Solid Foundations: The Rising Value of Geotechnical Services

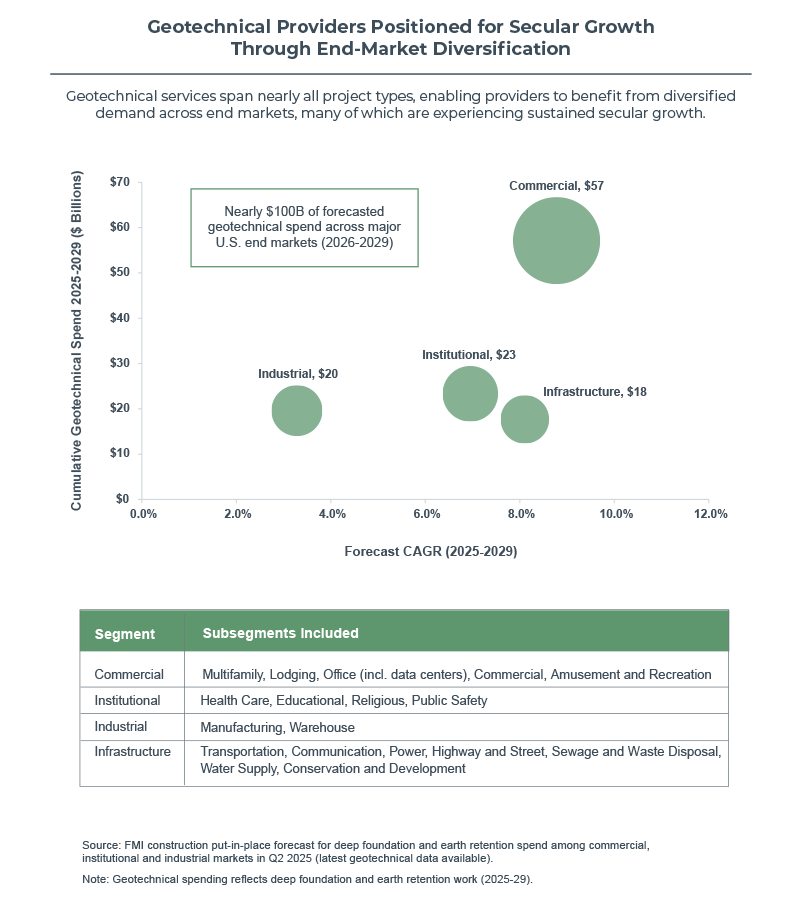

Geotechnical services have always played a foundational role in delivering safe, resilient structures. Today, demand for these services is rising faster than at any point in recent memory, as scarcity of buildable land, larger and heavier structures, rapid growth in advanced manufacturing and data centers, tightening environmental and resilience requirements, and multiyear infrastructure programs converge.

These factors are making subsurface work more technical and essential to predictable project delivery. From ground improvement and deep foundations to earth retention and environmental remediation, geotechnical work has become a more technically complex — and schedule-critical — components of the built environment.

As owners and general contractors face mounting pressure to deliver work with certainty, and as project complexity grows, the sector is drawing heightened interest from both strategic acquirers and private equity investors. Long-horizon construction programs across infrastructure, water and wastewater, coastal protection, power delivery, advanced manufacturing and data centers continue to expand, positioning geotechnical services as a bright spot within the broader engineering and construction market.

Across FMI’s recent work, one theme is clear: geotechnical providers with strong value-added design and engineering capabilities, specialized fleets and proven execution are becoming some of the most sought-after platforms in the construction ecosystem.

* FMI construction put-in-place data for deep foundations and earth retention spend for the commercial, industrial and institutional markets as of

second quarter 2025 (latest data available).

Why Demand for Geotechnical Services is Accelerating

A set of structural trends is reshaping where construction happens and how projects get built, dramatically increasing the technical intensity and schedule-critical nature of geotechnical work. Geotechnical services now play a central role in project certainty, risk management and long-term capital planning. The following dynamics are accelerating demand for geotechnical expertise and elevating its strategic importance across infrastructure, energy, industrial and commercial development.

1. Buildable land is becoming scarce. Prime sites near major metros have been absorbed after decades of development. As construction shifts to brownfields, infill parcels, coastal zones and areas with shallow water tables or variable soils, subsurface conditions become harder to predict and far more difficult to manage. These locations demand engineered solutions to control settlement, stabilize foundations and mitigate environmental risk.

