Planning Compensation in a Dynamic E&C Environment

The challenges of effective staffing may seem endless in the current engineering and construction (E&C) environment.

There are the obvious macro variables, including falling unemployment, 30-year-high inflation rates and voluntary turnover at levels reaching a two decade high in November, earning the moniker the Great Resignation.

These issues are compounded for E&C companies facing increasing demand for services, shifting backlogs and a growing talent gap in critical skills. Any one of these would create strain in satisfying workforce needs, so the combination has truly brought the competition for talent to the forefront.

Some companies have responded to the pressure by competing for talent at any cost. However, providing lucrative compensation packages is rarely a sustainable tactic. On the other hand, holding fast to outdated pay practices that ignore today’s labor

environment places business operations and performance at risk.

Fortunately, there is a middle ground that should prove more effective now and in the coming years. By carefully evaluating jobs and employees, companies are better positioned to meet operational needs and address talent requirements among a workforce

that can afford to be demanding.

Identify Essential Jobs

It is rare that employers can spend with abandon, so acknowledging that some positions are more valuable to the business than others is key.

There are some E&C jobs that are fundamental, such as project management and field labor, but companies should note others that are gaining traction in the industry and becoming more significant.

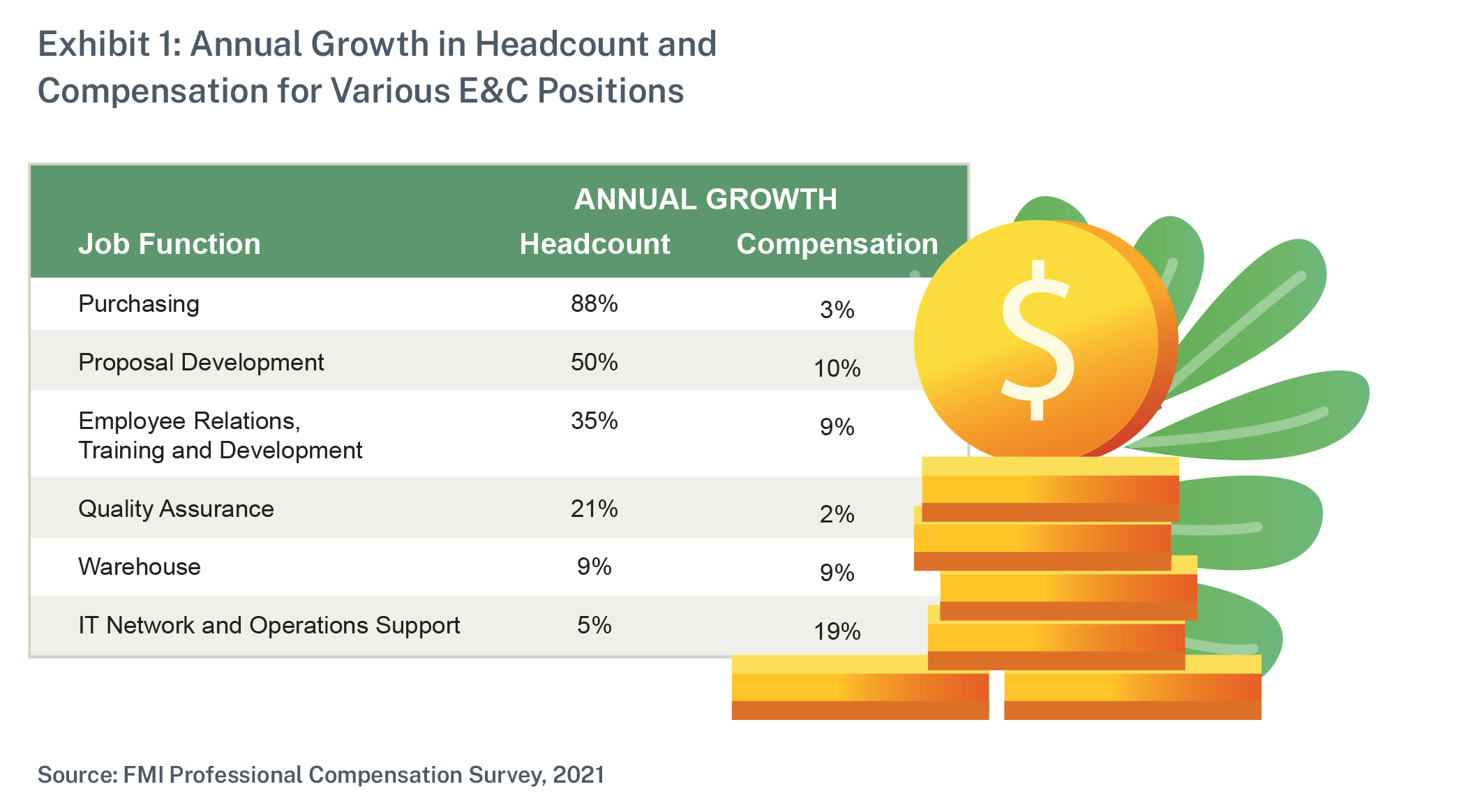

FMI’s Compensation surveys report annual trends in job staffing as well as compensation levels across the industry. In the 2021 surveys, jobs that appeared to be fastest-growing in terms of headcount and pay were not necessarily the obvious ones. Instead, job functions that traditionally serve as supporting roles were ranked higher.

The excerpt of year-over-year change shown in Exhibit 1 underscores current market fluctuations; however, for both staffing and compensation, FMI compensation survey data indicates that the trend is clearly positive for most common job functions.

Another aspect of evaluating mission-critical jobs includes looking at the positions with the greatest impact on the company. For example, FMI’s 2021 Construction Professional Survey revealed that virtual design and construction (VDC) management positions are outpacing lower-level individual contributor positions in both staffing and salary growth.

