Warehouse Investment: On Track to Drive More Demand for Commercial Construction

Warehouse and logistics, a subset of commercial construction, remains one of the fastest growing segments over the past decade.

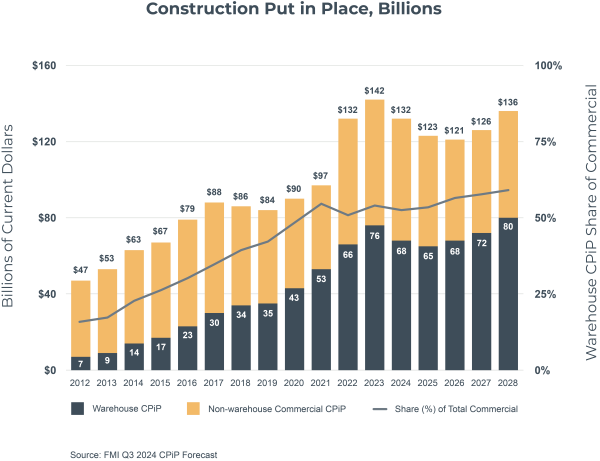

Between 2012 and 2017, when the U.S. economy was rebounding from a financial crisis, the subsegment more than quadrupled — with five consecutive years of annual spending exceeding 20% growth. Since 2017, annual spending levels have increased another 250%, far outpacing traditional commercial construction and catapulting annual warehousing spending to more than half of the total commercial segment in 2023.

FMI leverages historical and regional data reported by the U.S. Census Bureau, research on active and planned projects, and oversight of warehouse industry trends to put together a proprietary forecast for warehouses separate from commercial construction numbers.

Though FMI anticipates challenges over the next few years, long-term demand for warehouse space will likely rise, with annual warehouse construction nearing three-fifths of all commercial construction investment by 2028, according to FMI’s forecasts.

Notably, warehouse investment recently slowed due to overbuilding and pullback, including project cancellations, from large owners and developers like Amazon and other big retailers. As a result, FMI’s forecast includes some short-term corrections that align with a generally weakened economic outlook impacting the broader commercial segment and retail sales.

Still, the segment will likely rebound quickly — by 2026 — returning to double-digit growth by 2028. FMI expects warehouse needs will continue to redefine traditional commercial construction in the years ahead and near or exceed $100 billion annually by 2030.

Factors Impacting FMI’s Warehouse Forecast

Looking to capture work in warehouses? You’ll want to keep several things in mind during your strategic planning process.

- Geographic factors: The warehouse sector is geographically diversified due to limitations on transportation. Warehouses need to be spaced to accommodate how far trucks can go in a day, and the limitations of last-mile delivery necessitate substantial warehouse and logistics services in all major markets. Our ongoing investments in manufacturing and trade will only continue to accelerate infrastructure needs. While some cities invest more heavily in warehouses (e.g., Columbus, Ohio; and Ontario, California), broader regions of the U.S. tend to invest proportional to population.

- Competitive factors: A few large owners dominate the built-to-suit warehouse space, while many smaller players lease buildings or use third-party logistics. Large investment decisions at Amazon or Walmart may have significant ripple effects throughout the broader warehouse industry.

- Economic factors: Recessionary economic factors impacting consumer health, including rising unemployment and historically heightened inflation rates, will likely stall retail spending and as a result have some negative impact on e-commerce. However, e-commerce shows value and benefits over traditional retail channels. Increased adoption from buyers and sellers alike continues to climb as both groups are likely to shift behaviors to stretch purchasing power and/or gain outreach.

- Technological factors: The increased demand for efficient last-mile delivery and recent supply chain disruptions have made the future unpredictable as logistics providers are pushed to innovate. Large owners are investing in advanced technologies including real-time tracking systems, Internet of Things (IoT) connectivity, blockchains, AI, automation, decentralized distribution networks and more. These adaptations and their effectiveness in addressing logistical challenges will be key to predicting future demands on warehousing and logistics facilities.

The landscape of warehousing and logistics will continue to evolve rapidly alongside increasing demands for new facilities and equipment. Strong forecast growth in construction spending will be led by ever-changing economic conditions, consumer expectations and ongoing advances in and adoption of new technologies. Understanding geographies and market dynamics can help your company create a strategic plan that helps you capture more business in this space.