Planning for Tomorrow’s E&C Workforce Now

A look at what types of employees the E&C industry will need over the next few years and how top companies are working to fill those positions now.

As the U.S. business climate continues to improve and as the labor market tightens, this year is likely to be just as difficult for engineering and construction (E&C) firms that need to fill key positions within their ranks. According to the Bureau of Labor Statistics’ most recent numbers, total nonfarm payroll employment increased by 200,000 in January 2018, and the unemployment rate was unchanged at 4.1%. Construction led the pack in new job creation, followed by food services and drinking places, health care and manufacturing.

Construction added 36,000 jobs in January, the BLS reports, with most of the increase occurring among specialty trade contractors (+26,000). Employment in residential building construction continued to trend up over the month (+5,000). Over the last 12 months, construction employment has increased by 226,000 workers.

These numbers should get E&C firms’ attention. This year, 75% of U.S. contractors have plans to add to their workforces, according to a recent AGC survey. Concurrently, the growth expectations within the industry remain strong, even after several years of expansion. While promising for the industry at large, the healthy business environment will most benefit those firms that have already identified their target job roles and are acting quickly to recruit or internally develop candidates to fill these future critical positions.

Help Wanted

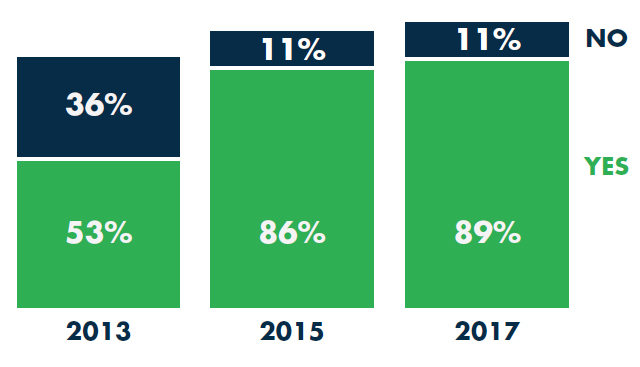

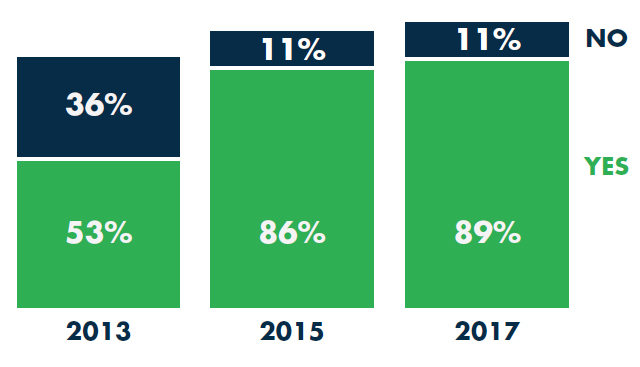

In FMI’s recent talent development study, 89% of contractors reported difficulty finding qualified workers to hire, and the vast majority believe the challenge of attracting and retaining staff will only intensify (Exhibit 1).

Exhibit 1: Are you facing talent shortages?

Source: 2017 FMI Talent Development Survey

So how can companies prepare for the future with the best possible workforce? This is the million-dollar question in today’s business environment, where these five strategies can help firms prepare now for the workforce of the future:

1. Strategic Planning and Execution

From time to time, companies will take an approach of bringing on “the best, no matter what” and then find a role for the new hire; but this rarely works favorably in practice. More often than not, the company finds it has overpaid for an employee who isn’t performing well in a role that was never well-defined. E&C firms should instead take a conscientious look at their operational status and ask themselves questions like: Where are opportunities? What competitive advantages do we have? Can we beat established competitors and other firms that are pursuing the same opportunities? And what are our financial goals, including owner expectations, bonding requirements and so forth? Use the answers to these questions to develop a broad strategy for your individual business and be sure to factor in talent needs and employee compensation.

2. Consider Future Staffing Needs

Effective planning is key, but without proper execution, E&C firms risk both future financial performance and their reputations. Taking the time to evaluate current employees’ skills, knowledge and abilities (KSAs) against those that are most likely needed to complete future projects is essential. Even top performers with the inadequate qualifications are destined to fail unless sufficient resources are devoted to training and development.

