumers). The largest registries include:

- Verified Carbon Standard

- Gold Standard

- Climate Action Reserve

- ACR (formerly known as American Carbon Registry)

“The compliance market helps drive the voluntary market — the presence of regulation in one area can drive voluntary action in others. Having two strong markets can act symbiotically and spur interest on both sides,” says Travis Cooke of Green Assets, a leader in developing carbon offset projects and conservation initiatives focused on forestry and timber management.

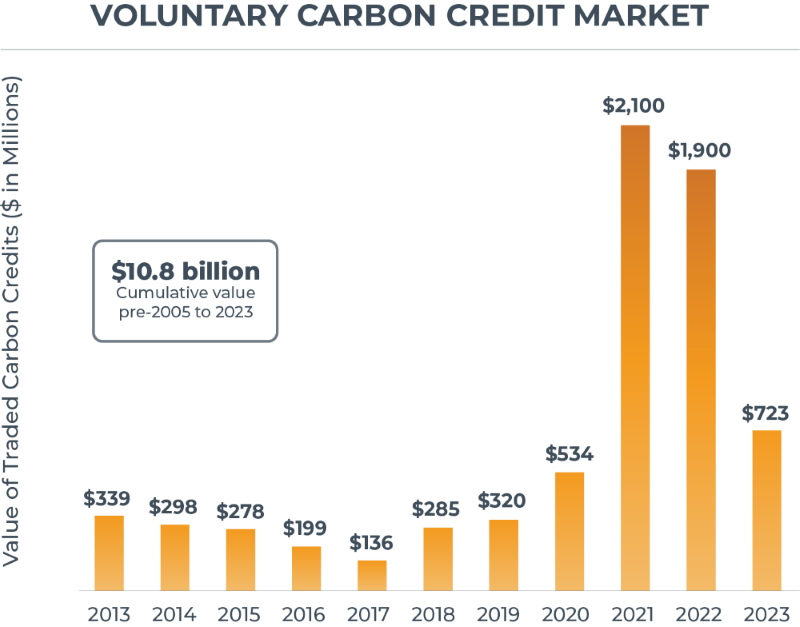

The VCM saw rapid growth in 2021 and 2022, with the value of credits traded surpassing $2 billion in 2021. In 2023, the market returned to a more normalized level, with a 20% compound annual growth rate (CAGR) from 2018 to 2023. This signifies that even with outlier value fluctuations, intrinsic support for this market is strong. Looking ahead, Bloomberg-forecasted scenarios estimate that demand for credits in the voluntary carbon market will increase six- to tenfold by 2030.

One company bridging both the supply and demand sides of the VCM is Therm, the creator of Refrigerant Carbon Credits™. Therm partners with businesses of all sizes to monetize climate-friendly refrigeration systems, food waste diversion systems and leak detection systems. These projects have a verified number of emissions reduced or avoided and are eligible for carbon credits.

“This is an incredibly exciting time for the voluntary carbon market. We’re seeing firsthand how market- based solutions are booming on their own, driven by real demand rather than mandates. The VCM is proof that sustainability doesn’t have to break the bank; businesses can achieve meaningful climate action while building value,” says Fritz Troller, CEO and co-founder of Therm.

Companies like Green Assets and Therm are scaling their impact to deliver high-quality emissions reductions.

- Advanced technology facilitates emissions management. Beyond internal operation improvements and carbon credits, advanced technology — particularly artificial intelligence and machine learning (AI/ML), internet of things (IoT) and blockchain — is revolutionizing the monitoring, reporting and verification (MRV) of emissions reductions and energy efficiency.

For instance, the advent of IoT technology has transformed emissions monitoring and reporting within the industrial sector. Real-time data collected through sensors and smart meters allows for the immediate processing and management of energy usage and emissions, adhering to established protocols for scope 1, 2 and 3 emissions. This not only helps companies maintain compliance but also enhances their ability to make informed, strategic decisions that align with their goals. When AI/ML is overlayed onto this data, firms can harness predictive analytics to make proactive adjustments to their operations.

Furthermore, advanced technology can play a crucial role in enhancing the transparency and credibility of emissions reporting and verification. Blockchain technology can ensure reported reductions are accurately recorded and immutable.

Along with improved verification standards, this technology can build trust among stakeholders and make emissions data more robust.

These technological advancements are setting new standards for MRV processes. Adoption of technology is a critical part of the infrastructure already supporting the growth of the emissions management and mitigation industry.

MOVING FORWARD

It’s clear that the need for emissions mitigation and management will remain strong, driven by a host of factors underpinned by profitable economics, and will be led by companies using innovative, business-led approaches that don’t rely solely on regulatory mandates. Supported by consumer, investor and strategic interest, these companies are shaping a profitable, scalable path to meaningful climate action through the use of advanced solutions and cutting-edge technology.

The dynamics of the carbon mitigation and management market present immense opportunity amid the challenges of today’s built environment. FMI is excited to continue partnering with clients to navigate the M&A environment in this space today and well into the future.