What’s It Worth? M&A Pricing In Volatile Commodity Markets

Functioning markets require buyers and sellers to agree on prices; otherwise no transactions can take place. This is true at the grocery store and in the world of mergers and acquisitions (M&A). Buyers in the M&A market, however, aren’t purchasing tonight’s dinner; they’re acquiring the future profits of the target company.

In trying to come up with a purchase value on M&A targets, much time is spent analyzing and estimating what those future profits may be. And a great deal of the analysis will be examining past performance since it’s usually a good indicator of future performance. But what happens when the recent past isn’t an accurate measure of what’s to come?

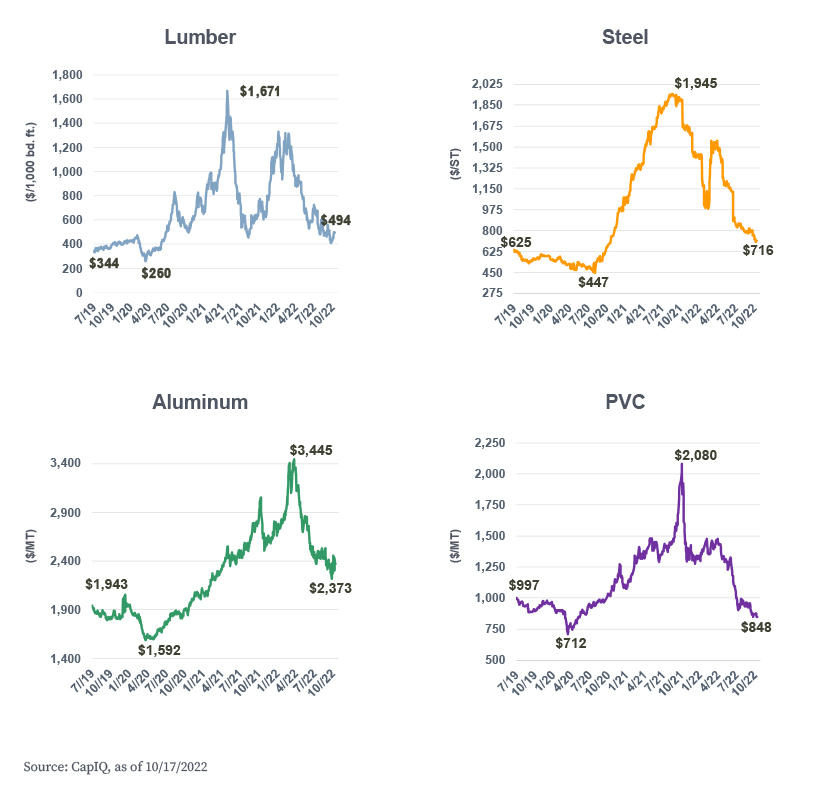

Strong demand, coupled with logistics challenges during the pandemic, created shortages in many building product material categories, increasing pricing and lead times. Price volatility was most extreme in dimensional lumber, though other commodities prevalent in construction, including steel, aluminum, hardwood lumber, PVC resin, copper and others, were also affected (see price charts below). That, combined with bottlenecks in manufacturing capacity, led to spiraling price increases and extended lead times for manufactured products. However, the environment made it easy to push through price increases. “How soon can I get it?” was often the only thing heard in response to a price increase. The result was a profitable pandemic for many.

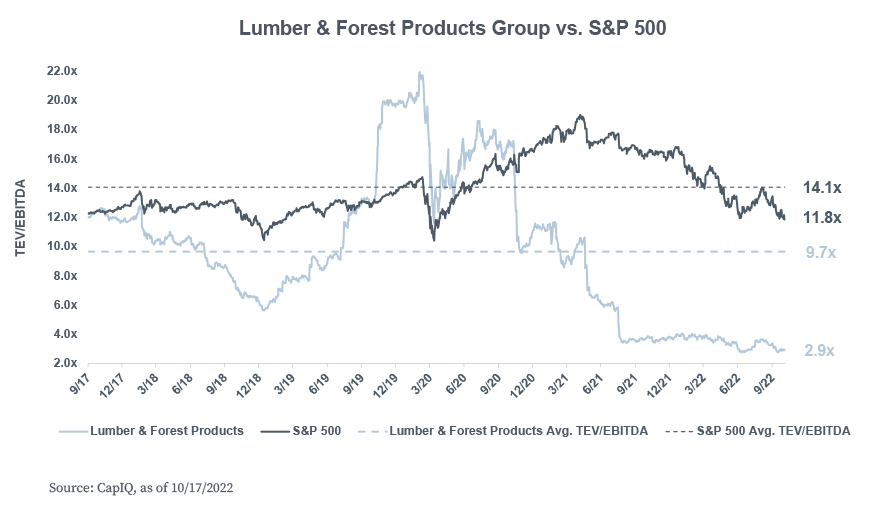

So how does this affect purchase multiples in the building products M&A market? A quick glance at the public equity markets gives us a clue. Let’s look at the forest products group, where the effect is most pronounced (see chart below). The group average enterprise value to earnings before interest, taxes, depreciation and amortization (EV/EBITDA) multiple is currently 2.9x, compared to a historical average of 9.7x. This clearly demonstrates that public equity investors predict earnings for this group of companies will decline dramatically in the near term.

The impact of this situation is pricing uncertainty in some sectors of the building products M&A market. If earnings can’t be forecast with any confidence, it becomes challenging to value companies. Many buyers and some selling advisors are performing price/volume analyses. These analyses look at the relative contribution of the two components of revenue growth to determine how much was from shipping more units versus how much was from shipping higher-priced units. One can then also run sensitivities on projected revenue and profit at various input costs. The results can be substantially different earnings forecasts based on different cost and pricing assumptions, and therefore company values. For this reason, we are seeing wide value ranges on properties we take to market as buyers’ views on market direction have never been more divergent.

Another consequence we are seeing is a sorting of the M&A market. Premium assets with high scarcity value are still commanding premium prices, while assets without such scarcity value are commanding more moderate interest. We anticipate this asset sorting to continue until the market gets a better feel for which direction the construction market and broader economy are heading.