Harness the Power of Your Board by Diversifying Your Directors

Conversations surrounding diversity, equity and inclusion (DEI) have been taking place in both professional and social environments for more than 60 years.

Despite the ongoing awareness of DEI imbalances, there has been a lack of urgency to pursue meaningful societal changes that address those concerns.

Recent movements, like Me Too and Black Lives Matter, have reinvigorated public focus on DEI by highlighting the continued presence of discrimination across broad segments of the population. In turn, this increased DEI focus has heightened the pressure on both individuals and organizations to reconsider their stances. Remaining silent or choosing to opt out of the conversation is no longer a viable choice and has become indicative of an anti-DEI position.

Research on DEI efforts demonstrated that customers, investors and employees – both current and potential – monitor organizational reports related to diversity.

The engineering and construction (E&C) industry is not exempt from these movements. And while strides have been made to improve diversity, most E&C firms are still lacking in several key areas.

According to research from the Bureau of Labor Statistics, about 88% of employees in the construction industry identify as white, and 89% identify as male.

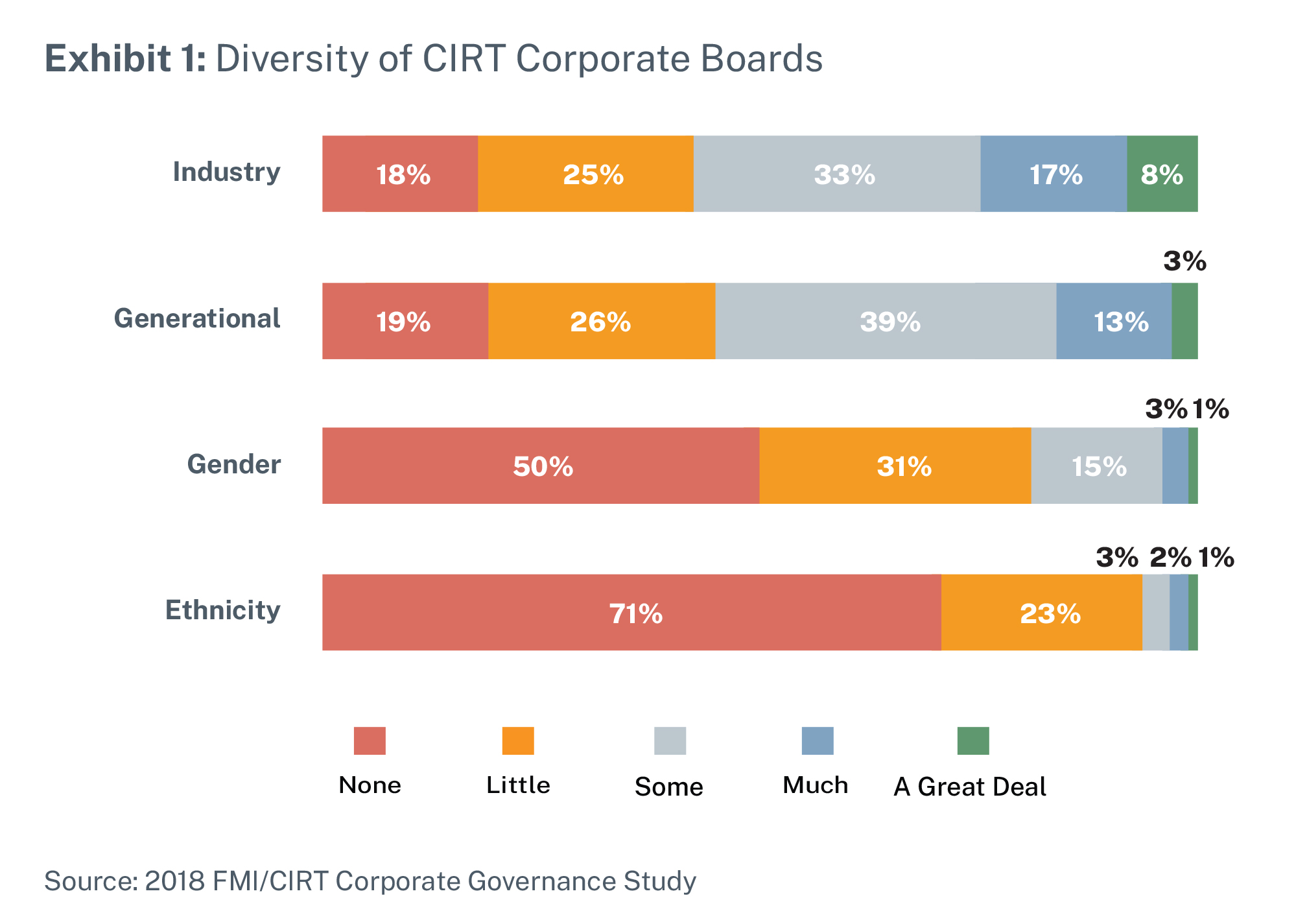

In 2018 FMI conducted a study of the governance practices in some of the E&C industry’s most successful firms – all members of the Construction Industry Roundtable (CIRT). Of survey participants, 71% did not have a single racial minority member on their boards of directors, and 50% lacked gender diversity as well.

FMI heard many senior executives express frustration in their efforts to address DEI, citing stiff challenges in recruiting and retaining members from diverse backgrounds. While the case is compelling and the desire to embrace change authentic, a different strategy is needed to reap the benefits of a more diverse and inclusive boardroom culture.

This ongoing homogeneity underscores gaps in the industry relative to breadth of knowledge, coupled with an array of opportunities to improve organizational performance and profitability.

A 2018 report by the Diversity and Inclusion Council of the Associated General Contractors of America found that companies with better diversity and inclusion policies consistently outperformed their less diverse competitors in several metrics.

Specifically, organizations with established DEI practices were more likely to have better financial results than the industry average, a stronger safety culture and increased employee productivity. These positive returns encourage investors to place money into firms with better DEI track records, while potential employees use this information to better inform their career decisions.

