2019 Building Products Market Update

Mixed Signals About the Future: How Well Is Your Building Products Organization Positioned?

Positioning your company for growth in the building products industry despite a potential market slowdown.

By Paul Giovannoni, Principal and Managing Director of Building Products

Economic signals are telling us that we’re near the top of the construction cycle. This means that the next five years will look very different than the last five years, which were characterized by full work pipelines and healthy growth in both the commercial and residential construction sectors.

Often a step or two away from the “real action” on the construction front, so to speak, building products companies – whether they are building product manufacturers or distributors—have to be especially cognizant of any blips on the economic radar and then respond accordingly.

As we saw during the Great Recession, the companies that wait until the well runs dry to deepen their customer relationships, diversify their revenue streams and optimize their sales forces wind up facing serious struggles. Those that take a proactive approach to what’s coming around the next corner are often best positioned to ride out the downturn and come out even stronger.

Mixed Market Signals

Right now there are mixed signals coming from the market. Data-driven indicators point to a possible slowdown, but contractors and builders remain busy and their backlogs filled. Even during this lingering time of business prosperity, it’s important for building products companies to start thinking about what lies ahead and the steps they should be taking now to get ready for the inevitable slowdown.

This isn’t always easy to do when contractors who feel good about the next several years continue to generate business for the building products industry. Peel the layers back on that enthusiasm, and you’ll start to pick up on some pessimism over what lies ahead for the next several years.

As everyone maintains a focus on challenges like labor shortage and finding the resources needed to complete active projects, the undercurrents paint a different picture—and one that looks faintly like the picture that was coming into focus just prior to the Great Recession. Put simply, despite the backlogs appearing full, business opportunities began to dwindle as funding became constrained and owners/developers pulled back.

Right now, we’re seeing indicators that certain end-user segments are slowing and certain geographic pockets of North America are experiencing construction slowdowns. In June, for example, Construction Dive reported that construction spending decreased 0.8% in May to a seasonally adjusted rate of $1.29 trillion (down from April’s $1.3 trillion).

During the same period, construction spending was down 2.3% compared to May 2018 and, year to date, fell 0.3% from the same January-May period last year. Month over month, May nonresidential spending for both private ($453.3 billion) and public construction ($334.2 billion) fell 0.9%. This represented the largest monthover-month drop in spending since November 2018.

In FMI’s 2019 Market Overview, we mentioned rumblings about a recession on the horizon and how they were starting to make company leaders a bit nervous. Many are just too busy keeping up with current work to start thinking about contingency planning. In fact, the constrained labor situation, coupled with select material increases, compressed project schedules and ongoing margin compression, is all creating more risk for E&C firms today—and right when we find ourselves at the top of the market.

3 Ways to Shore up the Business and Prepare

Planning for a slowdown now instead of waiting for it to hit (and then doing something about it) is just smart business in a world where economic cycles ebb and flow. Being prepared isn’t just about bracing for potential problems, however. It’s also about strengthening the organization overall and positioning it for future growth. Here are three things all manufacturers should be doing now not only to prepare for a potential slowdown, but also to ensure success in any market conditions:

- Put the customer at the center of the conversation. Know why your customers are loyal to your products versus another manufacturer’s offerings, and then use those insights to build out an even more compelling offering and solution for your loyal buyers. Look beyond the numbers during this exercise and focus on why they are (or aren’t) buying from you; why your product is being substituted for another (or vice versa); and how your solutions are differentiated or aren’t. Get inside the mindset of the specifier and influencers and try to get a clearer picture of why one of them would say to a project owner, “use this product instead of that one.”

It comes down to understanding the customer’s business, knowing what the pain points are, and understanding what motivates the customer to buy certain products. Ask yourself questions like “How do we help this contractor become more profitable and operate more efficiently?” and “How do we make it easier for that end-user to use our product versus another?” For example, you might help them find ways to improve their own labor efficiency or take the time to learn how you can be a better partner on a project delivered through design-build or other value-based procurement methods. By dialing in these details, you can begin to build stronger customer loyalty in a world where the next competitor is literally a screen tap or mouse click away. In the article “Ready to Drive Innovation? Start by Talking to Your Customers,” we’ve provided additional information regarding how to tap into customer feedback.

- Diversify into other end markets or owner types. This one may seem obvious, but here at FMI, we’re consistently surprised by the number of building products companies that avoid diversifying until it’s too late. We’ve seen companies wait until their pipelines have run dry before they start branching out in search of more resistant end user segments or other new opportunities. A door manufacturer, for example, has been historically focused on the residential construction segment. Right now, it’s trying to gain a stronger presence in the commercial sector as a way to diversify its business—knowing that in most cases (with the exception of the Great Recession), portions of the commercial market tend to do better when times are tough.

