Using the Built Environment to Further Impact Investing Goals

The letters E, S and G have taken on new meaning in the financial and corporate world in the past decade.

Short for environmental, social and governance (ESG), the number of fund vehicles with stated ESG or impact mandates doubled from 2016 to 2021, and more than half of the $630 billion raised by general partners in 2021 went to firms with explicit ESG policies.

As investors increasingly expect fund managers to incorporate an ESG framework into their investment decisions, we expect competition to increase among funds for what might seem like a finite number of assets that fulfill ESG mandates.

However, the universe of ESG-friendly assets is larger than might be expected. The built environment offers an array of opportunities to make impactful investments. Not surprisingly, a significant number of those are in the areas of climate change, natural resource conservation and green infrastructure — the environmental component of ESG.

What is less obvious are the opportunities to invest in social impact across the built environment. This is a challenge in the institutional investment space. In 2022 more than 40% of 1,100 fund managers surveyed by Capital Group, an institutional asset manager, acknowledged that the social in ESG is underrepresented in their allocations, receiving about half as many dollars as environmental investments. To help boost the investment in social impacts, we recommend exploring what the built environment has to offer.

Think Outside Typical Geographies

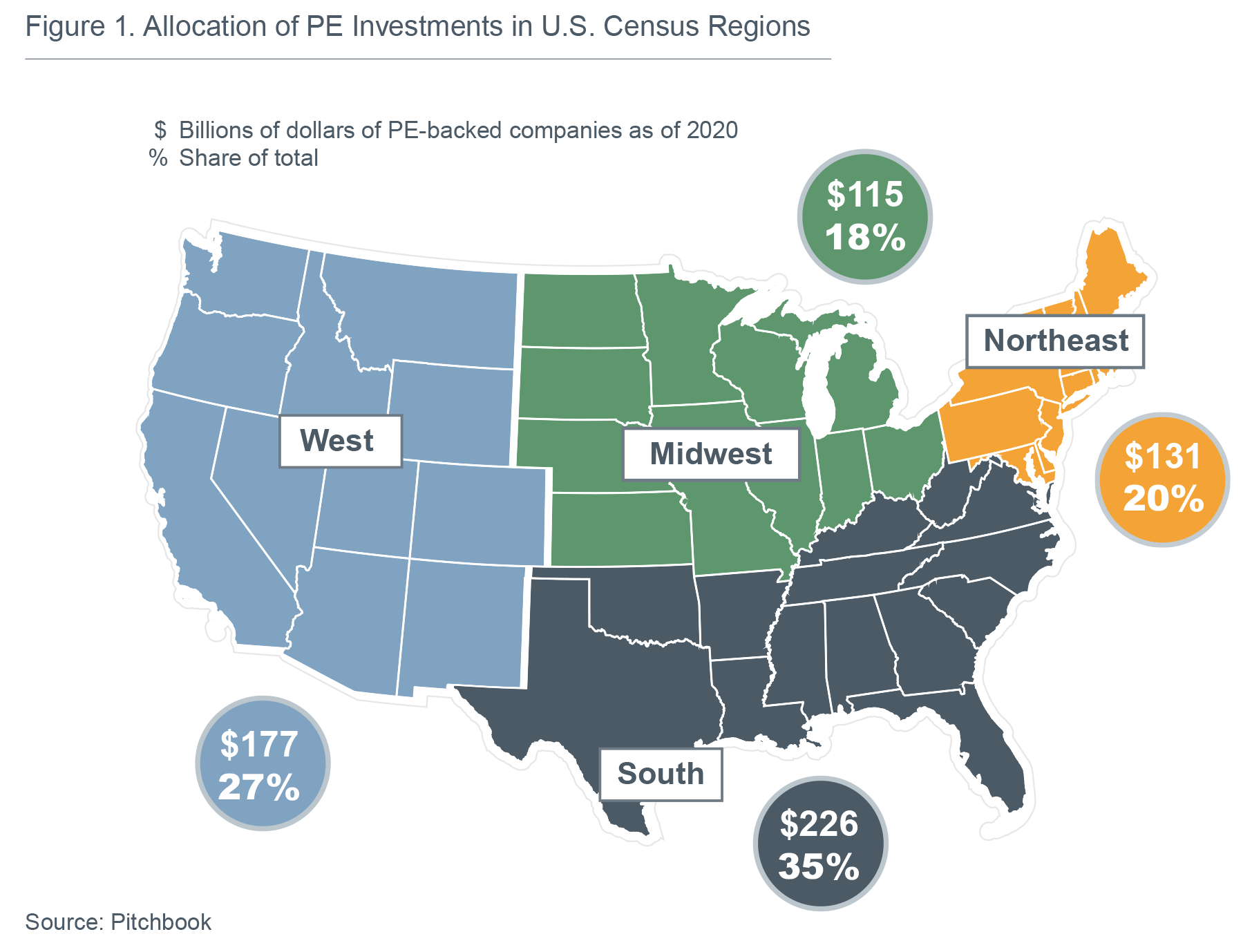

Of the private equity investment dollars in the U.S. in 2020, 32% were invested in California, Texas and Florida. Only 18% of private equity investments went to companies in the Midwest, despite making up 21% of the U.S. population (Figure 1).

Given the focus in the past decade in investing in high-tech, high-growth industries such as software, biotech and internet, industries that have outsized concentrations in Silicon Valley and Boston, this isn’t necessarily surprising. Yet, it does open the door to invest in geographies where those investment dollars can have an outsized impact on not only the businesses, but also the communities in which they are located.

Given the focus in the past decade in investing in high-tech, high-growth industries such as software, biotech and internet, industries that have outsized concentrations in Silicon Valley and Boston, this isn’t necessarily surprising. Yet, it does open the door to invest in geographies where those investment dollars can have an outsized impact on not only the businesses, but also the communities in which they are located.

