How Power Supply Issues are Impacting Data Center Construction

The explosive growth of data center construction in the past five years shows no signs of slowing down, much of it powered by capital expenditures from co-location and hyperscale data center owners. As artificial intelligence (AI) becomes more prominent, demand for data centers will only increase as illustrated by the 55% increase in 2024 in private data center construction from 2023.

Companies like Microsoft Azure and Amazon Web Services experienced double-digit revenue and sales growth (30% and 19% respectively) in 2024. This expansion of demand will put strain on resources for both construction and operations.

One of the largest constraints for data center construction remains power supply and the rising cost of electricity. Projections from Goldman Sachs indicate that global electricity consumption for data centers will increase by 160% by 2030. Keeping up with this demand for power infrastructure will be a major opportunity for the construction industry.

For example, Dominion Energy Virginia, whose service area includes data center rich Loudoun County, said data centers represented 24% of their electric sales in 2023, up from 21% in 2022. The Southern Company’s CEO stated that 80% of the emerging load is projected to be from data centers. According to research by the Lawrence Berkeley National Laboratory, data centers consume 4.4% of electricity in the U.S., which is projected to reach 12% by 2028.

States and independent utilities are scrambling to find solutions to mitigate the impact of this swelling of demand. For example, American Electric Power in Ohio proposed a rate structure requiring data centers to pay a minimum based on expected energy usage. Georgia’s Public Service Commission approved a rule that will require new data centers to pay for grid improvements during construction. Constellation Energy announced the reopening of the nuclear plant at Three Mile Island, which will be called the Crane Clean Energy Center, to support Microsoft data centers in the region.

Addressing the data center power shortage is a priority of the Trump administration. In a statement at the World Economic Forum, the president articulated a plan to give an emergency declaration allowing power generation projects to start with fewer regulations with the goal of doubling power generation.

One solution to current supply issues highlighted by the president is data centers generating their own power on-site. While most data centers employ uninterruptable power supply technology to smooth interruptions and back-up diesel generators, on-site generation could limit the amount of power data centers use from the public grid.

This shift is already underway. According to Bloom Energy the quantity of announcements for data centers with some on-site generation in 2024 is more than the total in the prior four years. In addition to reducing disruptions to public grids, this trend will change the nature of data center construction. More integration with natural gas infrastructure and larger and more complex power generation facilities will be a huge market for contractors and suppliers with capabilities to serve it.

While the recent unveiling of Deepseek caused some panic among investors, experts interviewed by FMI indicate that Deepseek is unlikely to dampen demand for data center construction. While more efficient AI models may reduce the need for high power data centers, it is equally likely to spur innovations that continue to increase demand for data center construction.

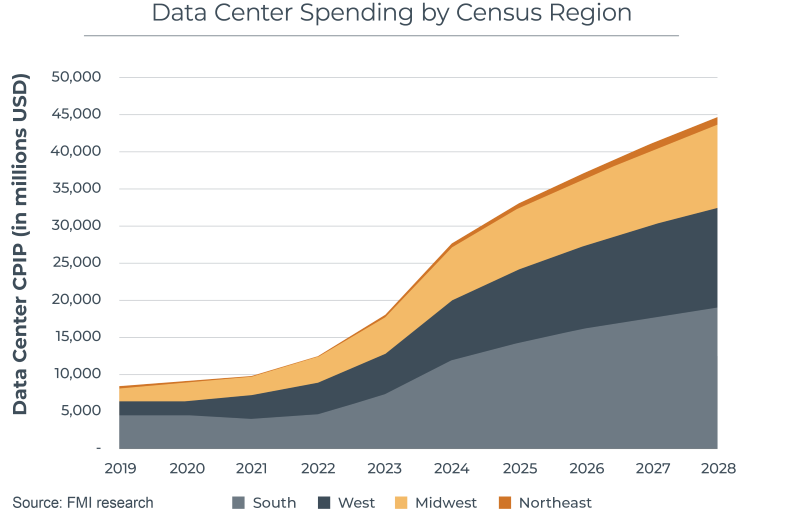

Data center construction forecast

In FMI’s 2025 North American Engineering and Construction Overview, FMI forecasts data center construction put in place, estimating that data center construction grew by 52.1% to $27.7 billion in 2024. Growth in the segment in 2025 is expected to be 19.5% in 2025.

This number includes put in place construction of privately owned data center buildings. Notably this excludes government data centers and does not include the servers, racks and other specialized equipment with the center. These definitions and historical values are aligned with the U.S. Census and may underrepresent data centers, which are not publicly known. These historical values are subject to revisions by the Census Bureau.

According to the U.S. Census Bureau Annual Capital Expenditures survey, only around 30% of CapEx spending in the data processing and hosting industry goes toward building or renovating structures. In the long run, we are expecting some moderation as excitement and demand rubs against power and land constraints and the construction industry’s ability to deliver. There may also be a risk of overbuilding if a large-scale speculative data center starts to be built.

Data centers is a fast-moving market with many growth opportunities and potential challenges. Power is only one of the factors impacting data center growth, but it is among the most pressing issues. Availability of land, water and labor will tighten as data center construction activity grows, and costs are impacted by changes in government policy including tariffs and investment incentives. FMI continues to monitor the changing landscape and provide updates in our market overview and outlooks.