Another aspect of evaluating mission-critical jobs includes looking at the positions with the greatest impact on the company. For example, FMI’s 2021 Construction Professional Survey revealed that virtual design and construction (VDC) management positions are outpacing lower-level individual contributor positions in both staffing and salary growth.

There are several potential explanations for this observation, including the need for leadership in a newer function in the industry, growth of the building information modeling (BIM) and VDC responsibilities within companies, development of leaders in preparation for succession plans, and advancement of employees to encourage retention, among others.

For workforce planning purposes, it’s important that employers understand what market demand exists; this way, employers can effectively prepare for the possibility of longer recruitment processes and higher-than-desired compensation packages.

Attract Key Employees

The need to hire employees who are a good fit is well known among E&C employers. The challenge is that in the current work environment, cultural and behavioral alignment may need to be secondary to hiring enough competent workers.

But this is not without risk, especially when hiring for essential jobs. In these cases, it may be well worth the time and investment to hire individuals who are most likely to be successful with the company in the long term. In addition to effective recruitment and onboarding practices, the following specialized compensation programs may apply:

- Sign-on bonuses (56%*): FMI’s survey data indicates that sign-on bonuses are most common at opposing ends of the organizational hierarchy: new graduates entering the workforce and senior leaders. For early career employees, the immediate gratification of upfront compensation can be a strong lure to join a company. At this level, the bonus amounts are typically consistent across new hires for key roles. Conversely, sign-on bonuses for leadership positions are often negotiated on a case-by-case basis. In some cases, the additional incentive may be aimed at making up for foregone compensation from the previous employer, while in others, it is simply intended to enhance the employment offer.

- Relocation benefits (67%): Like sign-on bonuses, relocation benefits are frequently offered to senior leaders required to move. Other job levels may also receive such benefits, sometimes at a lower value. In many instances, the benefits are a reimbursement of expenses the new employees incur during the move; but occasionally, employers may provide a lump-sum payment, similar to a sign-on bonus.

