Engineering and Construction Compensation: What Executives Need to Know

Companies need to pay attention to broader economic trends and other data issues when determining pay in today’s highly competitive environment.

Finding and retaining skilled labor continues to be a struggle for companies across the U.S., with unemployment at 3.6% in March, down from record highs in April of 2020. The return to 2019 unemployment levels, after dipping to 53-year lows earlier in 2022, has prompted many companies to take even greater interest in their workforce needs.

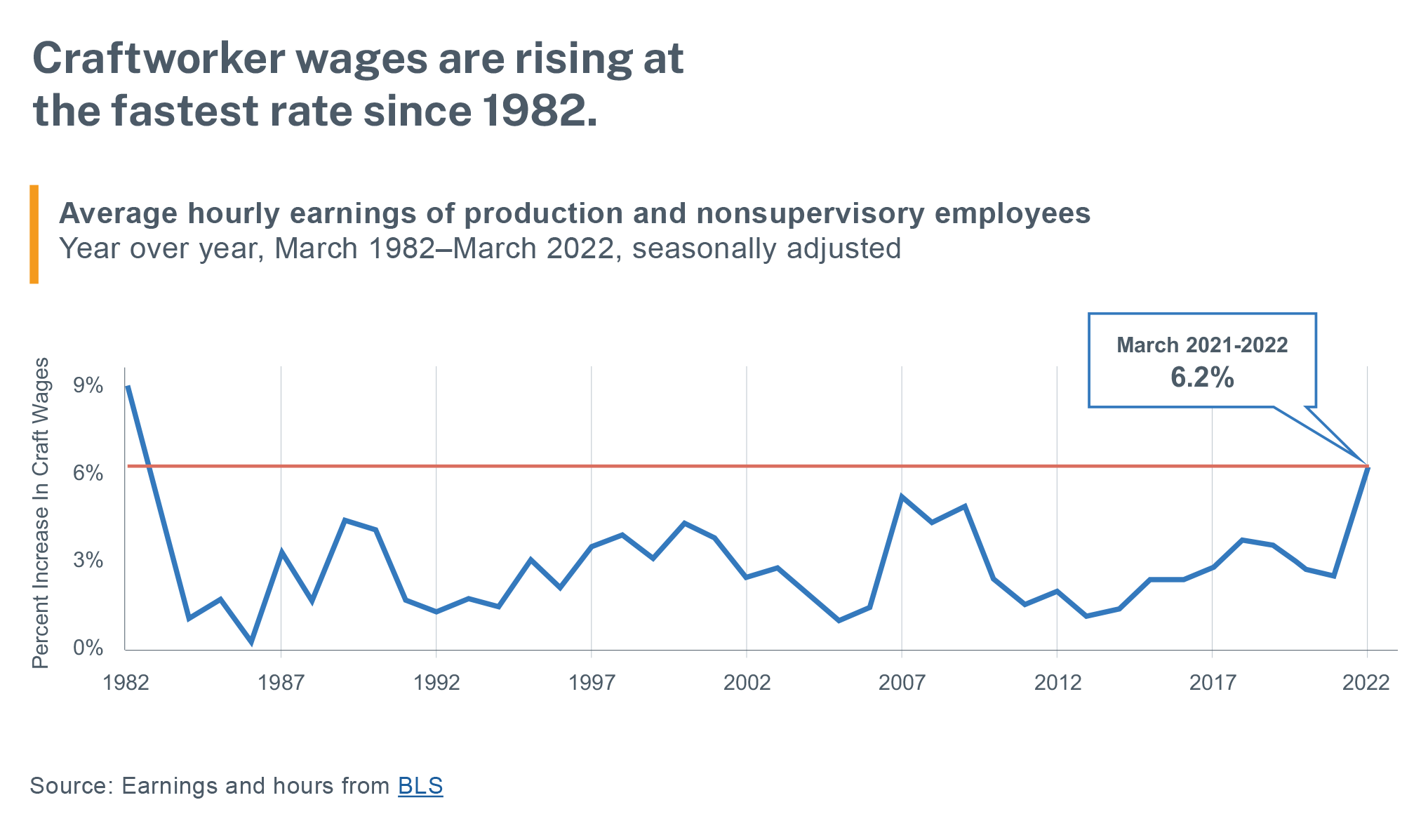

To improve recruiting and retention, some firms have been offering higher wages, better employee benefits and more flexible work arrangements. Average hourly wages for craftworkers, those considered production and nonsupervisory, climbed 6.2% from March 2021, according to the Bureau of Labor Statistics and the Associated General Contractors of America. This indicates that construction companies are paying more to attract workers and retain their current employees.