According to the International Economic Development Council, the multiplier effect of investment dollars can range from 1.5 to 3.0 or more, depending on the local conditions and the type of investment. This means that for every dollar of investment, between $1.50 and $3 or more of economic development could be generated in underrepresented geographies, greatly impacting local communities.

For example, a study by the Council of Economic Advisors within the Executive Office of the President estimated that every $1 billion in federal infrastructure investment would support 13,000 jobs for one year. Additionally, the Congressional Budget Office approximates that for every dollar spent on infrastructure, there is an economic benefit of $2.20. This economic impact is something the team at Huron Capital, a Michigan-based investment firm, has seen firsthand.

“Given our focus is to partner with founder-led companies, a core tenet of our investment strategy is not only to leverage our expertise but also to focus our efforts on making investments in talent, systems and processes so the company is well positioned to do M&A. In our experience, these companies grow their local employee base, creating more jobs and opportunities for giving back to these local communities,” says Gabe Mesanza of Huron Capital.

The impact of investment on local communities is also a core consideration for Instar, a middle-market private equity firm focused on North America.

“Our purpose of enriching people’s lives sits at the core of our investing strategy and approach,” says Jonathan Stone, Instar partner. “At Instar, we seek to invest in niche, industry-leading businesses providing essential products and solutions to the people and communities they serve.”

Digital infrastructure investment is one focus for the firm because of the broad impact it has on communities.

“Technology has profoundly changed the way we live, and the COVID-19 pandemic highlighted how access to social and economic opportunities increasingly depends on digital infrastructure, particularly in remote communities,” says Stone. “In 2021, we invested in LS Networks, a leading fiber network provider in the U.S. Pacific Northwest that’s bringing affordable, high-speed internet to businesses and homes in rural, underserved communities. This business connects Americans to their schools, jobs and families, thereby positively impacting quality of life and equality of opportunity.”

While construction, engineering and industrial service companies exist in every state, they make up a substantial portion of jobs in geographies that have been overlooked in recent years for significant private capital investment. For example, almost twice as many people live in the South compared to the Midwest, but the percentage of residents employed by the construction industry is similar in the two regions.

