Know What Your Employees Are Worth

Tight labor markets demand accurate and timely compensation practices. Understanding your employees’ true market value enables you to make informed decisions and retain high-performing players.

Tight labor markets, combined with escalating payroll costs, highlight the reality of the engineering and construction (E&C) industry’s ongoing war for talent. According to Global Construction Review, “Earnings for U.S. construction workers now outstrip the private sector average as contractors face what’s being called one of the tightest labor markets they’ve ever experienced.”1

Moreover, based on FMI’s latest compensation data, one in two construction employees is either overpaid or underpaid. The latter is shocking and represents a significant turnover risk if you’re not paying close attention to current facts and data. Worse, if you’re underpaying your employees, you might be putting your company’s brand at risk. Disgruntled employees can leave negative reviews on social media and hurt your organization’s efforts in recruiting and retaining talent long-term.

As a result, knowing what your employees are worth—and ensuring that pay levels for your jobs are competitive externally and equitable internally—allows you to plan more accurately for the future and adapt to ongoing market and labor fluctuations.

In the following article, we share fresh E&C compensation trends and provide recommendations on how to start tracking and measuring critical salary information for your own organization.

Get Your Facts Straight—Don’t Wing It

Working with construction firms nationwide, we have found that most executives still rely on pay information from their peers rather than using labor market intelligence to inform their compensation decisions. In this new age of big data and intense labor competition, why do contractors continue guessing about pay?

This guessing game can be risky: When it comes to compensation, pay too little and you risk turnover and potentially losing some of your most valuable employees. On the other hand, if you pay too much and risk bottom-line profitability, you could wind up facing some major difficulties—not the least of which will be going out of business. An analysis of 27,000 construction professionals’ pay (each benchmarked against local labor market data) revealed that about 7,000 were paid $112 million (3.7% of total base pay) in excess of the market, while 6,600 were paid $62 million below market. How can an organization navigate these challenges?

This is where salary or compensation benchmarking comes into play. The process of matching internal job descriptions/salaries with external jobs/salaries with similar responsibilities, benchmarking helps identify the market rate for each position. Knowing whether an employee’s salary is above market, within market range or below market, HR and finance teams can perform market assessments and salary comparisons efficiently and accurately. This is important because many different factors (e.g., geographic location, company size and the employee’s education level) must be considered before filling the position.

By benchmarking pay data, an organization can understand the associated risk at both the employee level and the organizational level. For example, overpaying certain positions and then reducing those salaries can hurt employee engagement and lead to job dissatisfaction, both of which could result in high turnover costs (if those employees end up leaving).

As such, compensation benchmarking is a key component of attracting and retaining top talent. Job seekers are in the driver’s seat today, and they know their worth, challenging recruitment and retention practices across all industries. Having current and reliable compensation information helps ensure that you’re balancing competitive salaries with fiscal responsibility.

For an organization that has never done compensation benchmarking, the results can be eye-opening. According to Jay Fayette, CEO of PC Construction, “We had no formal salary system in place. Pay discussions were arbitrary and unstructured and not based on the market. The process was transformative for our organization.”

"Given the competitiveness of the market and its rapidly changing nature, contractors must understand the reality of the market and not simply rely on anecdotes of hiring managers and recruiters. Those who don’t perform market research and salary benchmarking are putting their companies at risk."

– Peter Cregger, Chief Data Officer

FMI Survey Data Business

Know Your Market

With the labor market remaining very tight and unemployment hovering around 4%, we are seeing significant pay rate increases nationwide. Although total construction employment has rebounded to 7.5 million workers,2 it is still below its peak of 8 million workers in 2006.

