2021 Engineering and Construction Industry Overview: United States

2021: Finding Opportunities Amid Uncertainty

As 2020 ended, many hoped that 2021 would see us putting issues like the COVID-19 pandemic, turmoil surrounding the U.S. presidential election and sustained economic uncertainty behind us. A month into the new year, it’s clear that these and other challenges are not fading as quickly as we would like. Instead, COIVD-19 continues to cause tremendous uncertainty over how the first quarter and beyond will unfold.

While some geographies and industry sectors remained unscathed, or even thrived, most of the industry struggled with the pandemic’s impacts on people, projects and profits. These challenges continue to define the engineering and construction industry’s operating environment as we move into 2021.

In our 2021 Engineering and Construction Industry Overview, FMI anticipates a continued dissipation of the current recession. However, significant risks remain intact throughout our economy tied to impaired labor markets and various areas of contraction or expansion (and in some cases overexpansion) caused by previous events.

Key highlights of the report include:

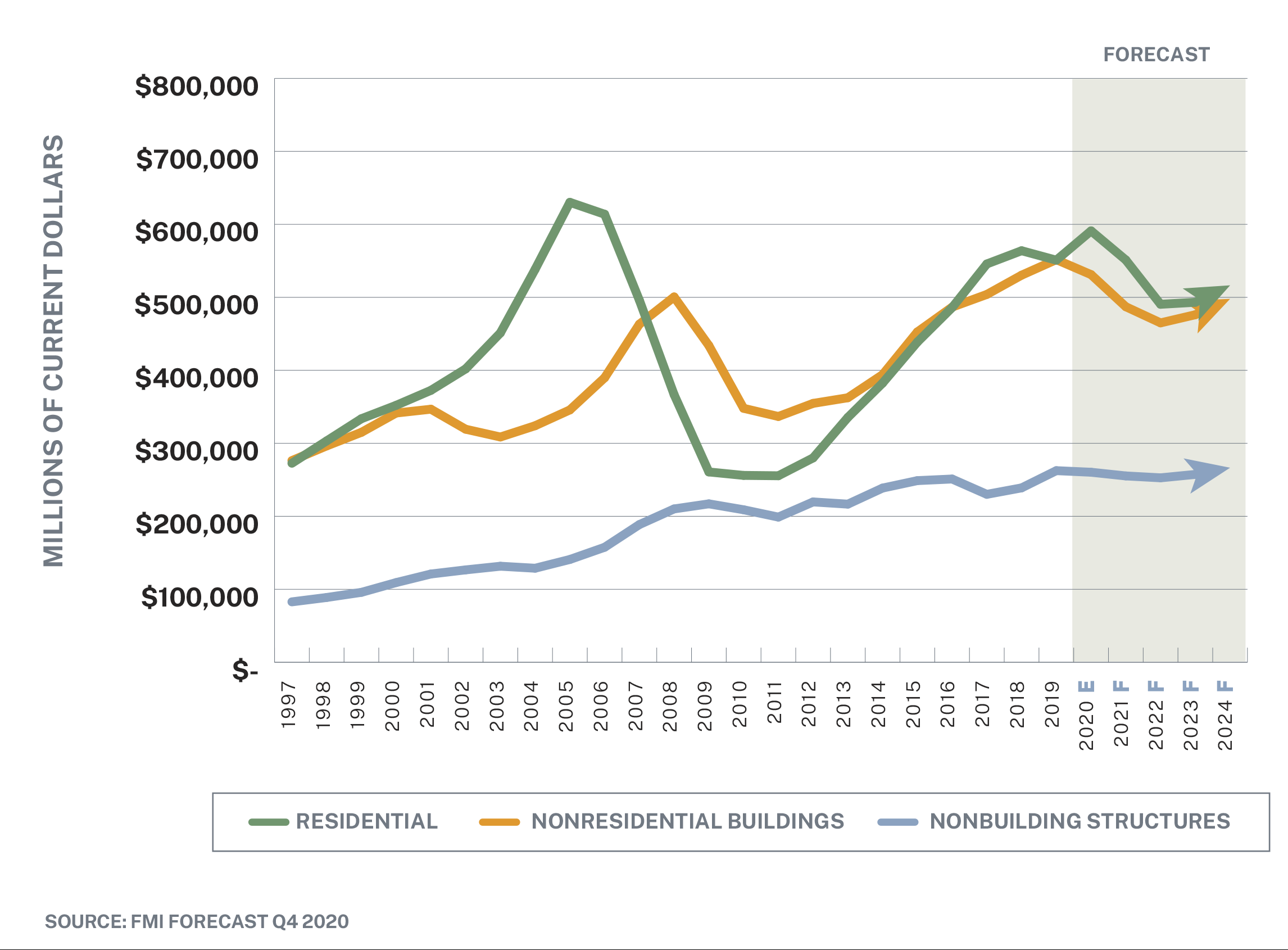

- Total engineering and construction spending for the U.S. is forecast to end 2020 up 1% compared to up 2% in 2019.

- Looking ahead to 2021, FMI forecasts a 6% decline in engineering and construction spending levels compared to 2020.

- Primary growth segments in 2020 are expected to be limited to residential improvements, single-family construction, public safety and water supply infrastructure, all with growth rates of 5% or higher.

- Some mixed public and private segments (multifamily, commercial, health care, communication, sewage and waste disposal, and conservation and development) are expected to end 2020 with growth roughly in line with the rate of inflation and therefore be considered stable.

- Most nonresidential building segments (i.e., lodging, office, educational, religious, amusement and recreation, transportation and manufacturing) alongside the largest nonbuilding structures segments (i.e., power and highway and street) are expected to end 2020 in decline.

- The latest Nonresidential Construction Index (NRCI) feedback suggests increased optimism for the first quarter of 2021, at 47.1, up from 45.6 in the quarter prior. The index however remains below the growth threshold of 50, suggesting fewer engineering and construction opportunities in 2021.

Total Construction Spending Put in Place

Estimated for the United States

Jay Bowman is a principal with FMI. Jay assists a broad range of stakeholders in the construction industry, from program managers and general contractors to specialty trades and materials producers, with the identification and assessment of the risks influencing the strategic and tactical decisions they face. In this role, Jay’s primary responsibilities include research design and interpretation, based on developing an understanding of the context within which these organizations operate. Jay can be reached at [email protected].

Jay Bowman is a principal with FMI. Jay assists a broad range of stakeholders in the construction industry, from program managers and general contractors to specialty trades and materials producers, with the identification and assessment of the risks influencing the strategic and tactical decisions they face. In this role, Jay’s primary responsibilities include research design and interpretation, based on developing an understanding of the context within which these organizations operate. Jay can be reached at [email protected]. Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. Brian’s combination of analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected].

Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. Brian’s combination of analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected]. Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at [email protected].

Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at [email protected].