Ownership and Succession Planning During and After the Storm

Building momentum for effective ownership transfer and management succession both during and after the crisis.

Ownership transfer and management succession (OTMS) in a closely held construction firm is challenging in the best of times. Transition brings a tightly interwoven set of challenges that include—but aren’t limited to—people, money, legacy and emotion. The last 10 years provided an ideal backdrop for succession thanks to strong work backlogs, profitable work that accelerated management buyouts, an active mergers and acquisitions (M&A) market, and up-and-coming leadership teams focused on building out corporate infrastructures for continued success.

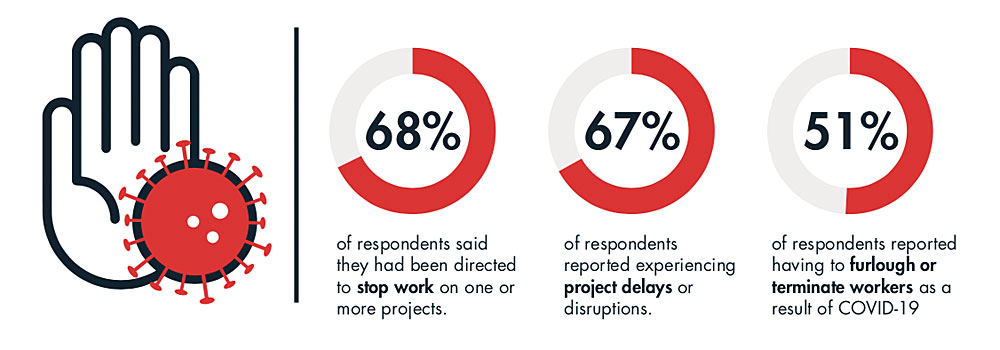

That all changed in a matter of weeks when COVID-19 ground projects to a halt, with 68% of businesses reporting directive to stop work and 51% to furlough or lay off employees.1 Suddenly, many construction businesses were confronting the new reality of work stoppage, furloughs, layoffs, significantly reduced profitability and an overall cloud of uncertainty and volatility.  Source: AGC Survey, April 2020

Source: AGC Survey, April 2020

Succession’s Role

Managing succession is often a complex, longterm process that’s highly sensitive to external shocks. Disruptions in profitability can delay internal buyouts, and distractions can set transition plans back by years.

The effects of COVID-19 will serve as a “succession” stress test for many engineering and construction (E&C) companies. With FMI’s accumulated experience of 65-plus years of guiding ownership transfer and management succession within the Built Environment, these critical factors for success are consistent across the decades:

-

Starting with clear objectives for transition

-

Beginning your plan early

-

Putting a strong emphasis on talent and culture development

This Quarterly article examines trends in ownership transfer and management succession using industry survey data to identify which changes, shifts and permanent adjustments the pandemic will drive. Snapshots were taken from the 2020 FMI OTMS survey—conducted in collaboration with the Construction Financial Management Association (CFMA)—and compared to previous OTMS industry surveys from 2017 and 2013.

Delayed Transition Plans

Predictably, the survey found that COVID-19 will negatively impact earnings for 75% of E&C companies. Because 56% of construction businesses transition to existing management teams and family members, ownership transfer is highly dependent on profitability to fund ownership transfer. A typical internal equity transfer can take seven to 10 years when profitability is consistent. That’s because a portion of earnings enable future owners to buy equity over time.

When earnings get squeezed, ownership transfer plans are likely to be delayed or extended for longer periods than originally planned.

This will be uniquely challenging for business owners who are close to retirement or expected to reduce their equity risk in the near term. Of those surveyed, 35% plan to exit their businesses in less than five years while 52% plan to exit their businesses in less than seven years.

Owners who delayed transition while enjoying strong distributions and growth over the past five to 10 years may face the reality of a long, grinding recovery in the years to come (particularly if they didn’t actively and aggressively develop next-generation talent during the “boom” years).

For those companies that are in the middle of a transition or expecting to make this move in the next two years, 20% of respondents believe COVID will delay the start of their ownership transfer plan. Furthermore, 27% believe COVID will extend the duration of their transfer, 26% expect minimal impact or delay, and 11% believe it will reduce total proceeds from ownership transfer.

What is lost in the statistics are the realities and stories of individual leaders and their companies. FMI’s experience tells us that several of the following scenarios may play out for many in the industry:

- Business owners in their 60s or 70s who postpone retirement and leave their lifetime investment at risk for much longer than desirable.

- Minority owners who see the reality of a long recovery and decide to retire, leaving majority owners once again holding most of the risk.

- Potential owners who may “age out” and cease to be viable shareholders due to the time required to buy shares, generating wealth and then selling back to the next generation.

Transfer Option Restrictions

Pre-COVID, the M&A market enjoyed a rare combination of robust economic conditions, low interest rates and a healthy mix of private equity and strategic buyers. These factors helped create a strong phase where third-party sales became a reality for many companies.

