Understand the Financials of a Construction Business to Drive Success

Understanding project level and company financials is as important as understanding the specifications on a project.

Specifications identify what is needed to deliver a successful project. Likewise, project financials show how to create a profitable company since the firm is the sum of all the project parts. Yet, too often, financials are unnecessarily complicated, making it difficult to understand the signals and underlying messages that help guide business decisions.

Too much complexity with financials and reporting makes it hard for project managers to grasp the story the numbers tell. Too simple and project managers may lose the chance to get on top of a problem before costs spiral out of control. It is a matter of having the right level of detail.

In FMI’s classic article “Why Contractors Fail” we outline the top reasons why companies in the architecture, engineering and construction industry go out of business. Of the 10 reasons cited, at least seven were based on financials. The reasons ranged from insufficient capital or profit generation to unrealistic growth. Basically, the economic model of the company was not set up for success, not deep enough to handle unexpected risk or critical information was not available in time to stave off a financial disaster.

Success Starts at the Time of the Sale

Successful projects, and therefore profitable companies, start at the point of selling a project. Contractors are continuously balancing their true costs (i.e., direct job costs combined with overhead and profit) with what the industry will bear with respect to pricing. The goal is to cover all the costs and add a bit for profit.

There’s a well-told story from FMI’s founder Dr. Emol Fails, a college finance professor, who talked about one of his students who could not determine why his chicken cleaning business was losing money. After evaluating the financials, Fails quickly realized it cost more to produce a pound of cleaned and processed chicken than its sales price.

Few companies would knowingly sell below their true costs. But the question becomes what is “true” cost when looking at a project cost sheet? A project can be profitable at the job level and yet be a loser at the company perspective. It simply does not contribute enough to cover company overhead and add to profits.

The key concept is the marginal contribution rate. An overly complicated sounding term, but a straightforward concept. The marginal contribution rate is the amount of money, as a percentage, that is left over from paying the costs directly associated with sales. It is the money needed to cover fixed overhead and contribute to profit.

Sales-related expenses are for the most part direct costs: labor, materials, subcontractors, equipment and job site expenses. There is a bit of overhead that also tracks sales, such as computers, phones, taxes, advertising, additional cost of vehicles to support projects, insurance, bonds and unfortunately bad debts. Those expenses, for most contractors, might be 1-3% of revenue.

To calculate the marginal contribution rate, take 100% of revenue and remove direct job costs and variable overhead as percentages. What is left over is the marginal contribution rate.

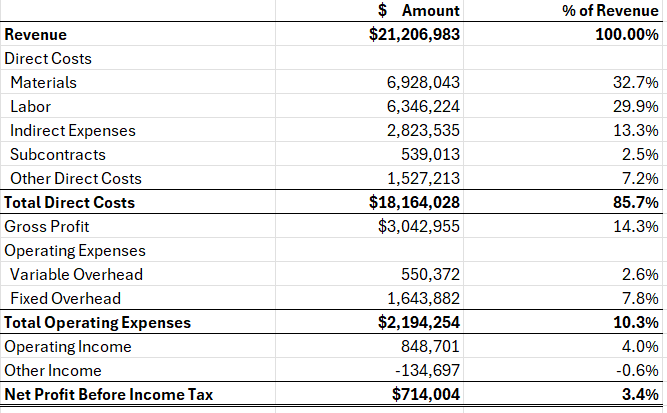

Here is an example:

In this example, the marginal contribution rate is:

Marginal Contribution Rate = Revenue % - Direct Cost % - Variable Overhead %

Marginal Contribution Rate = 100% - 85.7% - 2.6%

Marginal Contribution Rate = 11.7%

For every $1 of revenue, 11.7% or 11.7 cents are left over to pay for fixed overhead and contribute to profit. This offers an amazing insight into the company’s economic model.

Company executives would know that if they buy a new piece of equipment for $25,000, they will need to generate another $213,675 of revenue to cover it. At that amount of revenue, that is breaking even on the investment in that equipment. That does not allow for anything left over for overhead or profit.

Here is the calculation:

Revenue required = Cost divided by marginal contribution rate

Revenue required = $25,000/11.7 %

Revenue required = $213,675

It does not mean that investing in the equipment is not warranted, it simply means that executives need to think carefully about what the equipment contributes to the company and realize that the cost of $25,000 is only the tip of the iceberg.

Variable overhead for most contractors is a small amount, if the percentage of variable overhead is unknown, use direct costs as a percentage. For this example, that would result in modified contribution rate, or gross profit, of 14.3%. The revenue needed to cover the $25,000 of equipment to be $174,825. It is not as exact, but it does provide insight into the impact on the company.

The marginal contribution rate presents a simple and effective way to think about the organization’s economic model. But more importantly, financial acumen means learning what tools are available and how to use them to better manage the business.

More construction companies fail due to internal factors than external market factors. That means understanding the true financial health of the business, not just at the project level.

These calculations are one small tool to help you decode construction financials. Leverage our recent construction financial book, “Profitable Project, Profitable Business” to better understand how these calculations can be used to successfully manage a construction company.

Construction companies don’t fail because the numbers are wrong, they fail because the numbers aren’t understood. By focusing on contribution rates, true costs and the broader financial model, leaders gain the clarity needed to make better decisions at both the project and company level. These tools simplify complex financial realities and help contractors stay ahead of risks instead of reacting to them. With a deeper grasp of financial fundamentals, firms can build more profitable projects and ultimately, a more profitable business.