Bringing Employees to the Table: Using Compensation to Achieve Successful Ownership Transfer

How can owners ensure business continuity when they’re ready to relinquish ownership and management responsibilities?

COVID-19 has changed many things, but the necessity of planning for leadership and ownership transition remains. The latest FMI/CFMA Ownership Transfer and Management Succession Industry Survey revealed just over half of responding companies were in the midst of an ownership transfer plan prior to the pandemic. With the return to stability and post-pandemic operations comes the need to reinvigorate transition plans to best prepare companies for sustainability and continued success. Employee compensation is always important, and ensuring that current and next-generation leaders are fairly and competitively compensated is a factor that requires regular review. However, a less common consideration is the unique role compensation, most specifically long-term incentives, can play in facilitating ownership transfer.

What is long-term incentive compensation?

A long-term incentive plan, which is frequently a layman’s reference to a top-hat, nonqualified deferred compensation plan,1 is a variable compensation program under which the performance and/ or payout periods extend beyond one year. Long-term incentive awards are typically not taxable to the employees receiving them at the time of the award, but are taxed upon payout of the award; for companies, the deduction is not taken until payout. In order to maintain the tax deferral benefit for recipients, the award must maintain some degree of risk or be subject to substantial risk of forfeiture. FMI’s most recent compensation survey data suggests the following for long-term incentive practices within the engineering and construction industries:

- Slightly more than 40% of companies offer long-term incentive compensation.

- Typically, a long-term incentive plan is reserved for senior leaders.

- Among those with long-term incentive plans, companies allocate an average of 8% of pretax net income before incentives to long-term incentive awards.

- The vast majority of awards are cash-settled versus stock-based awards, but may be awarded as synthetic equity (i.e., phantom stock, stock appreciation rights, etc.).

- The most common vesting period is five years.

In the current market, long-term incentive plans are most popular as a retention tool, but they can also support the attainment of equity by key employees.

When is long-term incentive compensation best utilized for ownership transfer?

There is no single perfect scenario where compensation is the best choice, but there are factors that will identify this approach as particularly viable and beneficial to current and new owners. Knowing when this path is ideal is important, as there are potential pitfalls, such as the selection of inappropriate leaders, inadequate valuation of reasonable funding for equity transfer, and differing perceptions among current and future owners. Here are several scenarios that tend to lead to effective use of long-term incentives:

1. There is limited opportunity for an external sale. While the pandemic has created numerous mergers and acquisitions opportunities within the built environment, the opportunities to sell to an outside party are limited for many companies. There are certainly times where brand and reputation, market saturation, specialized services or equipment, or strategic attributes will result in a beneficial acquisition; but across the industry, this is rare. FMI’s recent OTMS survey indicates that only 6% of firms expect to transition the business through an external sale. This number reflects the fact that in many cases, there simply aren’t any good prospective buyers available.

2. Current owners are interested in legacy. To some degree, creating legacy is human nature. But for a business, legacy takes on a bigger meaning; beyond maintaining a company name and market recognition, there are employees who can be greatly affected by owner decisions. One owner in the midst of developing a long-term incentive plan asked, “What happens to the team if something happens to me? I want employees to know they have stability here.” The easiest exit option may be liquidation―workers will likely find new jobs, remaining assets can be sold, and so on―but for many owners, this is not a satisfying solution. Additionally, if younger generations are interested in future company ownership, but aren’t currently ready for leadership roles, there may be the need for an interim team to run the company. One solution is offering partnership to nonfamily team members who are critical to the business.

3. The company has good leaders who may also be good owners. Effective executives are not inherently good owners. The responsibilities, risks and governance expected of owners differ—often significantly—from those of nonowner leaders. As a result, it’s important to evaluate executives with an eye toward ownership. Long-term incentives are beneficial during this evaluation period because awards can be used to retain key employees without any requirement or expectation of future ownership.

