FMI U.S. Engineering and Construction Outlook: Second Quarter 2020 Report

Key Takeaways

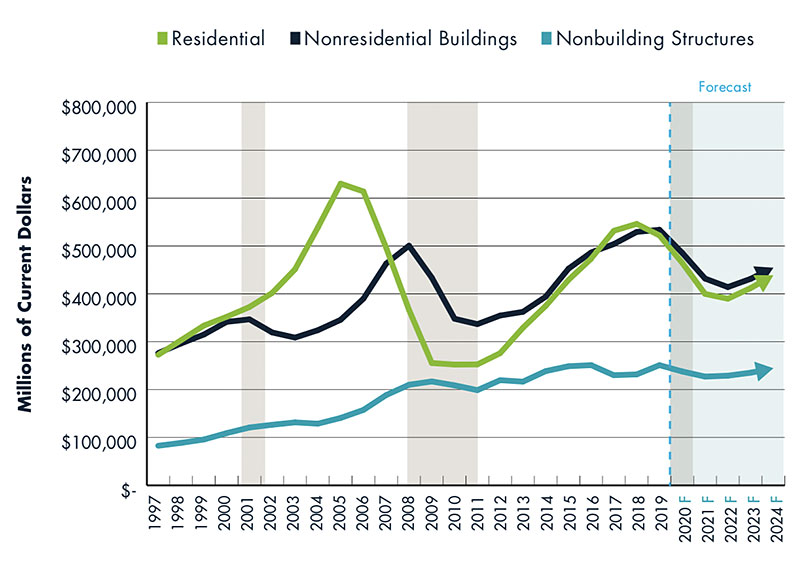

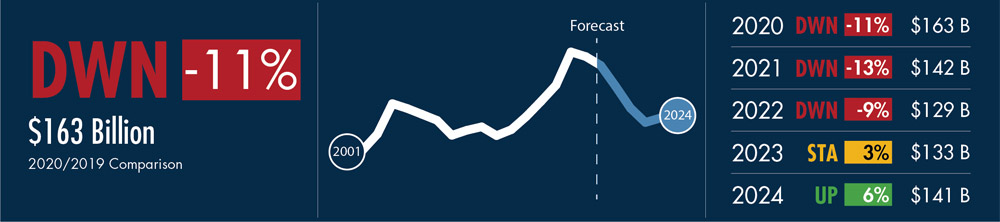

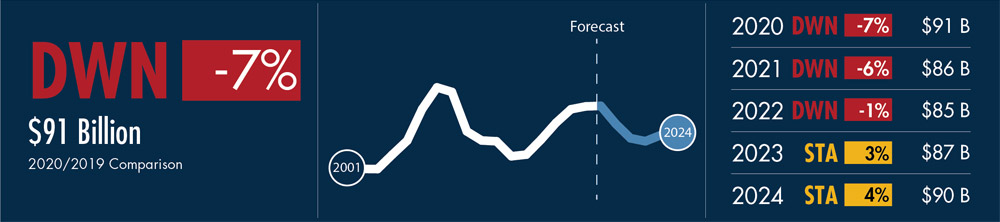

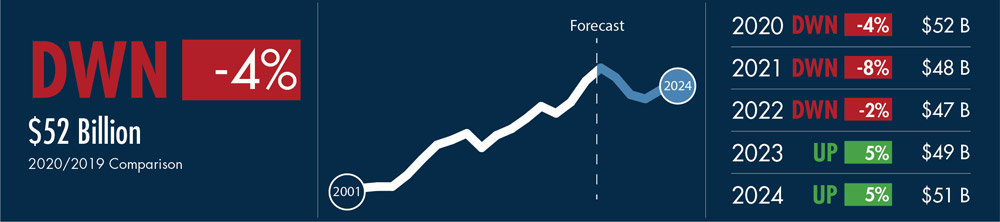

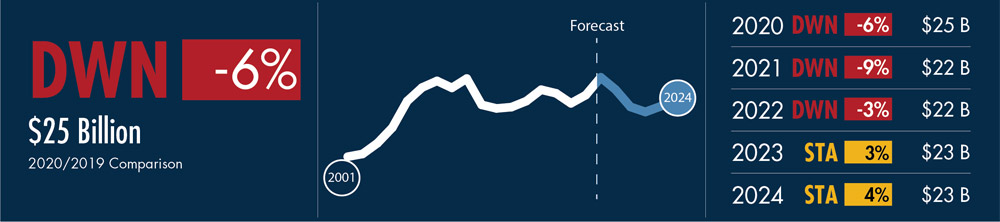

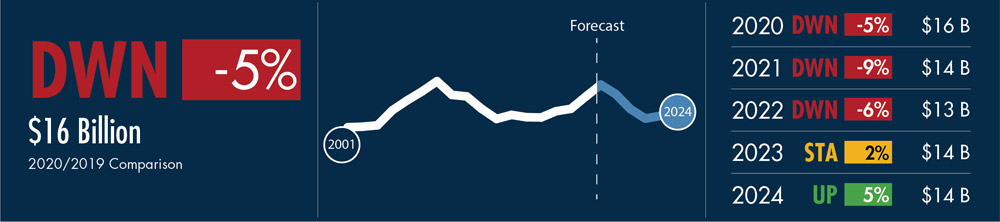

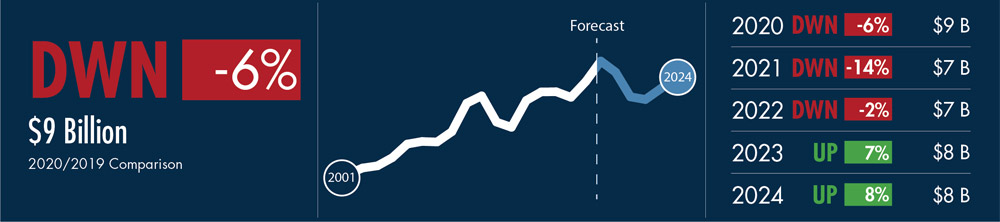

Total Construction Put in Place

Estimated for the United States

Throughout the value of construction put in place includes the cost of architectural and engineering work.

Throughout the value of construction put in place includes the cost of architectural and engineering work.