Additionally, a 2016 Harvard Business Review article found that teams that leverage diverse thoughts and experiences more carefully process information and generate innovative ideas. An objective analysis of the data shows a clear answer: For progressive E&C firms, it is not a matter of whether to address DEI issues; it’s where to address them. A good starting point is with the board of directors.

A global review of research related to diversity and inclusion by Catalyst found that demographically diverse boards are more likely to outperform their less diverse counterparts in several key board metrics. Diverse boards have more effective risk management practices, fewer financial reporting mistakes and overall increased engagement among board members.

While most boards of directors are aware of their relative lack of diversity, many organizations struggle with effectively filling these gaps. Open board positions in E&C are scarce. Approximately 55% of firms surveyed for the 2018 CIRT report said that there were no limits on board membership tenure, which allows current directors to retain their positions indefinitely. This decreased the opportunities for new members to join and directly translates to fewer chances to diversify corporate boards (Exhibit 1).

When these openings are available, boards understandably seek members with extensive E&C experience to capitalize on the deep knowledge and insights they possess. Unfortunately, the E&C industry has historically been homogenous in both thought and demographics, translating to fewer diverse candidates with the requisite experience.

In the E&C industry, 71% of firms do not have a single minority member, and 50% of firms have no gender diversity on their boards, creating a gap that can greatly limit the thought potential of the group.

- 2018 FMI/CIRT Corporate Governance Study

Boards typically leverage director networks when identifying and soliciting candidates. These networks are frequently comprised of people with similar traits and experiences, which further narrows the candidate pool.

Establishing an Environment to Succeed

One recurring issue with DEI is hiring to use underrepresented directors as an indication of progress on organizational diversity instead of recruiting them to add value to the board. To avoid this issue, board leadership should establish a culture of trust and collaboration to capitalize on the insights of these members.

Leaders can establish this culture through encouraging contrasting opinions, promoting input from different voices, and ensuring that the board structure is not too hierarchical. Board leaders must also be aware of the risk t hat t he board’s current (and potentially homogenous) culture may not readily welcome the ideas of its newest members – potentially failing to leverage their unique perspectives.

