What’s Coming in the Next Five Years for Water Infrastructure Investing

U.S. water supply and infrastructure remain in critical need of attention. An estimated 2.1 trillion gallons of water are lost each year from breakdowns in infrastructure, and 79% of companies in the private sector say aging infrastructure is the biggest challenge facing the water industry.

Infrastructure is crumbling while demand is growing, and many are concerned that there may not be enough water to meet the needs of people, industry and farms in the coming years.

Population migration is increasing pressure on urban and suburban infrastructure, particularly in the water-challenged West and Southwest, increasing the need for more water and wastewater treatment facilities to move water to newly developed areas. Many of the nation’s more than 16,000 publicly owned water treatment facilities are nearing the end of their useful lives or operating close to or above capacity.

The need for new technology to capture, monitor and deliver clean water is being driven by population growth, aging infrastructure, deferred maintenance, lack of investment in systems, climate change and increased water demand from industrial production. The availability of federal funds could help, but the mismatch in supply and demand continues to vex investors, companies and governments. The time to invest in water infrastructure is now.

“While the market has seen continued rehabilitation and replacement of water infrastructure that has reached the end of its life, the ability to finally complete ‘once in a lifetime’ projects with funding has been transformative,” says Bryan Odom, VP and director of water & wastewater services for WK Dickson & Co., a multidisciplined consulting firm specializing in community infrastructure solutions, with deep expertise in water and wastewater projects.

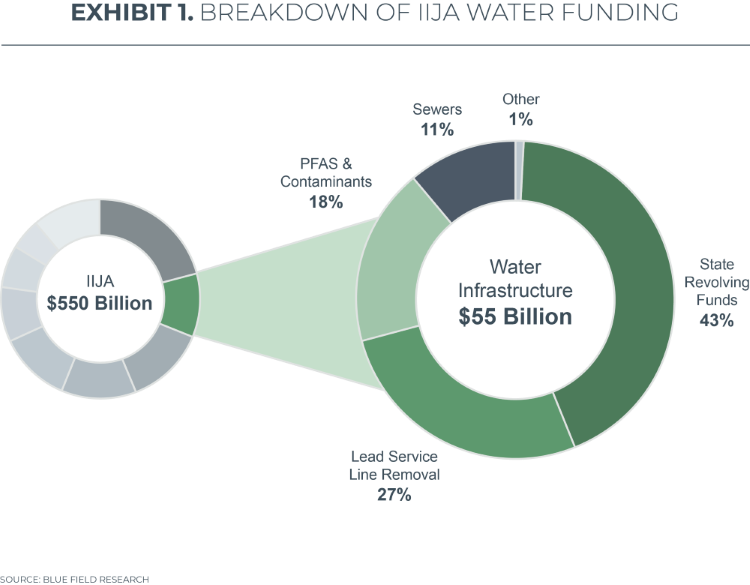

The Infrastructure Investment and Jobs Act (IIJA) provides $55 billion to build and repair water and wastewater infrastructure. It also includes $1.4 billion to improve and construct stormwater infrastructure. This support has resulted in new sources of funding and moved some project timelines ahead — but it barely touches the estimated $81 billion gap for wastewater and $434 billion needed for stormwater construction and repairs in the next 10 years.

“The large injection of funding into the market has helped communities to finally tackle a host of critical projects that could only happen with outside funding support,” says Odom.

Administering these funds, however, remains challenging as it largely happens at the state and local levels. Some municipalities need to repair infrastructure to improve quality (e.g., Flint, Michigan), while others need defenses against rising sea levels (e.g., Miami) or encroaching saltwater that’s contaminating supplies (e.g., New Orleans).

“Investing in modernizing water treatment facilities, implementing advanced leak detection technologies and replacing outdated pipes are critical priorities to ensure reliable access to clean and safe drinking water,” says Sanjiv Sinha, PhD, CEO of CIS, a national leader in the development and implementation of public infrastructure solutions with a focus on improving the environmental, economic and social condition of our nation’s infrastructure. “Additionally, municipalities must focus on enhancing resilience to climate change impacts, such as floods and droughts, by integrating green infrastructure solutions and adopting sustainable water management practices.”