Source: U.S. Census and FMI Forecast

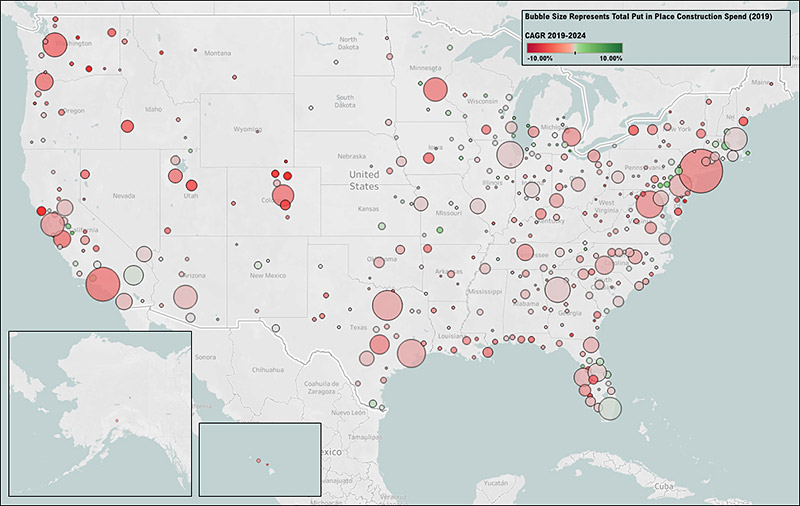

Total Construction Spending Put in Place 2019 and Forecast Growth

(2019-2024 CAGR) by Metropolitan Statistical Area

Source: U.S. Census and FMI Forecast

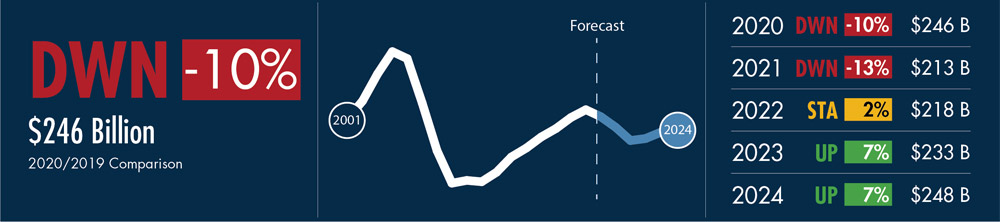

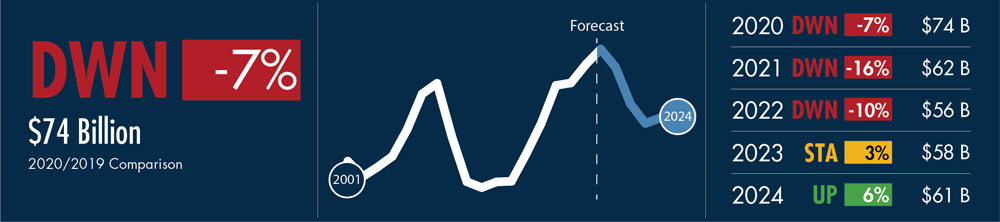

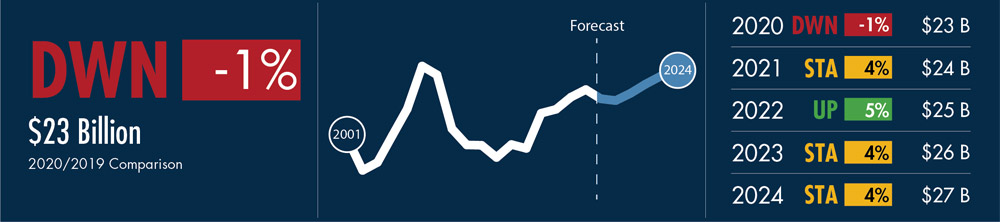

RESIDENTIAL CONSTRUCTION PUT IN PLACE

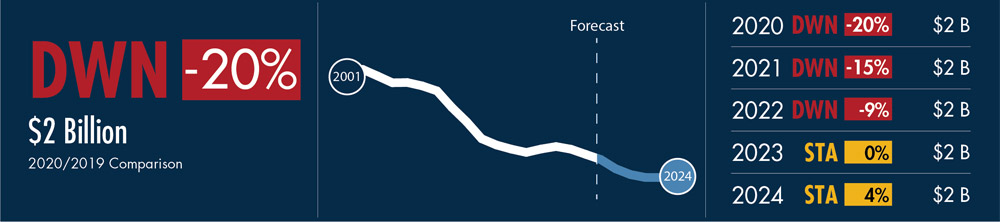

Single-Family Residential

- Heightened unemployment rates will weigh on inventories, prices and confidence

- Affordability and availability issues persist despite bottomed interest rates