Other Areas Ripe for Investment in the Built Environment

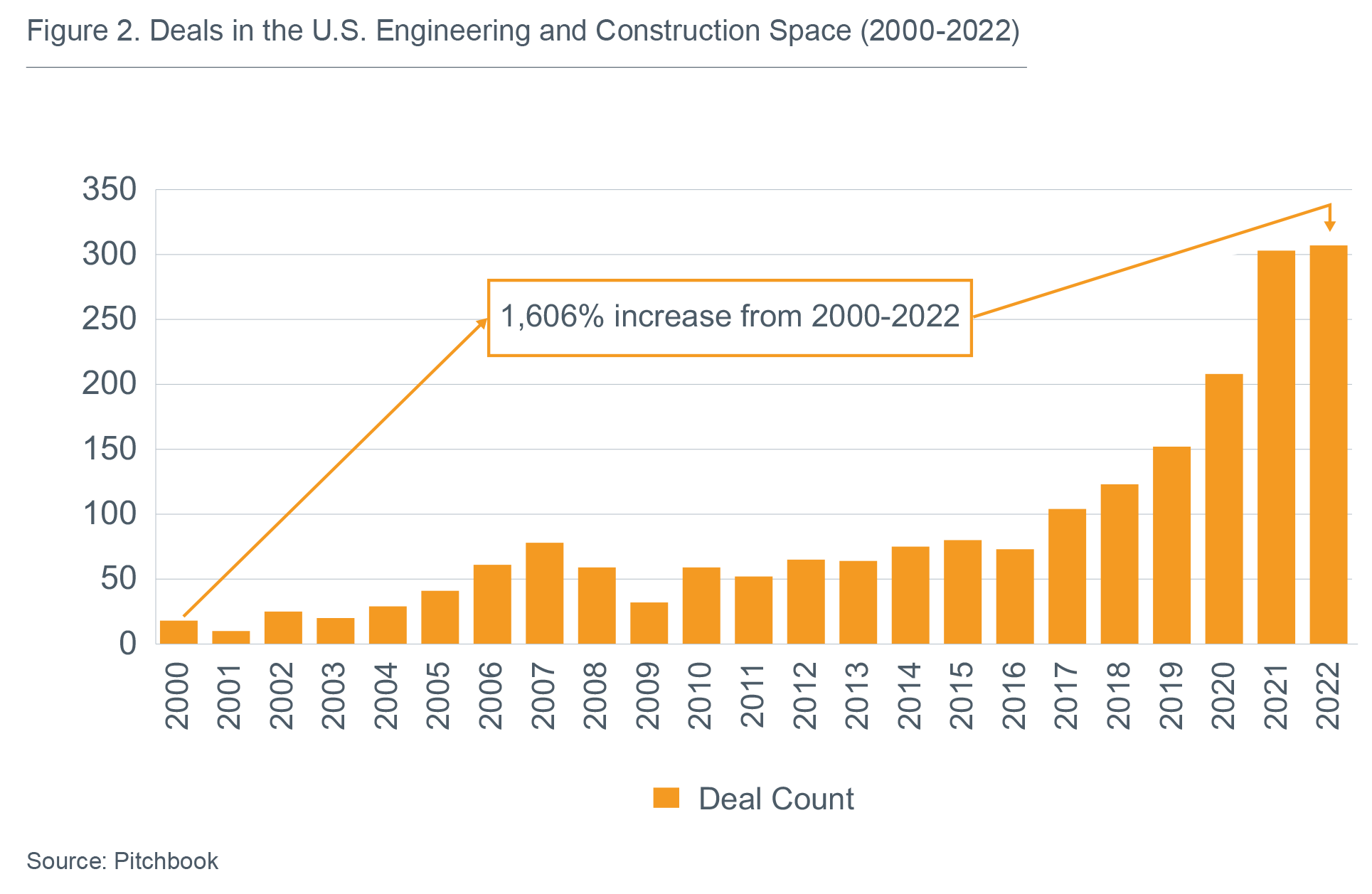

Private investment interest in engineering, consulting and knowledge-based businesses has grown significantly in recent years. For example, the number of deals in engineering and construction businesses increased from 18 in 2000 to 307 in 2022 (Figure 2). Those businesses serve a wide variety of end markets, geographies and clients.

We see several attractive opportunities to invest in companies doing the critical impact work of improving and protecting water quality, monitoring and improving air quality, and redeveloping brownfields or neglected urban areas.

We see several attractive opportunities to invest in companies doing the critical impact work of improving and protecting water quality, monitoring and improving air quality, and redeveloping brownfields or neglected urban areas.