- Referral bonuses (79%): Sign-on bonuses and relocation benefits are for new hires, but many companies also seek to recognize and reward current employees for sourcing successful job candidates. Values are typically small, most less than $2,000. Referral bonuses are usually paid after the first 90 days of the new hire’s employment, which coincides with common probationary periods.The strategy of encouraging employees to actively support recruiting efforts has several key benefits:

- Even if sizable referral bonuses are offered, there are still reduced costs if the need for professional recruiters and public job postings is reduced.

- The quality of candidates can be improved because employees are motivated to only refer those who have a high likelihood of being hired.

- Referred candidates are a known entity. As a result, there is a greater likelihood of cultural fit, which leads to longer tenures.

- Employees are implicitly reminded of the positive attributes of the company. To attract friends or peers in their networks to their employers, workers must be able to sell the firm. This factor may be more important than ever in today’s labor environment, where many individuals have multiple employment options or may not be seeking a job change. The ability to attract candidates on not only tangible compensation packages but also on firsthand accounts of a satisfying work experience can be paramount.

Retain Key Employees

Most companies tend to adopt rather subjective approaches to special pay practices aimed at retaining key employees. The rationale for doing so is to maximize flexibility. For example, a highly visible or complex project may warrant extra recognition for the project team.

There is already a heightened risk of burnout as the impact of COVID persists, and this can be exacerbated by challenging projects. When coupled with increased voluntary turnover and relatively low unemployment, the need to retain critical employees is high. Acknowledging that compensation is an important component of retaining talent, variable pay that compels and rewards employees to stay with the company can be an effective approach.

Employees may benefit from project completion or milestone bonuses that are awarded only if a project team member remains employed through that point in the schedule. While project managers and superintendents are the most common positions targeted

to receive project-based retention bonuses, nearly half of companies apply a discretionary approach, so that employees most at risk of turnover can be identified as award recipients, regardless of their position. Note that project bonuses structured to retain employees are not synonymous with project profit-based bonuses, whereby project team members receive a portion of project profits upon completion and collection.

Retention-focused compensation for other employees may be simply structured as a deferred bonus. In other words, part of the annual bonus or incentive award over and above the normal annual award is set aside for payment in the future. The most common term for such awards is three years, meaning that the award is paid out over time or in totality after that time. These delayed payments can serve as an effective tool to retain key employees. If a company pursues this approach, it is important to ensure compliance with Section 409A of the Internal Revenue Code, which regulates deferred compensation.

