Synchronizing Business Strategy with Ownership Transition Objectives

It’s clear: Transitioning ownership to the next generation of a company’s leaders is complex and requires extensive planning — especially considering the complexity can be exacerbated by the challenge of aligning capital allocations with the broader strategic and ownership vision of the business.

Ownership transition often begins as a financial conversation focused on valuation, liquidity and structure; however, it can quickly become intertwined with a company’s operational and strategic goals. This leads to an interesting question: Should ownership considerations or business strategy come first? The answer is that both are essential, and work on each needs to happen simultaneously.

Balancing the financial metrics of ownership transfer with long-term business direction is a complicated — and pivotal — aspect of successful transitions.

In practice, most high-performing multigenerational construction businesses operate under a “business first” mentality, with the idea that so long as leadership prioritizes driving long-term value in the business, current and future owners are more likely to benefit in a sustainable and aligned way. A thriving business generates additional transition flexibility, liquidity and opportunity over one that’s financially constrained.

Ultimately, ownership transition decisions influence not just who owns the business, but where the business is headed. That’s why thoughtful transition planning must take a holistic approach — not only encapsulating many of the key pillars of ownership transition, but also ensuring capital is allocated appropriately to meet both organizational and shareholder objectives.

Defining Capital Allocation

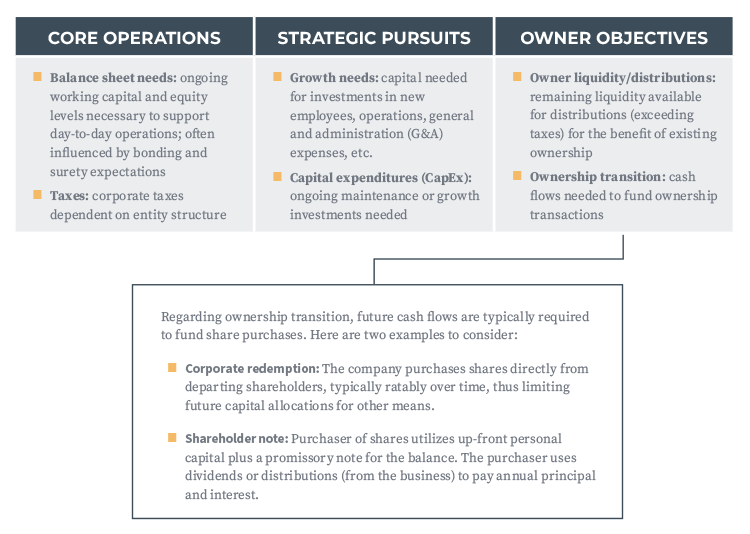

Fundamentally, capital allocation refers to the mechanism of distributing and investing the annual cash flows of a business. Each business must address capital needs across three primary areas — core operations, strategic pursuits and ownership-related objectives — noting the priority of each can shift based on timing and internal and external factors.

