Will DeepSeek Change Data Center Construction Plans?

The news that DeepSeek, a Chinese artificial intelligence company, created an artificial intelligence (AI) model comparable to those of U.S.-based companies for what first appeared to be a much lower cost roiled financial markets and left many questioning the future of the industry. Investors, as well as those in the construction industry, are wondering how this will impact data centers and the associated spending to build capacity.

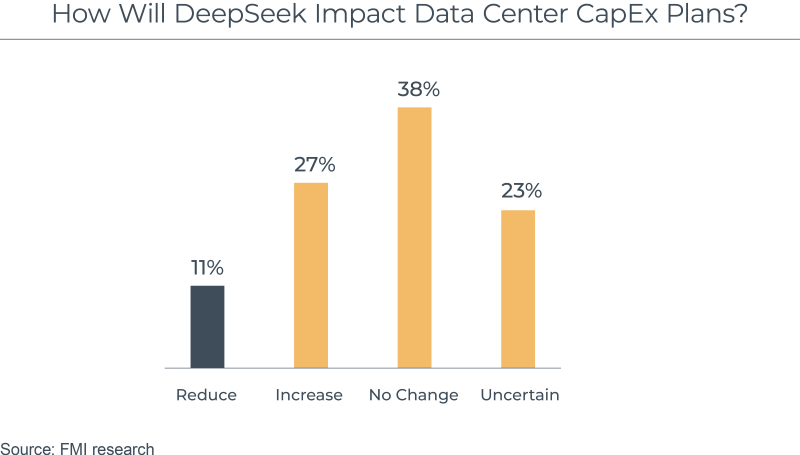

We interviewed 26 experts in the data center market during the last week of January 2025, finding that most do not see the news about DeepSeek significantly reducing capital expenditures (CapEx) for data center construction. While DeepSeek claims to improve AI efficiency, industry sentiment is that these optimizations will lead to more AI workloads rather than reduced infrastructure demand.

Nearly 90% of those we interviewed did not expect a reduction in data center capital expenditures in reaction to DeepSeek nor from innovation in AI from non-U.S. companies. Most expected no change at all or were uncertain about the new development’s impact on a rapidly changing industry. Consensus among experts contacted was that the demand for data centers and AI will likely increase, but the construction impacts are yet to be seen.

Overall, industry experts expressed a strong degree of skepticism surrounding the reported efficiencies of DeepSeek and doubted whether there would be any hesitation in planned CapEx over the short- to medium-term. Current CapEx plans are unlikely to be altered but plans may face higher scrutiny in optimizing computing costs. Challenges with power, electrical and mechanical systems will persist with these high-powered facilities.

“If the DeepSeek hype is real it will increase spend, but energy supply and demand is the limiting factor,” a hyperscale data center owner told us.

Our conversations centered around the concept of Jevon’s Paradox, which was mentioned by Microsoft’s CEO Satya Nadella in reference to open-source AI. The concept implies that innovations that lead to more efficient consumption of a resource increase demand, therefore pushing consumption to higher levels than before the innovation took place. There is a belief that AI computing efficiencies will ultimately lead to higher demand to construct data center facilities and infrastructure.

DeepSeek will likely improve AI efficiency, but it does not fundamentally alter the trajectory of AI infrastructure investment, according to data center operators. Instead of reducing CapEx, DeepSeek’s efficiency gains will shift spending priorities toward optimization and infrastructure scalability. Any cost savings will likely be reinvested into more computing capacity, driving continued demand for power, cooling and high-performance infrastructure.

CapEx growth will continue, but investment decisions will face more scrutiny

Despite alleged efficiency improvements, data center operators and AI firms are still committed to expanding physical infrastructure to meet rising demand. Investors are beginning to apply greater scrutiny to AI-related CapEx, particularly in large-scale projects, demanding clearer ROI justifications before approving new infrastructure spending.

“Recent news on DeepSeek will not significantly impact CapEx spending in the short term and will have limited long-term impact. However, it will affect data center architecture, especially regarding overall cooling systems,” said an executive at a data center services firm.

That means much of short-term CapEx spending will remain the same, but the long-term focus of investors may shift to optimization. Most planned data center projects are moving forward, as major AI firms already committed funding to large-scale expansions.

Over time, we may see less emphasis on unchecked expansion and more focus on infrastructure optimization, where AI firms prioritize maximizing performance per dollar spent rather than simply scaling physical footprints.

Efficiency gains will shift spending priorities, allowing AI firms to run more complex models, which will increase overall power consumption. Spending will shift toward high-density power and cooling solutions, rather than simply reducing the scale of new data centers.

Yet these energy and cooling constraints will likely be more of a bottleneck to meeting demand for data center growth than computing costs. Even with more efficient AI models, power consumption is expected to rise, putting greater stress on existing data centers. Infrastructure spending is shifting toward liquid cooling and power distribution improvements to accommodate AI workloads, with growing interest in localized and high-density cooling strategies.

While the initial news pushed technology and other stocks lower, those we interviewed did not see DeepSeek’s AI tool having a negative impact on capital spending on data centers. In fact, this could spur increased investment as more industries can adopt this technology and the demand grows. We continue to see investments in data centers as well as products and services supporting them as areas of opportunities.