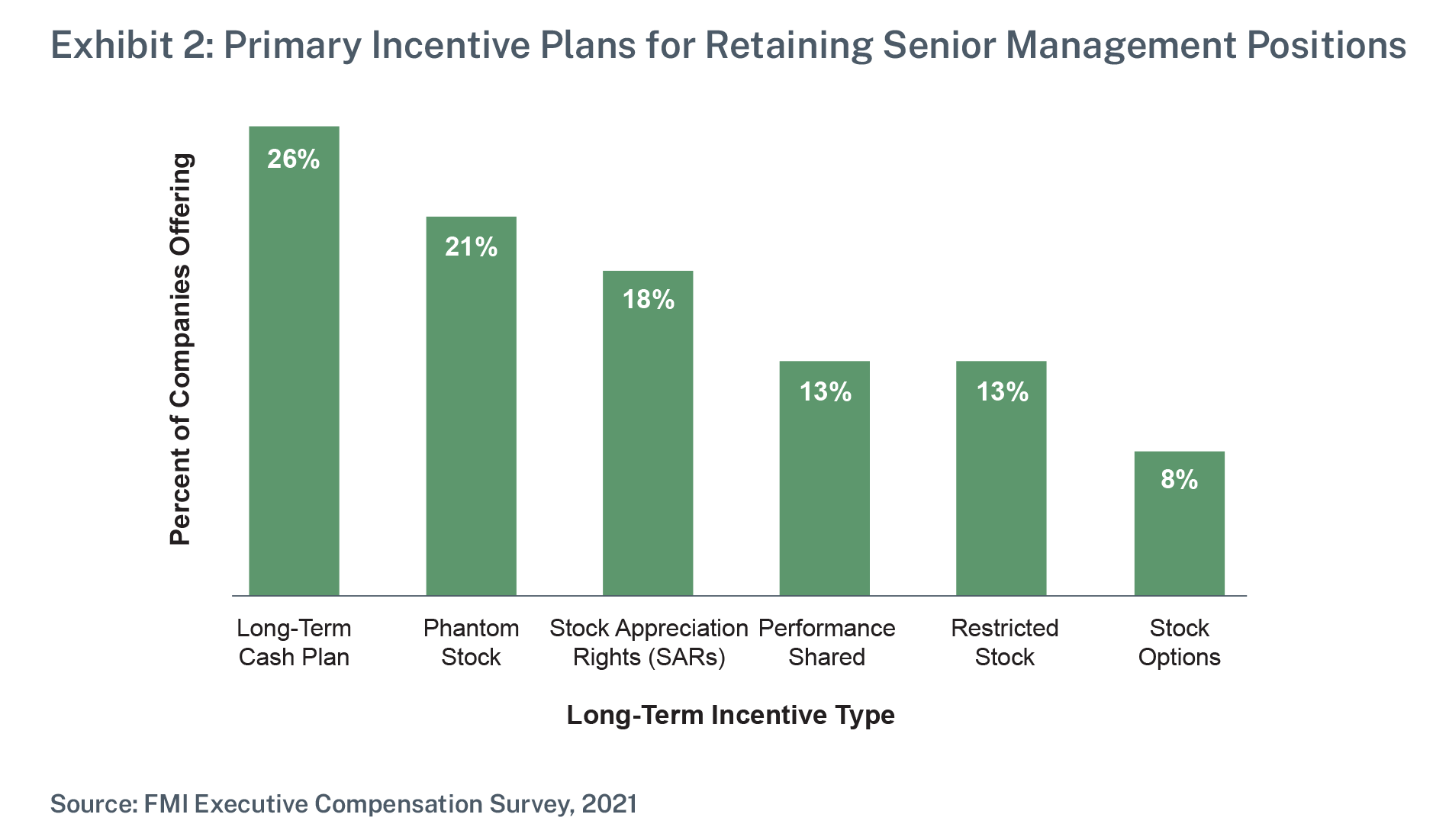

Finally, the primary compensation element used to retain senior management is long-term incentives. As displayed in Exhibit 2, cash-based, long-term incentives are most prevalent in the E&C industry. These resemble the deferred bonus structure described above.

Some cash-based awards have performance objectives, but most are strictly based on continued employment, such that an employee receives the additional cash payout after remaining with the employer for a period regardless of the performance of the company or the employee.

The alternative plan types identified below are more likely to incorporate both time and performance expectations. Therefore, an employer must consider the primary goal(s) of the long-term incentive program.

If there is a critical interest in keeping leaders, a company may be best served by an incentive approach that will offer future lucrative payments with limited consideration for performance. At times like these, when poaching is a legitimate concern, a strict focus on time-based awards may be optimal; but such structures require thorough modeling to confirm that future payments will not be detrimental to the company.

Naturally, there are other factors both monetary and otherwise that should be assessed, enhanced and communicated to effectively attract and retain talent. In addition, customized or unique approaches for key employees and positions should be developed with care and in conjunction with pay equity analyses and diversity, equity and inclusion initiatives.

Nonetheless, companies that analytically identify important jobs now and those they’ll need in the future, as well as the people in their companies who will do the work, will be able to focus on what is most critical for the short- and long-term success of the business.

*Values reflect the percent of FMI survey respondents offering the compensation program.

BLOG_TN_500x410.png)