Why the Residential Building Products Sector Remains Attractive for Private Equity

The residential building products sector has long been a core area for private equity investment.

Capitalizing on fundamental themes of new household formation, economic growth, geographic development and, more recently, aging of the nation’s housing stock, residential building products investments have consistently yielded successful private equity outcomes.

However, the current confluence of economic uncertainty, increasing interest rates, inflation and rapidly rising home values has created a murky picture of the fundamental health of the housing market. Add in continued supply chain disruptions and labor shortages, and private equity investors are left with numerous questions about the timing and magnitude of continued investment in the residential building products sector.

Despite recent uncertainty, the sector has remained resilient in the short term and is poised to benefit from several fundamental tailwinds in the medium and long term. As a result, the residential building products sector presents a variety of investment opportunities, particularly for those private equity investors who can be targeted in their approach and capitalize on market uncertainty in areas that may be overlooked by their private equity peers.

Key Differences Between Today’s Housing Market and the 2008 Crash

No Mid-2000s Housing Bubble at Play

Private equity investors often cite the housing market collapse of the mid-2000s as a cautionary tale for investment in the residential building products sector. However, the current housing market picture does not look anything like the housing bubble of the mid-2000s, when housing prices spiked, peaked and then plummeted to record lows by the end of the decade. Loose lending standards in that era resulted in a fundamentally flawed housing market, as consumers were buying homes at prices that far exceeded what they could afford. Additionally, companies kept building speculatively, creating a glut of housing inventory and ultimately putting the entire economy into recession.

Growing Shortage of Housing Inventory

Ironically, compared to the mid-2000s, the housing market is now dealing with the opposite problem. Developers have not built enough homes over the last 15 years to keep up with new household formations. This has created a significant shortage of homes and skyrocketing home prices, which, in turn, has kept a meaningful percentage of would-be buyers from owning a home. While estimates as to the magnitude of the current housing shortage vary from as little as 2 million units to as many as 7 million, it is clear that long-term, consistent building will be necessary to fill the gap in the country’s housing supply.