- Weakness through the prior expansion cycle, reconsideration of downtown living and increased remote working may provide stability and opportunities into economic recovery

Drivers: Unemployment rate, core CPI, income, mortgage rate, home prices, housing starts, housing permits

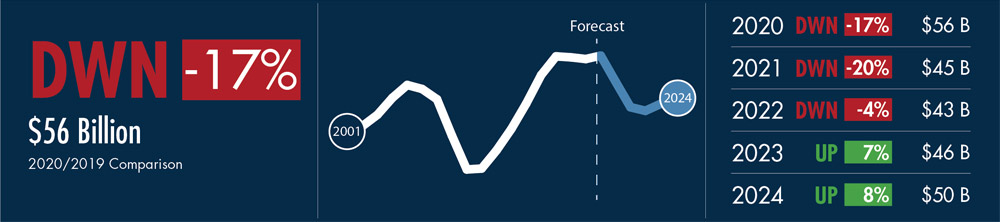

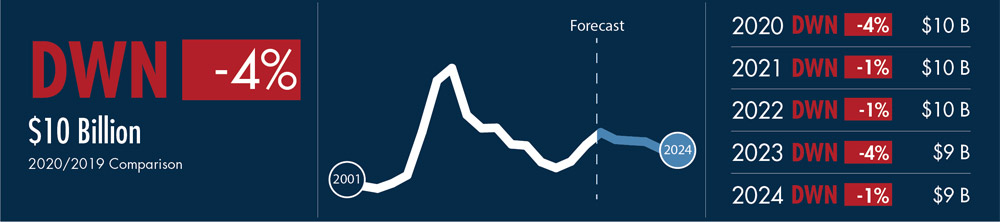

Multifamily Residential

- Demographic shifts favor secondary and tertiary urban submarkets

- Anticipate significant disruption to planned mixed-use developments

- Buyers and renters are increasingly transient in both living and employment obligations

- Heightened unemployment and volatility favor rentals

Drivers: Unemployment rate, core CPI, income, mortgage rate, home prices, housing starts, housing permits

