Keeping Pace: Utility Construction Mid-Year Outlook

In distance running, racers trying to meet a goal time often make use of a pacer, someone who sets a steady tempo to reach an expected time. These pace setters often drop back toward the end, leaving competitors to finish on their own to meet their goals, which often include setting qualifying times for future events.

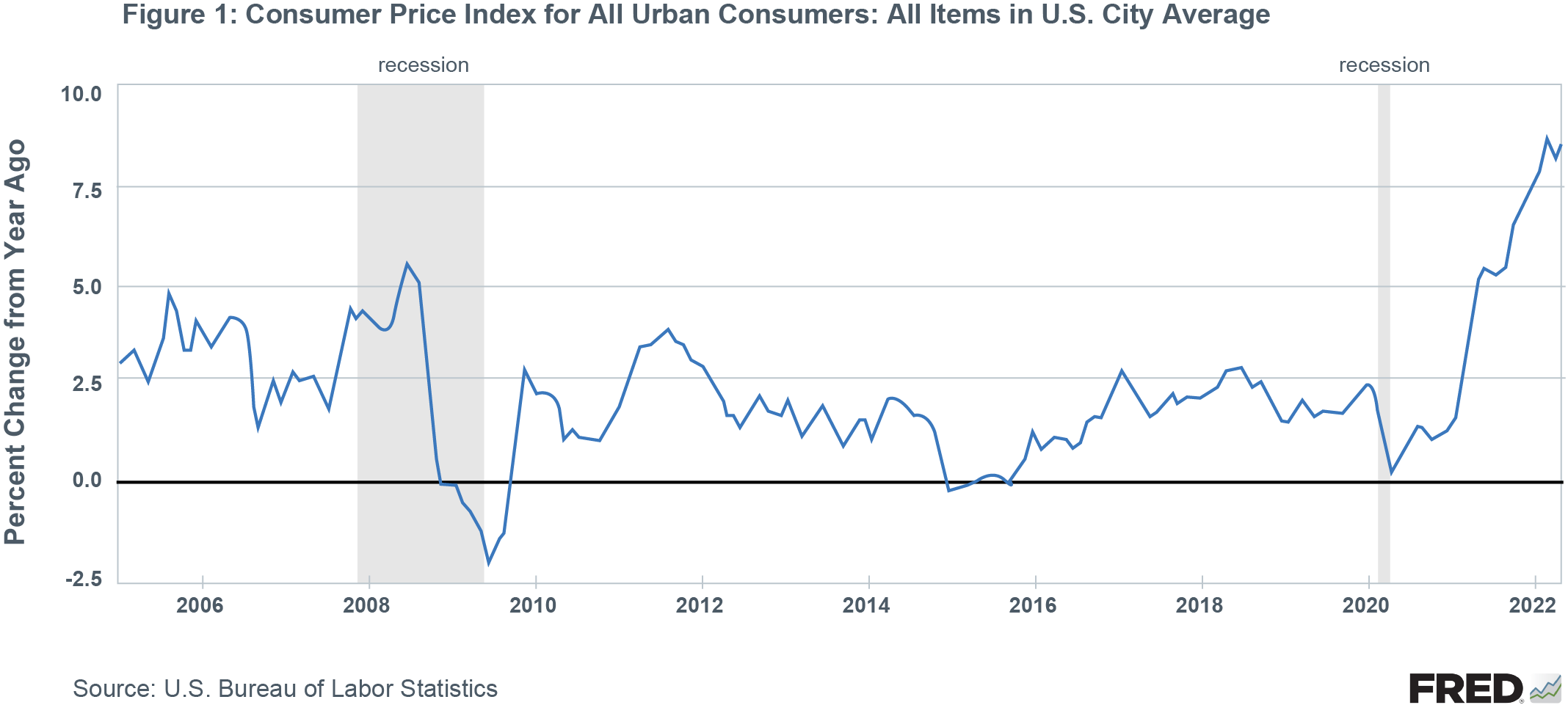

For utilities and their service providers, the target pace to maintain a profitable return in real dollars accelerated to the fastest level in almost 40 years. The Consumer Price Index reached 9.1% year over year in June before dropping to 8.5% in July, meaning that companies serving the utility industry are challenged with growing profit at a rate greater than inflation to preserve purchasing power. The firms that build and maintain utility and communication infrastructure have a daunting task; however, given the current demand, the long-term energy transition and the sector’s ingenuity, companies can match or even exceed inflation.

Utility and Communication Infrastructure Opportunity

The opportunity to thrive in the utility infrastructure market is ever-present. The combination of investor-owned utility investment with federal funding from both the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) suggests that backlogs for companies facilitating energy transition and maintaining current infrastructure will remain robust in the coming years. The need is great in both the short and long term as the U.S. seeks to strengthen infrastructure for the next generation.

Short-term Demand

Short-term infrastructure requirements that will likely drive spending over the coming three to five years include the hardening of current infrastructure, maintenance and repair of outdated products and new construction to address moving populations and new technology (i.e., 5G and rural broadband deployment).

