How Your Board Can Best Respond During Times of Rapid Change

Most boards of directors operate under a familiar, routine cadence: quarterly meetings and perhaps an annual strategy planning retreat augmented by a few committee meetings and calls with management. Often, boards develop an annual calendar to assure their attention is wisely focused across a range of important issues at just the proper time: audit-related matters in first and second quarters; annual business plans/budgets in third and fourth quarters; and other key issues sprinkled in the remaining open timeslots.

The collective wisdom is that predictability assures both efficiency and efficacy. However, the emergence of a global pandemic and its associated chaos has turned traditional board wisdom on its ear. Analysis, decision-making and action can no longer wait for a quarterly gathering. Instead, boards must match the pace of marketplace changes resulting from shutdowns and stay-at-home orders.

Key Pivots

The dissonance between standard board practices and current needs is too great to ignore. What is needed is a process of rapid recalibration: At least for a season, it is out with the old and in with the new. Here is a list of key pivots that a corporate board can take to responsibly address the coronavirus challenge:

- Contrarian thought — What was true last week can be functionally irrelevant in today’s topsy-turvy world. Over 180 nations are dealing with a new strain of virus while simultaneously dealing with severe economic disruptions resulting from governmental efforts to combat COVID-19. How do you make wise decisions in this environment?

Recently, PwC reported results of its survey of 55 finance leaders (CFOs) across a range of industries in the U.S. and Mexico during the week of April 8. All were asked a single question: “If COVID-19 were to end today, how long would you estimate it would take your company to get back to business as usual?” Fully, 61% of respondents said it would take less than three months, while only 5% said it would take more than 12 months to fully recover. Interestingly, this assessment stands in stark contrast to other economic data and projections (given the loss of over 25 million U.S. jobs over the last five weeks). What led these finance leaders to feel so optimistic?Answers like the ones given to the PwC survey may be indicative of something called “cognitive bias,” or the inclination to stick to our guns too much instead of modifying our position when presented with new information. Given this human tendency, it is appropriate for a board to question whether the CEO and executive leadership team are being provided with a broad and accurate pool of data with which to frame their decision-making. The board of directors is uniquely positioned to push management to think differently and more deeply.Today, a strategic and relevant board of directors should be posing an array of questions to the management team, including: What data did it utilize to predict potential impacts on the business? How many sources of information did it consult? Were alternative scenarios considered and modeled before drawing its conclusions and making decisions?Lastly, boards need to embrace contrarianism relative to the adjustment of organizational strategy and planning. Traditional board thinking takes a dim view of any CEO who makes major midstream adjustments to the business plan. Rightly or wrongly, boards intuit that something important was missed by management when crafting the plan. We suggest, however, that today’s environment dictates that boards apply that dim view to CEOs who do not revise their plans. In fact, fluid and adaptable strategies may be precisely the right medicine to help the company survive the economic effects of COVID-19.

- Correlated impacts — Food service has been one of the sectors hardest hit by the coronavirus. Most restaurants were directed to close by government action unless they could operate on a takeout/delivery model. Many will not recover, and their temporary closures will become permanent. Those that do reopen will likely encounter social distancing-related constraints; seating capacity will be adjusted to increase the distance between guests. This will severely impact the number of per-night “covers” (i.e., the number of meals served during a given service) and, by extension, will also severely impact revenue. What formerly was a successful business model will need revision: reducing costs. Who is impacted by this trimming? A partial list of those feeling the pain are food service companies, restaurant workers, farmers, building owners/landlords (from pressure to reduce lease rates), breweries and dairies. This exercise of correlated impacts could easily continue, but the illustration is clear: For every single impact, there are multiple affected parties.