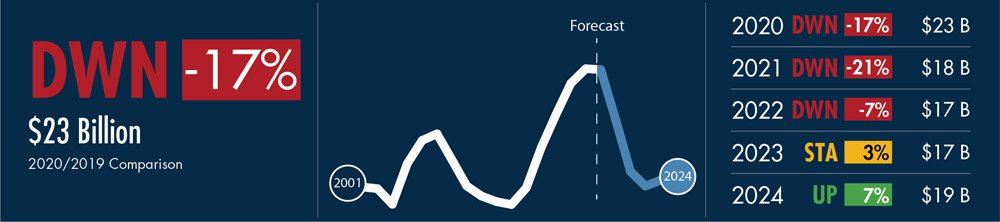

Improvements

- Shelter-in-place mandates spurred short-term demand for improvements spending through early 2020

- Fewer qualified buyers and home sales and declining rental turnover drive improvement spending lower in coming years

- Aging inventories and increased refinance activity help offset long-term losses

Drivers: unemployment rate, core CPI, income, mortgage rate, home prices, housing starts, housing permits

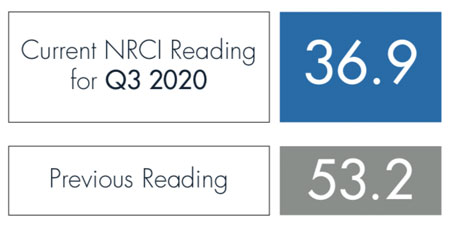

Nonresidential Construction Index (NRCI)

NRCI scores are based on a diffusion index where scores above 50 represent improving or expanding industry conditions, a score of 50 represents conditions remaining the same, and a score below 50 represents worse conditions than last quarter (or contraction).

NRCI scores are based on a diffusion index where scores above 50 represent improving or expanding industry conditions, a score of 50 represents conditions remaining the same, and a score below 50 represents worse conditions than last quarter (or contraction).

The data in the NRCI is presented as a sampling of construction industry executives voluntarily serving as panelists for this FMI survey. Responses are based on their experience and opinions, and the analysis is based on FMI’s interpretation of the aggregated results.

The data in the NRCI is presented as a sampling of construction industry executives voluntarily serving as panelists for this FMI survey. Responses are based on their experience and opinions, and the analysis is based on FMI’s interpretation of the aggregated results.NONRESIDENTIAL CONSTRUCTION PUT IN PLACE

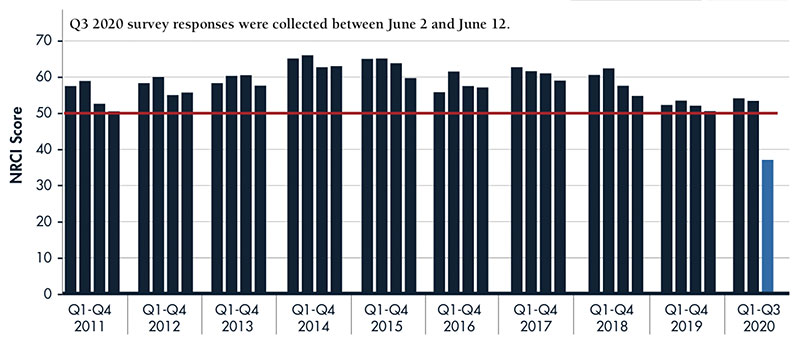

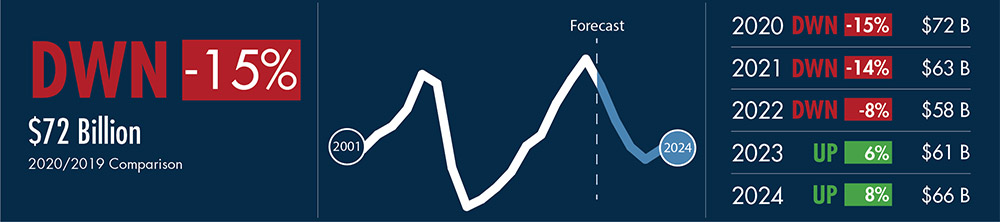

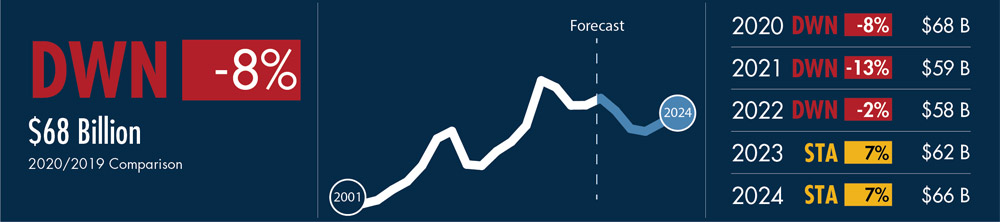

Lodging

- COVID-19 and protests caused major disruptions to travel (both business and leisure) nationwide

