How Strategic Investments in Your Talent Drive Operational Excellence

There is a nationwide pandemic occurring at this moment. It is sweeping the construction community into a frenzy. I’m calling it volume fever. The symptoms include obsession with top-line growth, frenetic bidding without logic, greater appetite for risk, belief that super-high gross margins will protect the firm, and unpredictable labor forecasts.

Unfortunately, there is no one elixir that will eliminate this crisis. At the onset of the coronavirus pandemic, many contractors were anxious about the markets in which they operate. In some niches, such as office construction, those fears were manifested. For other sectors, the effects were barely noticeable, and they continued to show outsized growth.

With total engineering and construction spending for the U.S. forecast to end 2021 up 3%, compared to up 6% in 2020, there is still competition for labor and specialty trade workers. Add to that expected growth after 2022 in nonbuilding structures such as power, highway and street, and water supply, the construction labor market begins to look even tighter.

Given the competition for workers across sectors, companies will need to look for other means to complete projects and continue to be profitable, especially as some see demand increase after Congress passed a $1.2 trillion infrastructure bill. New investments in roads and bridges ($110 billion) and power and grid ($73 billion) signal that these areas will likely see the biggest impacts from increased federal spending. Since this and other sector allocations are nearly the same as the proposed legislation, FMI already incorporated this into our 2021 North American Engineering and Construction Outlook for the fourth quarter.

Firms that fail to strategically address this talent shortfall will squander an industry glutton with backlog opportunities.

Supply Chain Disruptions

Given all these industry dynamics, many contractors are finding themselves in the situation of having plenty of work but not enough supplies or people to complete the jobs.

With inflation hitting a 30-year high in October, a 6.2% annual increase, concerns about the rising costs of materials, labor, consumer goods and other inputs are quickly becoming top of mind for most executives. In our fourth quarter CIRT survey, we learned that 4 out of 5 respondents are seeing project delays from supply chain issues. Additionally, 1 out of 5 respondents had seen projects canceled. To combat this, companies are most commonly looking at alternative products and broadening their supplier base.

While most CIRT members have been able to pass many cost increases to customers, it’s unclear how long they’ll be able to do so, especially given current inflation rates. Once supply chains return to normal, it may be hard to sustain these higher prices.

But as firms grapple with challenges surrounding both labor and supply chains, which are inextricably linked, what should become the right set of strategic initiatives? Should firms continue to focus on top-line growth or begin to refine internal operations, tool integration and real talent development?

Firms can obviously work on multiple items simultaneously, but it seems that often internal process improvements get pushed out as everyone works to meet client obligations. By not building meaningful infrastructure, firms are now struggling with weak operations and poorly trained employees, in addition to outside economic pressures.

