In Uncertain Times, Infrastructure Spending Fuels Confidence in Construction Materials

In a world that seems increasingly shaped by volatility, the U.S. construction materials sector continues to deliver one consistent message: slow and steady wins the race. From aggregates producers to downstream suppliers of hot mix asphalt (HMA) and ready-mixed concrete (RMC), industry players remain well-positioned to endure cyclicality. Thanks to strong public infrastructure funding, diverse end markets, disciplined pricing strategies and a focus on local demand, the sector is safely navigating global tensions and potential economic threats with resilience.

While the residential construction segment continues to face headwinds, certain markets are able to thrive, adding an additional boon in some geographies. All signs point to a solid long-term outlook for construction materials.

A Softer Start, But Stronger Foundations

Recent U.S. Geological Survey (USGS) data shows that aggregate production softened in recent quarters. In the first quarter of 2025, total construction aggregate output (crushed stone and sand & gravel combined) declined by approximately 6% year over year, marking the fifth consecutive quarterly decline. Much of this slowdown traces back to delayed private-sector projects and weather-related disruptions in key markets.

But for most producers and their investors, the story isn’t about short-term volumes—it’s about bottom- line performance. Strategic price increases and operational efficiencies are enabling public companies to continue strong financial performance despite lower output. As volumes dip slightly, highway and public infrastructure spending continues to create a firm floor for demand, giving operators a sense of security that overall cyclicality can only affect performance by so much.

“Our first-quarter momentum carries strong into Q2 as we benefit from favorable pricing and disciplined cost execution. While volumes softened slightly, public-sector infrastructure projects continue to support aggregates demand. We remain confident in delivering sustained growth through midyear.” – Tom Hill, Chair & CEO, Vulcan Materials Company

Infrastructure Investment: The Sector’s Anchor

The Infrastructure Investment and Jobs Act (IIJA) continues to be the backbone of stability, allocating billions toward road, bridge, transit and water projects. Despite inflationary pressures and labor shortages, state and local governments are advancing funded projects — from multi-phase highway expansions in Texas to urban transit upgrades in New York.

According to the Bureau of Economic Analysis, highway and street construction remains one of the most stable segments in the built environment, showing growth even as other categories like residential suffer from cyclicality. While the IIJA only has one year left in its five- year timeline, much of the money has not yet been spent, giving optimism that there is continued funding runway for large, materials-driven projects.

“Q2 results reflected strong pricing momentum and disciplined cost control, even as volumes moderated. Demand remains buoyed by public-sector infrastructure, and we're well positioned to benefit from continued IIJA funding through 2026.” – Ward Nye, Chair & CEO, Martin Marietta

Tariffs, Costs and the Local Advantage

Amid global uncertainty, the U.S. construction materials sector benefits from an often-overlooked truth: construction is a local business. Most aggregates and HMA are sourced and delivered within 30 to 60 miles of the project site. This proximity insulates producers from many global disruptions.