The real theme here is to diversify your business and end-use applications so that you are in a greater portion of the market when the slowdown occurs. That way, if the residential or multifamily markets dip, you still have a strong base of work in the commercial or industrial markets. Of course, this can be easier said than done. For the example manufacturer, tackling the commercial market requires a completely different go-to-market strategy. Whereas the commercial side is highly influenced by architects, engineers and contractors, on the residential side, the influencers can range from the “one guy and truck” contractor to the very large builder. This is just one challenge of diversification, but these are important idiosyncrasies to keep in mind as your company expands into diverse markets and customer segmentations.

- Optimize your sales force for success. Your sales team needs data, analytics and insights that can help it push forward and rack up those daily “wins” in any market conditions. Using market intelligence, for example, your reps can begin to ferret out the markets and geographies where the most potential lies and then work to leverage those new opportunities. Help them understand the market opportunities in each of those regions and where your company stands in those areas (in relation to its competitors). Keep in mind that just because sales volume is healthy in one particular region, that doesn’t necessarily mean your sales force is highly optimized there. This could in fact be a “false positive” and an indicator of a very active market, where more market share could be yours for the taking.

Optimizing your sales force’s efforts requires an understanding of these dynamics to ensure that you’re getting the most out of the potential opportunities within certain customer segments or regions. Using a combination of these insights (e.g., there is a $2 million opportunity out there that we’re not tapping into) plus good sales training, you can turn analytics into action steps and start capturing new sales opportunities.

Now Is the Time to Prepare

A slowdown is going to happen, and when it does, a decline in construction is sure to follow. This will directly impact building product companies, and those that aren’t preparing now will take the biggest hits.

Those that do think ahead will not only be able to take advantage of the downturn, but also be building resilient companies that can withstand a countless variety of market conditions. By taking the three steps outlined in this article—and even if the slowdown doesn’t surface for several years—organizations can effectively prepare for whatever the future brings.