4. There are constrained resources among prospective owners. This is a fairly common scenario. When internal equity transfer is the confirmed approach, new owners rarely have significant funds readily available for stock purchase. Accordingly, one or more of the following methods of supporting the ownership transition is usually pursued:

- New owner personal funds: Naturally, this contradicts the statement that new owners typically lack sufficient wealth to buy stock. So when new owners are obligated to buy stock directly, these individuals may need to take on new personal debt. With new owners taking on more financial burden, there are heightened expectations and stress related to company performance. Furthermore, if the new owners want to repay debt through distributions, this plan may conflict with prudent business goals for reinvesting funds in the company.

- Company-based loans: When the company loans new owners the funds needed to buy stock, there can be greater flexibility on repayment terms as well as greater corporate control. For example, any distributions from the stock obtained by new owners may be used to pay down the debt, and this is an easily monitored transaction. Similarly, all or some of earned incentive compensation may be used toward loan reduction. The challenges of this approach are also not dissimilar from the use of other personal funds and debt described above: The pressure on new owners to repay loans raises the pressure for large distributions and higher compensation.

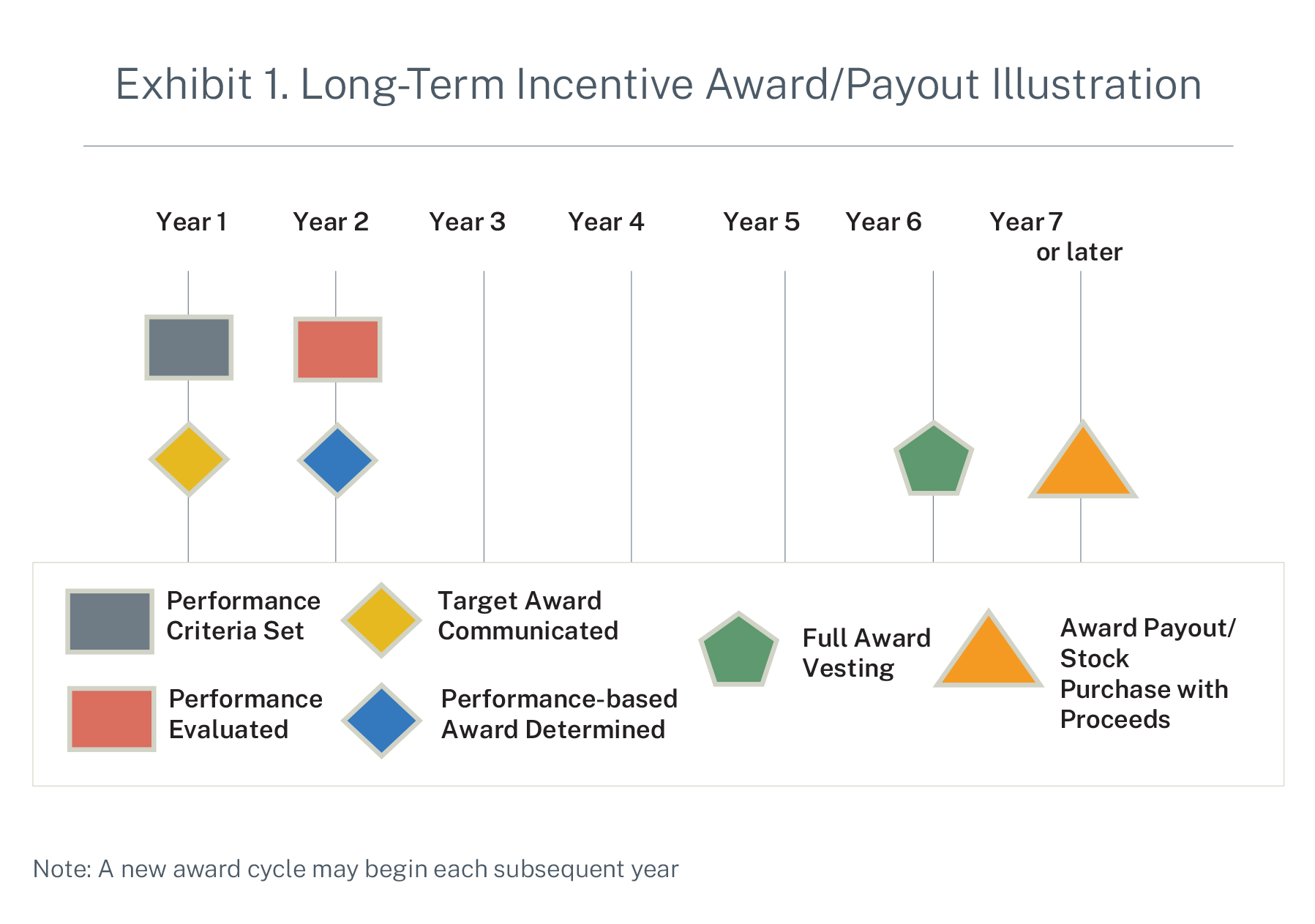

- Long-term incentive compensation: New owners are awarded long-term incentives and then use the proceeds to buy stock (see Exhibit 1). In other words, prospective owners are compensated at a level that enables them to make substantive stock purchases, often over multiple years. If long-term incentive awards are particularly generous, this method can be characterized as existing owners essentially buying themselves out with their own money. Profit that would otherwise go back into the company or be paid as distributions is instead being paid as compensation to the new owners. There are several ways to structure a mutually beneficial, long-term incentive plan, including:

a) Make the long-term incentive awards performance-based. This way employees are not being overcompensated to buy stock, but rather encouraged to enhance company performance and share in the rewards of doing so. In the event that a long-term incentive award recipient is found to be less than ideal for future ownership, there can still be acceptance of paying out the award in recognition of performance, with the understanding that it will not be used toward stock purchase.