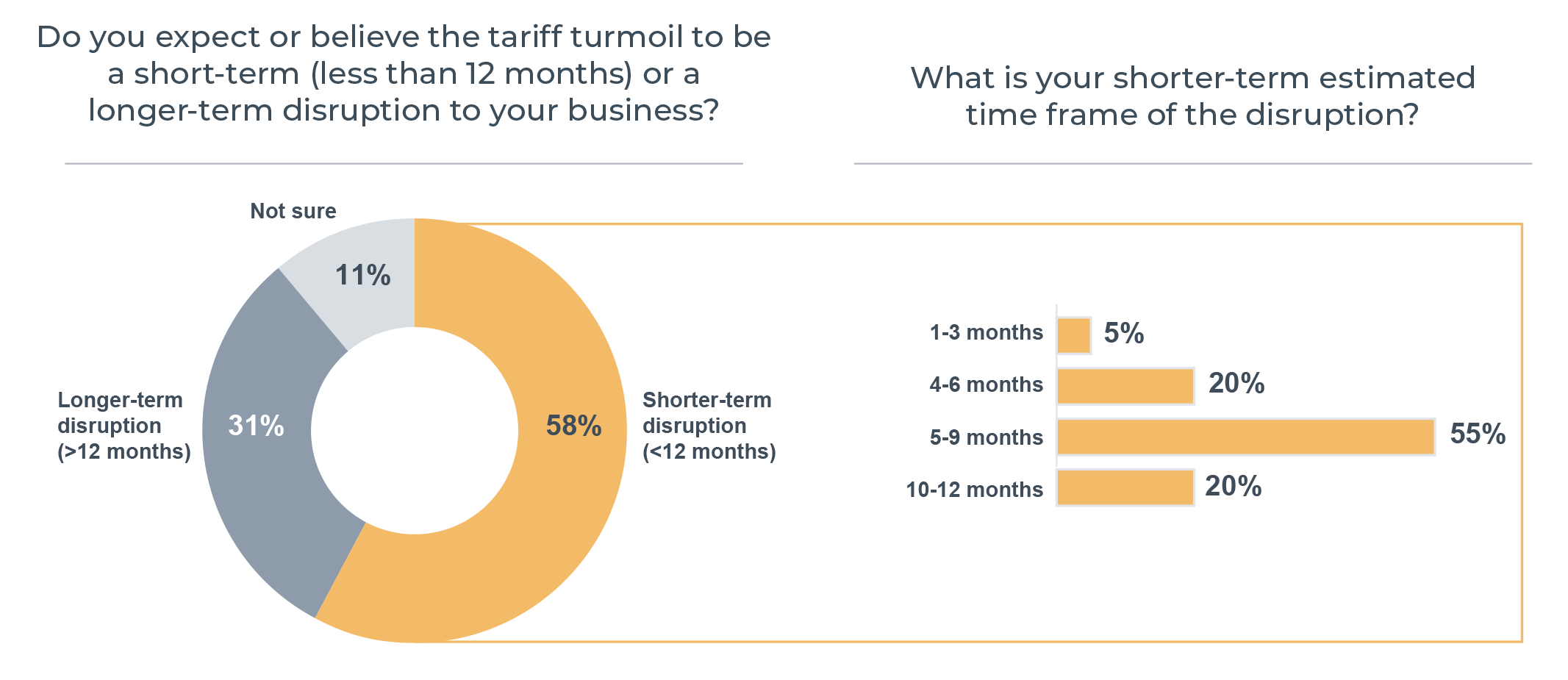

Still, challenges can persist in other segments of the supply chain. Tariffs on imported cement and liquid asphalt could affect some markets — particularly in the South and Northeast — yet many producers have mitigated risks through indexed contracts and domestic sourcing. As FMI’s latest Construction Industry Round Table (CIRT) Sentiment Index highlights, contractors are reinforcing contract language and expanding supplier relationships to stay ahead of pricing volatility.

Meanwhile, HMA contractors and suppliers are often protected through fuel and binder indexing, which adjusts contract pricing based on input cost fluctuations. This allows producers to maintain consistent margins despite fluctuations in raw material pricing.

