How to Leverage Your Board Ahead of Turbulent Times

The best boards are helping companies devise good plans of action for the future. Is yours on target?

A group of individuals elected to represent shareholder interests, a board of directors helps to establish corporate management and oversight policies. Going a step further, a board can also serve as a valuable tool in helping to lower business risk, prepare for turbulent times and weather economic recessions. That’s because boards help leaders take a step back from the day-to-day operations of their companies, effectively opening their eyes to the company’s strategic needs and best path forward.

Should the anticipated economic downturn—no matter how minimal or inconsequential it may be—rear its ugly head in the coming months, engineering and construction (E&C) firms will need all the firepower that they have to offset its effects, lower enterprise risk and survive the storm. Working simultaneously across the past, present and future, boards will play an important role in assuring this happens. By examining historical performance of the organization during other downturns and how those issues impacted the company, for example, a board can help devise a prudent plan of action for the future.

In this article, we explore the value of good boards of directors, hear real-life examples of these boards in action, and learn what steps E&C firms should be taking now to prepare for success in the future.

Finding Solutions to Real Problems

It shouldn’t take a recession for companies to realize the value of having a peak-performing board in place. Companies across the E&C industry are constantly seeking innovative solutions to the myriad challenges they face in today’s competitive business environment. Leaders are confronted with talent pressures, changing technologies, increased competition, demographic shifts, economic uncertainty and various other seemingly random obstacles.

To find solutions, leaders often re-examine the way they recruit, onboard, train and develop their people; hire talent with unique competencies precisely suited to their new job role; reassess business models; form new partnerships and strategic alliances; join peer groups; and look for ways to cut costs and increase productivity. In short, leaders in the E&C industry deploy a multipronged strategy to confront and conquer marketplace challenges.

Yet through it all, one powerful asset is often overlooked: the board of directors. FMI’s research confirms the fact that E&C firms are not fully leveraging the potential of their boards. In fact, as pointed out in a recent ENR story (“Engineering, Construction Corporate Boards Are Missing the Mark”), industry stakeholders confirm the struggle to make boards truly effective. However, these issues don’t necessarily imply that E&C firms are poorly managed. In fact, E&C leaders don’t know what they don’t know. Put simply, they may not even realize what a truly effective board can accomplish or what they could be doing better.

There’s Not Enough “Looking Forward” and “Looking Beyond”

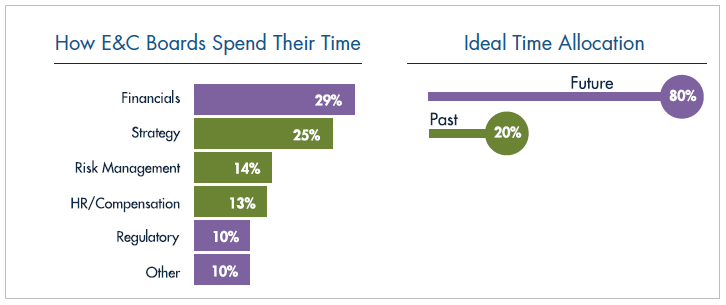

During our research, we uncovered that many boards don’t spend enough time “looking forward” and discussing strategy (Exhibit 1). This is an oversight in a VUCA world, where anything can happen at any time, and where the next downturn or recession could be lurking around the next corner. The most effective boards keep an eye on the horizon and encourage the organization to think about its vision and long-term business objectives. This includes:

- Encouraging innovative thinking across the organization

- Driving strategy

- Assessing and mitigating risk

- Fostering financial health

- Preparing for the future today

Exhibit 1.

Source: 2018 FMI/CIRT Corporate Governance Study

Unfortunately, study respondents say they spend more time reflecting on past performance than on planning for future success. In fact, nearly 50% of a board’s time is spent on financial results and matters of a historical nature, while just 25% is spent on organizational strategy. In reality, and to be most effective, boards should be spending at least 80% of their time on strategic topics. Imagine driving a vehicle at high speed on a congested interstate highway while spending half the journey gazing into the rearview mirror. Were we passengers along for the ride, we’d all agree that the far safer course of action is to focus (primarily) on the road ahead!