- Industry fundamentals, including occupancy rates and RevPar, are expected to remain depressed well into 2021

- Future losses tied to reduced mixed use and transportation investment

Drivers: Occupancy rate, RevPAR, average daily rate, room starts

Office

- Increased acceptance/leniency on remote working weighs on future demand

- Open-floor plan design, shared office space and coworking business models will be tested

- Reduced mixed use investment and corporate relocations

- Rapid expansion of data center investment continues alongside 5G deployment and increased e-commerce and remote working adoption

Drivers: Office vacancy rate, unemployment rate

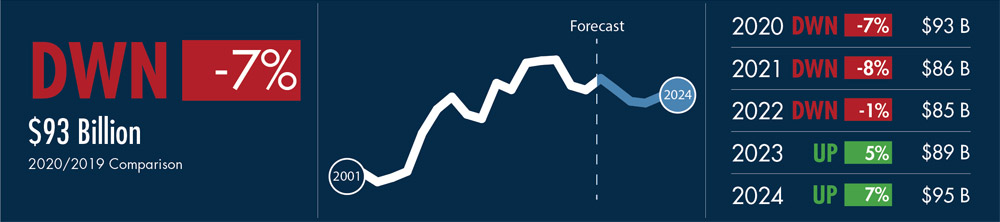

Commercial

- Ongoing and increasing bankruptcies through 2021

- Increased acceptance and use of omnichannel sales (i.e., online curbside pickup)

- Future losses tied to reduced mixed use investment and increasing vacancies

- Demand for warehouse and distribution picks up across all facility types

Drivers: Retail sales, CPI, income, home prices, housing starts, housing prices

Health Care

- Demand and adoption for health care services and technologies (e.g., telehealth and wearables) are expected to jump substantially in the wake of COVID-19 and 5G deployment

- Rapidly increasing adoption of telehealth significantly challenges capital plans for clinics and outpatient facilities

- Project pipeline suggests a potential resurgence in larger health care campuses

Drivers: Population change, population change in ages 75 and up, uninsured population, government spending, nonresidential structure investment

Educational

- K-12 and higher education both experience significant revenue losses; a fall/September start will be critical for many

- Industrywide prioritization in establishing and/or refining an online presence

- Increased focus on facility design in safety and well-being

- Maintenance backlogs receive much needed support through future infrastructure stimulus

Drivers: Population change younger than age 18, population change ages 18-24, stock markets, government spending, nonresidential structure investment

Religious

- Shelter-in-place mandates, rising unemployment and weakening consumer confidence weigh on existing capital plans

- Trend in declining attendance and religious affiliation continues

- Ongoing shift away from traditional worship facilities into community-focused service and gathering places

Drivers: GDP, population, income, personal savings

Public Safety

- Historically low crime rates reverse alongside rising unemployment and heightened social unrest

- Department budgets at risk of cuts as tax revenues decrease

- Large and high-growth metropolitans increasingly in need of updated facilities, resources and infrastructure

Drivers: Population, government spending, incarceration rate, nonresidential structure investment

Amusement and Recreation

- Anticipate pandemic-related shutdowns and capacity restrictions into 2021

- Loss of revenue, elevated unemployment, lower consumer confidence and spending, and reduced travel (both business and leisure), alongside economic contraction, results in fewer projects in planning

- Future bankruptcy and/or restructuring announcements are anticipated

Drivers: Income, personal savings rate, unemployment rate, employment

Transportation

- Transit/rail and airline ridership has plummeted and will remain challenged well into 2021

- Future bankruptcy and/or restructuring announcements are anticipated; losses bleed into state and local budgets

- Various anticipated megaprojects will be canceled or postponed

- Oncoming federal infrastructure bill and stimulus funding will support increased spending levels to aid economic recovery

Drivers: Population, government spending, transportation funding

Communication

- Demand is increasing for an online/e-commerce presence across multiple industries

- Communications investment will be prioritized and highlighted in upcoming federal infrastructure and stimulus packages

- Internet traffic, connected devices and demand for data storage and processing increase dramatically over the forecast period

- Fifth-generation (5G) iPhone rumored on track for late-2020 release

Drivers: Population, security/regulation standards, private investment, innovation/technology investment

Manufacturing

- Supply chain disruptions, political uncertainty, ongoing trade tensions and oil price collapse all support continued declines