CIRT Sentiment Index: Confidence with Caution

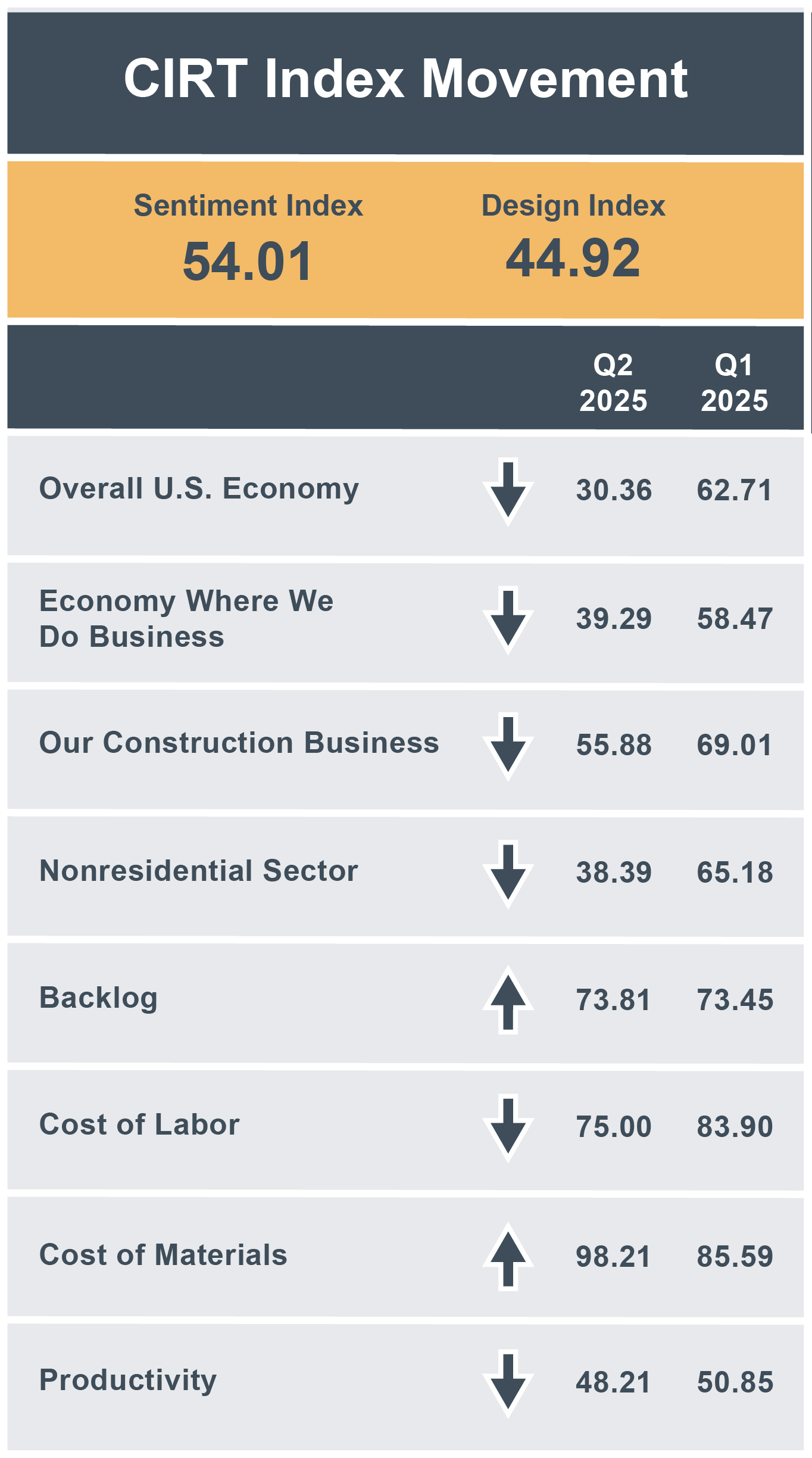

FMI’s second quarter 2025 CIRT Sentiment Index reflects an environment of cautious optimism. The index decline of 67.9 to 54.01 is mostly attributable to macroeconomic uncertainty.

Still, several indicators offer reassurance for construction materials:

- Backlog levels remain stable

- Most firms expect to manage input costs through sourcing and contracting strategies

- 58% of respondents view tariff risks as short-term

Perhaps most importantly, material cost concerns reached an all-time high, underscoring just how crucial price discipline and supply chain flexibility have become. Despite this, heavy civil and public works sectors were among the few to see positive movement in sentiment.

Residential and Private Construction Still Lag

On the flip side, residential construction remains the sector’s wild card. Homebuilding has yet to recover meaningfully, especially in high-cost urban markets where land, labor and financing remain prohibitive. While demand for housing remains high, affordability continues to strain construction activity.

Private commercial construction — particularly in the office and multifamily sectors — also remains sluggish. This may constrain upside volume for some aggregates and ready-mix producers. But for firms concentrated in public-sector infrastructure, public dollars are filling the gap.

Investor Perspective: Infrastructure Is a Defensive Play

From an investment standpoint, construction materials — especially aggregates and HMA — offer a compelling combination of hard asset exposure and public-sector stability:

- CRH and Vulcan have both outperformed broader indexes year to date.

- Strategic M&A activity is strong, with CRH and Vulcan completing bolt-on acquisitions in high-growth U.S. regions. Smyrna Ready Mix continues to charge forward with numerous RMC acquisitions announced.

- Valuations remain solid, particularly for vertically integrated businesses with long -term permitted reserves.

In FMI’s advisory work, interest remains strong from acquirers seeking durable infrastructure -linked exposure. Buyers are increasingly looking at supply chain control, geographic footprint and localized market strength as key investment theses.

The Road Ahead: Predictable Growth with Room to Run

Despite headlines that might suggest otherwise, the outlook for the U.S. construction materials sector remains healthy. IIJA-backed spending will persist into the foreseeable future. Public sentiment is broadly supportive of infrastructure.

Challenges such as tariffs, fuel costs and interest rates remain factors to monitor and navigate, but the sector continues to adapt with strategic sourcing and smarter contracts.

As producers gear up for a busy construction season, many are not just weathering the storms, they’re quietly thriving.