The Importance of Productivity

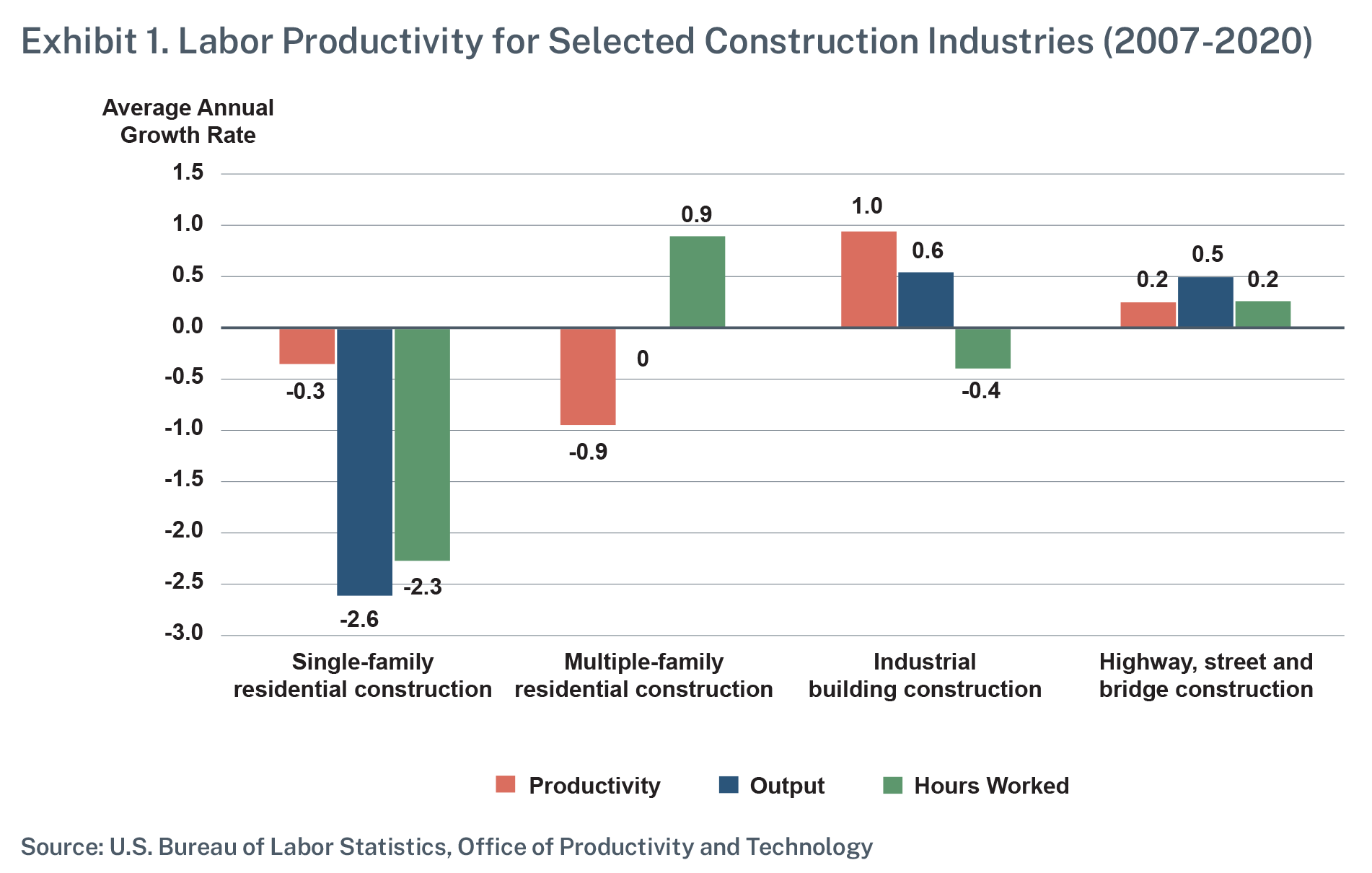

Given the current pressures on growth, labor productivity is a critical way construction companies will help drive the broader economy. In 2020, 5.9% of U.S. nonfarm payroll was attributed to the construction sector along with 4.3% of gross domestic product (GDP) — see Exhibit 1.

FMI also sees signs of wage inflation by tracking U.S. worker productivity, which fell a seasonally adjusted 5% in the third quarter as labor costs increased by 8.3%, according to the Labor Department.

In a survey of more than 2,000 nonresidential contractors, the Associated General Contractors of America (AGC) found that 90% had openings for hourly craftworkers; of those, more than 70% who were trying to hire a worker said the position was hard to fill.

Skilled labor shortages in the construction industry predated the pandemic but will be exacerbated by pandemic-related challenges. “I think it is going to be costly in terms of losing out on entry-level workers,” says Ken Simonson, chief economist at AGC, who tracks construction employment figures (in October 2021, the nonresidential sector was still 150,000 jobs below February 2020 levels).

That means getting the most out of your current workforce is critical to continuing operations uninterrupted. Companies may be OK in the short term when it comes to margins; but as labor markets become tighter, investing in operations will be a critical part of ongoing success and profitability.

Back to Basics

While it may seem like improving productivity is a monumental task, there are ways to break down the challenge into manageable parts. Incremental improvement will have a large impact on the bottom line over time but may not work for all your divisions. Take a department-level approach to finding places that can be improved and ways to implement them.

As you evaluate your current state of operations, here are several questions to help you get started.

Company Culture

- Is there consistency in your team’s operations?

- Are team members checking boxes, or is there meaningful project strategy?

- How are new associates in the office and field being developed?

Measurements of Success

- How does your firm measure success?

- Short of measuring profit and loss, how do projects and practitioners know if they are succeeding?

- How often do employees see metrics, and do they trust those numbers?

- How deep does volume fever permeate in the company? Are workers more concerned about the size of the contract or the profit it can bring in?

It’s the People

- Have you invested in developing the people you already have on the payroll?

- How are you recruiting the team you already have in place?

- Is their focus solely on working IN the business so that they have become numb to working ON the business?

- How much time is your team really training on skills they need to do the job as well as training for the skills they will need in the future?

- If the current team were the benchmark, are you one misstep away from a deepening labor crisis simply because your team is burned-out and underdeveloped?

Why Now?

Productive organizations are ones that are profitable during both the good times and when the economy takes a downward slide. Below are five reasons why focusing on operational excellence matters now more than ever:

- Operations Evolve: Think about the smartphone. How often are applications and programs updated and changed to provide better functionality and enhance performance? Think about that same analogy relative to a construction business. What version of operations are you using? Often planning methodologies and processes become stagnant, unused and even relegated to a dusty, three-ring binder, leading to deficiencies in planning and ultimately margin erosion.

- Consistency Is Key: How many different versions of operations exist in your business? For instance, is there a standard way your company builds a project, or does it depend on who you work with? A consistent operational model allows for replication and provides more consistent results. Variability in operations results in margin erosion, missed deadlines and often client dissatisfaction.

- Training Only Gets You So Far: Training is critical to every organization. Operational training is also more effective when it’s combined with the right infrastructure. When done without investment, training can cause frustration when employees don’t feel like they have the resources to implement what they learn. Training married with a framework of operational excellence can yield significant dividends.

- Technology Is Only a Tool: The industry is ripe for innovation. There are amazing software tools to improve every aspect of a business from job costing to estimating to human resources. However, software is just a tool. The same way an exercise bike by itself does not create healthier behaviors or weight loss, the new computer program or fancy app will only be effective with the right behaviors and strategy to support them. A great deal of money could be spent with minimal return on that investment, leading to further margin losses.

- Sustainable Results: For most contractors, financial performance has been strong. What happens in the event of a market slowdown, a recession or a once-in-a-lifetime catastrophic event? Creating a platform of operational superiority is the ultimate hedge against a market shift. In great times higher productivity means greater margins. In declining times higher productivity could be that edge on bid day or the ability to remain profitable when the competition is feverishly slashing its staff.

Investing in operations is more than just overhauling processes and procedures. It also includes integrating your training programs, technology and project management to create efficiencies. Even if you’re making money now, there’s always room for improvement; and that extra margin could be what carries your company through the next market downturn.