This is like the dropping of a pebble into a pond. Soon the impact of that one stone—if large enough—spreads across the entire surface of the water. What is first felt in one location quickly touches all locations. Consider the correlated impacts that apply to the construction industry. Many contractors view governmental/public works projects as a safe harbor during economic downturns. Yet, earlier this month the North Carolina Department of Transportation announced a 300-person reduction in its workforce and the postponement of 88 (of the planned 138) major construction projects planned for the coming year. This equated to approximately $2 billion worth of contracts. Why might NC DOT take these actions? Stay-at-home orders have drastically curtailed motor vehicle travel and automobile sales—major funding sources. Faced with a shortfall and no immediate prospect of a cash infusion, cuts were made. Does this situation apply to other state DOTs, or is this unique to North Carolina? If the former, a business like Caterpillar will want to deeply understand the magnitude of the problem (lest it be surprised by thousands of pieces of heavy equipment rental returns arriving on the yards of its dealerships as well as the associated economic impact).Boards need to do more than just ask questions about current and prospective clients/contracts. Some might say this is obvious, but the challenges our customers’ customers are facing—considerations that are one or two waves removed from our position in the pond—are key factors to understanding today’s environment. How are they weathering the storm? Are they able to secure the necessary funding and resources to operate effectively? Further, how are our subcontractors and vendors faring in this pandemic? Do they have adequate resources today? Furthermore, are alternate sources of supply available?

- Collaborative ideation — The novel coronavirus burst onto the world scene in December 2019, and few people noticed at the time. Consequently, COVID-19’s newness reduced the world’s most learned medical professionals and researchers to students learning on the fly. Even today, much information related to this virus remains unknown.

It is like going on a journey to a place you’ve never been before, over a route you have never seen, with limited supplies and the prospect of uncertain weather conditions. To say that planning would be a challenge seems almost comic. The most candid answer anyone can offer when confronting such uncertainty is, “I don’t know.”Organizations and their boards are also confronted with a global economic shutdown caused by societal/governmental responses designed to treat a pandemic. For dealing with this, there is no precedent or experience set to draw upon when seeking wise solutions. McKinsey recently reported that the demand shocks occurring during the first weeks of social distancing were profound. In both the U.S. and Canada, figures versus the pre-coronavirus baseline showed 40-60% drops across a range of sectors: workplaces, retail and recreation, and transit stations (including airports).Consider unleashing the idea-generating power of a team. An engaged board of directors could very well be the “silver bullet” that helps a business leader navigate the maze of uncertainty that is the COVID-19-shaped A/E/C industry. The diverse backgrounds and skills of directors will surely spawn a breadth of creative solutions.

- Continuity focus — The magnitude of change coursing through the business community threatens the very existence of many companies. A case can be made that the core mission of any board of directors is to assure and enhance the long-term success of the organization. It is highly likely that over the last 30 days, significant new threats have emerged that were in virtually no business’s 2020 strategic plan. Is our liquidity adequate to weather a severe downturn in revenue and/or margins? Do we have alternate sources of funding to backstop our current cash position?

The National Association of Corporate Directors (NACD) agrees that continuity is a vital board concern. NACD calls it “business resiliency” and defines it as the ability of an organization to be prepared to bounce forward better. Fundamentally, this mindset operates on the premise that a responsible business (and its board of directors) must adapt and grow from a disruptive experience.A key element of building resiliency is addressing the challenge (and opportunity) of scalability. When crafting a new business plan, what steps best position the company to bounce back strongly? Similarly, what investments should be made today (even if they result in short-term “red ink”) to lay a foundation for that rebound? A continuity mindset prioritizes long-term economic benefits to all of the organization’s constituents (e.g., shareholders, management, workers and the communities where it operates).

The Best Response

So how does a business best respond in situations like this— unknown and unprecedented? This can be a vexing question, yet it is reasonable to assume that fresh thinking and a willingness to adopt new (and different) ways of operating must be part of the mix. The proper setting must be created to foster collaborative ideation, welcome contrarian thought and assess correlated impacts—all while maintaining a focus on the continuity of the firm.