This dynamic slowed in early 2020, and COVID-19 accelerated that downward trend. As potential buyers are managing their own internal issues with a focus on core operations—and as debt capital markets tightened—M&A activity slowed tremendously. According to Mergermarket, a provider of M&A data and intelligence, transaction volume is down 32% compared to the previous year, and transaction values declined by 53%.2

Our survey data reflects this trend, with just 5% of respondents planning to sell their businesses to a third-party buyer (down from 8% in 2017 and 17% in 2013). Since most construction businesses are privately and closely held, a reduced M&A market leaves an internal sale or liquidation as the primary options. Even in the best of times, a third-party sale at a compelling valuation is an option for only a fraction of firms. With COVID restricting that option further, business owners should be realistic about their hopes for an outside buyer materializing to make a major purchase.

ESOP: Continuing to Gain Acceptance

Employee Stock Ownership Plans (ESOPs) continue to be a viable and attractive option for owners of construction companies. Our research indicates that 9% of respondents plan to sell to an ESOP, compared to 12% in 2017 and 4% in 2013. According to the National Center of Employee Ownership (NCEO), in 2018 (the most recent data available) construction companies led the way, creating the highest number of new ESOPs versus all other industries.

A company that chooses to become an ESOP has control over the number of shares to be sold to the ESOP, whether debt will be utilized to finance the transaction, and how to compensate key employees/management post-closing, among other factors. In addition, S corporations that choose to become 100% ESOP-owned companies have the unique advantage of being exempt from all federal income taxes, while C corporation owners that sell to an ESOP can defer capital gains taxes. Therefore, an ESOP can present significant tax benefits for the seller, the company and its employees and can be a good hybrid transfer option compared to selling to a third party and executing an internal management buyout.

Leadership and Talent Development

Regardless of the ownership transfer method, leadership depth will always be the single most critical factor in succession. For many next-generation executives, COVID represents a life-changing event in their leadership and one that will test their character, agility, empathy and vision.

Anecdotally, FMI has already seen multiple examples of new executives and owners responding with grace, poise and clear direction. Alternatively, we have seen new owners struggling to adapt and instead regressing to leadership styles that only worked during pre-COVID times. Learning that a group of leaders and new owners is not ready is painful in the current market, and something that will surely endanger and delay the best-intentioned succession plan.

According to our survey, 47% of companies either agree or strongly agree that leadership development is more important now than it was pre-pandemic (compared to 19% who disagreed or strongly disagreed). Also, 82% of owners see their businesses’ future growth and profitability being directly affected by the readiness of their successor(s).

Source: FMI/CFMA 2020 OTMS Survey (snapshot August 2020)

Questions to Ask Yourself Now

In 2020, COVID-19 created a storm of volatility and uncertainty, stress-tested resources and balance sheets, and accelerated the need for strong next-generation leaders. As we’ve seen from past recessions and disruptions, long recovery periods, insufficient resources and next-generation leaders that go undeveloped represent a dangerous combination.

With all of the turbulence and unpredictability in the market right now, it’s the ideal time to check the pulse of OTMS, starting with a rigorous look at what will change forever, what principles still hold regardless of market cycle, and how business owners can adjust their plans. As you work through this “pulse-checking” exercise, ask yourself these 10 key questions:

- How have my transition goals shifted in the current market?

- Who will lead the business moving forward?

- Is our succession plan aligned with our vision and our strategic and operational goals?

- How aligned are the current and next-generation owners and leaders in terms of ownership, growth and vision for company?

- What is most important to current owners—legacy and continuation of the business, control of the business and/or maximizing financial return?

- Where are points of risk/overreliance on key leaders?

- How are we preparing successors for future leadership roles?

- How will the current disruptions (e.g., economic recession, COVID-19) impact our ownership transfer plan?

- Do we have effective buy-sell agreements in place to protect the organization and all shareholders?

- And, finally, is there a more effective and efficient ownership transfer technique available (i.e., is an ESOP an effective alternative)?

We’ve studied construction firms and their ability to perpetuate enduring success from one generation of owners to the next. Achieving that goal usually hedges on building and leveraging holistic OTMS plans that clearly define how and when equity will transfer, delineating who will lead the organization within strategically pivotal roles, and preparing these leaders to succeed in these future roles. These plans also help formalize contingency strategies that identify interim leadership when emergencies and/or unforeseen key role vacancies occur.

Finally, these plans create a clear transitional road map for the leader in the current position, detailing what must be done to exit well and prepare for a life outside of work. There is no better time than the present to prepare for this big step as we face a future filled with uncertainty and ambiguity.

1 “Forty Percent Of Construction Firms Report Layoffs Amid Widespread Project Cancellations As Economic Impact Of Coronavirus Grows.” AGC. April 10, 2020.

2 Statistics are based on 1H20 (June 2020 vs. June 2019).