History Repeats Itself: A New Wave of International Interest in the U.S. Infrastructure Market

Mirroring the 1970s, when large international firms first targeted acquisitions to enter the U.S. construction market in a significant way, new international players are emerging alongside traditional international competitors to target the U.S.

Beginning in the 1970s, large European construction firms began targeting acquisitions in order to compete in the U.S. market. This process was accelerated by the collapse of the OPEC boom, particularly for German firms that relied heavily on oil-exporting countries. Thus, in 1979 Bilfinger Berger became the first major international player to purchase a significant contractor with its acquisition of Fru-Con. This was soon followed by Philipp Holzman’s acquisition of J.A. Jones in 1980.

This trend continued over the next few decades as additional, large European firms (e.g., ACS/Dragados, Hochtief, Balfour Beatty, Ferrovial, etc.) and firms from other developed markets (e.g., Japan, Australia) entered the U.S. market both organically and through acquisition. Today, competitors from these traditional markets continue to pursue additional market share in the U.S. In fact, nine of the current 50 largest contractors (according to ENR’s 2016 Top 400 Contractors) are internationally owned, eight by traditional international competitors from developed economies.

In this article we’ll explore the current state of foreign interest in domestic E&C firms, including an emerging group of new international players, and outline the implications and recommendations for companies operating in the U.S. market.

History Repeats Itself

In the years leading up to the recent oil price decline, most international expansion among large E&C firms focused on firms from developed economies entering emerging markets—and was primarily driven by commodities. In 2014, for example, the transformational M&A transactions in the E&C industry (i.e., Aecom/URS; SNC/Kentz; Amec/Foster Wheeler) which defined the year were in large part driven by a desire to acquire capabilities in the oil and gas segment and a foothold in the African, Middle Eastern and Latin American markets.

Now, mirroring the 1970s—when large international firms first entered the U.S. in a significant way—this trend has reversed. The recent collapse of commodity prices (much like the collapse of the OPEC boom), coupled with global economic uncertainty, has diminished the attractiveness of many emerging markets. Today, alongside the familiar international firms, new players are emerging from around the world, with cash earned when commodity prices were high and strategic objectives to deploy capital in developed markets.

Many of these new competitors have been working predominantly in emerging markets, including Africa, Latin America and the Middle East, and are now looking to gain market share in developed markets. Some of these firms are simply looking to diversify out of commodity-driven economies, while others have grown too large for their current market and must expand internationally in order to utilize the resources acquired.

An extreme example of the second dynamic is China, where over the past decade contractors have grown significantly and built substantial capabilities as a result of the investment in Chinese infrastructure. Given the uncertainty in the future of Chinese infrastructure spending, these firms are now pursuing international projects. To date, they have been most active internationally in Africa, where:

- commodity prices drove the need for infrastructure,

- the Chinese development bank was willing to finance infrastructure projects and

- Chinese contractors could import labor to complete the work.

Recognizing the instability of this dynamic and the inability to operate in this manner in the U.S., major Chinese firms have joined firms from other markets in their pursuit of United States market share, both organically and through acquisition.

Key Factors Driving Interest in the U.S.

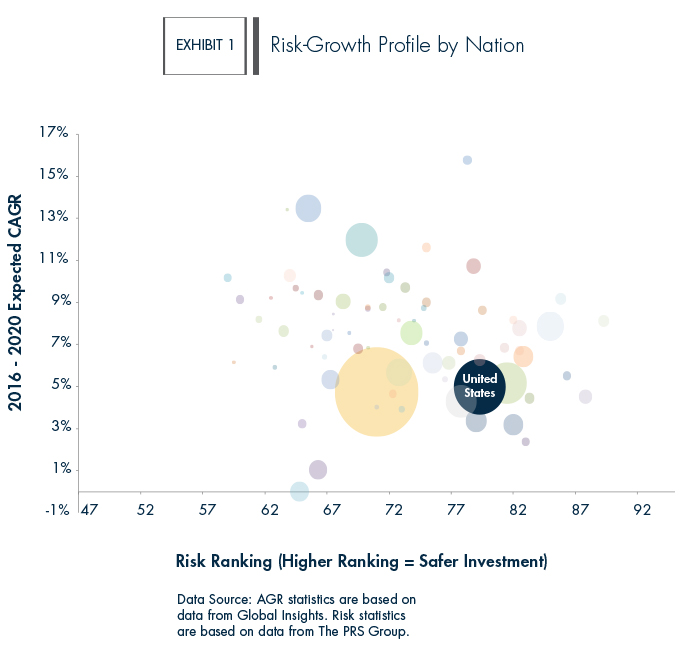

For global firms (or those with a strategic desire to expand internationally), deciding where to make investments should be an exercise in understanding the market risks and expected return from said investment. As shown in Exhibit 1, the U.S. provides an adequate, if unspectacular, outlook when comparing expected market growth with country risk.

According to recent forecasts, China, India and the U.S. will account for over 50% of global construction growth in the next 20 years. However, as it relates to the U.S., that is more a function of size than superior growth rates. FMI expects the U.S. construction market to grow 4.4% annually through 2020, a rate impressive for a developed market of its size but not overly impressive. Similarly, the U.S. rates favorably when considering market risk but is not superior. In fact, according to The PRS Group, a global leader in quant-driven political risk and country risk forecasts, the U.S. rates as the 55th least risky of 72 countries when considering a blend of political, financial and economic risks.

