Why Large Contractors Fail - A Fresh Perspective

During the past few decades, there have been dozens of large contractors that, after many years of growth and apparent prosperity, experienced notable financial disasters, resulting in bankruptcy or a reincarnation of the business in a much different form.

Most recently, firms like the Truland Group Inc. have proven that construction firms are not too big to fail, even though they have operated successfully for generations with annual revenues ranging from hundreds of millions to several billions of dollars.

In one of FMI’s classic studies—“Why Contractors Fail”1 —we investigated root causes responsible for bringing down industry giants over time. Almost a decade later, we conclude that despite the changing business environment in today’s engineering and construction industry, many of our findings still hold true, particularly in a growing market where contractors are significantly more likely to go bankrupt compared to during a downturn.

As we like to say, “Contractors don’t starve to death; they die from gluttony. They get too much work, too fast, with inadequate resources, and then they get into financial trouble and run out of cash.”

In this article, we look at today’s changing risk environment and revisit the five fundamental factors that conspire to cause contractor failure. These five factors are timeless and can help contractors avoid some critical mistakes while they continue to survive and thrive in good economic times.

Today's Risk Environment: A Changing Landscape

Hit hard by the Great Recession, the construction industry has struggled to bounce back to pre-recession levels. Still, there are a number of positive trends taking place. For example, the industry didn’t witness nearly as many surety losses or large contractor failures as expected during the downturn—a sign that surety companies and banks have learned their lessons and are not letting companies overextend themselves any longer. It is also a reflection that the industry is becoming increasingly sophisticated: leaders are better educated and more apt to run their organizations effectively.

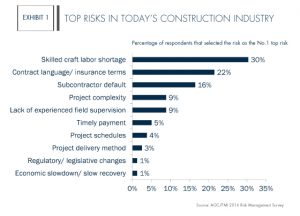

Working with hundreds of engineering and construction firms, we have also witnessed heightened risk awareness among business leaders. This was confirmed in a recent study where AGC and FMI surveyed the general and specialty contractors in AGC’s Surety Bonding and Risk Management Forum: 86% of respondents stated that today’s risk environment is different compared to five years ago, with skilled craft labor shortages being one of the biggest risks they currently face (Exhibit 1).2 In response to the heightened risk environment, the majority (90%) of the survey respondents are managing risk differently and applying new tools and programs to assess risk more rigorously compared to five years ago.

However, initial findings also indicate that the majority of contractors struggle to manage risk effectively. This is particularly alarming as we face another perfect storm in our industry. Consider the fact that between 2009 and 2015, the average number of months of contractor backlogs (for all types of contractors) has increased 33%.3 At the same time, contractor margins are tighter, contractual conditions and projects are more complex, and 1.5 million fewer construction workers remain in the industry (compared to pre-recession levels) unable to keep up with increasing demand.

Compounding these dynamics, baby boomers are reaching retirement age at a rate of 10,000 per day, and a younger and more inexperienced (millennial) workforce is moving into the industry. Moreover, contractors are winning more work in today’s recovering environment, which in turn is placing increased stress on their working capital. In other words, they’re trying to do more with less. That kind of pressure on working capital—coupled with craft labor shortages, fluctuating market dynamics and a dramatic loss of industry knowledge and leadership—creates a recipe for a potential disaster. It is within this environment that contractors face a higher risk of financial reversals.

Now more than ever, company leaders need to focus on five key organizational areas in order to navigate the unsettled external factors shaping today’s industry. Following is a summary of these five factors that we identified in 2007 and that are just as applicable and significant today.

What Causes Large and Historically Successful Contractors to Self-Destruct?

In our investigation of why large contractors fail, we isolated about 200 potential factors that can lead to contractor failure. Upon examination of these factors, we determined that no single factor would usually signal the impending doom of a construction firm. We found that failing companies usually exhibited a combination of interacting factors that caused company performance to spiral toward inevitable financial failure.

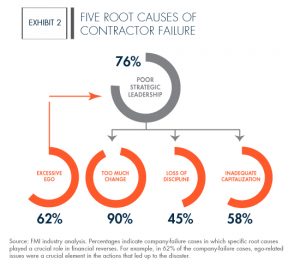

During our analysis, we identified five root causes for contractor failure. Poor strategic leadership is the common thread among all these factors. External factors (e.g., economic conditions, risk environment, etc.) are not primary causes but can accelerate the chain reaction of company failure. In essence, when contractors fail, “They do it to themselves—it doesn’t happen to them.”

FMI’s five root causes of contractor failure identified in the original study continue to be responsible for contractor failures today. Yet all of the causes can be controlled and mitigated.

