Thinking Ahead: Breaking Down the Details of the Infrastructure Investment and Jobs Act

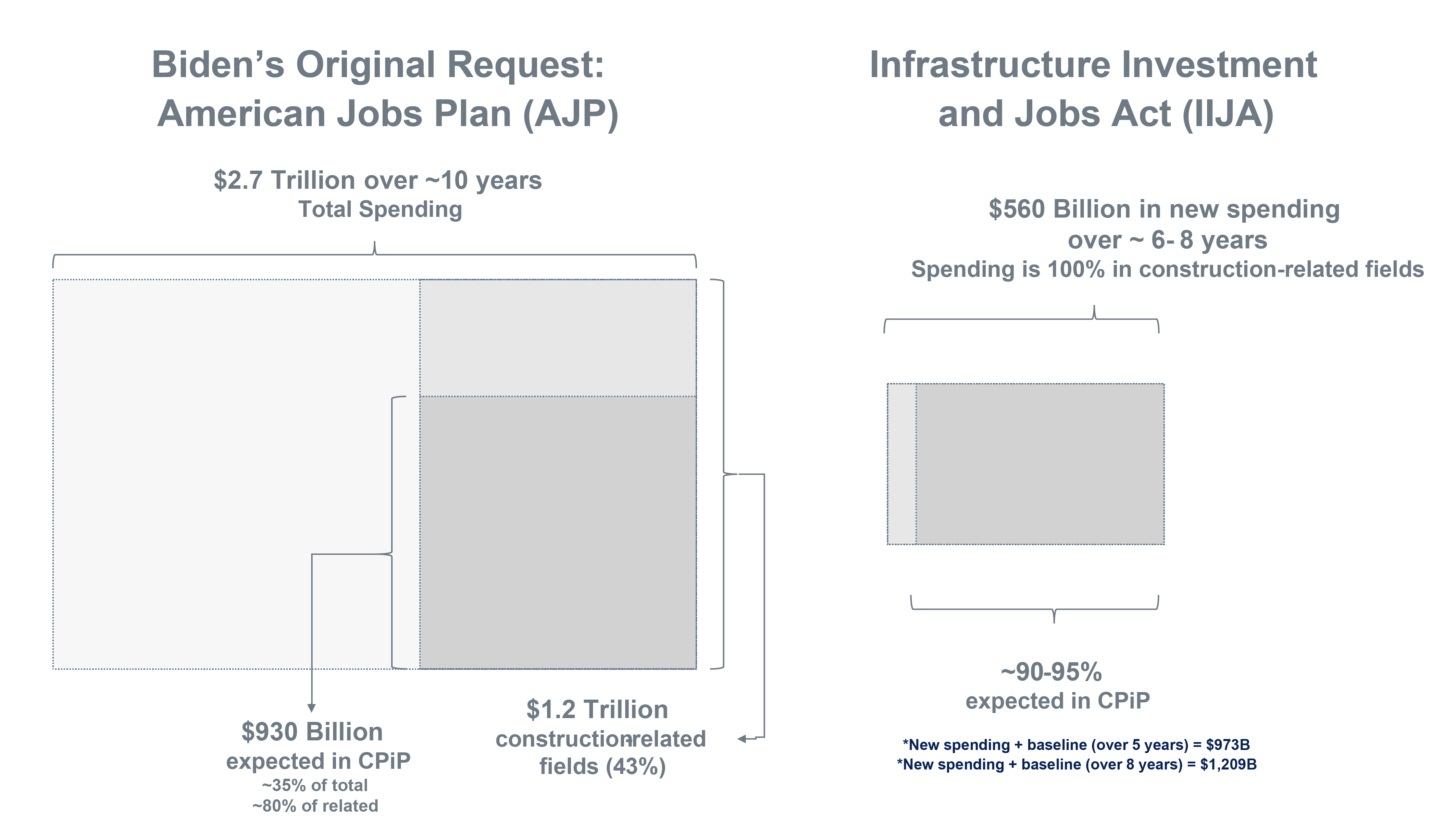

The Infrastructure Investment and Jobs Act (IIJA) is expected to fund $1.2 trillion dollars in engineering and construction activity over the next eight years. This legislation marks an important milestone by nearly doubling federal investment in new and existing programs, with approximately $560 billion in new funding. Additionally, nearly all these funds will be directed into engineering- and construction-related fields, an important distinction from President Joe Biden’s original request via the $2.7 trillion American Jobs Plan.