- Large-scale planned petrochemical and transportation equipment investments will remain challenged

- Reshoring manufacturing becomes a political platform going into the presidential election

- Increased investment in robotics and facility automation

Drivers: PMI, industrial production, capacity utilization, durable goods orders, manufacturing inventories

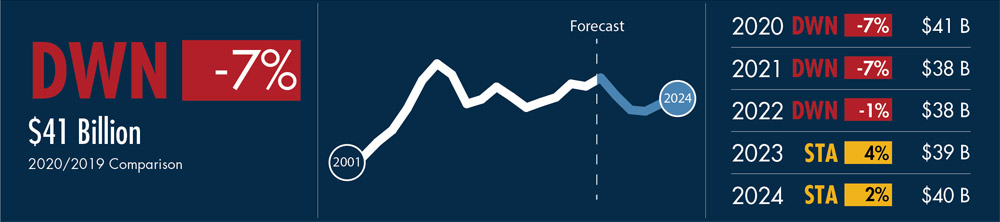

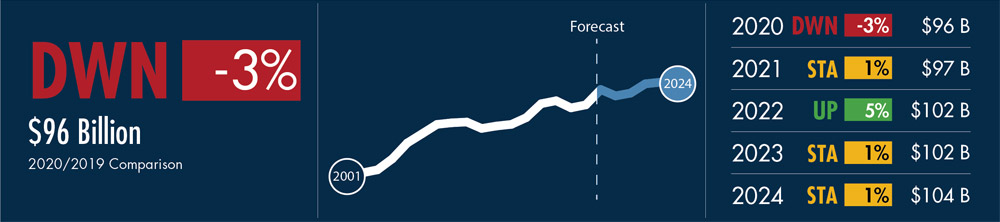

NONBUILDING STRUCTURES CONSTRUCTION PUT IN PLACE

Power

- Oil and gas price collapse, alongside a wavering trade climate, will continue to challenge pipeline and related infrastructure investment

- Resiliency improvements, regulatory requirements and electrification trends are expected to help offset short-term and midterm losses in oil and gas spending

- Lower energy prices contest demand for planned large-scale renewable projects

Drivers: Population, industrial production, government spending

Highway and Street

- The successor to the FAST Act will become a political platform in the upcoming election; low likelihood of increased federal gas taxes

- Budgets and capital plans will become increasingly strained with lower tax collections; states that have passed recent/large measures (e.g., California’s SB1) will fare better than others

- Future economic stimulus into infrastructure construction will largely be directed into shovel-ready and resurfacing projects

Drivers: Population, government spending, nonresidential structure investment

Sewage and Waste Disposal

- Overall demand will decline alongside reduced residential and nonresidential development

- Passage of America’s Water Infrastructure Act in late 2018 and reauthorization of the Water Infrastructure Finance and Innovation Act (WIFIA) provide some stability in capital plans

- Future infrastructure stimulus and low borrowing costs are expected to help uphold spending levels

Drivers: Population, industrial production, government spending

Water Supply

- The Water Quality Protection and Jobs Creation Act of 2019 injects billions into the Clean Water State Revolving Fund through the forecast period

- Overall demand will decline alongside reduced residential and nonresidential development

- Future infrastructure stimulus and low borrowing costs are expected to help uphold spending levels

Drivers: Population, industrial production, government spending

Conservation and Development

- Low oil prices and declining industrial production/expansion will limit short-term needs for remediation and conservation spending

- Ongoing USACE spending tied to 2019 Disaster Relief Act efforts

- EPA budgets will remain in contention through the 2020 presidential election

Drivers: Population, government spending

Jay Bowman is a principal with FMI. Jay assists a broad range of stakeholders in the construction industry, from program managers and general contractors to specialty trades and materials producers, with the identification and assessment of the risks influencing the strategic and tactical decisions they face. In this role, Jay’s primary responsibilities include research design and interpretation, based on developing an understanding of the context within which these organizations operate. Jay can be reached at [email protected].

Jay Bowman is a principal with FMI. Jay assists a broad range of stakeholders in the construction industry, from program managers and general contractors to specialty trades and materials producers, with the identification and assessment of the risks influencing the strategic and tactical decisions they face. In this role, Jay’s primary responsibilities include research design and interpretation, based on developing an understanding of the context within which these organizations operate. Jay can be reached at [email protected]. Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. Brian’s combination of analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected].

Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. Brian’s combination of analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected]. Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at [email protected].

Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at [email protected].