The Five Root Causes of Contractor Failure

- Poor Strategic Leadership This is by far the biggest reason for failure in today’s business environment, where strong leadership can serve as a cornerstone for success in even the most difficult market conditions. For example, many companies get into financial difficulty when ownership changes hands from one generation to the next. To ensure successful ownership transfer and management succession, owners need to prove that the company can grow and succeed without them. The only way to do this is by having the right successors in place who are capable and willing to lead. At that point, the question becomes, can the next generation carry the business forward. This is frequently where firms get into trouble—regardless of whether they are family-owned or not. Companies that do not define a clear vision, purpose and a fact-based strategy often find themselves reactionary without setting true direction. Under poor strategic leadership, people begin making bad decisions (i.e., poor project selection, hiring the wrong employees, putting the wrong systems in place and so forth), and before the company’s leadership is aware, the firm can find itself on the path to failure.FMI’s recent millennial research4 also underscores the importance of strong strategic leadership in the context of attracting and retaining a young workforce. Our findings showed that millennials are 25% more likely to stay long term when the company’s vision and direction are clear and inspire enthusiasm for work. For employees, this noticeable difference underscores the importance of understanding the key elements of an organization’s vision and strategy as well as recognizing what leadership expects from them, which is especially important for younger people who are just beginning their careers.

- Excessive Ego Another root cause of poor decision-making is the leader who exhibits an excessive ego. Extremely confident and often unwilling to listen to the opinions and suggestions of others, this person can literally take down the entire company. In our original study, we referred to this personality as the “Mind of the Contractor” (see our 2016 Quarterly article “The Icarus Leader: How High Will You Fly” for a more in-depth view on this topic). In order to be a successful contractor, you must have self-confidence and a high tolerance for risk. Contractors also must possess a high degree of optimism, or they would have a difficult time winning any bids and securing work. The key is to avoid carrying that optimism and risk tolerance to the extreme—a scenario that can lead to bad business decisions and ultimately company failure. There are many examples of construction firms that have run into financial problems due to the leader’s hubris and perception of being invincible. Sometimes this is referred to as “driving the business off a cliff at 100 mph”—self-destruction at its worst.

- Too Much Change The research and one-on-one interviews we conducted indicated that in 90% of the company-failure cases, “too much change”-related issues were a crucial element in the actions that led up to the disaster (Exhibit 2). When too many things happen too quickly, it’s easy to get overwhelmed and thrown off course. Any company can absorb some level of change, but there’s a limit to what most organizations can handle at any given time. To avoid driving too much change in the organization and managing it more effectively, we suggest companies make a list of everything that’s new, including customers, projects, geographical targets, superintendents, project managers, systems, etc., to fully understand the speed of change the organization is currently going through. The more changes they can name, the higher the risk of failure. Therefore, it is critical to manage the rate of change on an ongoing basis.

- Loss of Discipline Successful construction firms tend to be extremely well-disciplined in all areas of their business. Most companies that experienced failure grew from small, regional operations into national powerhouses (e.g., J.A. Jones, Guy F. Atkinson, etc.). Along the way, these firms almost universally lost their internal business discipline, became overall bureaucratic and started doing things outside of their core competencies. On the other hand, there are a few world-class contractors in the U.S. that operate with an incredible amount of discipline. They do the same thing the same way—every day and everywhere that they operate. This discipline is built into the company’s culture, transpires throughout the organization and can last for generations.

- Inadequate Capitalization Cash is King, and inadequate capitalization will bring a company to its knees in short order. In the construction industry, a single job (depending on its size and scope) can have a profound impact on a firm’s success or failure. The difference between a good year and a great year or a bad year and a catastrophic year can be one or two jobs.Sometimes people will ask us, “How much money should I keep in my construction company?” And we always answer this question by asking, “How much money can you lose on a single construction job?” And when you think about this, the answer is, “All you’ve got.” Construction projects have upside limits on the level of profit that you can earn, but the amount of money you can lose is unlimited. Overcoming this failure factor requires an adequate capital base that allows you to withstand inevitable problems and live to fight another day.

Controlling Your Own Destiny

Controlling Your Own Destiny

Construction is a dynamic and inherently risky business. Our research indicates that the causes of contractor failure are similarly dynamic and involve a number of difficult-to-manage risk factors. While many point to external factors as the primary culprits for failure, we see many examples of companies that succeeded despite the same difficult external forces being present while others failed. In our study, many seasoned industry executives emphatically rejected the notion that luck or other extraneous forces were responsible for their companies’ decline.

Nonetheless, we do see a need to identify the role that external economic conditions can play in hastening the demise of firms that are already on the road to failure. Our study indicates that these external factors are not root causes, but that they are actually accelerants that quicken the pace of demise for companies already suffering from one or more of the root causes noted. Successful contractors live on a thin edge. However, the good news is that all the root causes identified are controllable—regardless of the external environment—which means leaders can shape their own destiny and not be victims of fate. As the industry continues to shake off the effects of the Great Recession and adapt to new labor market trends and competitive pressures, the companies that take these factors to heart and strive to overcome them will survive and come out the winners.

To assist companies with this charge, FMI is continuing its research and publication on topics aimed at helping companies more effectively control their fates. Future Quarterly issues will investigate causes of contractor failure associated with different business areas and provide effective strategies for managing those risks in the future.

[1] “Why Contractors Fail: A Causal Analysis of Large Contractor Bankruptcies.” Hugh Rice and Art Heimbach. FMI Quarterly Special Issue. 2007. [2] Key findings of this study “Managing and Mitigating Risk in Today’s Construction Environment” will be published by AGC and FMI in July 2016. [3] See our Quarterly article “Managing and Mitigating Subcontractor Default Risks” by Mike Bond, Zurich. June 2016. [4] Millennials in Construction: Learning to Engage a New Workforce. 2015 FMI Industry Survey.

.png)