Determining how to spend finite dollars to solve these pressing challenges is one of the hardest decisions for cash-strapped municipalities. The choices need to be made quickly, leading community leaders to turn to experts for help shaping projects.

“WK Dickson’s and the utilities’ challenge has been to craft the projects in such a way that they can be successfully completed within the tight-schedule deadlines associated with the IIJA/RIA funding,” says Odom.

The regulations around water and wastewater are also changing. In 2023, the Environmental Protection Agency (EPA) announced a proposal to require water systems to replace lead service lines in 10 years. Other government initiatives are focusing new rules on remediation services, such as removing per- and polyfluorinated substances (PFAS) from drinking water.

Substantial investment will be required in the next decade as stakeholders work to manage aging water and wastewater infrastructure against a backdrop of increasing water demand and scarcity, as well as rising costs.

Key Trends We're Watching

- Aging infrastructure

- Climate change

- Federal funding

- Urbanization and population shifts

- Changing regulations

- Modernization and technology upgrades

- Socioeconomic disparities in resouce access

Finding the Right Opportunities

The need for investing is clear; the hard part will be finding the right opportunities. Federal funds are helpful, but they’re not enough to resolve all the issues facing U.S. water and wastewater infrastructure. A broad base of support will be needed to create a water infrastructure system that can support demand in the coming decades. This means that governments, private and institutional investors, industrial manufacturers, and farmers large and small, as well as technology startups will need to work collaboratively to solve the most pressing challenges for water.

Traditional Investment Options Abound

There continues to be strong interest in putting capital to work in traditional water infrastructure segments. Recent mergers and acquisitions (M&A) activity highlights the opportunities strategic and financial buyers see in the sector.

The acquisition of MWH, a leading Colorado-based water infrastructure contractor, by Japanese construction and infrastructure developer Obayashi Corporation highlights the growing interest in delivering large-scale water infrastructure projects. MWH plans to continue expanding geographically and growing market share by leveraging partnerships with Obayashi’s North American divisions and subsidiaries, demonstrating the need to scale to achieve many of these large projects.

Xylem Water Systems, a publicly traded Washington, DC-based water technology company, continues to build through acquisition, including the recent $7.5 billion stock purchase of Evoqua Water Technologies Corp., a leading water treatment solutions and services company. This emphasizes the ongoing demand for traditional water businesses, such as leak detection, that improve infrastructure and create opportunities for contractors and investors alike.

This is especially true when it comes to private equity investors. Many continue to seek traditional water and wastewater investments, particularly those with reoccurring maintenance and services businesses. Other strategic investors are looking to build portfolios of products or expand geographically to improve margins in a commoditized business.

The Future of Water

Innovative technology solutions are also needed to address prominent challenges, particularly when it comes to industrial water usage, processes, recycling and detection.

Take, for example, Renovo Resources, a California-based company that develops water treatment infrastructure to help oil and gas companies reuse production water. While it’s hard to quantify the amount of water used by the oil and gas industry, estimates have put it at 2.4 billion gallons of water daily. The need to conserve and recycle is clear as demand grows and more oil is produced in the U.S. Renovo’s technology that helps drillers recycle water for other uses makes it critical to conservation efforts.

“Renovo’s treatment of oilfield-produced water for beneficial reuse has multiple benefits,” says Lnsp Nagghappan, CEO of Renovo Resources. “It substantially minimizes class-II injection volumes (80-90)1 and creates a new freshwater source for farmers, addressing regional drought issues.”

Infinity Water Solutions (Infinity) also builds infrastructure that recycles water via proprietary technology in the Permian Basin in Texas, where water demand is outpacing supply. The company has storage capacity and delivery infrastructure for fulfilment that goes beyond traditional government-owned treatment facilities — with the belief that water recycling goes beyond increasing the amount of water available in the region.

“Water is only half of the equation,” says Michael Dyson, Infinity CEO. “Our focus is not just on the direct reuse of the water molecules themselves, but on the value of the derivative minerals, metals and hydrocarbons found within the same waste stream. It is these ancillary byproducts, resulting from refinement, that provide a level of economic assurance and help subsidize the cost of water treatment.”

