Don’t Risk Poor Cash Management Due to Lack of Strategy

Regardless of market conditions, having the right level of liquidity is a crucial aspect of successful risk management for contractors.

Poor cash flow is one of the biggest reasons why construction companies fail in any operating environment, and according to FMI’s research, inadequate capitalization causes 58% of contractor failures. While healthy cash flow remains important during overall economic or industry-specific downturns— when the pipelines have dried up and incoming payments slow to a trickle—it should never be overlooked or ignored.

When business is good, sales are brisk and project pipelines are full, not having enough liquidity can have an even bigger impact on an organization. Our research has also shown that contractors are more likely to fail during strong markets instead of downturns, in part due to the strains inadequate cash flows have on organizations. During downturns, companies tend to pay more attention to cash flows and risk management than when work is abundant.

Without appropriate cash flow, contractors can’t pay suppliers, buy the materials they need to finish projects, pay staff on time or maintain their customer bases, all of which can create significant challenges. And while one or two missed payments don’t necessarily mean disaster, accumulated problems can have a significant impact. In many cases a bad project or two may be all that it takes to cause a failure, so being diligent and intentional about the selection and monitoring of your partners is critical.

For this article, FMI interviewed executives at four top subcontractor default insurance (SDI) carriers about lessons learned from the last two years, the state of SDI and risk profiles, and how they’re helping clients navigate the current operating environment. We’d like to express our gratitude for the generous time and candid answers from interviewees from Cove Programs, Hudson Insurance Group, Liberty Mutual and AXA XL. We’re excited to share their insights into the SDI market and how they’re thinking about moving forward in 2022 in this second article in our series.

Where Prequalifications End and Project Risk Management Begins

Smart companies are always assessing potential risk and working to avoid issues before they become real problems. The first line of defense for most organizations is a formal prequalification process. However, as the size and complexity of projects grow, many companies are evolving their prequalification process to become a more continuous exercise throughout projects.

Hudson risk manager William Lane says the company is closely watching how contractors adjust their approach to prequalification and how subcontractors are managing their cash for 2022. “One of the most important things we could advocate in the marketplace is that continuous qualification piece, doing an interim check sometime in June, July, August to see if that money’s still there and still attributing to the health of the business,” he says. “Subs are going to be prequalified on that financial picture, which could change.”

Nathan Espe, executive vice president and head of SDI at Cove, agrees, “Some general contractors may only prequalify a subcontractor once a year or on a one-time basis before the start of the project. Instead, they should also be prequalifying during the course of the project to be sure that the subcontractor continues to perform well on all its other projects and that the company has the financial capacity to manage those projects.”

Espe sees technology playing an important role in the prequalification process now and going forward. “There are some great tools available out there that continue to evolve,” says Espe. “As those tools continue to mature, we’re going to encourage our clients to utilize them more frequently in the ongoing prequalification process.”

Another important area of prequalification that is often overlooked is developing and maintaining an understanding of project selectivity among your subcontractor partners. It often only takes one or two bad projects to significantly alter a subcontractor’s financial health, and according to Douglas Schrift, chief underwriting officer at Liberty, after the last economic downturn, many contractors and subs took whatever work they could to boost cash.

“As the economy crashed many felt they needed to chase work and it cost them,” Schrift says. “As things improved they weren’t able to perform on committed projects, so they decided to shift towards better opportunities, or they couldn’t staff or provide the equipment or resources necessary to perform. We’re not in a recession, but this situation is not dissimilar. Subs feeling confident in their appetites to grow, even if conservative by historical standards, can quickly derail in an environment where reliance on existing employees, using sub tier labor, or timely access to materials is considerably less stable. If the resources to complete committed work are no longer reliable, the subcontractor cannot perform. Don’t be timid during the bid interview process.”

Understanding current work in progress and backlogs and getting a sense of how subcontractors are evaluating risk can provide a better sense of which subs may be at risk for not completing work or rushing through a job. This can help contractors mitigate those problems before they occur.