Each year FMI requests input directly from leading contractors regarding “hot jobs” and new jobs that should be included in future surveys. Interestingly, the areas attracting the most interest for 2018 are not operational roles, but, instead, key support functions, including safety, risk management and marketing/business development. There are two primary reasons for this:

1) These roles have been slow to be established among smaller contractors, and as companies seek to take advantage of the industry’s growth, these areas must be addressed immediately and effectively.

2) There is a natural and obvious evolution to safer work environments and projects, and coupled with potential savings through risk management and revenue growth through business development, these three functions can be continuously improved upon for the benefit of the firm.

2017/2018 Hot Jobs and New Functions

Identified by FMI Survey Participants

1. Pre-Construction Director/Manager

2. VDC (all levels)

3. Marketing Manager/Specialist

4. Safety Engineering Manager/Specialist

5. Compliance Officer/Director

6. Information Security Officer/Director

7. Business Unit Strategy

8. Equipment Manager

9. Surveyor

10. Community Affairs Manager/Specialist

One recent article speculated on why craft shortages exist when the potential income opportunity is so high relative to U.S. average pay. However, as the industry seeks to take advantage of technological innovation, construction professions may become more attractive to younger workers. For example, FMI has observed significant heightened interest in BIM/VDC compensation levels in recent years and expects the trend to continue as virtual pre-construction becomes commonplace and as remote work sites become possible for many positions, given evolving technology advancements.

Going forward, contractors should assess the current workforce, with an eye toward future expected needs—which may be defined by specific jobs, KSAs or functional areas, and develop a workforce staffing plan that considers human resources as well as available technological support systems.

3. Know the Market

Understanding the marketplace can be as influential on talent management as the staffing plan itself. For example, one E&C firm may want to recruit business development positions in the highly competitive, union shop-heavy Mid-Atlantic, while another firm recruits for a project executive in the active, but largely settled Midwest. These two markets are dramatically different in terms of labor supply, market span and relative competitiveness. As a result, firms must consider the recruitment pool—including where candidates might come from—when organizational size, headcount, geographic location and industry are key criteria to consider.

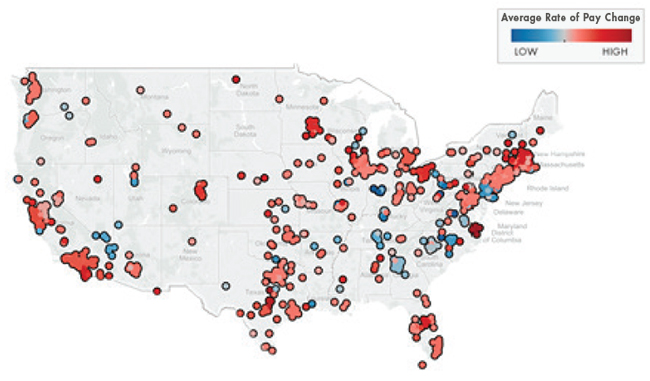

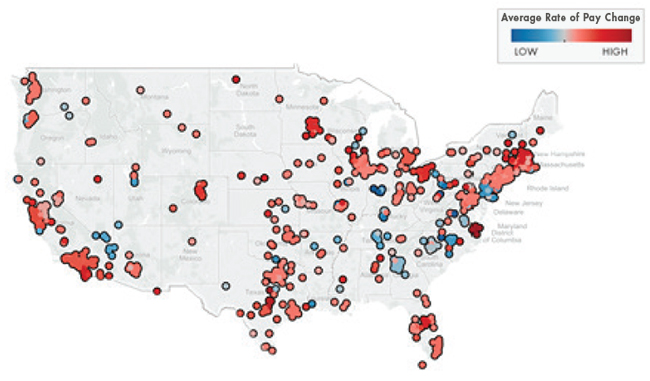

The rate of salary growth is also a natural indicator of market conditions. A market that is undergoing expansion, particularly when combined with a shortage of qualified labor, generally leads to accelerating salaries. The red areas identified in Exhibit 2 are regions recognized as having the highest pay increases for project managers in FMI’s latest “Construction Professional Compensation Survey.” Conversely, the blue areas highlight slower salary growth rates.