While exciting, companies will see opportunities as well as challenges when it comes to putting the money to work.

Opportunities

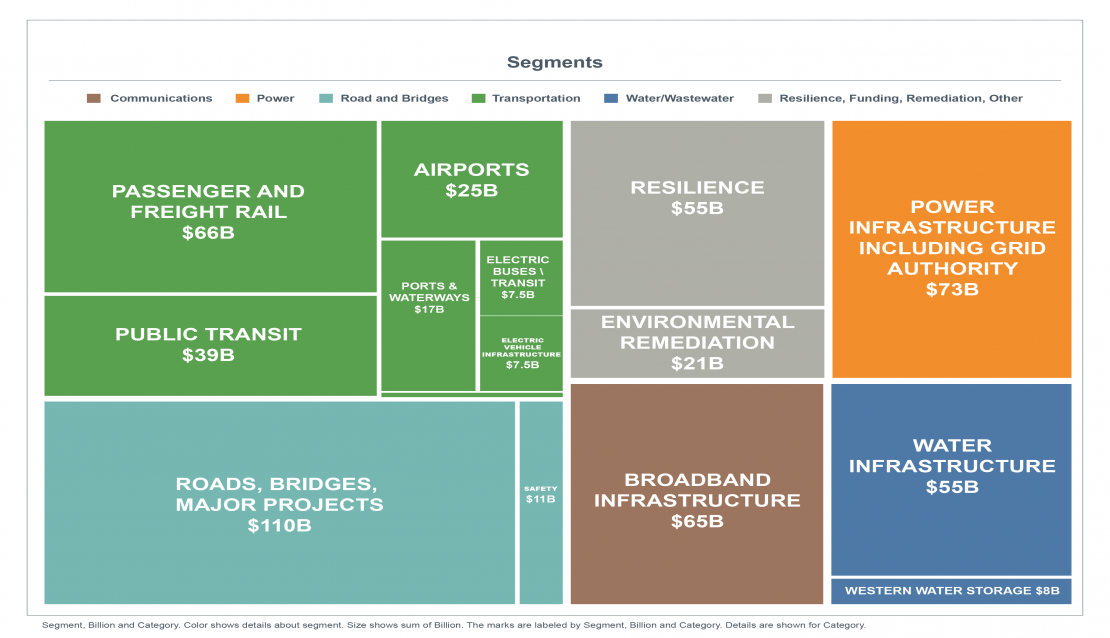

Naturally, clients are interested in how this funding is broken down across segments and geographic markets to help determine their strategies. Of the $560 billion in new funds, approximately 52% will be directed into roadway and transportation spending (30% of funds will be dedicated to transportation spending and 22% will be dedicated to roads and bridges), 36% will be allocated to utility infrastructures (i.e., power, communications, and water/wastewater projects), and 14% will be used on resilience, remediation and community-related projects. Based on existing models and prior legislation, expected formula-based geographic distribution of new funds will be concentrated primarily in the South Atlantic (18%) and Pacific (15%) Census Divisions.

