How to Avoid Wasting Millions of Dollars Chasing Down Business

Getting smart about your go-to-market strategy, picking the right customers and pre-positioning yourself for the win will help set up your company to gain profitable market share without breaking the bank.

In the construction industry, millions of dollars are spent chasing projects that are never won. This costly and time-consuming process can leave some contractors feeling as if the system is rigged against them. It’s in the client’s best interest to have competition bidding on a project. For some clients that means one or two highly qualified construction teams. For others that number might rise to three to seven contractors. It all depends on how well the owner has prequalified contractors before a request for proposal (RFP) hits the streets.

There are usually differences between how the owner and the contractor look at the project pursuit process. From the owner’s perspective, multiple teams chasing the project can bring innovative ideas, ensure a more competitive price, and give the owner more options for project partners. This helps the owner understand the differences between competing teams and ultimately leads to more informed decision-making. If the owner is sophisticated and a serial builder, for example, he or she will likely know what to look for. If not, having multiple contractors pursue the project provides the owner with a broad spectrum of options and insights for delivering a successful project.

Contractors view the process very differently. It can seem like an unnecessary step in the process, a beauty contest where appearance matters more than substance, or simply a way to get the ultimate project price down. Too often, the project pursuit process drains the contractor’s time, energy and capital.

Ideally, a contractor seeks a one-on-one relationship with the owner, helping the owner frame the project needs and then winning the work, because the contractor has demonstrated its value in the process. The final step involves agreeing on contract terms and cost.

Chasing 10 projects to win two, three or five of them is challenging at best. Today there is over $1 trillion in construction work in the pipeline. Using rough numbers, if the average hit rate (i.e., success rate chasing work) is 30%, that means the industry must chase $3.3 trillion of work to win every project in the pipeline. The cost of chasing work is significant, and both owners and contractors must find a better way to collaborate with one another to improve the project bidding/award process.

Market Forces Are Impacting the Industry

It’s a buyer’s market right now, but that is changing (or has already changed) in some geographic markets around the country. Not all local markets have grown equally in the last five years. Many major cities on the East and West coasts have enjoyed significant growth, while many markets in the middle of the country have remained very competitive.

One major industry driver right now is the higher number of contractors available versus projects to build. That sets up a system of contractors competing for projects. In geographic markets or market segments where that dynamic is different, contractors typically enjoy better profit margins and can more easily win new work.

A lack of qualified talent, both in the field and office, is encouraging contractors to be more selective about which projects to pursue. It has also led contractors to raise their prices. Many contractors today are one or two major projects from stripping their bench of key project talent.

Clients do not see the world the same way. They want contractors to bring the team that will build the project as promised. The challenge is that if you have that team available now, you might not by the time the owner makes a decision. Most contractors find themselves needing to present the same team on more than one project at a time. It makes sense that some customers want the strongest team available to work on their project, and some even specify the people by name. The question becomes, can that contractor charge a bit more for guaranteeing that team for the project. The answer goes back to supply and demand: When the supply of top talent is low and demand remains high, prices should go up.

The same can be said for innovative ideas that are brought forth during the project’s proposal and presentation stages. Naturally, the customer wants the best ideas for building its project; it just makes sense. For the contractor, however, investing the time and talent to generate and implement highly innovative ideas on one specific project can be very costly.

There are only so many business development, preconstruction, estimating and operations hours available to invest in project pursuits. As a result, not all projects being chased get the level of attention that they deserve. Contractors must make smarter strategic choices regarding which customers and projects to pursue.

The Real Impact of Hit Rates

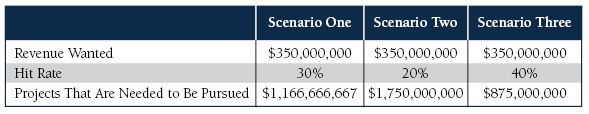

Small changes in hit rates (i.e., rate of winning a project) have dramatic impacts on contractors. Exhibit 1 shows the impact of changing hit rates for a company from 30% to 20% and 40%, respectively. If the company wants to end up with $350 million in work, and at a 30% hit rate, it would have to actively pursue $1.167 billion in work. If the hit rate drops to 20%, that number goes from $1.167 billion to $1.75 billion, or almost a 50% increase in the number of projects needed to pursue.

Exhibit 1. The Real Impact of Hit Rates

Finding that much quality work to chase is daunting enough. Finding the time to estimate the project, bringing in innovative ideas and committing your best team are downright overwhelming.

If the hit rate can be improved to 40% (which is a pretty high bar for most contractors in the private or public arenas), then the company would only have to chase $875 million in work, or about 75% of what is needed for a 30% hit rate.

Hit rates can create the pressure to “chase more to win more.” It is easy to get trapped on that hamster wheel, running faster and faster just to win sufficient work to keep the company busy.

