Now is the Time to Prepare for Transferring Ownership of Your Company

The generational shift from baby boomers to their successors is underway across the built environment.

With 41% of the current U.S. construction workforce expected to retire by 2031, many of them owners of engineering and construction (E&C) firms, the industry is experiencing a massive generational shift. Even if you’re just beginning to dream of your post-work years, now is the time to start planning since transitioning ownership is a long-term, continuous process.

The aging population continues to drive mergers and acquisitions (M&A) activity, and business owners focused on their legacies need to address the impending ownership transition and management succession of their firms. Preparation for this is critical. Developing the future through defining the strategy, instituting operational improvements and financial discipline, and addressing leadership talent development is vital to successfully transitioning ownership.

Many departing baby boomer owners developed experience and business acumen through various economic cycles, including periods of prosperity as well as economic challenges such as the Great Recession and the COVID-19 pandemic. These learnings, among other leadership skills and knowledge, are critical when passing a business to the next generation.

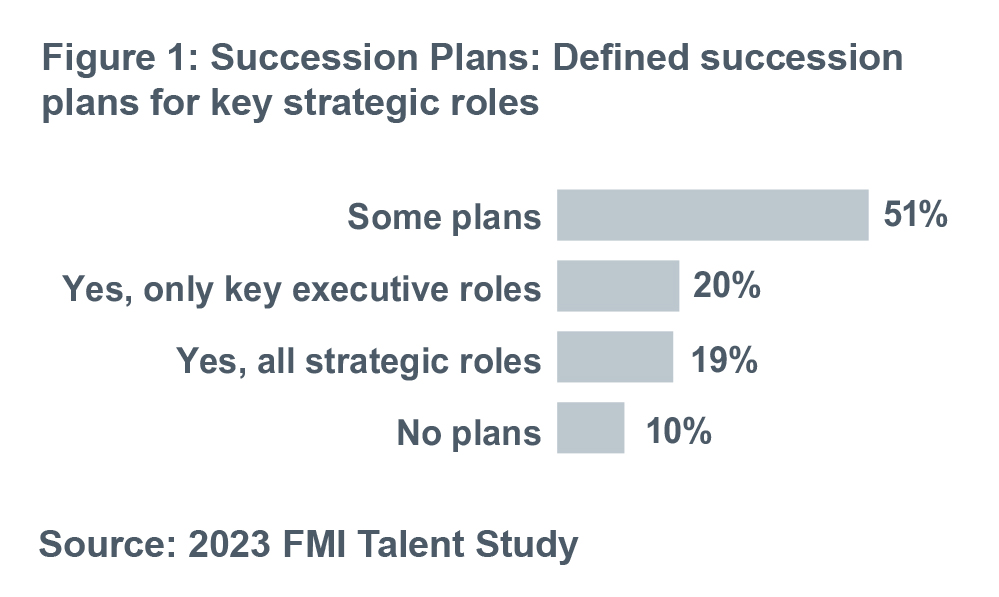

Of more than 300 executives surveyed for FMI’s 2023 talent study, about half said they had some plans for how to transition key roles.

From a talent gap standpoint, in the 2023 first quarter CIRT Sentiment Index, members indicated that 4 of the 5 top risks for 2023 are related to either the supply or retention of labor. Notably, slightly more than half of members plan increased hiring levels as compared to 2022, and roughly half of members believe their current labor force is low as compared to backlog needs. These findings outline an existing talent gap between hiring needs and labor availability alongside a lack of transition planning, furthering the need for defined succession planning.

Addressing Succession…Getting Started

Business succession planning impacts all facets of the company – people, culture, governance, operations and financial capacity. Successful transitions of E&C companies take time, thoughtful planning and a willingness to address critical questions early in the process.

1. Be Proactive

It is never too early to start, and, frankly, the time will never be right. Succession takes time and, given the cyclical nature of the industry, requires a level of inherent flexibility. A best first step is to ask a few priority questions:

What are my primary objectives?

Factors to Consider:

- Maintain family ownership

- Institute broader ownership

- Create value or maximization

- Ensure legacy and/or enduring organization

- Mitigate risk

What is my timeline?