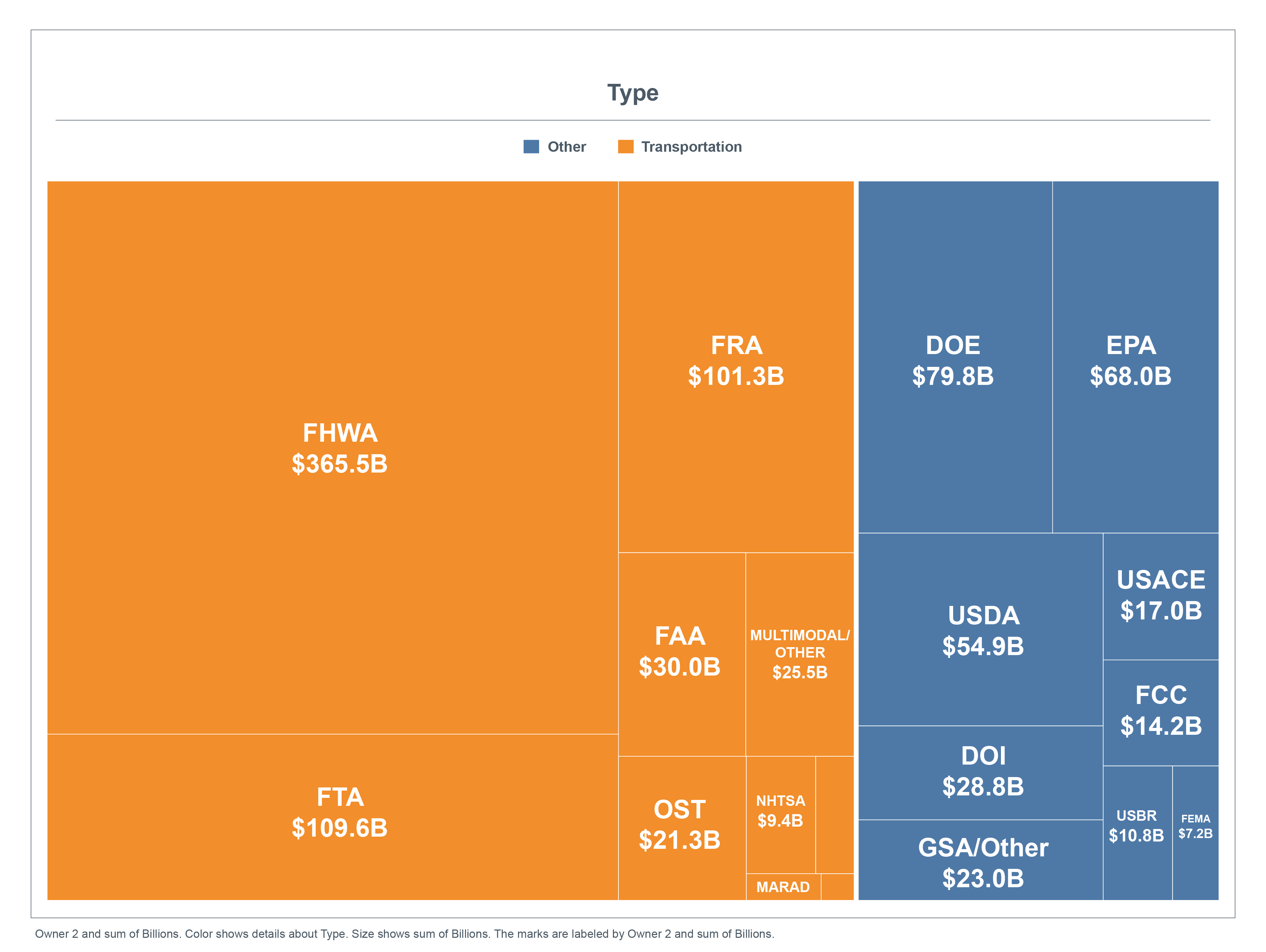

Additionally, 69% of program totals will be allocated to transportation and roadway agencies, while 31% will be allocated to utility agencies and other related government groups such as the Department of Energy, the Department of Agriculture, the Army Corps of Engineers and the Environmental Protection Agency.

Though each agency is expected to approach capital planning differently, a common thread across these agencies is that expansionary investment has regularly been postponed to prioritize rehabilitation and renovation needs. We expect to see a short-term emphasis on repairs and renovation projects given the increase in funding and the backlog of needs.

Challenges

Labor and materials constraints are the most obvious challenges to the success of the IIJA. Volatility in these crucial inputs feed into other considerations tied to margins and associated risks to take on new work in an unpredictable climate.