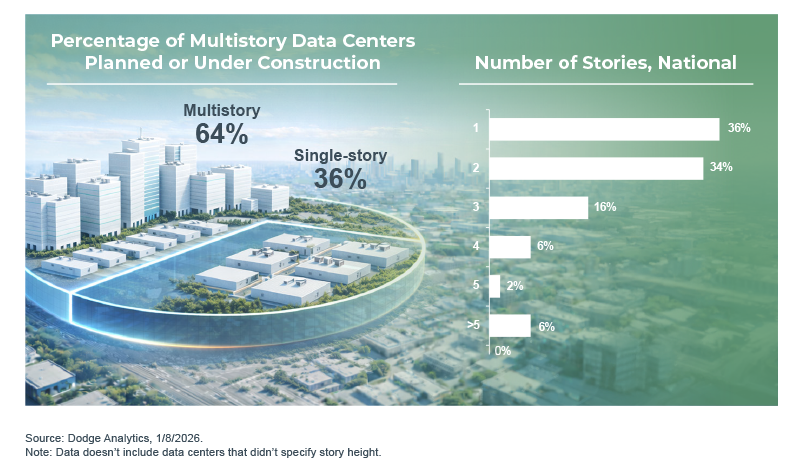

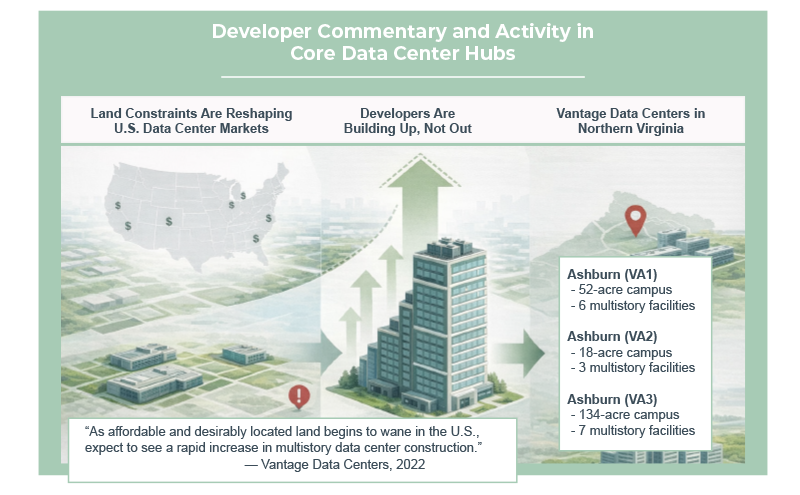

2. Buildings are larger, taller and heavier. Structures continue to expand in footprint and height across industrial, manufacturing, warehousing, health care and multifamily. Heavier loads and larger building pads increase settlement risk, introduce inconsistent soil profiles and require more sophisticated ground reinforcement. Data centers are a prime example. As land costs rise in key hubs, owners are constructing multistory, high-load facilities on constrained sites, driving sustained need for ground improvement and deep foundation systems.

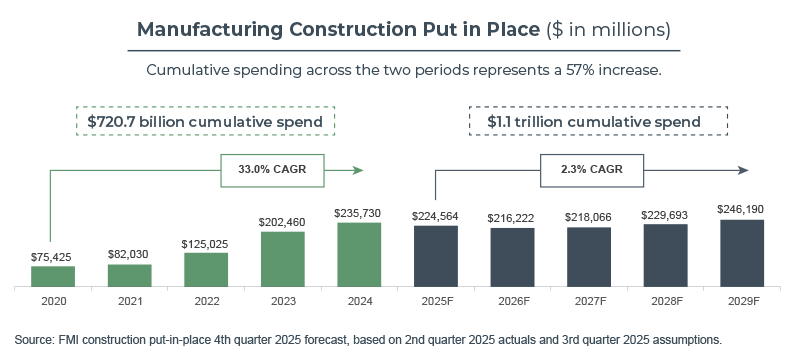

3. Advanced manufacturing and reshoring are driving multibillion-dollar geotechnical demand. While manufacturing starts may moderate in the short term as megaprojects move from groundbreaking to execution, underlying activity remains robust. Dodge Construction Starts data illustrate significant month-to-month volatility — with 10 manufacturing and industrial projects valued at $1 billion or more breaking ground in October 2025, followed by a pullback to two in November — yet year-to-date starts remain meaningfully ahead of 2024 levels, underscoring continued strength in advanced manufacturing investment. Semiconductor fabs, life sciences manufacturing facilities, electric vehicle (EV) battery plants, clean energy components and advanced industrial facilities all require highly engineered geotechnical solutions. These sites often combine large footprints, heavy equipment loads and compressed schedules that make early-phase geotechnical expertise mission-critical.

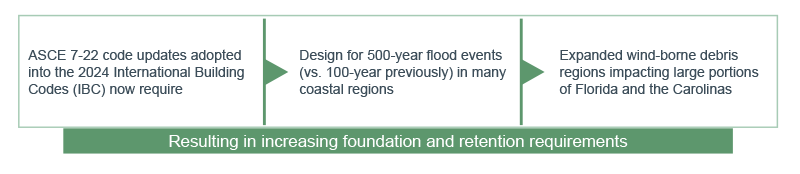

4. Environmental and resilience requirements are growing. Regulations tied to climate resilience, stormwater management, wind and seismic loading, PFAS remediation and groundwater protection are reshaping early-stage construction requirements. These factors increase demand for earth retention systems, slope stabilization, dewatering and specialized subsurface containment — particularly in coastal and high-growth regions. As these needs expand, many traditional geotechnical firms are moving into environmental and resilience-related services, drawn by attractive growth and margin profiles and enabled by their existing specialized equipment fleets, technical expertise and ability to self-perform complex subsurface work.