This trend is likely to continue and accelerate as inflation outpaces worker pay amid the tight labor market. Purchasing power fell 1.2% when adjusted for inflation as workers absorb higher prices for energy, food and other products, prompting many companies to begin considering higher cost of living wage increases and midterm adjustments.

For construction companies, high inflation and continued pandemic-related challenges are exacerbating issues with projects and schedules. Further compounding the situation, employees have begun thinking about work differently than they did before the pandemic. Many employees are looking for more flexible schedules, something that construction companies may struggle to provide, given the need to be on-site and deliver on strict deadlines, making it harder to recruit in an already constrained environment.

Tracking Key Compensation Trends

As companies refine payroll budgets this year, a common question across the industry is: How much should we be increasing employee pay to remain competitive and keep our current workforce? FMI has reported on compensation practices within the built environment for more than 20 years, and for more than a decade, base pay increases have averaged between 3.0% and 3.5% of payroll.

However, last year’s market pressures prompted projections of a 4% rise on average for 2022. And while this value was confirmed as the budgeted estimate through the end of 2021, there was reasonable speculation that the actual increase in 2022 might be higher.

FMI conducted the Pay Practices Survey in February 2022 to gauge base pay increases as well as annual incentive compensation being earned by construction employees.

From the more than 200 survey responses, it’s clear that most companies are responding in earnest to current market conditions and pressures: the 2022 average base pay increase is now budgeted at 4.7%. Among the respondents, less than 1% kept pay static from last year.

Respondents were most likely to characterize base pay increases as merit- or performance-related. In addition, approximately 93% of responding companies reported that bonuses have or will be paid to employees for 2021 performance. The survey also revealed that 77% of employees within these companies received or will receive bonus awards. This indicates that while most employees are receiving bonuses, there are limitations on eligibility and which performance levels are worthy of bonus rewards.

Construction appears to be behind the curve when it comes to pay increases. According to the U.S. Bureau of Labor Statistics (BLS), the overall employment cost index, which measures the change in the price of labor defined as compensation per employee hour worked, for private sector workers was up 7.1% during the fourth quarter of 2021. For construction, the index was up 5.4% for the same period.

At the same time, demand for projects is increasing. With the consumer price index continuing to rise and currently at 8.5% year over year—the highest since December 1981—and consumer sentiment declining, it’s clear that construction companies will need to increase pay or get more competitive with pay rates to avoid losing their current and prospective workers to competitors or other high-growth industries (e.g., logistics). In other words, labor investments aren’t keeping pace with cost pressures.

Other Key Drivers

Unemployment continues to fall, alongside a slow rise in labor force participation, the latter of which is currently at 62.3% (up from 61.9% in November 2021). Construction unemployment increased from year-end 2021 due to seasonal factors but is down year over year to 6.0% in March 2022, compared to 8.6% in March 2021.

Combined, these numbers tell the story of a labor force that’s still in flux and continuing to adjust in response to both the initial and ongoing impacts of the global pandemic.

Since the middle of 2020, most of the gains in construction employment have occurred in the residential sector. We anticipate that most of the hiring will move from residential to nonresidential and other infrastructure-related fields. This shift will be driven by the Infrastructure Investment and Jobs Act (IIJA) opportunities and an anticipated slowdown in residential activity.

Dealing With the Pressures

Fueled by a tight labor market U.S. employers need to rethink how they’re rewarding workers, putting pressure on compensation programs to keep pace with market changes.

The real personal income, excluding government payments, has been declining since November 2021, indicating that workers continue to feel pressure from rising prices and less purchasing power. Construction is no exception, with pay increase trends running behind inflation for the first time in many years. Many in the industry are beginning to consider additional pay adjustments, one-time lump sum payments, or extension of additional employer-paid benefits to better compete in the current labor market.

To deal with these realities, contractors will need to carefully plan for increased labor costs and competition. When accounting for growth or expansion this year, contractors need to keep labor costs at the forefront of their overall strategies.

Based on FMI’s data, construction companies should consider targeting an increase of approximately 5% in payroll budgets. While obviously short of inflation, this is significantly higher than recent history. The key will be to make sure that expectations are set and this is affordable going forward, since pay reductions are highly detrimental to employee engagement and performance.

After this, companies should wait to determine if additional adjustments are needed, based on inflation trends and other economic indicators. When necessary, companies may consider highly lucrative offers, retention bonuses and other strategies for essential positions, but this should be evaluated case by case and with the consideration of market-competitive pay levels and internal fairness.

FMI’s latest survey focused on pay increases among existing employees, versus how much starting pay has increased on a year-over-year basis, or what it now takes to bring on a new hire. This means we may expect rising pay compression and equity problems that employers must address to support corporate goodwill as well as to comply with increasingly prevalent fair pay regulations.