This focus on putting dollars to work outside of traditional investment hubs has been a long-standing priority for gener8tor, a venture capital fund that runs multiple accelerators in various states, including Wisconsin and Indiana. Gener8tor was also recently certified as a B-Corp, reflecting its commitment to investing in underrepresented founders.

“Gener8tor believes we can do well by doing good and that innovation happens everywhere,” says Abby Kursel, a partner at t he firm. “We’ve made a particular effort to invest across race, place and gender and have demonstrated outsized returns for our limited partners (LPs) by doing so.”

One area that many investors are looking into is that of air quality, an area that disproportionately affects communities of color and poorer neighborhoods. According to the Centers for Disease Control, 11.9 million Americans live in counties with unhealthy levels of air pollution, with racial and ethnic minority populations disproportionately impacted. Lower-income communities are also disproportionately exposed to environmental hazards, including hazardous waste contamination and homes with asbestos and lead paint and pipes. By investing in companies working to protect basic resources and remediating hazardous environmental conditions, investors can fulfill their impact investment mandates from both environmental and social angles.

Creating Financial Security

Finally, we see several ways investors can provide financial benefits to a meaningful swath of founders, senior managers and employees. While these kinds of financial outcomes are meaningful for employees at most companies, the built environment employs a significant number of minority, veteran and first-generation American workers. For example, the U.S. construction workforce is approximately 43% minority.

Investment firm KKR made headlines last year when it announced the sale of its portfolio company C.H.I. Overhead Doors. C.H.I. senior management implemented a broad-based employee ownership program, in accordance with the KKR playbook, when KKR first acquired the company. C.H.I. non-management employees received an average payout of $175,000 when KKR sold the company to Nucor Corporation.

Graham Thomas, who leads the implementation of employee-ownership initiatives for KKR’s portfolio companies at the newly created Labor Center of Excellence at KKR, says the impact of the ownership program continues to have a profound effect even after the sale to Nucor.

“After the payouts, loyalty was up,” says Thomas. “Six months after the payout, voluntary attrition has been close to zero.”

Thomas says investors who are worried about the cost or challenges of implementing an employee ownership program at a company with a large labor force are often surprised to find the programs can pay for themselves.

“We’ve found that what we need to believe in terms of incremental company performance to cover the cost of the incremental equity is minimal,” says Thomas.

“When KKR instituted a similar program at another portfolio company, Gardner Denver (since merged with Ingersoll Rand), employee turnover rates dropped about 85%, “The increase in productivity and reduction in cost from not having to recruit and train new hires more than paid for the employee [equity] pool.”

The outsized returns that can be generated by focusing on impact investing goals is something IMB Partners, an investment firm focused on electric and gas utilities and government contracting sectors, has also seen.

“At IMB Partners, we have learned that diversity is a key factor in outperformance as it has helped us to open sales channels, create more diversity of thought, and bring new voices to the leadership table,” said Lamar Warren, director of IMB Partners. “By intentionally seeking diverse candidates, IMB and its portfolio companies have been able to consistently obtain top-tier talent in a tight labor environment, which has aided in generating top percentile returns. For example, over a four-anda- half-year holding period for LaFata Contract Services, a premier utility project and construction management firm, IMB Partners and the management team doubled the number of minorities and women on its team, which supported a substantial growth in earnings.”

Taking into consideration some of the less-obvious investment angles in ESG, like the social component, can reveal differentiated investment opportunities that can yield strong returns and help attract more investment dollars. In fact, 26% of investors globally last year refused to invest with a manager because of a lack of ESG policies, up five points from the prior year, according to Ernst & Young. It’s why the investment funds FMI has spoken with believe the focus on impact investing will continue to grow in the coming years.

“We believe that companies which proactively address ESG issues are better managed, more in tune with market headwinds or tailwinds, and are better positioned to adapt to changing market conditions, and investments in such companies are able to deliver better overall outcomes for our investors, our firm, our portfolio companies and the communities in which we operate,” Mesanza says.

As more companies look for ESG investment opportunities, it’s important to partner with a firm that understands the nuances of the built environment and that can find companies that fit your investment criteria. Giving yourself a competitive advantage now will help generate better returns in the long term.