Using Captive Insurance to Strengthen Your Organization and Build Resilience

Here’s how E&C companies can use captive insurance to shield themselves against the impacts of an economic recession while also strengthening their positions in the marketplace.

After more than a decade of prosperity in engineering and construction (E&C), the storm clouds are beginning to gather and paint a picture of an industry where project pipelines may not be as robust as what we’ve seen over the last 10-plus years. Knowing firsthand the difficulties that companies faced when sidelined by the Great Recession—an event that’s since faded far into the rearview, replaced by much more prosperous times—FMI is advising organizations to prepare now to play whatever game is put in front of them in 2020.

Rewind the clock three years, and the built environment was facing a very different risk landscape. Contractors were having a difficult time adapting to a world where 35% of executives thought their organizations were ineffective in managing risk, according to AGC’s/FMI’s risk survey. Executives today are much more likely to take a proactive approach to risk management as opposed to viewing it as a defensive exercise.

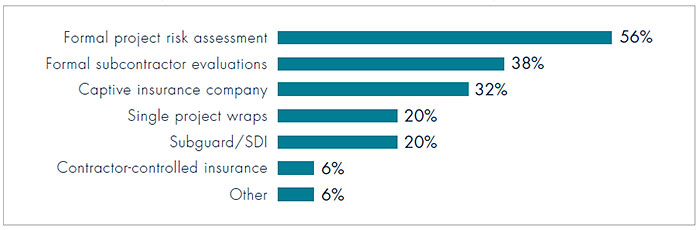

The industry has since evolved, and through that evolution, contractors have increased their emphasis on risk as a strategic priority by incorporating risk management into their overall operational strategies. While these strategies aren’t new to the industry, many contractors have adopted or refined their approach to formal project risk assessments (56%) and completing formal subcontractor performance evaluations (38%), according to FMI’s latest AGC risk survey (Exhibit 1).

FMI’s research also shows that firms are using new tools and risk management strategies and leveraging technology in a more sophisticated way to adapt to the changing E&C landscape. Captive insurance falls into this “advanced bucket” and is now being used as one of three top risk management tools that contractors have started to implement in the last three years, with 32% of respondents having implemented captives in that same period (Exhibit 1).

Exhibit 1. Please describe any new risk management tools that you have started to use in the last three years.

Source: 2019 AGC/FMI Risk Management Survey

Source: 2019 AGC/FMI Risk Management Survey

Self-Insurance Versus Captive Insurance: What’s the Difference?

With self-insurance, a business owner must use resources on hand to fund unexpected losses. These assets may not always be readily available at the time of the loss—a reality that can challenge organizational stability. Establishing a captive insurance company, on the other hand, establishes a risk management program for the business and sets aside funding for potential future claims through premiums paid to the captive.

“If you’re like most business owners, you likely pay an insurance company in the commercial market to cover the risks of your business. And if you’re like most business owners, you may not know there is another option,” attorney Peter J. Strauss, author of “The Business Owner’s Definitive Guide to Captive Insurance Companies,” writes in Forbes.

An entity that’s established with the primary objective of insuring—or reinsuring—the risks arising from the operating business of its owners and providing a broad range of risk management capabilities, captive insurance is currently used by over 90% of Fortune 1000 companies.

Of course, risk “ownership” is a continuum. At one end of the spectrum is a fully insured position with first-dollar coverage and very little risk (but a significant price tag). At the other end is a company that operates without any coverage and only its own balance sheet. The latter bears the burden should something go awry.

Along that continuum are considerations like small deductibles, large deductibles and captive insurance companies. Captives come in a variety of different shapes and sizes, but at their core, they all offer contractors a sophisticated tool for supporting their risk management efforts. And despite the complexity that they can introduce, the basic idea is simple: Start your own insurance company that is “captive” to the parent organization(s).

“Owning” More Risk

Construction is evolving, and contractors must also evolve in order to keep pace, stay solvent and maintain growth. Part of that evolution should focus on how contractors approach risk management. For example, these firms are often in the best position to manage and mitigate risk, so when appropriate, they shouldn’t be afraid to “own” more risk. Captives can play a significant role in leveraging risk management for companies willing to embrace the concept.

From FMI’s perspective, the top three benefits of owning more risk via a captive approach include:

1. Savings in Acquisition

- Spend fewer hard dollars on insurance in the commercial market

- Help stabilize costs and availability of coverage over time

2. Improved Profitability

- Document and support cost of risk for owner contracts

- Capture investment income from the reserves

- Bespoke coverages

- Create profit pockets in your risk management program

- Minimize the impact of other losses/risk

3. Tax Savings

- Deductibility of reserves (deduction taken when reserves are set, not when losses are paid)

- Potential favorable elections for small captives

Despite these and other positive impacts, many contractors are reluctant to leverage or embrace captive insurance. When contractors consider risk management or, more specifically, insurance, the various stakeholders are understandably concerned with a variety of dynamics that impact their roles or responsibilities. Whether formally or informally, most organizations consider these three factors when managing risk:

- Severity of the risk

- Frequency of the risk

- Appetite for the risk

Evaluating the first two factors is generally straightforward, but thanks to various stakeholders, establishing an organizational appetite for specific risks can be difficult. For instance, most organizations default to a position of “owning” less of the risk and, therefore, buying more insurance.

As the old adage reminds us, “Buying insurance is simply renting a balance sheet.” While the concept is certainly not new, when you consider how well positioned a contractor is to manage risk—and how effectively great organizations are managing that risk—it’s surprising that more organizations aren’t aggressively looking for ways to embrace more risk (with an aim at outperforming the market).

Strong Partners

Just like with anything related to your organization, when it comes to captive insurance, strong partners are a critical component of success. As a complex and often nuanced strategy, there are myriad decisions and considerations during both the setup and operation of a captive. Strong partners understand your organization and your risk management strategies related to utilizing a captive and leverage that understanding in designing and operating your program.

Just as project owners select your organization based on industry-specific experience and a deep understanding of a project type, construction companies should be equally diligent when selecting captive partners. For many organizations, captive partners become an integral part of their overall risk management team; strong partners should also provide unique perspectives on insurance markets and industry trends.

Lastly, for companies intimidated by the task of setting up and operating a captive, having strong partners in the process can significantly alleviate the burden that a captive places on an organization.

Don’t Just Build a Better Mousetrap

According to AGC’s/FMI’s research, about 58% of companies expect to see more change in the built environment within the next five years than there has been in the last 50 years. This puts unique pressures on E&C firms, not the least of which will be the need for affordable and effective risk management.

While many contractors pour countless hours of time and energy into value engineering projects or building a “better mousetrap,” many of them remain unwilling to value-engineer their approach to insurance. Captive insurance presents a unique and sophisticated way to protect the balance sheet while shining a spotlight on risks, providing a more focused lens into risk management and building a more resilient organization.

BLOG_TN_500x410.png)