A Growing Remodeling Market

Aging of the Country’s Housing Stock

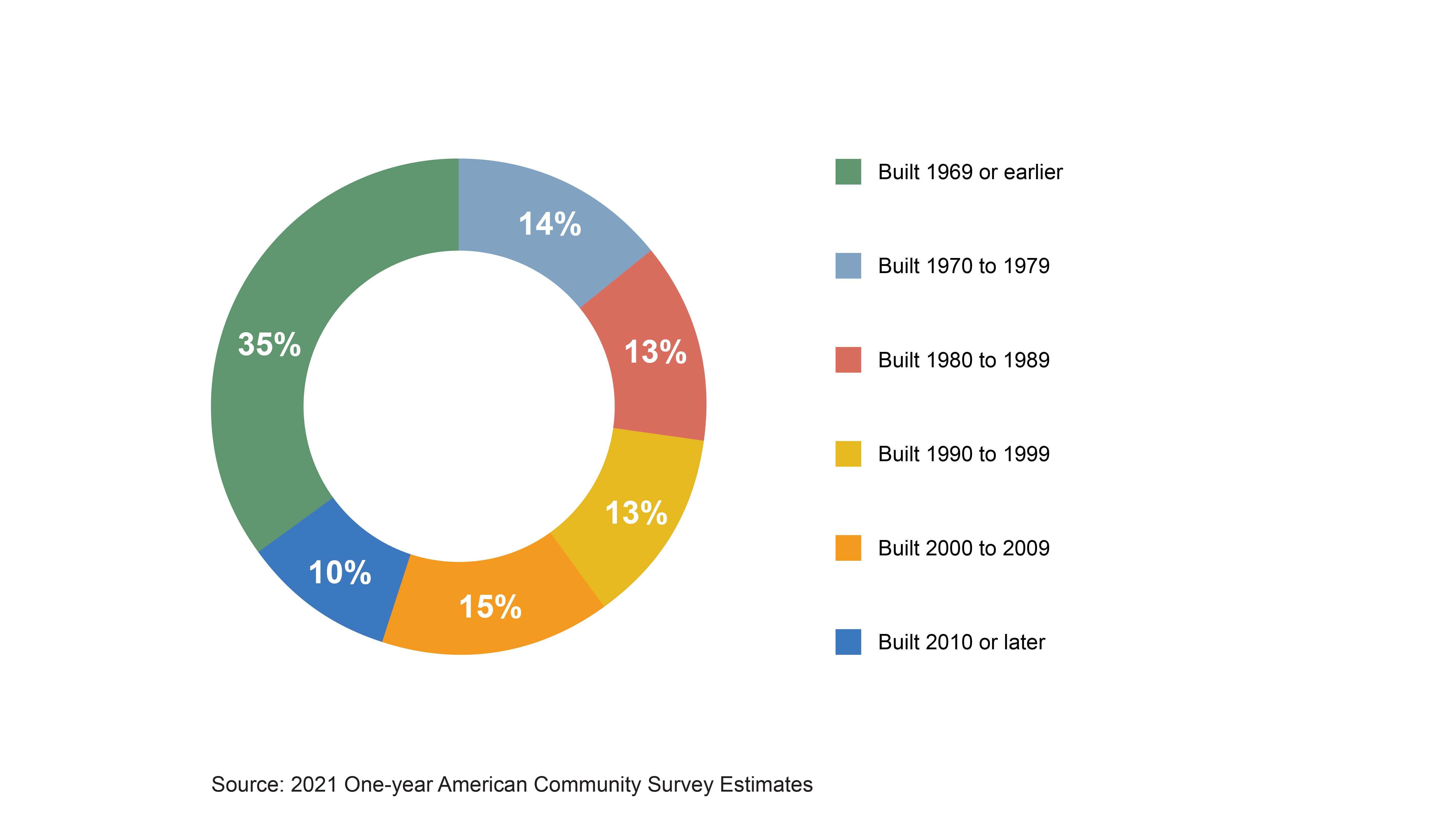

While the gap between supply and demand of new homes has grown, simultaneously, the existing housing stock has aged to a tipping point. According to the National Association of Home Builders, 75% of existing housing stock is now more than 20 years old. Thus, there is a massive amount of inventory that is entering its prime remodeling and renovation years.

Trade-up-in-Place Motivation

The current supply of existing homes for sale is extremely low—just 1.08 million versus 1.91 million in May 2019. A housing market that would ideally have five to six months of existing inventory on the market has consistently had less than half of that supply. Thus, while the high interest rate environment has made renovations more expensive for homeowners, the combination of low new housing supply and limited existing home-for-sale inventory creates a huge motivation for current homeowners to trade up in place by taking on major renovations to update, upgrade and expand current living space.

Other Trends Driving the Residential Building Product Space

Impact of Rising Interest Rates

While the housing market has not been the cause of recent economic instability, it is nonetheless bearing the weight of federal policy designed to support the economy by fighting inflation. As of August 2023, interest rates reached 20-year highs, reducing prospective homeowners’ purchasing power and making financed home renovations more expensive. Furthermore, builders have been impacted by increasing construction costs, supply chain challenges and concerns about lot availability. Ironically, shelter inflation accounts for an estimated 40% of the rise in consumer prices; thus, Federal Reserve efforts to fight inflation in the short term will need to be supplemented by greater housing supply that can promote home price stability in the long term.

Builder Sentiment Is Strong

Perhaps counterintuitively, despite high interest rates and other operating challenges, builder sentiment remains extremely strong. Builder confidence has continued to rise during 2023 and is at its highest level since mid-2022. The key driver of builder confidence is the endemic undersupply of housing, which will create substantial future opportunities for sales and drive greater consumer acceptance of higher interest rates, particularly as other economic indicators such as unemployment and gross domestic product growth remain favorable.

