First Look: Civil Infrastructure Construction Index

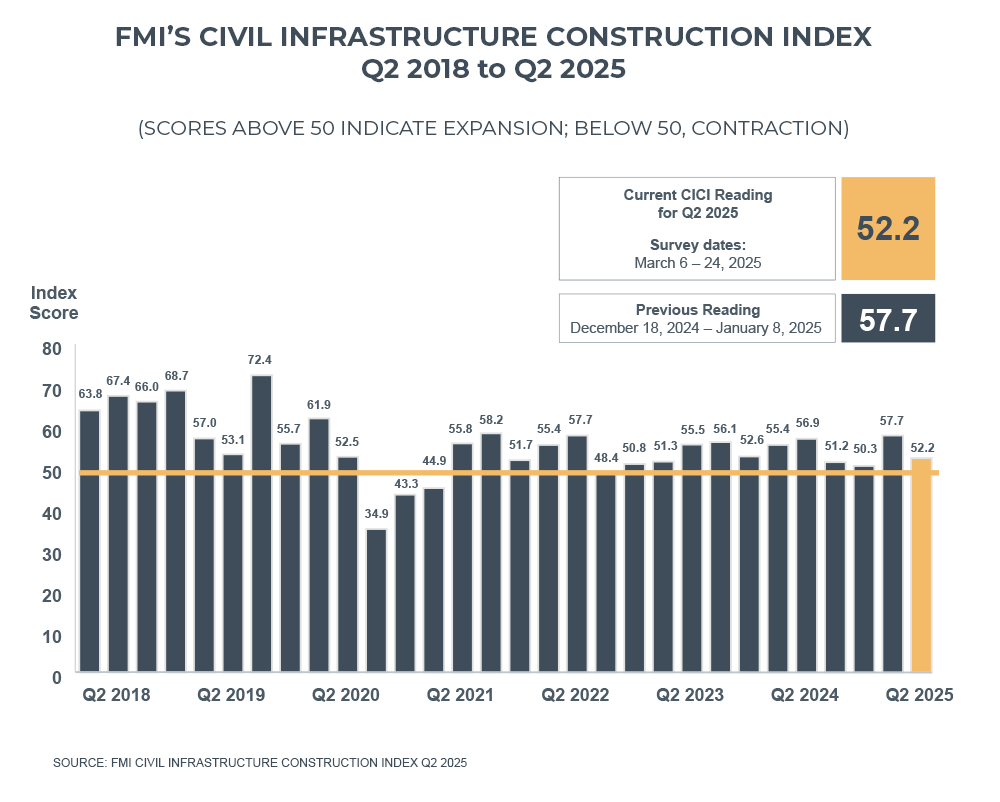

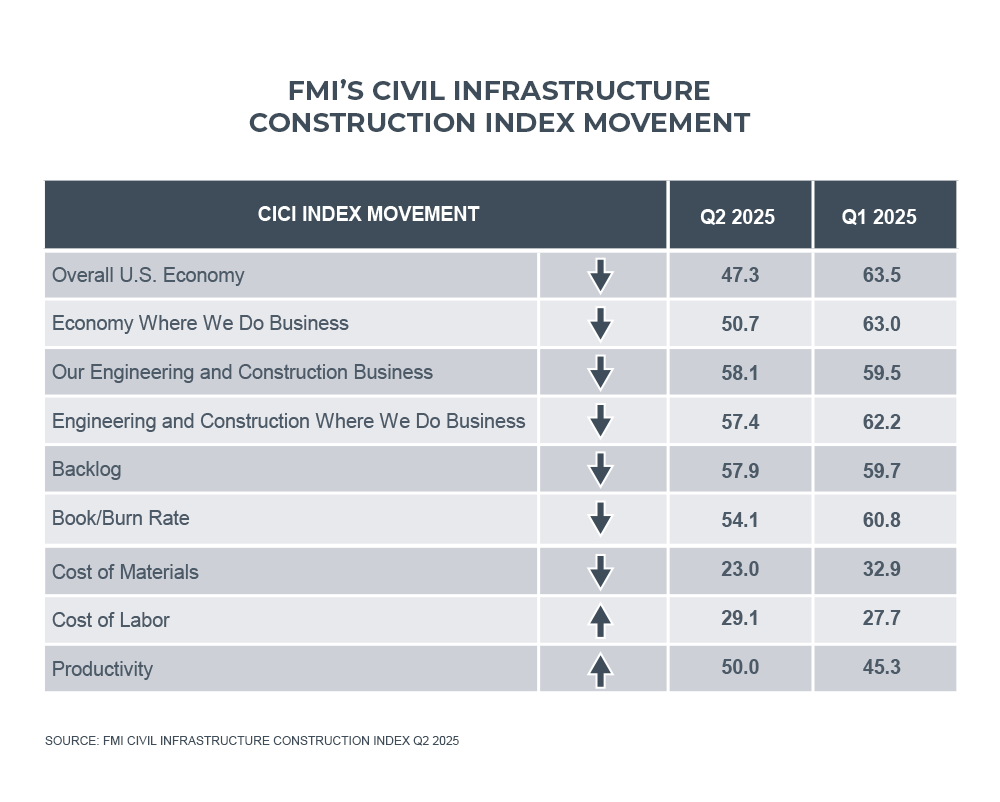

The Civil Infrastructure Construction Index (CICI) declined in the second quarter of 2025 to 52.2 from 57.7, reflecting a dip in optimism compared to the previous quarter.