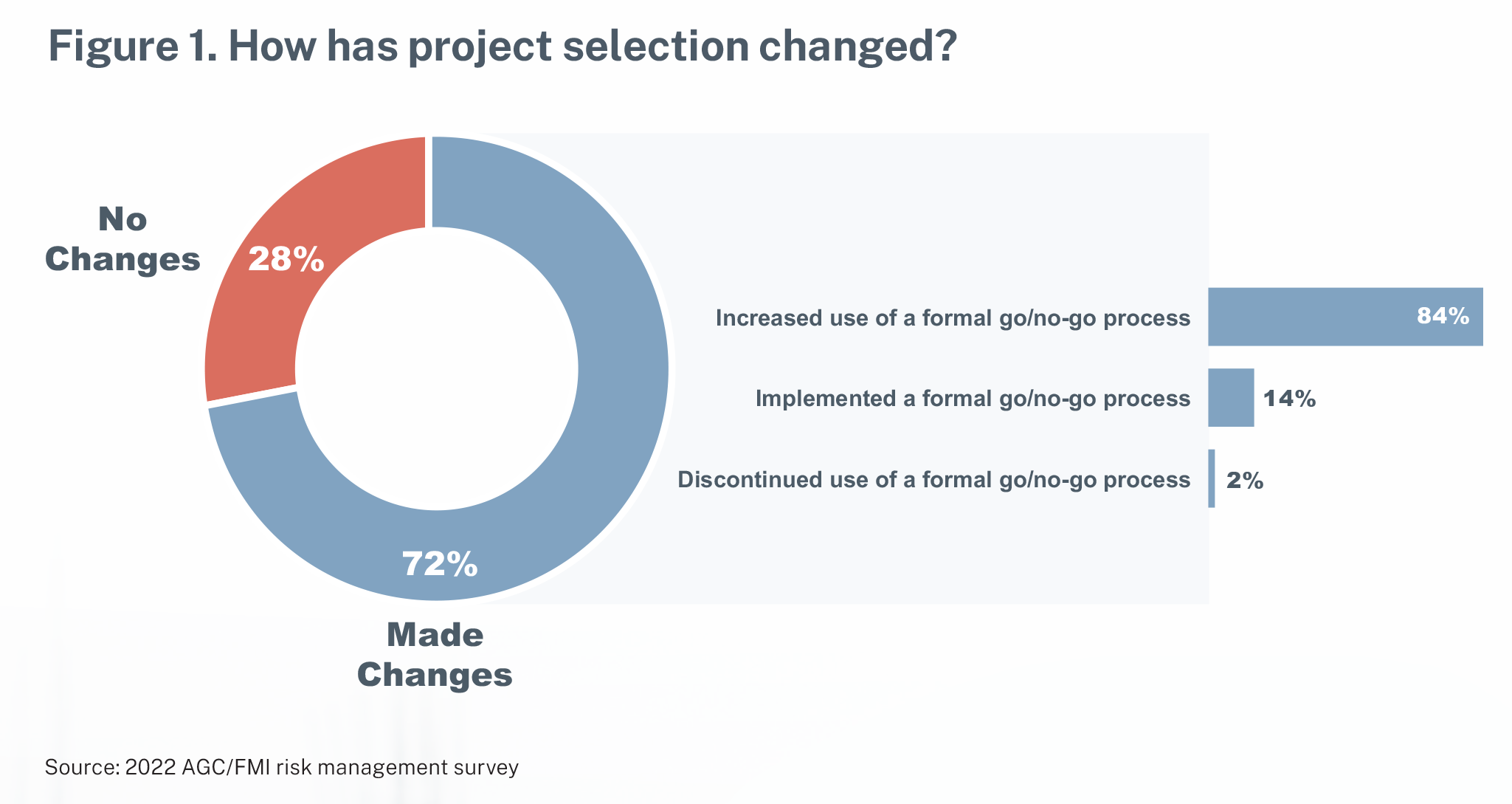

The importance of proactively identifying problems was also confirmed in the latest AGC/FMI risk study, where 84% of respondents said they had made changes to their project selection process and increased the use of formal go/no-go procedures in 2021 (see Figure 1).

Don’t Wait for Bad Things to Happen

All too often we see companies taking a wait-and-see approach to risk management. But those that get ahead by acknowledging and addressing project risk early and having open conversations will be in the best positions to manage or mitigate project challenges.

“The closest thing we have to a silver bullet is starting proactive conversations with builders and subpartners early,” says Cheri Hanes, SDI risk engineering team leader at AXA XL. Even before the contracts are written up and the work starts, Hanes puts time into better understanding what’s keeping those companies up at night, what problems they’re encountering out in the field, and what potential issues may emerge once the project starts.

