Cultivating the Next Generation of E&C Technical Talent

The E&C industry is undergoing a technology revolution that is impacting how firms find, train and retain top technical talent.

With information system innovation at an all-time high, the engineering and construction (E&C) industry is experiencing dramatic changes right now. New technological advancements, combined with demographic shifts in the workforce and owners’ demands for cheaper, faster and better projects, are resulting in heightened pressure for E&C companies to continuously improve and advance.

Augmented reality, 3D printing and scanning, building information modeling (BIM), virtual design and construction (VDC), prefabrication and even unmanned drones are helping E&C companies work smarter, boost productivity and improve collaboration across project teams. But these innovations also pose challenges, particularly when it comes to finding, developing and retaining the right talent.

In this article, we explore the impact of technological influences on today’s E&C labor practices, discuss what new skills and competencies will be required in the near term and provide recommendations on how to develop a workforce of the future.

The Merging of Design and Construction

Over the past decade, we have witnessed a significant increase in firms adopting BIM/VDC systems in all aspects of the design-build process. This includes modeling, customer decision mapping, estimating, virtual building, prefabrication, site analysis and coordination, construction resource utilization and field work planning, among others.

With the growing use of enhanced BIM/VDC systems comes the demand for specialists to employ these tools effectively. In one extreme example of how BIM/VDC usage is impacting the industry, we can look to Broad Sustainable Building, a Chinese construction firm that last year brought new meaning to fast-build projects by completing a 57-story skyscraper in Changsha in just 19 days. While this prefabrication feat was as much for notoriety as it was to meet housing demands in south central China, the project highlights the current prevailing expectations for efficient design-build engagements, which will rely heavily on effective BIM/VDC tools and a technically proficient workforce.

Early adopters of BIM/VDC processes now have a performance record that proves the operational gains that may be realized using innovative modeling and virtual planning systems. Mortensen Construction, for example, analyzed 18 projects completed between 2004 and 2014 and identified the following benefits resulting from their VDC process:

- Average schedule reduction: 32 days

- Productivity increases: 25% and greater

- Average direct cost reduction: 2.95%

As the positive impacts of BIM/VDC are noted across the entire E&C industry, it’s clear that such innovations are revolutionizing project delivery. Some of the key areas of innovation include:

- Prefabrication. With the ability to better plan and model construction projects, E&C companies anticipate the expansion of prefabrication work, which has the potential to significantly reduce project timelines.

- Automation. Where possible, firms are seeking to implement automation processes already highly utilized within the manufacturing industry. This is critically significant from a safety standpoint, as the use of robotics could limit the exposure of workers to site safety hazards.

- Virtual Collaboration. The ability to liaise in real time with customers and other project stakeholders using mobile devices and related technologies is increasingly cited as advantageous to project design and decision-making, particularly for health care clients.

Technical Talent Wanted

Naturally, the expanding utility of BIM/VDC tools has driven the need for specialists that can effectively apply these systems. FMI Compensation has collected staffing and salary data from E&C companies for BIM professional jobs since 2009. Our longitudinal analysis reveals several key observations:

- Growth of the Profession

The number of companies that report having a BIM professional on staff has increased significantly over the last two years. In “FMI’s 2016 Construction Professional Compensation Survey,” we noted an increase of 68% in companies identifying at least one BIM professional within their workforces. Our survey findings also indicate the greatest growth of incumbents at the senior BIM professional level—a trend we expect to see continuing in the coming years.However, our research also shows a slight decline in entry-level BIM specialists, which seems out of line with the overall trajectory of BIM/VDC adoption and deployment. There could be several explanations for this observation, including:

- Demand for experienced BIM/VDC professionals is overwhelming and leaves little motivation for newcomers to enter the field.

- The economic downturn led to layoffs and hiring freezes that stifled the recruiting of beginner BIM/VDC professionals.

- Training efforts, as well as employer expectations for rapid skills development for BIM/VDC specialists, are great, so employees are improving their knowledge and skills quickly and, therefore, moving beyond “beginner” status to higher steps on the career ladder in short order.

- Increases in BIM/VDC Staffing

FMI’s survey data suggests that companies are hiring more BIM/VDC professionals. In 2014, E&C firms participating in the “Construction Professional Compensation Survey” indicated that, on average, they employed slightly fewer than four individuals in BIM/VDC professional positions. In 2016, the average staff count rose to nearly five BIM/VDC employees. The largest staff increases involved higher-level roles, suggesting the increasing need among E&C firms for highly skilled professionals who can facilitate coordination and collaboration among multiple stakeholder groups on complex projects.

- Gradual Salary Increases

For the past 15 years, FMI’s Compensation Group has been tracking six key benchmark job families, including business development, project management, project superintendent, estimator, general foreman and BIM (the latter has been tracked since 2009). Exhibit 1 shows the base pay trend for each job family and reveals that, in general, pay levels have been increasing since 2001. Although employment levels may have receded during the recession, those jobs requiring specialized skills and knowledge have experienced steady pay increases.