FMI research also confirmed that too many E&C boards look inside the industry for outside perspectives. True diversity on boards is limited to a thin minority, with only 3% of E&C firms having some racial or ethnic diversity; 15% of firms having some gender diversity; and just over one-third of E&C boards having significant industry background diversity. In short, boards across our industry bear a strong resemblance to the executive teams they serve alongside.

So how can boards better understand where they are spending their time and change their perspective from being “historians” to “futurists” while opening themselves to fresh ideas and solutions? And how can boards be best leveraged by companies that want to lower their risk and prepare for turbulent times? Hugh Rice, a senior chairman at FMI, says those questions plague companies across all industries, and not just E&C specifically. However, because the construction field is primarily privately owned, the real value in having and leveraging a board is less visible than in industries where a large percentage of firms are publicly owned (and therefore naturally have an active board of directors with outsiders included).

For E&C companies of all types, Rice says boards offer new perspectives, objective third-party viewpoints and challenges to the norm. “Board members don’t really care if someone likes what they say or not,” he says. “It’s a way of getting unvarnished input, and that’s really critical.” Add outsiders (i.e., non-family members) to the mix, and the board becomes that much more valuable. “It’s hard to put on your VP of operations hat and then objectively serve on a board with a CEO whom you work for,” says Rice. “That dynamic just doesn’t work very well in terms of candid input. Having outsiders on the board changes the whole conversation.”

Making Waves

For a board to be most effective, it needs to have a clear view of the organization’s strategic vision. This, in turn, helps to propel strategy, as Ron Magnus, managing director of FMI’s Leadership and Organizational Development practice, found out when serving on the board of directors of an expanding resort. He explains:

“I showed them how to create strategic vision and the board members immediately said, ‘That’s exactly what we need.’ They went to work on their purpose, their values, what they envision the future to be, and what their big hairy audacious goal was. That has propelled their strategy, because they came up with something huge in terms of a global strategy. And they’re now well on their way and have done a great job of building out their construct and developing the associated strategies. And the boards really come alongside these guys to help them work through the details of what it means to go raise money (to buy another island and build a resort empire).”

As the board member for another large, global nonprofit organization, Magnus was recently reviewing its new five-year strategic plan. He says the process has taken “a lot more time than I ever thought on the front end,” but has been well worth the effort. “Now they’re getting to the final wordsmithing of the three primary objectives, what the strategy’s going to be, and what culture they’re trying to build,” Magnus explains. “And as painful as it’s been, it does take time to do it right.”

As part of that process, the nonprofit engaged its board (including Magnus) as an “outside consultant” to ensure that it had covered the bases and to ferret out any gaps in the five-year plan. “This group is thinking about how to use the board and how the board interacts with strategy,” says Magnus. “That’s been encouraging to see.”

Four Ways to Leverage Your Board

Few E&C firms are maximizing their corporate boards, and even fewer of them are using their boards of directors to ward off risk and prepare for the future, but that doesn’t mean there isn’t time to right the ship. Companies that want to do a better job of leveraging their boards’ strategic capabilities can:

- Strive to develop an active fiduciary board. Every corporation has a board, but not every company has an active fiduciary board that can help it drive strategy and prepare for the future. For example, a board may be appointed or elected by the company’s ownership only to spend its time signing documents prepared by corporate counsel that say, “A meeting took place and here’s what occurred.” This clearly doesn’t help to drive strategy, nor does it prepare the company for an uncertain future. If you’re going to go to the trouble to build a board, engage it, and put the time in from a managerial and ownership standpoint, then it might as well be a highly engaged fiduciary board. This will bring a different level of commitment from directors and will help board members create a viable plan of action for the future.