The problem is that if no one asks the tough questions upfront, the original choices will stay in place, and the real problems will arise later—often too late to be able to manage the problem proactively.

“Start your conversations about risk during the subcontractor prequalification process and then share that information upstream to protect against increased risk,” says Hanes. “Making early, strategic decisions and using a flexible approach could potentially save everyone a lot of heartache. If you don’t know, you don’t know. So asking those questions becomes critically important.”

Often these conversations take place during the subcontractor prequalification process; but if they happen earlier, all the better. Respondents from the 2022 AGC/FMI risk management study confirmed this trend as well: Almost 30% of research participants increased communication with their project partners in the past year.

Recognize Problems as Early as Possible

Even with the best of intentions and the strongest prequalification process, contractors still make mistakes. Strained by the same labor shortage, supply chain disruptions and ongoing pandemic impacts that most companies are grappling with right now, contractors have turned to quality assurance and quality control (QA/QC) as more than just an accountability mechanism. In most instances of default, there are signs along the way that offer warnings or potential challenges. Those strains often become evident as subcontractors underdeliver on quantity and quality but find themselves overdelivering on billings.

Cash-strapped subcontractors tend to try to pad their billings, charging for work before it’s delivered. It’s important that general contractors review work and only pay for what’s been completed satisfactorily.

Diligent QA/QC also helps companies identify potential cash flow issues early and then address those problems proactively, versus waiting until they turn into insurmountable challenges. “Our builder partners have always had a strong focus on QA/QC,” says Hanes, who also points to technology as a key facilitator of good QA/QC for contractors right now.

“Technology solutions have become a much larger part of the QA/QC conversation and have really powered up our builder partners’ abilities to be proactive and contemporaneous in their quality documentation and communication,” Hanes explains, noting that AXA XL’s emphasis on QA/QC springs from the fact that quality issues are often a large driver for claims.

In other words, if a claim gets expensive relative to the original subcontract size—say more than double—that is nearly always driven by quality issues, including rework. When subcontractors are stressed or short on cash, there is also a tendency to bill for more work than what’s been completed. Unless contractors are diligently monitoring work and only paying for satisfactorily completed jobs, they could find themselves paying for removal, rework and acceleration.

To avoid these challenges, general contractors must thoroughly manage completed work, make sure that work has been performed correctly, and not pay for work that isn’t part of the current billing cycle. With a structured QA/QC program and pay-requisition processes in place, contractors can help avoid the painful position of having overpaid for poorly installed work.

Best Practices for Managing Risk

Through upfront conversations with owners to shift risk allocation, escalation clauses and solid QA/QC programs, general contractors can more effectively manage risk and maintain healthy cash flow in any market conditions. Lane also tells general contractors to assess the project owner’s behavior and propensity to share the risk, which allows contractors to plan appropriately for the risk itself.

For example, where some owners may put t he burden on the general contractor to allocate risk, others are willing to work more collaboratively with contractors (e.g., by issuing line-item allowances) to ensure overall project success and reduce the related risk.

“A lot of this will come down to the behavior of owners,” Hudson’s Lane points out, “and whether or not they want to allow the general contractor to allocate or share that risk with them.”

Hudson Senior Vice President Wallace Moreman says escalation clauses are another tool for both addressing risk and maintaining positive cash flow. These clauses allow a contractor to impose material price increases after a contract has been signed, and they’re being used more in this era of supply chain shortages, extended order lead times and fluctuating raw material prices.

“A lot of the companies we work with have been able to get escalation clauses in the contracts because they understand we’re operating in a different environment,” says Moreman. “They’re also purchasing job materials as early as possible and either storing them on-site or off-site, so those materials are available when they need them. That’s added a little bit of cost to the job, but at least they know they’ll have the availability of the product when they need it.”

Be Proactive

The key theme of most of our conversations with SDI leaders was to be proactive and diligent. Have conversations upfront and don’t limit your assessment of qualifications to a moment in time far removed from the actual execution of the work. Keep the

dialogue going throughout the project life cycle and pay attention to indications of financial stress along the way. Despite the challenges inherent in the industry, general contractors that effectively and proactively manage risk across their portfolio will be better positioned to outperform the market and build value.

BLOG_TN_500x410.png)