Introduction to the Building Products Market Update

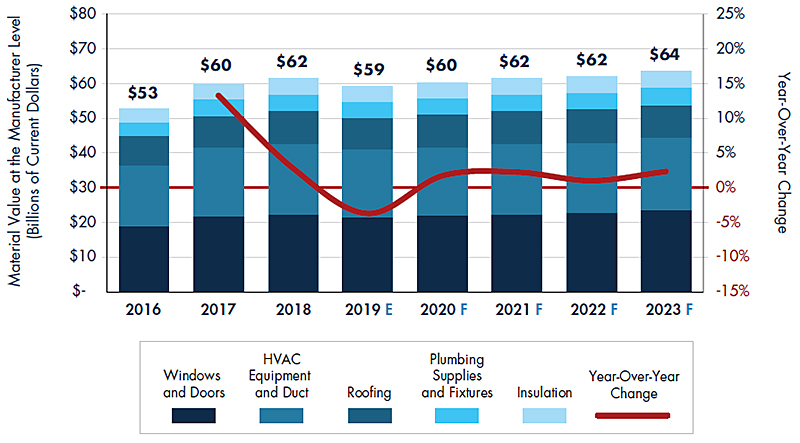

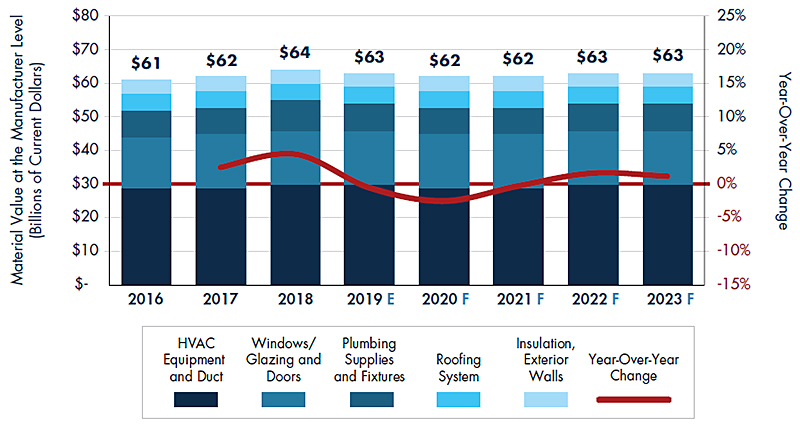

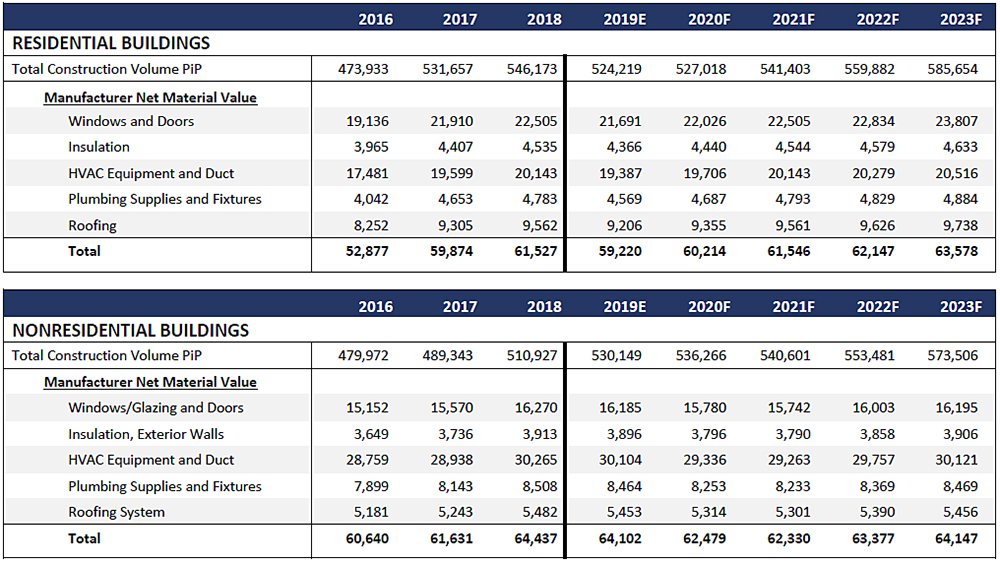

In FMI’s inaugural Building Products Market Update, we focus on several major product categories: windows and doors, insulation, HVAC, plumbing and roofing systems. This isn’t an all-inclusive listing of product categories, but it does represent some of the more critical, nonstructural components of the built environment. When examining the forecast, it’s important to keep the definitions of the categories—and the subcomponents within each—in mind. Combined, these categories represent approximately 12% of total residential and nonresidential construction costs.

As we examine the five-year industry outlook, we anticipate there will be a slowdown in both the residential and nonresidential sectors that will impact total construction spending (and of course trickle down to these product categories).

In the residential sector, we anticipate a near-term slowdown in the overall market and these product categories. This slowdown is at the national level, but there are certainly markets across the Southeast and West Coast where residential market activity will continue to remain strong and show few, if any, signs of slowing. It is anticipated the windows and doors product category will have the greatest volume of activity over the next five years in the residential sector, for example, followed by HVAC and duct.

Slowing in the nonresidential sector is expected to occur four to five years out as the market reacts to a stalling residential sector. Similar to the residential sector, this slowdown will be felt to greater and lesser degrees at the local and regional levels, but will also be felt at the national level. Much of the slowing will be in private construction, while the institutional portions of the market are expected to remain stable (and, to some degree, grow). The education market is expected to remain strong across the entirety of the forecast. The HVAC and duct market is expected to have the greatest volume of opportunity in the nonresidential market, followed by windows and doors.

In addition to the slowdown in opportunity, we’re watching several trends that could impact the future of prices and the broader industry. In some cases, a slowdown and the need to innovate and improve the construction process will be the catalyst for these trends, which are:

- Recessionary impact on pricing and specifications—Total market demand will decline in a recessionary environment, driving stronger competition. Installing contractors and end users will be more willing to entertain alternative products or brands in order to save money, and specifications will likely become harder to hold.

- Technology adoption—Dramatic investments are beginning to reshape how we build. In some cases, this will be reflected in new product offerings. In other cases, traditional products will be challenged to adjust to emerging construction processes and techniques. Builders and contractors are looking for efficiencies and a way to gain competitive advantage enabled through technology.

- Supply chain shifts—The current building products supply chain is ripe for change. Increased digital engagement, improved logistics and shifts toward prefabrication/modularization will all shape the new supply chain and impact the way in which we do business.

- Alternative procurement methods—Increased usage of design-build and IPD will continue to drive the need for integration of the complete value chain in the preconstruction process. This will mean greater integration of building product manufacturers in the design and engineering process.

With the strong potential for these future trends to affect a market shift, it is important to keep in mind how building product manufacturers and distributors can plan for opportunities. By preparing for changes now, companies can position themselves for the needs of their customers ahead of the market change.

Total Construction Spending Put in Place 2018 and Forecast Growth (2018-2023 CAGR) by Construction Segment

* Improvements includes additions, alterations and major replacements. It does not include maintenance and repairs.