So while the U.S. provides an adequate risk-adjusted return profile, international firms continue to pursue expansion into the U.S. at an accelerated rate for additional reasons, including:

Big, Stable, Growing and Open Market

The U.S. is the second-largest construction market in the world and the largest developed market. As such, it provides assurance that market swings (both up and down) are less severe than those of smaller, emerging markets. For example, during the Great Recession, U.S. construction put in place declined by nearly a third from 2006 (the highest point) to 2011 (the lowest point), but only by 3% when removing residential construction. In fact, during that same time period, nonbuilding construction put in place grew by 26% as the public markets invested in order to stimulate the economy. In addition to its size, the domestic market continues to grow and welcomes new market entrants across sectors (i.e., public transportation, private manufacturing, oil and gas, etc.). As stated earlier, China, India and the U.S. are expected to account for a majority of the global construction growth in the next 20 years. However, the inherent barriers to entry in both the Indian and Chinese markets deter new competitors and provide a less attractive alternative for resource investment.

Fragmented Market and Competitive Landscape

One of the largest misconceptions outsiders have about the U.S. is that it operates as a single entity. In some ways, it more closely resembles Europe, with multiple markets operating independently of each other. This is especially true of public infrastructure procurement, where decisions are made at the state or local level. In fact, the California, Texas, New York City and Florida markets would each be one of the 20 largest countries in the world by construction put in place. And while the overall U.S. is expected to expand by 4.4% through 2020, California and Florida (the largest and fourth-largest states by construction put in place, respectively) are expected to grow by 9% and 8% annually through 2020. Unsurprisingly, these two markets attract significant international interest.

Ability to Export Competitive Advantages

The most obvious example of this dynamic is the interest in the projected Public-Private-Partnership (P3) market in the U.S. Many international players (predominantly European) see their expertise in project financing and concessions as a competitive advantage for P3 projects in the U.S. Of the 16 current, domestic P3 transportation jobs (highway, bridge and rail), 11 have an international firm in the design-build contract. That number is 13 when including Lane Construction, the large heavy/civil contractor who sold to Salini Impregilo (Italy) in 2015.

Ability to Import Competitive Advantages

Certain acquirers specifically target companies with distinct competitive advantages that are transferable to their existing markets. This can be related to market trends (e.g., ability to perform under alternative delivery methods), customers (e.g., pursuing companies with a customer base poised to expand internationally) and operations (e.g., technical capabilities which could be leveraged on a global basis).

Developed Market Conditions

As a developed infrastructure market, the U.S. provides additional security, including favorable payment terms, reduced compliance risk and stabilized currency. While margins are often lower in the U.S. due to increased competition (a byproduct of the open market), the payment terms are more favorable and secured. Large international firms that pursue infrastructure projects in emerging markets often find higher margins but delayed payments and higher client credit risk. Additionally, the enterprise risk related to potential compliance issues is reduced in the domestic market, and, over the long term, U.S. dollars are the safest currency investment.

Assessing the Top-Five Implications for E&C Firms

International competition in the U.S. construction market has been around since the 1970s and is not a revelation for domestic firms. However, the current market conditions outlined above create new dynamics that domestic firms should consider, including:

- Increased M&A activity in the U.S. and internationally. History has produced mixed results for international competitors entering developed markets (specifically the U.S.) organically. The desire to gain market share in these markets is already resulting in increased international consolidation. In fact, for specific market segments, the only hindrance to increased M&A activity in the U.S. is the lack of motivated sellers.

- Multiregional building contractors and large heavy/civil contractors remain the most attractive assets for international acquirers. International firms remain interested in large, technically proficient contractors that can provide significant and immediate market share. Additionally, civil contractors with the capabilities to execute large, complex infrastructure projects provide a conduit for international firms to export competitive advantages, including project financing and technical capabilities.

- International competition is beginning to penetrate less traditional markets. In addition to the building and civil segments, new players have emerged in less traditional segments such as light industrial, water, renewable energy and traditional power. This includes traditional contractors as well as engineering and design-build firms, as many of these segments are more likely to procure work through design-build or other alternate delivery methods.

- Active markets or regions will get more competitive. As mentioned above, large geographic markets (e.g., California, Texas, Florida and New York) have been a focus of international expansion for many decades and continue to attract attention today. These markets are projected to represent nearly 40% of the total U.S. construction put in place for the next five years, and competition will continue to increase in those geographies.

- Opportunities for joint ventures exist as a strategic option for many domestic firms. Increased interest in the U.S. market provides local or regional firms a potential avenue for competing on larger, complex projects through joint ventures or other partnerships with multinational firms.

While the majority of historic international interest has predominantly concentrated on megaprojects or large, multiregional contractors, the increased fervor over the U.S. outlined above is leading international firms to explore new acquisition opportunities, including midsized firms and new market segments. For specific companies, the increased interest presents an attractive exit alternative; for others, it could result in new competition with an impact on go-to-market strategies. Either way, the interest in the U.S. is creating new competitive dynamics throughout the industry, and domestic firms need to be aware of the impact this trend is having on their respective markets.

.png)

.png)