b) Establish awards that are market-competitive and reasonable. Unless a small number of new owners need to acquire significant equity quickly, long-term incentives can be conservatively awarded over time, consistent with broader market practices and the company’s performance results.

c) Require additional new owner contribution. Long-term incentives may be combined with one or both of the methods above, so that new owners are making a personal investment from other funds concurrent with their use of award proceeds to buy stock.

- Equity grants: Instead of (or in addition to) the previous methods, new owners may simply receive equity-based awards. These could be outright stock grants or restricted stock or stock options. Frequently, both restricted stock and stock options include performance and time requirements, so they are not overt gifts. However, stock grants and restricted stock awards usually result in ownership rights for the recipient, as do stock options when exercised. With 66% of companies indicating successors will not be ready for another three to five years, according to the Ownership Transfer and Management Succession Industry Survey, bringing on new owners immediately may not be preferable. Alternatively, companies can create an equity-based, long-term incentive plan, which requires performance stipulations to be met before an award is made and a vesting period before a recipient is formally an owner.

5. The timeline is long. Timeline delays are one of the greatest impacts of the COVID-19 pandemic on ownership transfer. A six- to 10-year time horizon now surpasses the previously common projection of two to five years for 100% ownership transfer. Unfortunately, the need for more time is frequently not aligned with current owners’ optimal date for exiting the business: 49% of owners reporting they want to exit within five years do not have an ownership transfer plan. Long-term incentive awards offer the specialized benefit of being immediate retention and motivation tools while also giving current owners more time to vet the readiness and appropriateness of potential new owners. Current owners and other leaders must ensure that prospective ownership successors are prepared to take over the business. Therefore, an assessment of current skills, competencies and interests is essential—as is addressing areas where gaps are present. Taking on ill-prepared new partners can be disastrous. In this situation, using long-term incentives to retain key employees can be advantageous, whether the long-term incentive award proceeds are ultimately used for stock purchase or not. Clearly, there is an array of options to consider when establishing an ownership transition plan. Even if an owner has determined it is best to look inward, there are many approaches to explore. As described, companies can utilize unique compensation structures―specifically, long-term incentives― to support equity transfer while also helping retain key leaders.