Source: U.S. Census and FMI Forecast

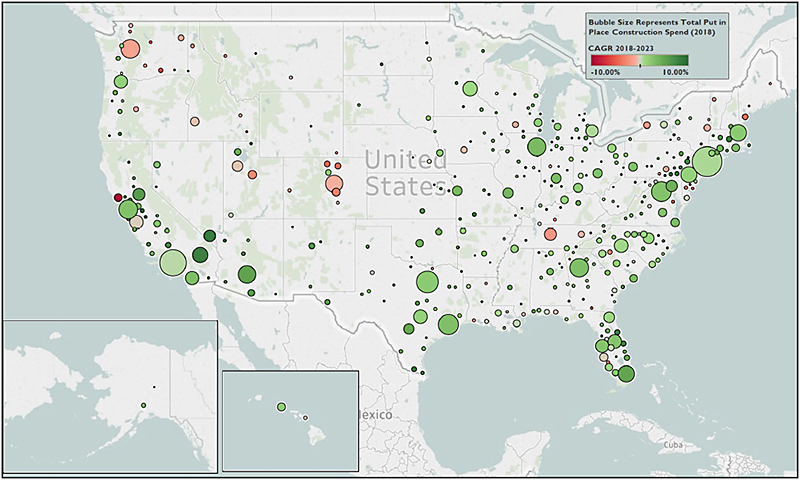

Total Construction Spending Put in Place 2018 and Forecast Growth (2018-2023 CAGR) by Metropolitan Statistical Area

Source: FMI Forecast

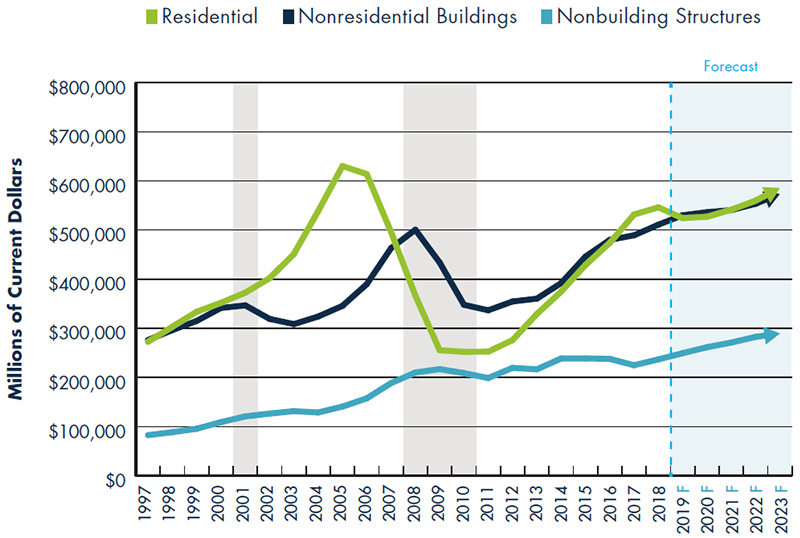

Total Construction Put in Place Estimated for the U.S.

Source: U.S. Census and FMI Forecast

Residential Buildings

2nd Quarter Forecast (based on Q1 2019 Actuals)

Data includes multifamily housing

Macro Trends

- Rising home prices, debt levels and slow wage growth have resulted in significant affordability concerns for single-family homes.

- Homebuyers are weary of the current economic climate, with mortgage rates expected to continue a slow decline.

- Millennial buying practices and urbanization trends continue to drive long-term opportunities.

- Multifamily new construction activity across several major urban markets appears to have cooled.

- Improvement activity is expected to stall due to reduction in moving activity through 2020.

- Labor constraints for remodeling are expected to hold back the market.

Nonresidential Buildings

2nd Quarter Forecast (based on Q1 2019 Actuals)

Macro Trends

- Many major end segments driven by developer investment (office, commercial, lodging) are expected to slow over the next several years.

- Institutional activity in health care and education will remain stable as changing demographics continue to drive activity on K-12 schools and senior living facilities.

- Rising tax revenues and urbanization are increasing near-term opportunity on government buildings.

- Uncertainty in the manufacturing segments exists due to trade negotiations, new tariffs and oil price volatility, which are all stalling activity.

- Labor remains a major concern, though advancements in technology adoption and commitment to prefabrication will provide relief for contractors.

Estimated Material Value at the Manufacturer Level

Total United States

Millions of Current Dollars

Source: FMI Corporation

View the product category definitions

About the Authors

Paul Giovannoni is a principal within FMI’s Strategy practice and his primary focus is partnering with members of the building products industry by assisting them in developing their strategies relating to growth, value creation and new product launches. Paul’s extensive experience working with many of the most well-respected manufacturers and distributors in the industry, combined with his deep relationships in the contractor community, enables him to bring a comprehensive perspective of the market to his clients. Paul may be reached at [email protected].

Paul Giovannoni is a principal within FMI’s Strategy practice and his primary focus is partnering with members of the building products industry by assisting them in developing their strategies relating to growth, value creation and new product launches. Paul’s extensive experience working with many of the most well-respected manufacturers and distributors in the industry, combined with his deep relationships in the contractor community, enables him to bring a comprehensive perspective of the market to his clients. Paul may be reached at [email protected].