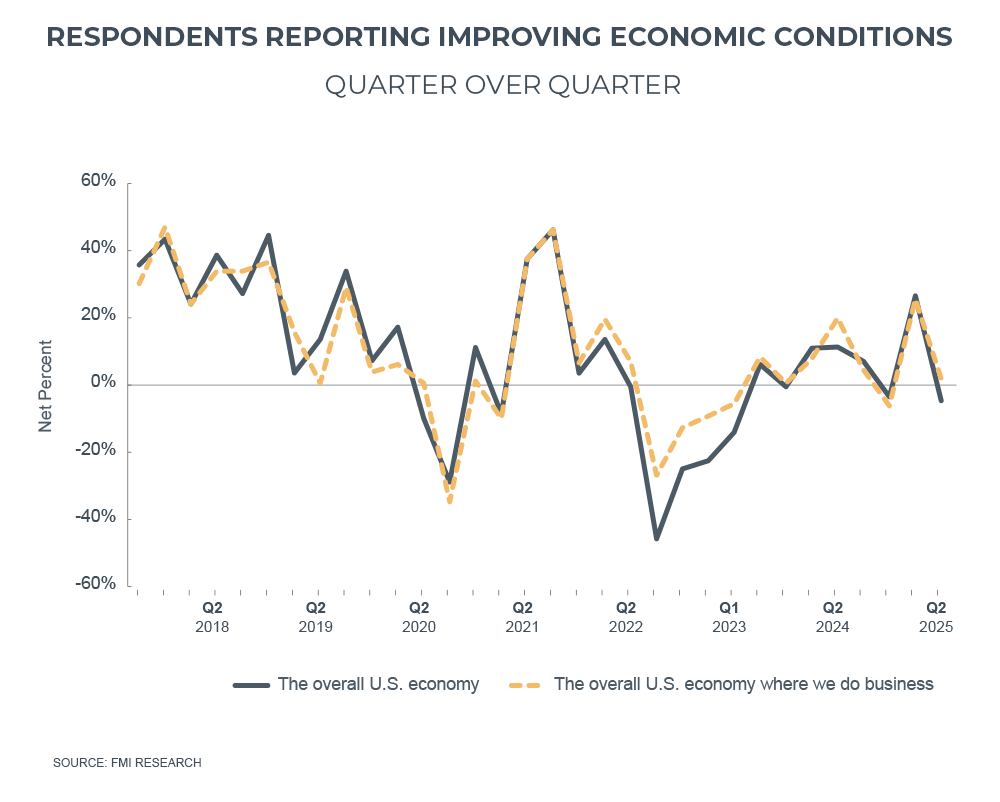

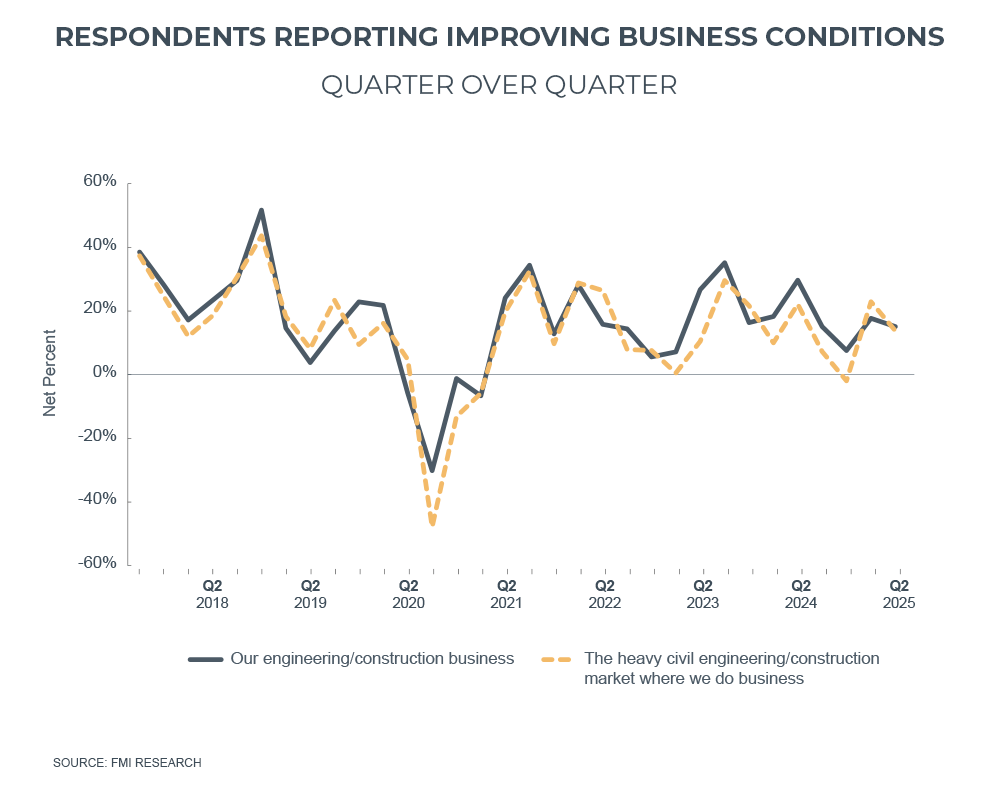

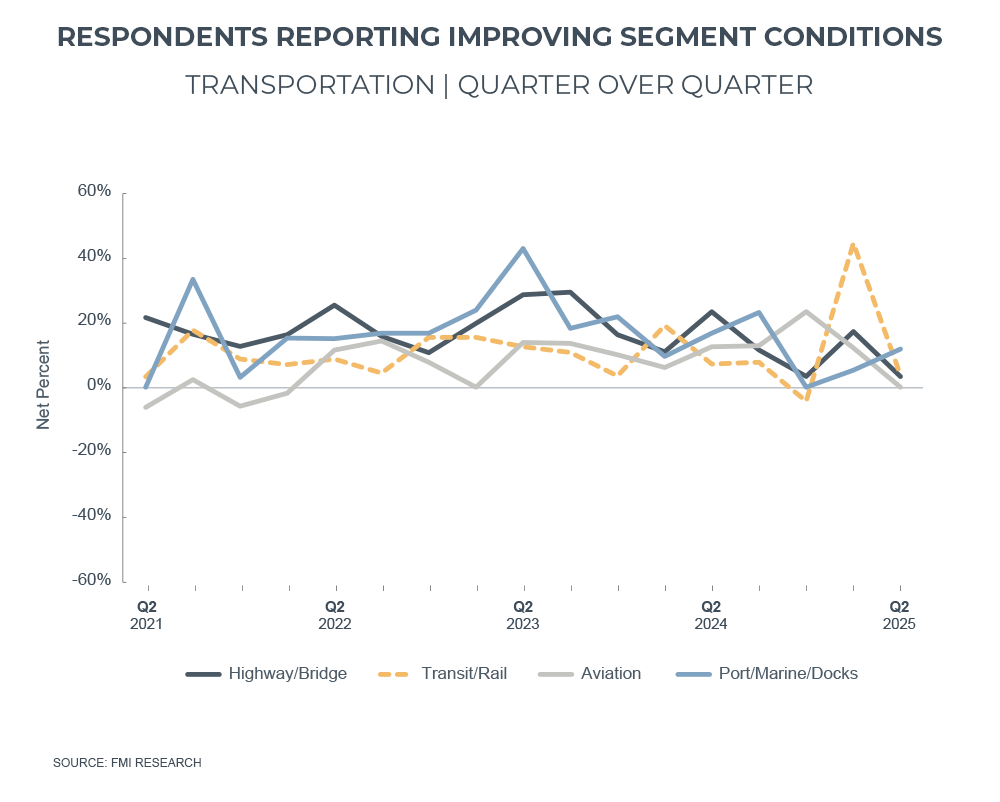

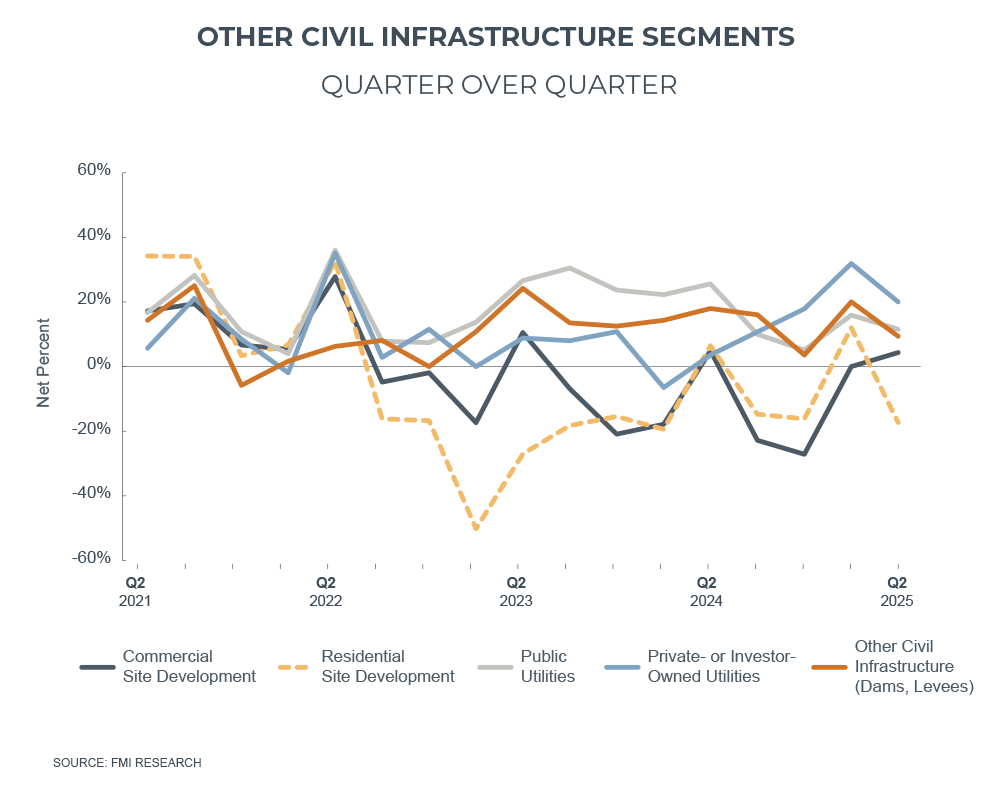

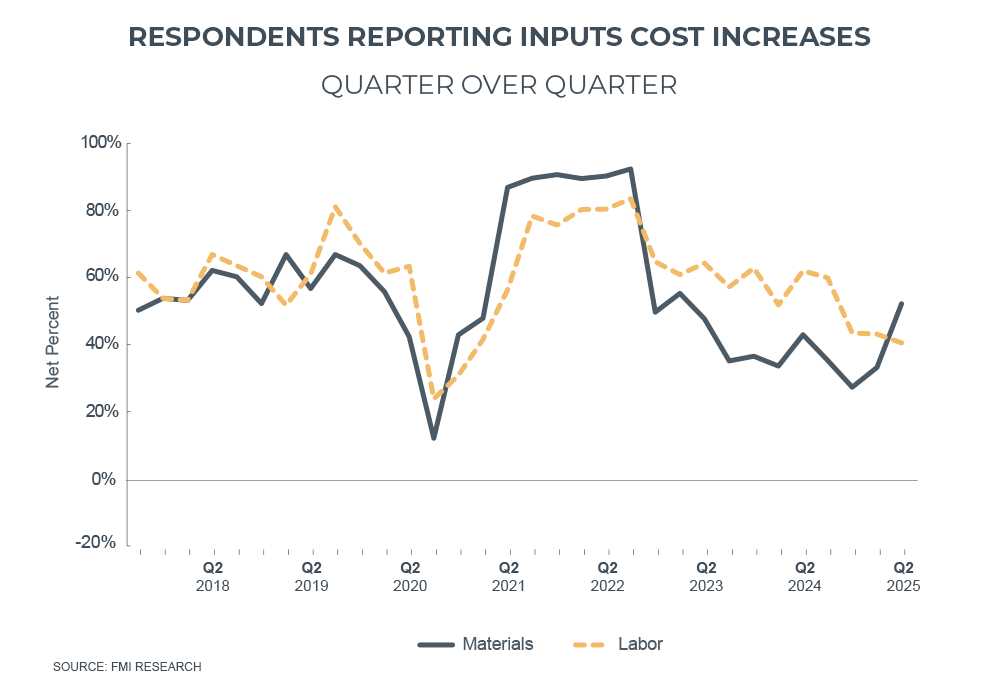

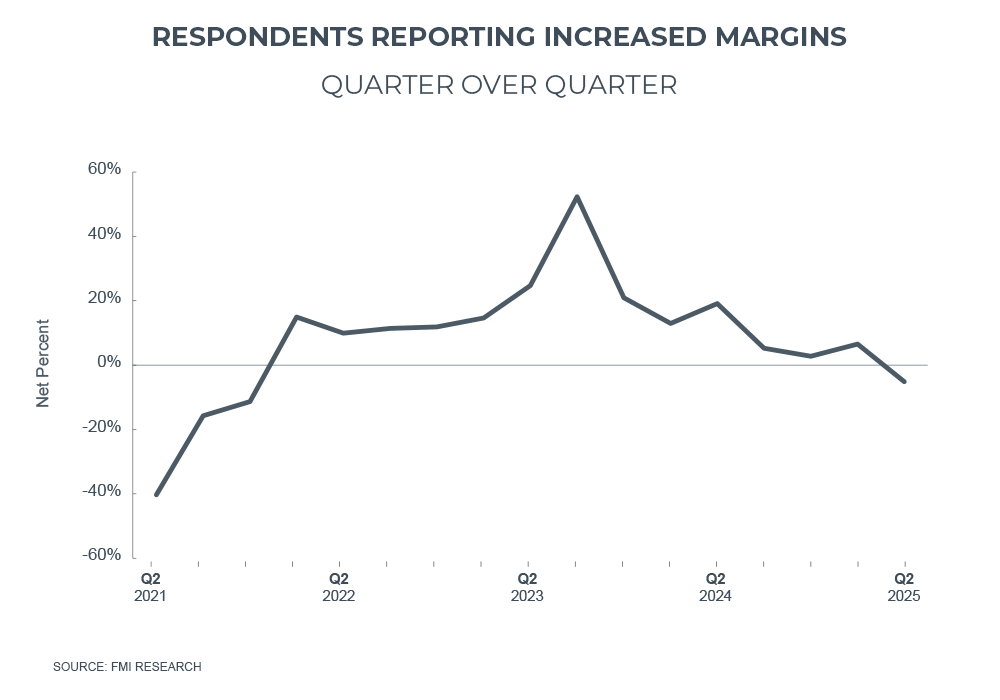

Index components point to reduced confidence in economic and business conditions. Backlog expectations softened, material price expectations increased and participants reported net-negative margin growth quarter over quarter. Across infrastructure segments, sentiment weakened broadly, with a notable return to contraction in residential site development.

The industry is entering an environment marked by volatility, uncertainty, complexity and ambiguity (VUCA). Strategic thinking, agility, resilience and proactive decision-making remain critical. As such, timely information to help you make decisions is more important than ever. That’s why we will begin releasing our index numbers, typically found in the Civil Infrastructure Construction report, as soon as it’s available. The full report will be released in the coming weeks. Our survey participants enable us to provide vital insights into current trends and market conditions. If you’re interested in contributing, we encourage you to fill out the CICI sign up form.

The above table and accompanying arrows illustrate how individual components contribute to the overall index score compared to the prior quarter. For most components, scores above 50 signal healthy or expansionary market conditions quarter over quarter. Cost of materials and cost of labor are exceptions whereas lower values in these components indicate expectations for rising prices and serve as a counterbalance.