Fear of losing control is one reason often cited by business owners/leaders for failing to tap the potential of a board of directors. Arguably one of the greatest benefits of building one’s own business is to not have to be accountable to anyone else—consequently, a board can be viewed as an obstacle to this unilateral authority. However, directors are always elected by shareholders in accordance with the governing documents of the corporation. Whoever holds the controlling ownership interest controls the board. All directors serve at their sole discretion and can be dismissed at a moment’s notice.

- Create committees to address specific topics. To be most effective, board meetings must focus on detailed discussions around many different topics, including the audit function (i.e., protecting the interest of shareholders and ensuring the management is accurately reporting the business’s financial condition). It also must ensure there are no gaps from the standpoint of risk exposure, with an emphasis on returns that are creating unnecessary levels of risk that could adversely impact the business down the road. These issues require focused conversations and don’t necessarily warrant a group of 15 people sitting around a table. Instead, utilize committees that are specifically focused on certain topics. For example, if you set up an audit committee, populate it with people who understand that world and who possess a deep knowledge of financial statements and questions to ask an external auditor. Examples of other commonly utilized committees include compensation (or human resources), governance, technology and executive.

- Find members who want to make a difference. Have these conversations early and often and focus on members who want to make a real contribution (versus just filling an empty seat). This can be done by a governance committee, a board chair or lead director, or an outside counsel—but regardless of who is involved, it definitely needs to be done. The best directors are ones who have a mindset of “I want to make a difference. I want to make a contribution. I want to leave this place better than when I found it.” Truly great directors know that when their giftedness and talents cease to be of strategic value to the organization, it’s time to make room for a more suitable replacement. The good news is that the vast majority of directors that I see serving on boards have this mindset. You want these people on your board because the thought of not being able to contribute scares them to death. These are the folks who will be the first ones to say, “I just need to get out of the way.” Unlike a Supreme Court justice, a director’s seat should never be considered a lifetime appointment.

- Use boards as succession planning tools. When your board supports the succession process, you ultimately help your company be successful while also lowering its risk profile. In a world where baby boomers are retiring at an alarming rate and the job market is tighter than ever, a departing CEO can take its toll on the company’s bottom line. I once served on a board that, during a meeting, learned for the first time that its CEO had picked his retirement date. That date was about a year out, and everyone kind of nodded along with him and said, “OK, good.” There was no sense of urgency around the impending retirement. My heart started beating faster as I realized this could be a serious problem. After conferring with the other board members, a special committee was mobilized to choose a new CEO. This was a full fiduciary board, so we had a lot of input into it. We followed FMI’s best practices and ultimately found a new CEO who is doing a great job. This is just one real-life example of how profound a board’s impact can be when it weighs in on succession-related issues.

Successful CEO transition extends well beyond initial selection. An engaged board of directors can be a difference-maker in supporting the new CEO. If hired externally, the board can help navigate the cultural and political “potholes” that could confound the incoming executive. If promoted internally, a board can become a useful change agent in an organization that tends to resist it—especially from an insider. I’ve heard many grateful CEOs thank a board for providing the necessary cover to say, “I know this is going to be difficult, but the board is pushing me really hard, and I need your help to make it work.”

What Can We Do Differently?

Historically, the construction industry has been woefully behind the times when it comes to asking itself questions like “what can we do a little differently?” “how do we differentiate ourselves?” and “how do we apply technology to something that has been done the same way for hundreds of years?” But change is in the wind, and we’re going to see more and more companies taking these issues into consideration as they prepare for the future.

By fully leveraging the power of their boards—ensuring that members aren’t afraid to speak up, add their contributions and go beyond lip service—E&C firms can essentially “see” around the next corner, address the risks and avoid repeating past mistakes. The best directors ask questions, poke and prod to find out what the consequences are, what the exposure is, and what the downside will be. They bring fresh thinking and creative solutions to bear on old problems. That’s the mindset that you want showing up to your board table for every meeting.