When it comes to resiliency investments, many companies are working to make U.S. coastlines more resistant to seawater intrusion and encroachments from rising sea levels. One such company is True Environmental, a diversified environmental services organization and the parent company of Matrix New World Engineering (Matrix). Matrix is part of the team developing a climate resiliency master plan for the New York City financial and seaport districts. The highly complex work builds on years of experience the Matrix resiliency ream has accumulated while designing and constructing some of the nation’s most innovative and sizeable mitigation projects.

“Matrix is focused on adapting the natural and built world to a changing climate,” says Jim Stamatis, CEO of True Environmental.

Notably, after studies were conducted that showed traditional on-land strategies wouldn’t be effective in the area, Matrix was tasked with including in its master plan for NYC the design and implementation strategy for a potential shoreline extension.

A New Investment Model

The rise in water technology-focused venture capital funds and other investment models is illuminating the industry’s capital requirements.

Burnt Island Ventures is one fund that’s helping to treat, distribute and monitor water via innovative technology. Investments include Aclarity, which is focused on eliminating PFAS; LAIIER, a leak detection solutions company; and several technology companies aimed at helping municipalities more effectively monitor systems.

And yet, given the mixed history of profitable water investments, is there a need for new investment models? Traditional venture capital and private equity investors are putting money into the space, but it’s minimal compared to other environmental sectors.

Because water’s investment horizon is typically a decade or more (compared with a shorter horizon for other sectors), dedicated funds, family offices and other permanent capital must combine with government funding to push the industry forward. And investors need to understand the fundamentals of water, including that it’s not as easily scalable as other resources, remains a highly regulated utility and is a heavy asset, making the infrastructure needs unique to the sector. It also has important public health restrictions, making those who own assets conservative in what they’ll implement and how technology is managed.

Given these variables, many companies and investors are spearheading creative funding approaches.

“Accessing available funds requires significant financial and technical resources,” says Sinha of CIS, which works with public clients to develop infrastructure solutions that drive local economic inclusion and equity, reduction of public risk, and increased community investment and buy-in. When needed, CIS can provide financing up front to its public partners to enable a project to proceed.

“We have been successful in providing investment of capital and resources focused on accessing the available funds but, unique to CIS, we have skin in the game for the implementation of achievement of both project and broader socioeconomic goals,” says Sinha. “We fully expect triple bottom-line considerations to gain hold, PPPs to evolve to meet those needs, and private finance to continue to gain traction.”

That sentiment is echoed by Garney Construction, the largest national water and wastewater contractor and a pioneer in the public-private partnership (P3) model for water infrastructure. Take, for example, Garney’s involvement in the Vista Ridge project in San Antonio, Texas. At the time of its construction, it was the largest P3 water supply project in the U.S., delivering about 20% of the city’s water. Garney served as developer, contractor and primary equity investor for the project.

“This diverse role demonstrates our adaptability and commitment to constructing and ensuring these projects’ long-term success and sustainability,” says David Bird, vice president of project finance and development at Garney Construction. “Eventually, we divested our interest in a specialized private equity fund, further highlighting our strategic approach to project management. Garney’s future focus remains on developing P3s to support our municipal clients.”

Setting the Stage

While it’s still early in the game for the next generation of water investment and technology, the sector holds palpable excitement. Just ask Infinity’s Dyson.

“By harvesting wastewater and reimagining it as a resource rather than a waste stream, there is the potential for a blue economy — an economic renaissance propelled by water,” he says.

Preparing now for what’s coming in the next five to 10 years will be critical in solving many of society’s water and water-related issues. Whether you’re a traditional water or wastewater services or infrastructure contractor or you’re working on a new technology, there is capital for your business. The key will be finding the right buyer, partner or fund that understands the future of the industry and how companies fit into the ecosystem.

Understanding how best to invest in the people, technology and infrastructure that add value will enable you to attract the capital and partners you need to grow and thrive in the years ahead.

1Class-II fluids are primarily brines brought to the surface in oil and gas production.