From Exit to Entry: A Financial Loop

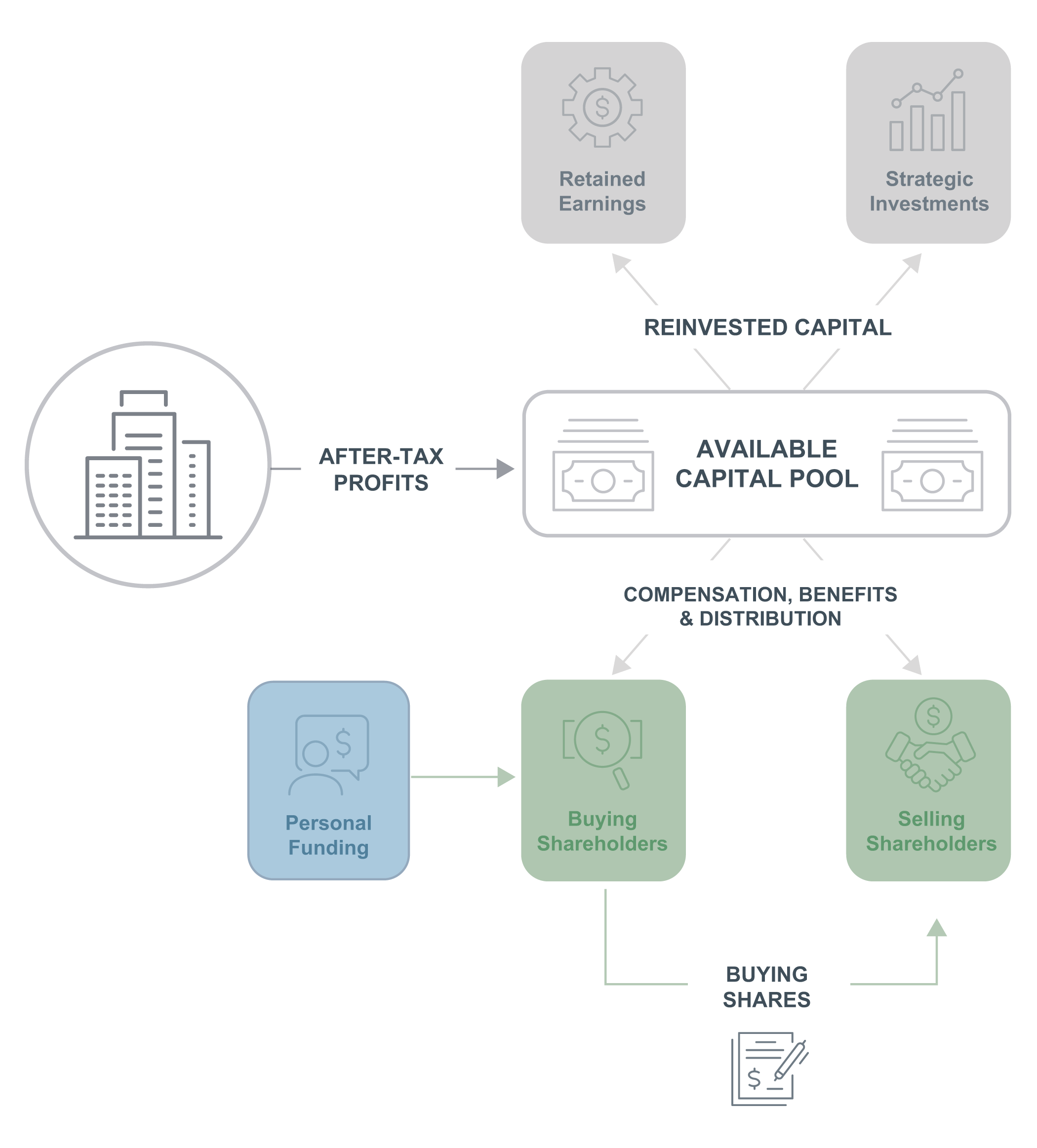

One fundamental constraint in ownership transition is the relatively “closed loop of funding.” Essentially, a business must independently generate adequate cash flows to finance future ownership purchases. Outside of internally generated cash flows, there’s typically limited capital to fund future transitions. As a result, construction leaders must carefully balance how capital is distributed among key stakeholders, including current owners, future shareholders, employees and, most importantly, the business itself.

Capital allocation involves quantifying what it takes to execute a transaction in financial terms. The total capital required is a function of what the company is worth — as well as how much ownership is being transferred and over what timeframe. Ultimately, affordability is a factor of the capital required, the relative timeline and the external factors that can impact a transition.

Key capital constraints to watch for:

- Excessive valuations and significant transfer amounts: Using an inflated valuation level, attempting to solve for a specific valuation or transitioning large blocks of ownership can ultimately limit flexibility and increase risk to the organization and buying party.

- Constrained timelines: Taken in tandem with valuation, when an owner’s exit timeline is not sufficient or when liquidity needs, leadership readiness or business performance don’t align, the business can become strained.

- Use of third-party or excessive debt: Adding debt to the equation (and its repayment requirements) adds risk to the process and limits future capital flows.

Without proper balance, the above factors can quickly outpace a business’s ability to self-fund, especially when operational cash flow must also support reinvestment and growth.

Strategy Comes First

Ownership transition, no matter how well-structured, cannot succeed in the absence of a thriving, forward-moving enterprise. Strategy, as the engine for the business, drives profitability and ultimately generates the capital required to fund ownership transition. Without this foundation, ownership transition becomes financially constrained or disconnected from the realities of the business.

Prioritizing strategy over ownership-related considerations ensures that capital remains available to support the core direction of the business. For example, if an unexpected strategic opportunity or business need arises, capital committed to meet ownership obligations could limit the company’s ability to respond. By putting strategy first, flexibility and growth potential are preserved, and reactive or constrained financial decisions that could compromise the enterprise are avoided. Ownership transitions should be designed to support the business, not hinder it.

Key questions to consider when building a strategy-aligned transition plan:

- What is our company’s long-term vision for the business, and how does this translate to mid-to nearterm strategic priorities?

- Can we quantify the investment needed to best pursue our defined strategic priorities?

- How do our current ownership structure and ownership transition needs promote or inhibit our ability to make necessary capital investments?

By addressing these questions, leadership can ensure that ownership transition is both financially sound and aligned with the company’s long-term objectives.

Ownership as a Strategy

Ownership should not be viewed solely as a financial process. It should be used intentionally as a strategic tool to drive alignment, financial performance and long-term business continuity.

Many of the largest, most successful construction companies in the U.S., including a growing number of ENR Top 100 firms, have intentionally migrated toward broader-based employee ownership. Key examples include Barton Malow, JE Dunn and DPR Construction. For these firms, expanding ownership is not just about value — it minimizes risk, creates buy-in and drives a long-term mindset across the organization. When employees embrace this perspective, they’re more likely to make decisions in the best interest of the company.

By treating ownership as a strategic lever, companies can reinforce their values, facilitate continuity and enhance value over time.

Recommendations for Leadership

Decisions about ownership transitions are among the most consequential that a construction business will make. Business owners and leaders should aim to:

- Evaluate the landscape holistically. Rather than viewing ownership transition in isolation, it must be examined within the full context of operational needs, growth goals and financial capacity. Ask:

- What are our current and future capital requirements to support day-to-day operations and strategic growth? •

- How do those needs intersect with the funding required for ownership transition?

- Understand capital structure implications. Whether company leadership pursues an employee stock ownership plan (ESOP), internal sale or broader ownership expansion, each path has vastly different funding and reinvestment implications. Ask:

- How will our chosen ownership model impact the company’s ability to reinvest in growth, maintain bonding capacity and remain competitive in the market?

- Are we structuring the transition in a way that preserves flexibility and minimizes risk?

- Balance current and future needs. Transition decisions must align with both the current state and future vision of the business. Consider:

- What does the business need to be successful today?

- What will it likely need in five or 10 years to grow and evolve?

When ownership transitions are driven primarily by shortterm financial objectives, such as maximizing liquidity or solving for a specific value, this focus often comes at the expense of the organization and puts the entirety of the process at risk. But when transitions are structured to be strategy first, capital becomes a tool to support reinvestment, growth and ownership alignment — better positioning the business to create sustained value and ensure a successful transition, both operationally and financially.