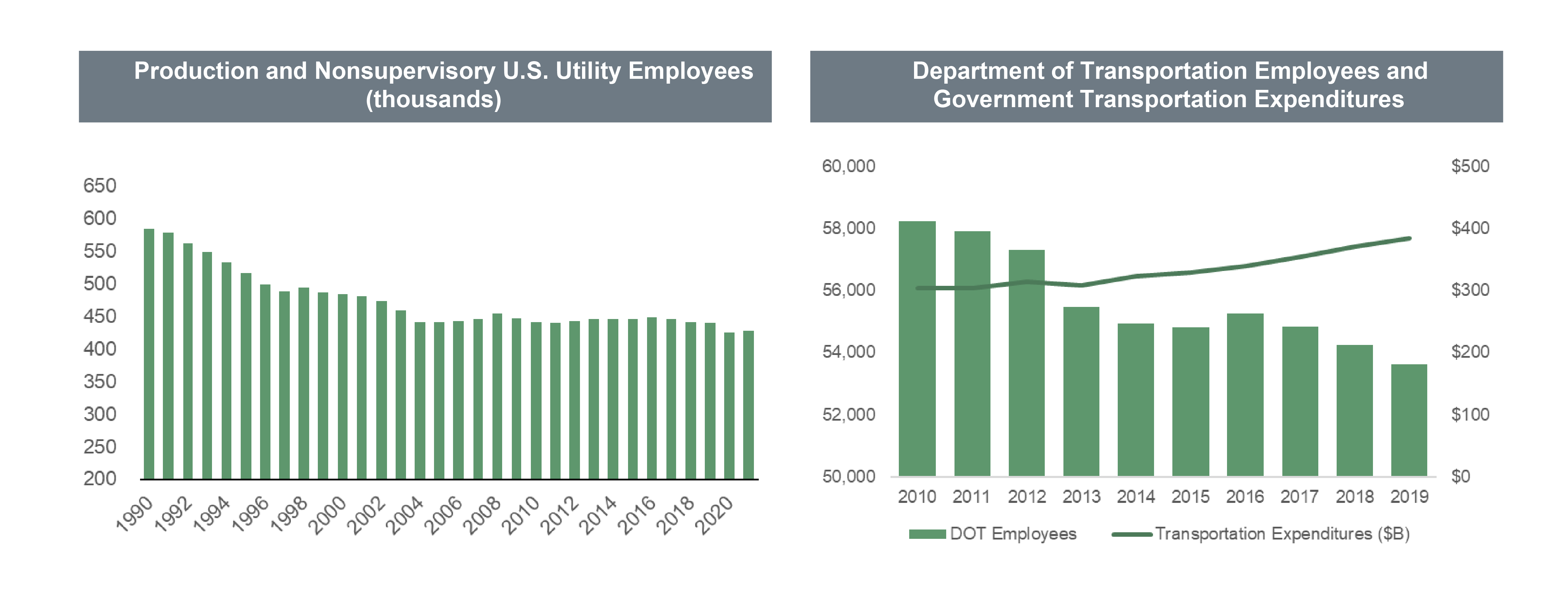

Labor shortages are apparent across all facets of the E&C industry and present risk to everyone as industry pay scales are adjusted to meet shifting demand. Project Labor Agreements (PLAs) are now mandatory for federal projects $35 million or larger, and agency staffing limitations will likely continue to drive outsourced tasks previously addressed by employees.

These owner-driven limitations have historically led to changes in the way work is contracted (i.e., design-bid-build versus design-build). Many of these agencies will face additional pressure to juggle resources and applications tied to expanded competitive grant programs to maximize E&C opportunities.

Future pricing relief for many construction materials is also in jeopardy. Though supply chain constraints are expected to subside as pandemic pressures ease, federal infrastructure spending is historically insensitive to high prices and high interest rates. Sustained demand for infrastructure materials may lead to elevated and potentially higher prices in the years ahead, possibly dampening demand across a large portion of private E&C stakeholders.

No matter how the IIJA may impact your organization or local economy, strategic direction is needed to navigate the opportunities and challenges ahead. It is also important to consider that as inflation continues to hover near 40-year highs and materials and labor costs remain elevated, real investment gains from this bill could easily be absorbed by increased expenses. Higher prices alongside elevated investment levels and more complex programs means more risk for everyone.

Every sector of the heavy civil market is expecting growth. Now is the time to make sure you have a clearly defined strategic direction, including markets and geographies where you can successfully compete, to grow with discipline and drive long-term success. You have the opportunity to be selective about the clients, geographies, projects and markets you pursue, playing to your strengths as an organization creating the company you chose to become.