Hardening Infrastructure

Increasing the security (or hardening) for current infrastructure requires improving both the reliability and resilience of U.S. utility infrastructure and there are many areas where companies ranging from service providers to utilities can assist. It begins with what often seems simple – ensuring the grid is protected against weather events. Depending on where a system is present, the primary threat could be hurricanes, flooding, fire, ice or tornados. Each requires a unique solution to ensure that the associated utility infrastructure does not go down when a weather event occurs.

The next area of hardening that has been ramping up is protection against security-related threats. Following accidents that caused stoppages in major pipelines and events like the 2020 Nashville bombing, plans to improve the security around critical infrastructure increased meaningfully. This includes moving from chain-link fences with easily accessible paths around major substations to walled facilities with reasonable security as well as limiting access to rights-of-way where major pipelines are located to prevent potential threats.

Additionally, it includes laying fiber along major transmission to ensure real-time communication of outages to the infrastructure owners. This fiber activity coincides with major fiber backhaul to support 5G infrastructure and significant funding of rural broadband in the IIJA legislation, so demand for the new build, splicing and maintenance of fiber will also be necessary to implement these plans.

Maintaining Current Infrastructure

Over the past four years, publicly traded utility companies and infrastructure owners have increased their investment in capital maintenance projects, specifically around oil and gas infrastructure where new buildouts are increasingly untenable. The volume of work available has shifted the competitive dynamic among contractors from geographic considerations to labor considerations.

Many of the themes driving infrastructure construction spending remain the same: aging infrastructure across the electric grid, natural gas network and water and wastewater systems; upgrading transmission to support distributed energy; and the constant need for faster, more reliable internet and communication speed.

Coincidentally, undercurrents of change in the industry also exist that could influence the way that companies operate today. Distributed generation is the fastest-growing form of new power generation, and companies are rapidly developing technology that would allow local, affordable power storage. The installation and inspection requirements for critical infrastructure developed by the Pipeline and Hazardous Materials Safety Administration are expanding the requirements for hazardous pipeline operators and regulated utilities. Consequently, installation and service expectations for contractors have increased so that the pipeline operators and regulated utilities can track what, when and who put the infrastructure into the ground. Requirements for being a successful utility transmission and distribution contractor are high, and the demand for quality constructors in this space is significant.

Long-term Transition

While there are ample short-term opportunities for utility service providers, the long-term transition ensures stability in the segment and is the catalyst for the increasing investment in this market. Distributed generation, the electrification of everything to facilitate a clean energy transition and the increasing use of connected devices (i.e., Internet of Things) will likely fuel demand.

Challenges for Service Providers

The theme for 2022 of “less for more” remains as price increases from labor, materials and fuel impact the utility industry. The transitory discussions of 2021 are a distant memory and pricing pressure is impacting almost every line item of the bid sheet. This has begun to effect both the public and private markets.

Additionally, due to rising demand (and most recently the war in Ukraine), oil prices have increased by more than 500% since the lows of 2020. However, due to the federal government’s environmental policies, U.S. energy companies are hesitant to make the investments in drilling and large pipeline infrastructure that would accommodate price decreases. As a result, U.S. gas prices climbed to an average of $5 per gallon for the first time in history earlier in the summer before dropping slightly. While many utility companies benefit from higher prices of oil, the cost of production is impacted by the rising input costs of fuel.

Lastly, labor prices have risen year over year to keep pace with climbing inflation and because the market has been near full employment for some time (see Figure 1). However, the Federal Reserve’s actions will weigh heavily on the economy and an increase in the labor pool and decrease in labor costs should occur as the federal funds rate increases and end-markets that are most affected by rising rates must scale back (residential/commercial construction).

