The Power of Corporate Governance (Part 1 of 2)

How companies can fully leverage their boards of directors and other leadership groups to achieve success in any market conditions.

In 1776 the founding fathers wrote the Declaration of Independence, formally severing Great Britain’s rule over the colonies and creating the United States of America. They next had to determine how the country should operate. In response, they wrote a Constitution outlining the formation of three branches of government that would, together, govern the country. Each branch had clearly established responsibilities, duties and accountabilities. Together, these branches formed the government that still today moves the country toward its vision.

Now think about your company. At some point it was founded and formed into a legal entity (partnership, corporation, LLC, etc.) with governing documents (a constitution, of sorts) establishing how the company should function and how its people and teams would be organized. Corporate governance is the governing structure of your company. Just as the legislative, judicial and executive branches govern the U.S., the board of directors, management team and shareholders govern an organization. Each has a distinct, complimentary role that results in the sum of its parts being stronger than any one portion thereof.

Those in corporate governance roles have a superordinate priority: to understand the organization’s vision and enable its people to achieve that end. In order to be successful, the relationships between the branches of corporate governance must be clearly defined—preferably in the company’s governing documents—to ensure the clarity of roles essential to supporting adequate checks and balances.

Let’s use a hypothetical example: METS is a midsized electrical contractor on the East Coast that has a long-term goal of being the electrical contractor of choice in New York. METS’ CEO plans to retire in the next few years and is trying to figure out how to leverage METS’ different branches to see the company through the transition while continuing a growth trajectory.

Every company is unique and requires its own specific governance structure; no single approach suits all organizations. However, there are still best practices and guiding principles that companies, like METS, can apply to improve the way they govern. In Part I of this two-part series, we’ll explore how this electrical contractor uses governance structures to support its impending transition, with two to three best practices that highlight the key tenants of a successful governance structure.

What Does a Board of Directors Do?

A board of directors can have a significant impact on any business. For example, having the right people on the board will provide continuity during a period of transition while focusing on long-term strategy. Just like all branches, the board is integrated into the corporate vision and uses its tools to help the organization achieve that vision.

Here are three strategies that companies can use to make the most of their boards:

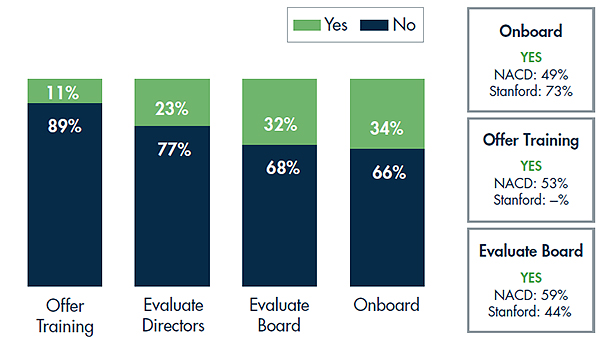

- Put the right people in place. A board’s effectiveness is only as strong as the members that make up that board. According to our recent FMI/CIRT study, which surveyed 133 members of boards, a board is far more effective when directors are evaluated (Exhibit 1). Just as the organization expends capital to ensure that it hires the right employees, the same rigor should be used when bringing on new board members. The board should conduct a needs analysis to determine what roles and skills are needed on the board first. From there, it’s a matter of finding and vetting the right candidates to ensure the board is as strong as possible. As author Jim Collins states, “…if you begin with “who” rather than “what,” you can more easily adapt to a changing world.”1