Getting Off the Hamster Wheel

Winning profitable work starts long before you pursue a client or a project. Here is a quick list of things you can do to help get off the hamster wheel:

-

- Get your strategy straight. It all starts with strategy—what slices of the market do you want to target, who are the right customers, what services do they need, and how do these offerings set you apart from the competition? No one chases the complete commercial or institutional markets anymore; contractors chase market slices. You might want to target community colleges that are expanding their campuses, for example, or if you do well with big concrete work, you may want to focus on commercial projects that will require parking garages.

-

- Base your decisions on facts. Get smart about which market segments are growing, which are cooling off, and which have already peaked. This is not to say you can only chase growing market segments; but it does alter the strategy needed to bust in and win market share.

FMI uses a “4C model” to illustrate the context of profitable growth (see Exhibit 2). Start with the business “climate” that you are operating in (e.g., demographics, per capita income, government regulations, research and development, economic cycles, etc.), and then dig into the changes, expectations and needs of “customers.” Since they are the ones who will be buying your services, find out what criteria they use to select contractors. Ask them about the “competition” (the third C in the model); find out what competitors are good at and where there are opportunities to improve.The last C in the model is your “company” and what you are truly good at, simply OK at, and where you might lag behind the best contractors in the market.The 4 Cs come together to create the context behind crafting your go-to-market strategy. Simply put, that strategy identifies which market slice you will pursue, the right customers to get in front of, your ideal projects (i.e., sweet spot) and your market differentiation.

- Base your decisions on facts. Get smart about which market segments are growing, which are cooling off, and which have already peaked. This is not to say you can only chase growing market segments; but it does alter the strategy needed to bust in and win market share.

-

- Build a compelling story. You don’t have to be 100% differentiated from your competition. The key is identifying things you currently do (or could expand upon) that would create more value for your customers. If you simply match the competition that is already in the market slice, expect heavy price competition from entrenched contractors.

You need a story that explains to customers why you are the right choice for their project. Back up your story with proof that you really can deliver that additional value and guess what? Customers will listen.

- Build a compelling story. You don’t have to be 100% differentiated from your competition. The key is identifying things you currently do (or could expand upon) that would create more value for your customers. If you simply match the competition that is already in the market slice, expect heavy price competition from entrenched contractors.

-

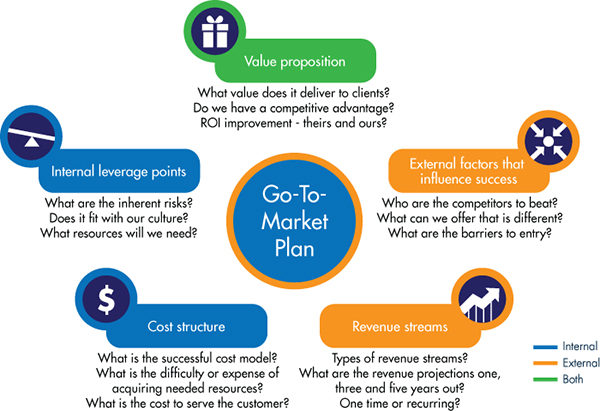

- Build your go-to-market strategy. This strategy will help you define which customers to target and connect with before an RFP hits the street. This is when they will be the most open to meeting with you and talking to you. You need to get in early and deep to create an advantage to win their project. Exhibit 3 shows several key elements of a go-to-market strategy.

Remember, it’s in the customer’s best interest to have multiple contractors chasing a project. You don’t just want to be a number in the game. Find ways to stand out and add value for your customer, and build your strategy to win around that value proposition.

- Build your go-to-market strategy. This strategy will help you define which customers to target and connect with before an RFP hits the street. This is when they will be the most open to meeting with you and talking to you. You need to get in early and deep to create an advantage to win their project. Exhibit 3 shows several key elements of a go-to-market strategy.

-

- Think like the customer. What is the same, and what is different from the customer’s other projects? What is the project’s business purpose? Who are the key end users that need to be included in the decision? What is something the customer has struggled to get other contractors to fully focus on.

Find out what the customer wants and why it is so important. What value do you bring that the competition does not? Value, by definition, is something that a person is willing to spend a little bit extra to obtain. See if you can find something the customer values that your organization can deliver better than anybody else.

- Think like the customer. What is the same, and what is different from the customer’s other projects? What is the project’s business purpose? Who are the key end users that need to be included in the decision? What is something the customer has struggled to get other contractors to fully focus on.

-

- Put your time where your strategy is. Build in organizational capacity that’s centered on a key focus, such as spending time with customers in advance. Everyone is busy today, so even when you do a good job of targeting specific customers, a lot of other things will be vying for your attention. The tactical things we all get caught up in take time away from the strategic moves that are needed to put ourselves in a winning position.

Exhibit 3. Key Elements of a Go-To-Market Plan

Why throw millions of dollars out the window trying to win bids and customers? Chasing work is a necessary but expensive proposition for contractors, but the firms that get smart about their strategies are generally the most successful and profitable. Getting smart about your go-to-market strategy, picking the right customers and pre-positioning yourself for the win will help set up your company to gain profitable market share without breaking the bank.