The risk of tokenism, the act of only hiring members from underrepresented groups as a symbolic effort, also exists. Ultimately, mismanaged board DEI efforts achieve demographic diversity though fail to create a healthy environment where the contributions of diverse directors are openly received and respected.

It is not enough to simply create an environment of collaboration though. Research from Harvard Business Review shows that when members from underrepresented groups feel that the board values diversity and inclusion, they feel more comfortable addressing and championing issues that are important to them. Open conversations surrounding DEI topics foster increased sharing of ideas. Underrepresented directors reported feeling greater comfort in speaking about a given situation or issue when feeling that their insights are valued by all members of the board.

Diversity can take many different shapes. A recent report from the Conference Board found that cognitive diversity on a board can significantly improve board performance through expanding its knowledge base and enhancing the board’s ability to advise the organization.

Instead of focusing exclusively on gender or racial diversity, boards should also consider diversity of age, skills, perspectives and thought. FMI research from the 2018 CIRT report found that there is a positive relationship among boards that have a diversity of experience. This suggests that instead of focusing exclusively on demographic diversity, boards must begin the process of selecting new board members by defining what type of diversity best serves the interests of the organization.

Beginning With the End in Mind

A targeted search and selection process will help ensure companies can effectively recruit and select diverse board members. This process ranges from reevaluating the needs of the board to establishing a board culture that empowers diverse thought.

Typically, it begins with a clearly developed candidate profile before starting the search for new directors. This allows the board to establish the qualifications needed for a new member while considering a broad range of experiences, competencies and demographics, including:

- Past and current directorships, especially board and/or committee chair roles.

- Enterprise-level leadership responsibilities.

- Depth of industry-related expertise.

- Nationality, ethnicity, generational and gender characteristics.

- Financial acumen.

When establishing a profile with the intent to select and place board members who possess both demographic and business diversity, boards must first evaluate what gaps of thought and experience exist among the current members. The National Association of Corporate Directors (NACD) suggests enhancing director selection procedures by reevaluating the competencies, backgrounds and industries that will be valuable on the board of directors.

Additionally, boards must anticipate and select members to meet the needs of the organization. As organizations grow and transform, board members with different areas of expertise will become critical to firm success. For example, if an organization is seeking to engage in mergers and acquisitions, candidates with experience in finance and cultural integration would be valuable additions to the board.

Expanding the Candidate Pool

Once a profile for a new board member is established, the search process provides additional opportunity to recruit a diverse candidate pool. One such method to increase diversity in the candidate pool is for directors and executives of the organization to share the position profile with diverse business networks and personal contacts.

When sharing the role, the communication should state that this is not a direct appeal per se. Rather it should be framed in the context of, “If you happen to know of someone who fits this profile, please have him or her contact us.”

Often during the search process, a friend of a friend emerges as a superior candidate – reflecting a broadening pool of potential directors. This degree of separation will allow for increased diversity of thought. A recent director search conducted by FMI for a client resulted in three finalist candidates with unique attributes all found through one-degree- of-separation candidates.

Outside search firms can also help improve the candidate pool. In the search mentioned above, the client benefited from increased diversity in thought and experience in candidates because a network unrelated to the client organization was being leveraged. Further, outsourcing the process to an external firm allows for a broader and a more extensive background review.

Candidate Assessment Model

The concerns around building diverse and inclusive workplaces have been a part of office conversation for the past 60 years and will continue to be for the foreseeable future. The steps presented in this article aim to provide an initial framework for leaders to capitalize on the increasing diversity in the industry and establish diverse boards for their organizations, not only to address social imperatives, but also to achieve greater organizational success.

Qualifications to Consider

When evaluating candidates, it's important to consider candidates' experience with areas such as:

- Risk management and mitigation.

- Leadership and talent development.

- Strategic business planning.

- Technology design and application.

- Internal growth.

- Legal, regulatory and environmental issues.

- Previous roles and responsibilities.