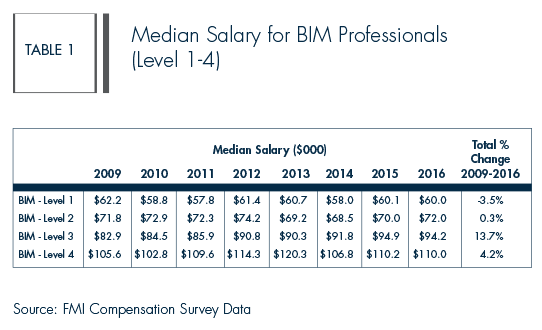

Table 1 below shows how national median salaries for less experienced roles (i.e., Levels 1 and 2) have grown little or declined since 2009, while salaries for more advanced roles (i.e., Levels 3 and 4) have increased.

- With the decrease in beginner BIM/VDC professionals relative to more experienced incumbents, the median salary levels reported are no surprise. As such, there is little pressure to increase wages for entry-level roles, given the lack of growth at this level, while the focus on higher-level roles is driving salary increases. That said, apart from the “BIM – Level 3” position, the rise in BIM salaries since 2009 is lower compared to general E&C industry compensation increases. It remains to be seen whether continued demand for BIM/VDC specialists will ultimately result in larger pay increases in the near future.

Developing an Effective Talent Development Approach

As BIM/VDC systems continue to evolve, so too will the roles of individuals responsible for using them. Thus, E&C companies must remain cognizant of not only how they are using BIM/VDC for projects, but also how best to utilize staff and effectively hire, develop and retain these increasingly critical employees. Here are our top recommendations for companies that want to fully leverage technological developments while maximizing their current and future workforces:

- Conduct Periodic Needs Assessments

To ensure the right people are in the right roles, start by assessing current BIM/VDC practices as well as forecasting process updates. Then compare existing employees’ skills and competencies relative to workforce needs, given current and future practices. Knowledge of the work to be performed will be essential in determining the incumbent qualities needed to perform BIM/VDC functions.

- Understand the Roles That Need to Be Filled

Today, BIM/VDC professionals take on a broad spectrum of roles, including:

- Technician Versus Facilitator. The technical BIM/VDC role is a traditional position that grew out of earlier design drafting roles. The technician role is responsible for administering systems and ensuring their effective and efficient operations. Alternatively, the facilitator role is responsible for project management and coordination related to BIM/VDC. While many firms distinguish between these two roles—namely because they tend to require different job competencies—we expect these roles to merge into one over time. This would require technical specialists to be well-versed in project coordination and bring greater efficiencies to projects through a primary, specialized point of contact.

- Expert Versus Cross-Training. Even while we observe growth in the number of BIM/VDC professionals, some firms want to train their existing workforces in BIM/VDC systems rather than staff subject matter experts. With the adoption of BIM/VDC integration, cross-training is a more plausible approach (versus when BIM/VDC is introduced and implemented in a short time frame).Deciding which job design approach to pursue will depend on the extent to which BIM/VDC systems are utilized on projects, who uses those systems and in what capacity, and how well various project team members learn BIM/VDC operations.

- Evaluate Recruitment Initiatives

E&C firms must determine how to staff the BIM/VDC function, given the results of a needs assessment. Desired job roles should be reflected in the firm’s recruitment strategies. For example, if a company finds that experts are preferred, it may need to provide a premium compensation package to effectively attract experienced talent.Based on the demands for talent and review of recruitment effectiveness, E&C firms may require outreach initiatives to expand the population of BIM/VDC professionals. This may be particularly true, given the diminished number of entry-level specialists.

- Sharpen Retention Efforts

As the labor market becomes constrained, companies that have successfully established high-functioning BIM/VDC teams will need to assess optimal staff retention approaches. Potential strategies may include:

- Professional Development. Given the targeted growth among experienced BIM specialists, it is mutually beneficial for employees to expand their skills and knowledge in BIM/VDC and for employers to invest in their employees’ long-term development. Career development offerings are also a key contributor to engagement among employees, according to FMI’s Industry Survey, “Millennials in Construction: Learning to Engage a New Workforce.” It is routinely recognized that engaged workers are more likely to remain with their employer long-term.

- Career Tracks. Clearly defined advancement opportunities can help BIM/VDC professionals recognize their long-term employment possibilities. Many E&C firms began with just one BIM individual-contributor position, but today, many larger companies are building complete career paths that are similar to those in project management. For instance, one FMI compensation survey participant indicates that the following job descriptions have been drafted for BIM/VDC positions: specialist, engineer, manager, regional manager and director.

What’s Next for BIM?

Looking ahead, we expect to see continued innovation across BIM/VDC systems where prefabrication, automation and virtual collaboration will begin to take center stage as the industry’s use of technology expands and matures. To best leverage these trends, E&C companies must sharpen their talent management pencils in a way that ensures the recruitment and retention of the right level of technical talent. That talent must be able to leverage advanced technologies and work even smarter in 2017 and beyond. For this and other reasons, a competitive pay strategy serves as a cornerstone of any good human capital investment approach.