Exhibit 1. Talent Development Practices for E&C Board of Directors

Source: 2018 FMI/CIRT Corporate Governance Study

- Lean on the board for stability during transition. Senior executives come and go on a much more routine basis than members of the board do. Because boards are not forward-facing in the organization, transitions at the board level often go unnoticed or unmentioned to the organization at large. When a member of the METS board recently left, for example, that person’s role was easily assumed by other members of the board until the replacement was identified, selected and onboarded. When the METS CEO leaves, there is a potential for a vacuum of power and responsibility that can negatively impact the bottom line of the organization. With the board comes continuity throughout transitions. In other words, the board serves as a resource to bridge the gap between leaders as well as ensure that the organization is working toward its long-term vision and strategy during transitory periods. To minimize those gaps, the CEO will start working with the board years before his or her transition. Should the CEO depart suddenly, however, the board will still have the skill set (among its members) to come together and provide leadership until a new CEO is found. Boards bring a level of stability to an organization because they think long-term and provide consistent oversight. Those facets are critical for an organization, especially for one that’s going through a leadership transition.

- Stay focused on long-term strategy. Board members are long-term strategic thinkers within the organization. For instance, they may look at succession planning 10 years in advance while also thinking about how the organization can achieve its long-term strategy, vision and goals. Boards are the continuity in the organization when a senior executive leaves the company, not when an entry-level employee is added to the team. “Corporate governance is a company-level mechanism that is activated by competent, engaged boards in the pursuit of business performance outcomes via strategic management.”2

Best Practices for Leadership Teams

An organization’s management team ensures that the day-to-day operations run smoothly. This serves a dual function regarding internal and external operations. The management team keeps internal processes and procedures running smoothly from human resources functions to bookkeeping and logistics. It also ensures that all client-facing operations, including business development, public relations, quality control, etc., are refined and operating at a high level.

While the METS CEO may be in the process of a transition, it doesn’t change the long-term strategy and organizational vision of being the electrical contractor of choice in New York. Everyone from operational leadership to finance to marketing continues to service clients and expand the business regardless of the transition at the top.

Now, one of the challenges that management teams face is finding the right balance between strategic thinking and tactical execution. While the board of directors optimally focuses entirely on strategy, the management team must be able to divide its efforts in a way which makes the most sense for the organization.

For example, the management team must ensure the day-to-day operations run well, but it can’t afford to keep its head in the sand. In a rapidly changing business landscape, management teams must stay abreast of industry and economic trends so that they can adjust their tactics before it’s too late.

Quality client and employee relationships are significant markers of a successful company. The management team serves as the leaders of the company to the employees and represents the company to the clients. As the organization seeks new business, and as new talent joins the company, the management team is frequently looked upon as a metric with which to gauge company culture and health.

The Role of Shareholders in Driving Organizational Success

A shareholder is an investor in the company and, therefore, owns a portion of that organization. That person likely only invested in the company because he or she wanted a return on investment (ROI). Because of this, shareholders want to make sure that decisions made by the company align in a way that generates adequate ROI to offset investment risks.

The shareholder’s primary connection to the company is through his or her voting rights. Typically, each individual share held represents one vote; thus, the more shares one owns, the more votes one receives. Shareholders most often exercise their voting rights in selecting members of the board. And just as a citizen can elect his or her respective representative in or out of office depending on performance, a shareholder can do the same with the board of directors.

Bringing It Together

As the economy ebbs and flows, regulations change seemingly by the day, technology advances at a breakneck pace, and business threats emerge, the best organizations have diverse teams in place to pursue the company vision. Those teams consist of a board of directors, management and shareholders. Cumulatively, these groups are charged with the incredible responsibility of maintaining the health and success of the business.

Each branch of corporate governance provides a level of stability and focus essential to the success of the company. Aligning those branches with the company vision and strategic goals truly sets the organization on the path to success. Understanding each of the branches of corporate governance is necessary for building the cohesive structure that enables a company like METS to succeed. In our next article, we’ll highlight how METS aligned its branches and truly maximized its potential—even in a time of transition.

1 Collins, J. C. “Good to great: Why some companies make the leap ... and others don’t.” New York, NY: Harper Business. 2001.

2 Crow, P. R., & Lockhart, J. C. “Is corporate governance a structure, a process, a group of policies, or something else? Proceedings of the 11th European Conference on Management, Leadership and Governance.” Lisbon, Portugal. 2015.