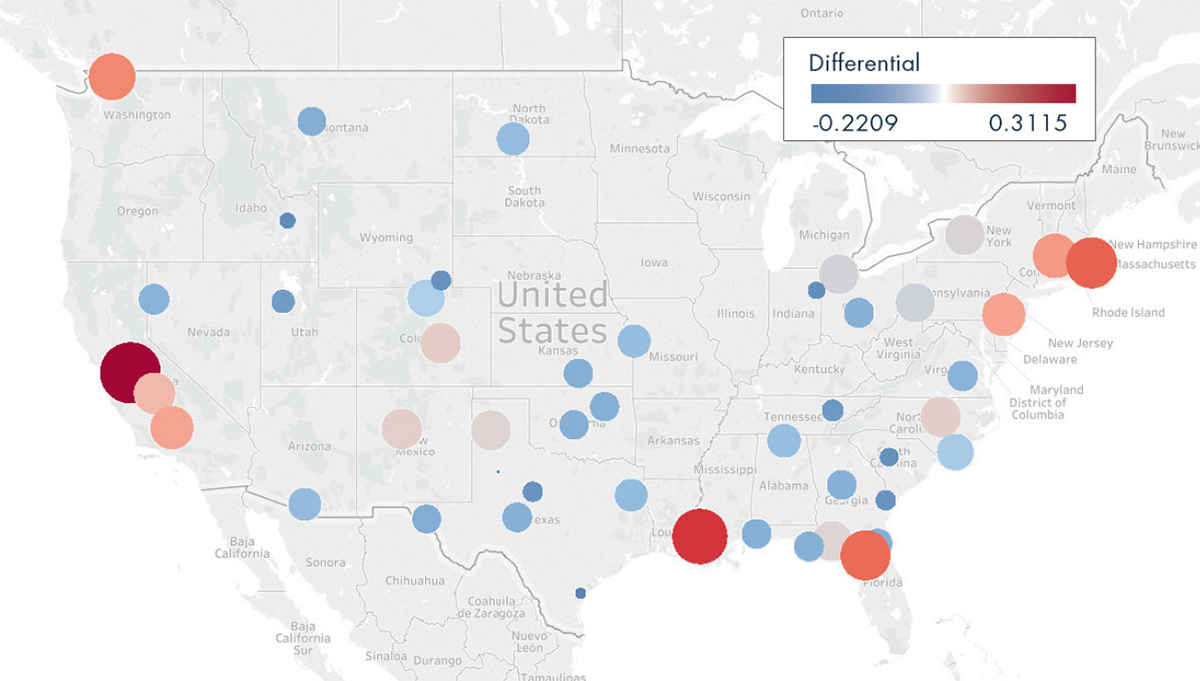

While these high-level observations are interesting, companies also need to understand the changes taking place in their local markets. Consider this: The average base pay for construction professional jobs in the most competitive MSAs can exceed the national average by 30% (see Exhibit 1). Note that the most competitive markets (with some exceptions) tend to be on the East and West coasts. Similarly, less competitive markets can be 20% below the national average.

Exhibit 1. Geographic Compensation Differential From National Average for Select Cities (2018)

Source: FMI Compensation

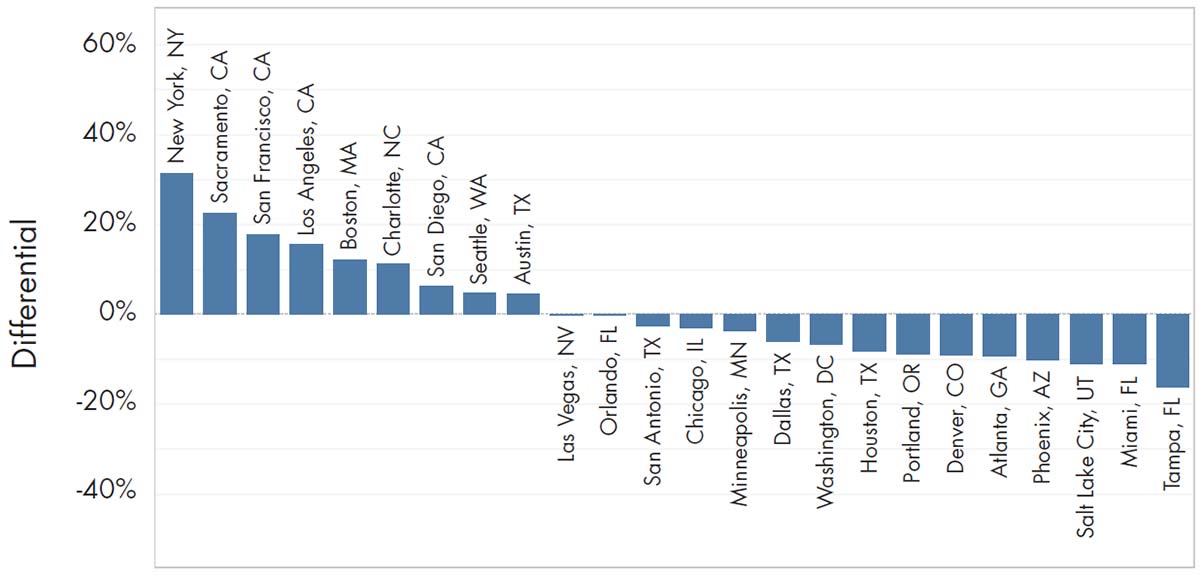

Exhibit 2 shows the wide pay swings that can occur nationwide. In this example, we show compensation differences for the project superintendent position.3 Note that pay in New York is 32% above the national average whereas pay in Tampa, Florida, is 16% below the national average—a total swing in pay of 48%. FMI’s data also highlights smaller regional differences, such as Orlando versus Boston with approximately a 10% swing in compensation differences.

In summary, pay levels can vary dramatically across geographies and market sectors. Executives and HR professionals must keep track of market fluctuations and understand the implications for their organizations. In a fast-changing industry such as E&C, pay levels can be outdated within six months.

Exhibit 2. Geographic Differentials From National Averages

Source: FMI Compensation Construction Professional Survey (2018 – 2017)

Play Offense – Not Defense

In today’s war for talent, it’s easy to blame your competitors for poaching your top employees. After all, they just offered a few more dollars, right? Wrong.

Top employees today, particularly in competitive markets, understand their value. A comprehensive compensation strategy that goes beyond just salary serves as the cornerstone of any good human capital investment approach. Organizations are thinking creatively and experimenting with long-term incentive plans and employee stock ownership plans (ESOPs). Increasingly today, construction organizations require a comprehensive total rewards strategy that includes incentive compensation, long-term compensation, medical benefits, training and development as well as work-life balance to attract and retain talent.

Having clear advancement opportunities in place and well-defined career paths—including goals and metrics around salaries and incentives and requirements for advancement—is also important in retaining younger employees. In FMI’s research on “Millennials in Construction: Learning to Engage a New Workforce,” the numbers confirmed what we’ve known all along: If employees feel like they’re making progress and advancing in their careers, then they are more likely to remain with their companies long-term.

The point is, leaders and HR managers are in the prime position to engage younger employees by providing meaningful compensation benchmarks and goals, offering encouragement and using the right resources to achieve specific performance goals (that are tied to compensation metrics). In other words, there must be a clear link among the compensation plan objectives, performance measures and outcomes.

While it can be overwhelming to design and execute a strategic compensation plan, it is well worth the investment long-term. With the right planning, forecasting and analysis, the right plan can successfully decrease your compensation costs while propelling employee performance well into the future.

1 “U.S. construction wage tops $30 an hour as employment soars.” Global Construction Review. July 15, 2019.

2 Bureau of Labor Statistics. Employment statistics for May 2019.

3 Level 4—professional who can manage projects over $100 million and with at least 15 years of experience.