Thinking Ahead: Infrastructure Bill Passes, Project Delays Aren’t Free

With inflation hitting a 30-year high in October, a 6.2% annual increase, concerns about the rising costs of materials, labor, consumer goods and other inputs are quickly becoming top of mind for most executives. In the last few weeks, the term stagflation, meaning when the economy is experiencing rising inflation and stagnant activity, has also become a popular component to the conversation. Many are also watching how much and how quickly wages are rising, another indication that rising prices may persist. Given some of these known challenges, companies will need to focus on mitigating project delays, controlling costs, improving efficiencies and becoming leaner in order to continue to grow during these times.

Infrastructure Bill Finally Passed

This week Congress passed President Joe Biden’s $1 trillion infrastructure bill, putting in place money for roads and bridges, power and the grid, rail, broadband and water infrastructure among other areas.

New investment in roads and bridges ($110 billion) and power and grid ($73 billion) signals that these areas will likely see the biggest impacts from increased federal spending. Since this and other sector allocations are nearly the same as the proposed legislation, FMI already incorporated this into our 2021 North American Engineering and Construction Outlook for the fourth quarter.

While the infrastructure bill was not surprising, the timing of its passage does raise questions about whether an additional social spending bill will pass this year. This proposed legislation has fewer implications for the overall built environment but does include some tax credits for renewable energy that may affect some in the industry.

Indicators Point Toward Short-term Inflationary Pressure

The U.S. trade deficit grew to a record $80.9 billion in September, an 11.2% increase, as supply chain challenges are pushing importers to order more stock to meet consumer demand. Many companies are building inventories and ordering more goods as a precaution before the holidays.

U.S. worker productivity also fell a seasonally adjusted 5% in the third quarter, according to the Labor Department, while labor costs increased 8.3%, signaling employers are facing wage inflation.

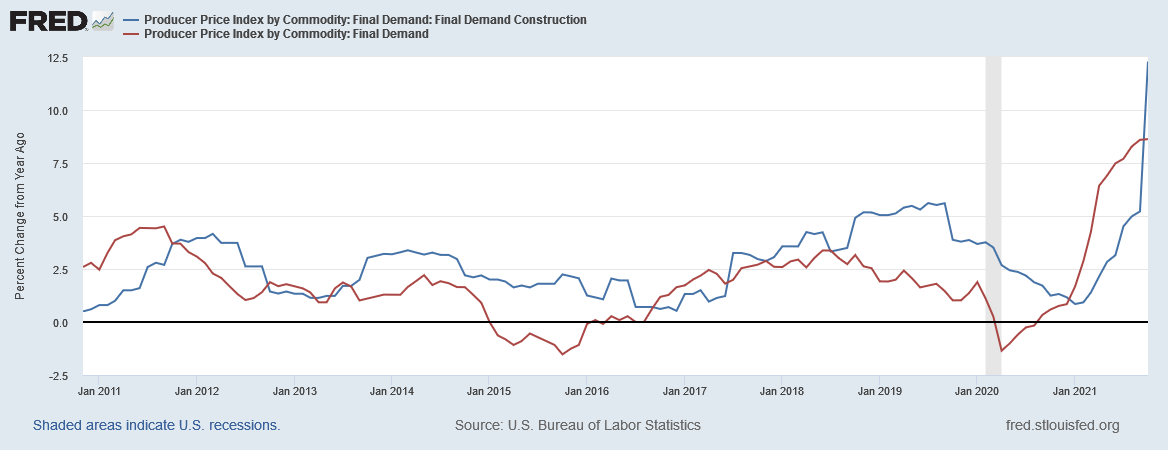

Another key indicator, the Producer Price Index (PPI) increased 0.6% in October from the previous month, with 60% of those increases attributed to a rise in prices for final demand goods. The final cost of construction also climbed 6.6% for the month of October, or a staggering 12.3% year-over-year, according to the Bureau of Labor Statistics. With many in the industry facing delays from labor shortages and supply chain issues, project prices are rising quickly, and margins are at risk.

Last week the Federal Reserve announced it would reduce buying assets by $15 billion per month starting in November. The purchases will gradually decrease into mid-2022, ending a program begun to help stabilize the economy during the pandemic. It is no surprise that they opted to maintain interest rates, but the pull back from bond markets will likely cause a natural uptick in rates.

Labor, materials costs and availability challenges are hitting companies’ bottom lines. In our CIRT survey released this week, we learned that four out of five respondents are seeing delays from supply chain issues. Additionally, one out of five respondents had seen projects canceled. To combat this, companies are most commonly looking at alternative products and broadening their suppliers.

While most CIRT members have been able to pass many of these increased costs to customers, it’s unclear how long they’ll be able to do so, especially given current inflation rates. Once supply chains return to normal, it may be hard to sustain these higher prices.

Later this month, in our upcoming Heavy Civil Construction Index, we are looking forward to presenting survey data on heavy civil contractors’ annual materials and labor inflation assumptions used in bidding through the third quarter of 2021.

As we enter the business planning period, construction and related firms will need to pay attention to continued supply chain issues and higher labor costs. The third quarter gross domestic product growth of 2% was the slowest yet in the recovery, something easily attributed to the surge in coronavirus cases and supply chain issues.

It’s likely that many in the engineering and construction space will need to move into different markets or adjacent businesses to sustain growth or may look to acquire other companies to get the talent necessary to deliver on jobs, especially if these pricing pressures continue to impart project delays and cancellations into 2022.