Deal Activity Has Slowed Dramatically

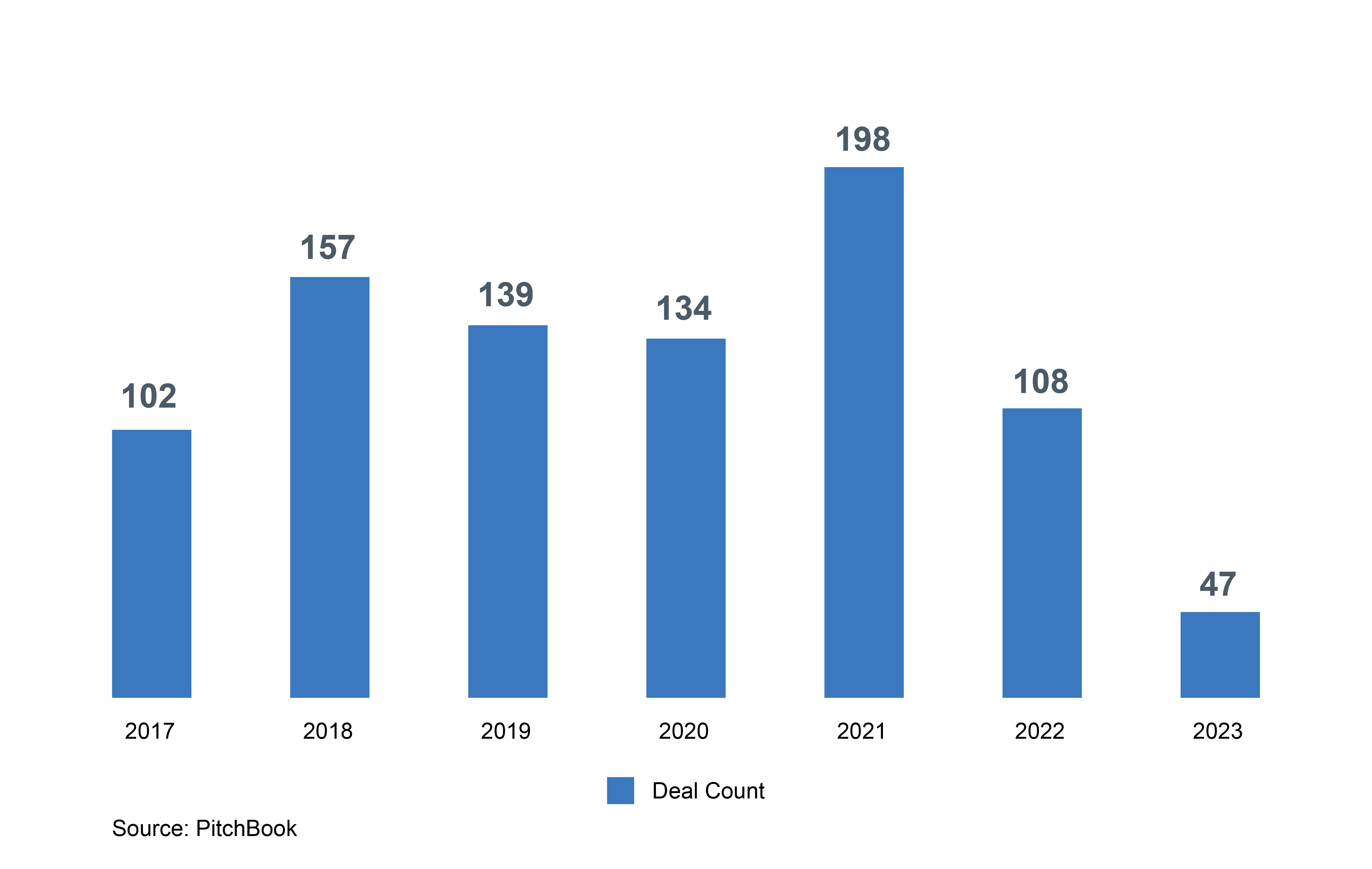

As a result of the murky picture in the housing market, mergers and acquisitions (M&A) activity in the building products sector began to slow dramatically during 2022. According to PitchBook, total annualized transaction activity declined around 56% from 2022 and 76% from 2021 levels as of August 21, 2023. While companies in the sector have continued to perform well, buyers and debt sources have become extremely cautious based on perceived uncertainty. As a result, valuations in the sector overall are more reasonable than in 2021, when a post-pandemic flurry of building products M&A drove valuation multiples to historically high levels.

Capitalizing on the Current Market Opportunity

Today’s housing market environment presents an extremely attractive entry point for private equity investors to acquire portfolio companies in the residential building products sector.

A few reasons why:

- Long-term need for new building activity in both the single-family and multifamily markets.

- Huge inventory of housing stock in need of repair and remodeling.

- Housing supply fundamentals that make home renovations a necessary alternative to purchasing a new or existing home.

- Medium-term return to a more favorable interest rate environment that should spur increased new and existing home sales.

- Returning stability in the supply chain and easing of labor shortages. „ Healthy employment and job security.

- M&A market that has slowed, but is comprised of well-run, healthy companies without the unsustainable valuation multiples that flooded the market in 2021 and that are still attached to many other M&A sectors.

Specific M&A Tactics

Given the long-term attractiveness of the residential building products sector, here are some tactics that private equity investors can consider to capture value in the medium and long term while navigating potential volatility in the short term.

- Consider multifamily opportunities. While renting a home has historically been cheaper than buying, the gap between the two has been growing since the end of the COVID-19 pandemic. In the 20 most populous U.S. housing markets, renting currently carries a pricing advantage of approximately $1,000 per month, an increase of almost 20% since 2022. Further, tenant turnover in multifamily dwellings creates a more frequent need for repair and remodeling in product categories such as flooring, cabinets and countertops, among others

- Focus on products that are taking market share. Innovation in the sector has been driving the development of conversion products that have better long-term performance, lower maintenance needs, greater environmental sustainability and easier installation than prior generations. In many cases, these products have the potential to grow at much faster rates than the building products sector overall, while generating superior margins for manufacturers and distributors. Historical examples include composite decking and manufactured stone materials.

- Explore the high end of the market. The high end of the housing market has tended to show greater resiliency to economic cycles. Targeting building products companies that sell into the high end (market-dependent, but generally defined as $1 million or greater in home value) can help avoid volatility while capturing superior margins.

- Create a path to geographic diversity. Housing markets are local and regional in nature. Over the past decade, Sunbelt and western U.S. markets have shown greater growth than others. However, even markets well positioned for long-term growth can have short-term, idiosyncratic disruptions that challenge residential development. Targeting businesses with existing geographic diversity or organic and inorganic paths to rapid diversity can create better investment results and position the platform more optimally for exit.

- Embrace end-market diversity. Single-family and multifamily end markets often have specific growth characteristics driven by factors such as interest rates, lot availability and consumer preferences. Building products companies often pursue one end market or the other, given variances in product price points and sales channels necessary to successfully address each market. However, making the investment to develop a thoughtful dual-market strategy can create sustained long-term growth.

The residential building products sector is incredibly nuanced at the moment but laden with short, medium and long-term opportunities for private equity investors. FMI’s investment banking and consulting practices have unique insights into the market and can work with buyers to sort through the data and uncover attractive opportunities poised to generate value.