To this end, we recommend convening a special “What if?” board session. For the time being, set aside the topic of crisis response. Instead, focus time and energy on identifying a series of business-influencing questions that the organization needs to better understand. The list should cover an array of topics: medical, political, financial, geographic (i.e., local vs. national vs. global) — anything the board feels may be significant. Note both the key questions and the details associated with the to-be-determined answer. This exercise quickly moves a board and management team from a position of “I don’t know yet” to a different (and better) place of “If we definitively understand all of the issues noted, we will be in a position of deep understanding.” It is from this new place where the wisdom needed to guide the business emerges.

Next, pivot to scenario planning. Engage the board in a conversation around different possible influencing outcomes. What if the shape of the economic recovery is “L-shaped” instead of “V-shaped” (as many have predicted)? What steps must we take to prepare for a prolonged downturn? Are there other services or market sectors that will fare well under those conditions? Do we have capabilities or an interest in pursuing those opportunities? Conversely, what if an effective vaccine and treatment regimen emerges for the virus by year’s end? Can we capitalize on a potentially rapid recovery if we retain and invest in talent over the balance of 2020? Model a range of outcomes—at least eight to 10—assessing both the degree of potential impact on the company and probability of occurrence.

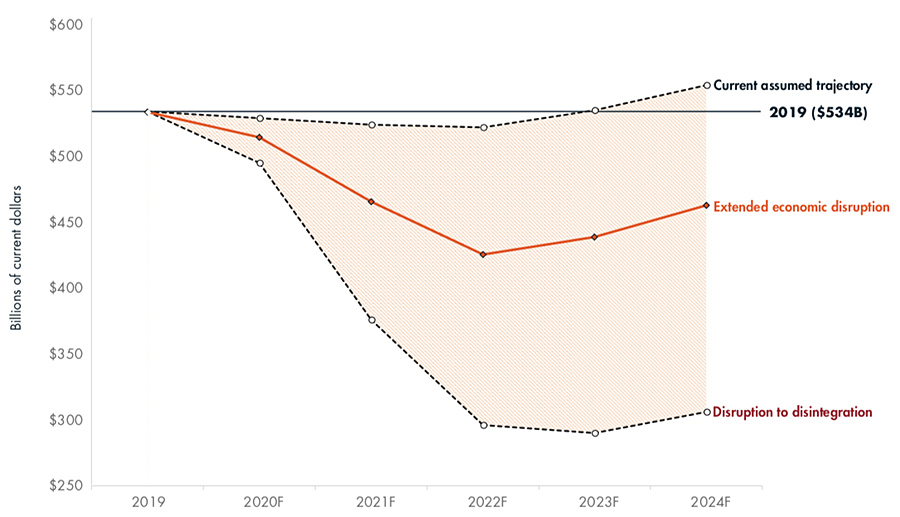

Armed with this new data, organizations can begin to paint a more accurate picture of what lies ahead. Exhibit 1 reflects how scenario planning can inform decision-making; it represents three possible scenarios for U.S. total nonresidential buildings construction put in place over the next four years. For more details, see “Downright Dangerous Decisions: Developing Strategy Amid Uncertainty.”

Not all organizations have an active board of directors. For the many that do, this is the opportune time to maximize that board’s value. Throw out the old way of engaging the board by embracing an “all hands on deck” mentality. A business that can effectively tap into the expertise and rich experiences of its directors is well on the way to successfully navigating the shoals of COVID-19.

Exhibit 1. U.S. Total Nonresidential Buildings Construction Put In Place

Source: FMI, March 20, 2020

About the Authors

Michael Mangum is a principal with FMI’s Leadership & Organizational Development practice. He brings over 35 years of construction industry experience to help drive organizational growth and personal transformation. He can be reached at [email protected].

Michael Mangum is a principal with FMI’s Leadership & Organizational Development practice. He brings over 35 years of construction industry experience to help drive organizational growth and personal transformation. He can be reached at [email protected].