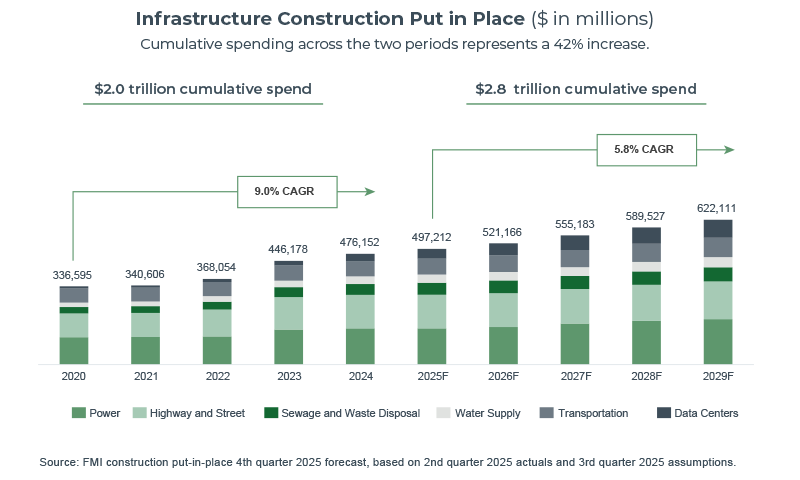

5. Infrastructure investment is fueling multiyear activity. Federal and state programs in transportation, water, wastewater, power and coastal protection are generating long-duration, capital-intensive projects that require significant geotechnical involvement. Infrastructure spending is less sensitive to interest rates and continues even as other segments moderate, providing a durable pipeline of demand.

Geotechnical Services Now Define Project Certainty

Owners and general contractors have long relied on value-based procurement when selecting geotechnical partners — particularly in the private sector, where schedule certainty, technical capability and risk mitigation outweigh a low-bid approach. Increasingly, the public sector is following suit. As infrastructure owners and agencies take on larger, more complex programs, they recognize that the lowest price rarely delivers the predictable outcomes required for schedule-critical projects.

At the same time, elevated interest rates, persistent cost escalation, policy uncertainty, tariff exposure and compliance requirements such as the Build America, Buy America Act (BABAA) have raised the stakes for early-stage decision-making. In this higher-cost, higher-risk landscape, owners cannot afford delays or surprises below ground.

As sites become tougher and structures grow larger, geotechnical providers often determine whether a project stays on schedule and on budget. While geotechnical scopes typically represent only around 3.5% of total project cost,* early missteps below ground routinely cascade into schedule delays, redesigns and downstream cost escalation — elevating subsurface work to one of the most consequential drivers of overall project performance.

This shift explains why private developers and public agencies alike are moving toward value-based selection, prioritizing providers with:

- Equipment reliability and fleet depth

- Regional soil and geologic expertise

- Design-build or design-assist capabilities

- Proven ability to meet aggressive schedule demands

- Strong safety and quality track records

Experienced geotechnical firms have become strategic partners. Each day saved at the beginning of a project improves margin, reduces contingency use and strengthens overall delivery performance, reinforcing that value — not price — increasingly defines geotechnical procurement.

* Based on FMI analysis, taken from FMI consulting stapled diligence, published in July 2024.

Case Study: What Investors See in Leading Geotechnical Platforms

FMI has completed several notable transactions in the geotechnical sector, each underscoring the attributes investors value most. The sector’s consolidation reflects rising structural demand and how difficult it is for others to replicate these specialized differentiated capabilities.

Across strategic and financial buyers, several attributes consistently drive value:

- Differentiated engineering expertise and design-assist capabilities

- Hard-to-replicate specialty equipment fleets

- Strong safety culture and trained craft workforce

- Exposure to non-cyclical policy-backed sectors

- A track record of schedule certainty and high-quality execution

- Barriers to entry rooted in local soil knowledge, reputation and resume

These characteristics create meaningful competitive advantages and position well-run geotechnical platforms for sustained growth.

A Sector on Solid Ground

From infrastructure renewal and advanced manufacturing to coastal resilience and mission-critical digital facilities, geotechnical services sit at the center of some of the largest and most complex construction programs of the coming decade. As development extends into more challenging environments and owners demand greater predictability, the role of geotechnical providers will only grow. With strong long-term demand drivers, high technical barriers to entry and increasing investor interest, the geotechnical sector is positioned for sustained growth — and, for the right platforms, exceptional opportunity.