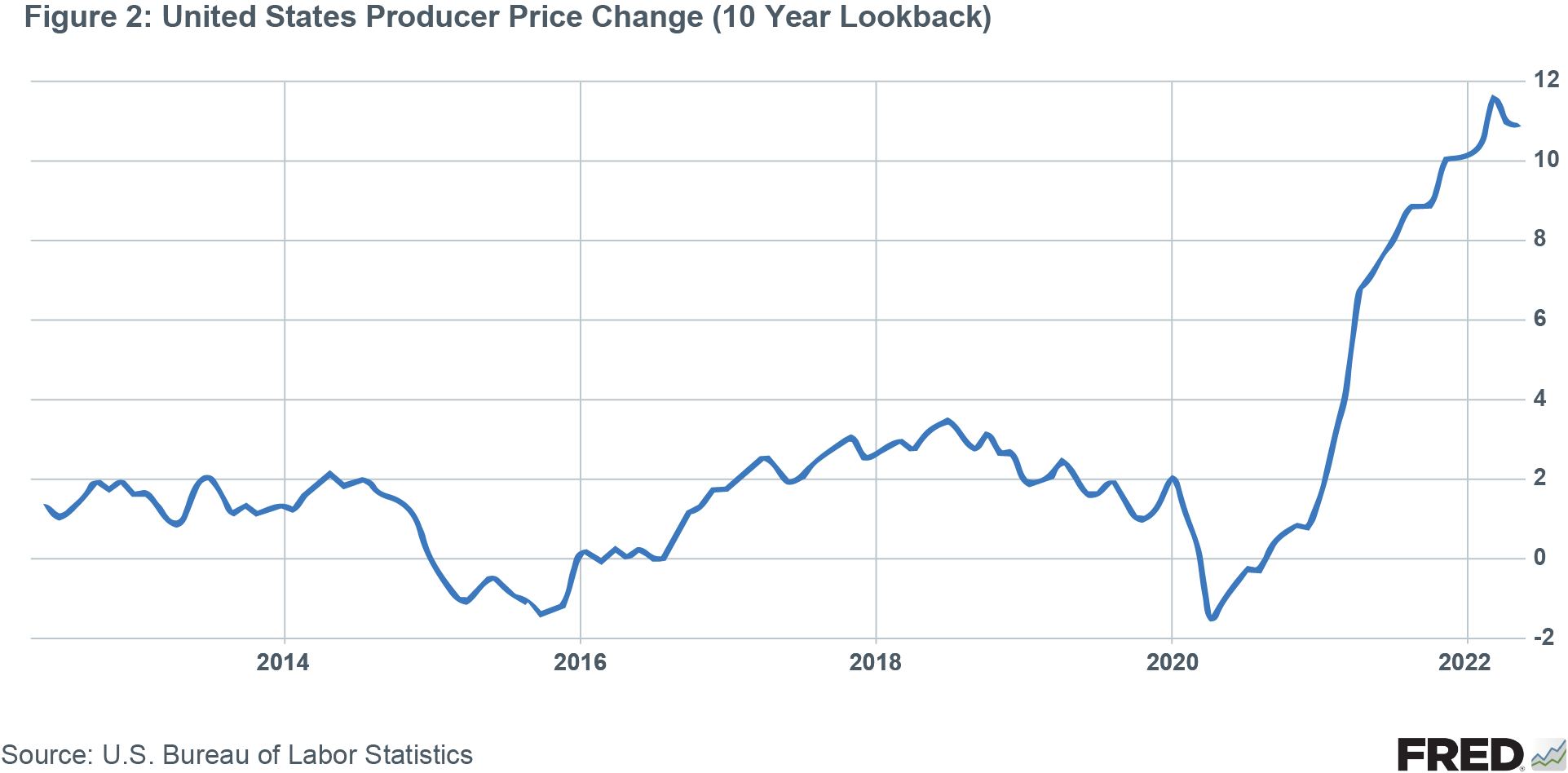

In addition to the often-cited CPI, the Producer Price Index (PPI) (Figure 2) is a common reference for FMI because there is less variability in the calculation of the index. Actual producer prices rather than proxies for the prices, (i.e., owners’ equivalent rent) make up the index. Thus, the rise of more than 10% is a more accurate reflection of current inflation and the impact to both businesses and consumers alike.

Rising to the Challenge

Employee Training and Development

As utility service providers grow their businesses, new leaders are a necessity. With each expanded crew, there is likely a foreman and new superintendents who will have responsibility for the labor on their teams. With enough crews tackling work in the field, new project management and training will be needed to prepare field employees to take on additional responsibilities in other areas.

In addition to finding qualified candidates, training the individuals beyond just the required job tasks is important as they move into leadership roles. Communication, organization, project accounting and technical knowledge are all critical as employees progress within a company. Balancing the need to finish work with time spent on improving individuals is an essential step in growing businesses. A highly trained workforce allows an owner to sleep better because his crews have financial control of projects, understand where pitfalls occur and possess the necessary technical skills to address issues on jobs before they occur.

Productivity Awareness

With both pricing and supply chain challenges, scaling crew requirements puts pressure on an organization to address increased demand. Couple this with the expansion of an aging workforce and the result is a green crew incapable of taking on the challenges of the day.

Strong service providers analyze their organizations for effectiveness and ability to execute on the project. They analyze the quality of their crews, distribute the high-performing individuals who need minimal direction and try to give inexperienced crews work that allows them to develop. To protect profit, two recommended strategies are: 1) tracking the productivity of teams that work together and 2) ensuring that safety awareness is stressed at the highest levels and that the implementation of the safety program is more about training and less about infractions.

Project Selectivity

The last and probably most impactful activity is project selectivity. As managers are weighing the cost increases across fuel, labor and products, it’s essential to get the numbers right for the long-term health of the utility industry. Based on the productivity tracking of individual crews, increased prices for scarce materials and the rising cost of labor, the right number may be higher than what is currently being estimated. This may mean that competitors win work; however, to maintain financial strength in growth, it is important to know a company’s limitations. The productivity numbers will change as crews gain experience and prove capabilities; therefore, it’s more likely organizations can win the jobs that require a sharpened pencil.

Conclusion

The utility transmission and distribution industry is experiencing a historic period for investment in under-served infrastructure. FMI remains optimistic about the long-term prospects for growth and profit; however, the near-term challenges in a tumultuous market will be felt by both utilities and their service providers alike. Approaching the market with strong people and talent development, thoughtful bidding and costing and keen awareness of one’s capabilities will ensure profitable growth.