Factors to Consider:

- Stepping away from the business

- Fully transitioning ownership

- Ceding control

How strong is my next generation?

Factors to Consider:

- Identified vs. in place

- In place and executing vs. development needed

- Risks associated with ownership

- Strengths and weaknesses

As you ask yourself these questions, also think about what you will do in the next phase of your life. Many owners find that determining what will happen after ownership is transferred is one of the hardest parts of starting the process. It is wise to consider how you will be actively engaged outside of the business after you leave. The more clearly this is defined, the better your chances for success.

These questions are for you to address; however, understanding the goals and aspirations of your next generation is important for informing the future. Ultimately, the answers to the above questions will allow you to create goals for planning.

2. Envision the Future

Based on key objectives, owners should ask themselves what the most effective organizational structure is to manage operations, mitigate risk and institute governance. This informs the steps the company and leadership need to take to achieve the stated goals.

Topics to address include:

- Definition of key leadership roles alongside responsibilities and required competencies.

- Development of ownership criteria (i.e., executive management, years of service, achievement of profit and growth goals, corporate goals, driver of culture and employee engagement).

- Transition of control (i.e., timing, shared versus individual control).

- Assessment of corporate oversight (i.e., advisory council or formal board of directors).

All firms experience corporate evolution as generations transition. It is a natural progression. It takes time, and likely multiple iterations, to fully predict a future state, yet it is a great way to set the direction for the future.

3. Initiate the Beginnings of a Strategic Plan

It is important to build a corporate vision that aligns with your succession goals. Succession takes resources, namely financial, as corporate capital is typically utilized to affect stock transactions. This limits capital for other uses (i.e., strategic investment) and underpins the need for proper financial planning and management.

A corporate and financial plan should be both manageable and achievable, addressing the following areas:

- Strategy: Markets, growth, sectors, hiring.

- Financial: Growth and profitability benchmarks.

- Risk Management: Surety concerns and required capital levels.

- Contingency Planning: How to deal with unforeseen events.

- Talent Development: Leadership development and successor growth.

There are two important factors to consider. First, think about the appropriate revenue and organization size. When you grow too fast or take on too much, the ability to manage change, alongside succession, can become compromised. Many firms limit growth during a transition (at least initially) to ensure a successful initiation.

Second, it is important to engage the correct constituents, both internal and external, to help you build and execute your strategy and, ultimately, your succession plan. Having help understanding the bigger picture and the pros and cons of specific options or paths can help guide you in the process.

4. Accelerate Training and Development Efforts

Culture and employee engagement matter in today’s work environment. Further, there is a level of investment required in successors to ensure readiness for advancement. This is made more challenging, given the existing talent shortage.

FMI’s recent talent survey outlined several themes, yet two have a direct effect on succession:

1. Talent shortages and limited employee capacity are hindering revenue growth (not enough workers to complete projects) and causing burnout. The “all hands on deck” scenario effectively impedes succession progress.

2. Companies expect to lose employees at all levels in the organization. Average expected employee loss to attrition and retirement in the next five years is:

- Executives — 22%

- Senior Managers — 22%

- Project Managers — 23%

- Field Managers — 28%

In our practice, we see a lack of depth in the senior project manager ranks, where many future leaders are developed. Further, many firms are dealing with two-sided recruiting, meaning they are recruiting new employees while having to continuously engage existing organizational talent to keep them on board, providing further proof that talent investment is needed.

To combat the talent shortage and to shore up succession development, instituting a formal and communicated development plan reaching all levels (from the field to executives) is critical. Firms that effectively communicate their investment in and development of employees with a path for growth ultimately improve the chances of attracting and retaining talent, engaging employees and increasing the likelihood of transition success.

It is human nature to hold off addressing ownership transition decisions; yet many in the industry wait until it is too late, thus limiting options and potentially preventing objective achievement. Getting started and initiating the planning process will put you on the path to success.

As you continue through the succession journey, you will need to address specific financial considerations regarding the valuation and transacting of stock, taxation, risk mitigation and estate planning implications. Engaging a financial advisor to counsel you through the critical factors to consider, potential options and an understanding of the pros and cons of each option is a recommended path.