Exhibit 2: Rate of Pay Change for Project Managers

Source: FMI Compensation Survey Data

4. Gauge Employee Perceptions

Along with understanding the external influences on pay, gathering employee input on compensation programs is also important. You can do this via one-on-one discussions with management, focus groups reflecting similar roles, or employee surveys. Senior management and owners should have a sense of what employees think of their compensation packages and what elements have the most benefit and lasting impact.

Employees working for fast-paced, technologically advanced design-build contractors are best-suited for less competitive salaries that are offset by lucrative incentives, which include synthetic equity to resemble high-tech firms. But without knowledge of perceptions and values among the workforce, management is only guessing based on what others are doing, or worse, what “feels right.” However, employee views should not be the sole, or even primary, determinants of the structure of compensation packages. (Hint: See #1 above.)

5. Set Aligned Compensation Packages

As we evaluate the industry outlook, there are multiple factors to consider, especially when it comes to the war for talent. When developing an “aligned” compensation package, these previously identified task outcomes should be considered:

- Corporate strategy

- Staffing needs

- Labor market conditions

- Employee perceptions

Armed with this information, management can develop a talent management strategy for attracting and retaining the necessary positions. Then it can create or revise supporting compensation and benefits programs that recognize and reward staff for achievements that advance overall strategies. Based on the quality and quantity of talent needed across various job functions, a firm may consider one or more of the following pay approaches:

▪ Top grading

Identify the most important employees in the firm and make sure they’re getting the most advantageous compensation packages. The employees who fall into this category may be determined on a highly subjective basis, provided there is a justifiable, and documented, rationale. They may be the highest performers, have the greatest potential, be recognized as future successors, serve in key job roles or management levels, or any combination thereof.

▪ High-performance orientation

Many E&C companies are progressively working toward a more performance-driven organization to reward top contributors to corporate success. As a result, salaries may simply keep pace with cost-of-living adjustments, but high performers receive bonuses that are notably higher than average and low performers. Some firms may double down on performance by providing higher bonuses and higher salary increases to high performers. By awarding little to no incentive pay to others, a company can still maintain a conservative budget for raises and bonuses.

▪ Mission-critical distinction

Evaluating jobs for relative importance can play an important role in determining staffing needs and employee compensation plans. Some companies develop a checklist or voting system among senior leadership to identify jobs that are essential to ongoing organizational performance and then develop an aggressive approach for recognizing and retaining employees in those jobs through compensation, development opportunities and other benefits.

▪ One-time incentives

Most companies should not make regular use of one-time incentive awards, particularly if those rewards are largely discretionary, as these can create confusion, entitlement and jealousy among employees. However, sign-on bonuses for highly valued or difficult-to-hire jobs may enhance a firm’s ability to quickly attract good candidates. For example, monetary recognition through a modest pay increase or one-time award may be appropriate for an employee who assumes extra duties or earned a new certification that will benefit the firm. In these instances, the increase should be temporary (if the expansion of job roles is not permanent), and there should be a clear policy related to employee changes that warrant a pay increase or bonus.

▪ Total rewards optimization

As new technology systems help E&C companies better monitor talent management activities, understanding the needs and wants of the workforce will get easier. Over time, firms will have employee data that can allow for customized total compensation programs. This way, employees who are good workers—but who are more settled in their roles—might receive packages that are benefits-heavy and have incentives for providing training and collaborating with others. On the other hand, high performers seeking promotions may receive compensation packages that are skewed by merit and achievements, with rewards for pursuing new skills.

Workforce Planning for the Future

Every firm is different, so there is no “right” or “wrong” way to prepare for the E&C workforce of the future. There is also no best path to recruiting and retaining the most suitable workers, but companies that take a thoughtful approach to their employment needs will be best-equipped to thrive. With the right people in place, it’s much easier to capitalize on future opportunities, persevere through cycles and overcome critical challenges.

As outlined in this article, the key considerations during this process include an array of factors that range from job function to organizational level to work location. Other important factors include less tactical characteristics like workers’ values and perceptions. Once an E&C firm’s talent needs are known, different compensation strategies can help that company attract, motivate and retain the ideal workforce. With these strategies in place, companies can start to piece together the picture of their future workforces and work toward turning those ideas into reality.

Download PDF